Market Brief 17/10/2022

VIETNAM STOCK MARKET

1,051.58

1D -0.97%

YTD -29.81%

1,047.20

1D -1.34%

YTD -31.81%

226.46

1D -0.63%

YTD -52.22%

80.01

1D -0.19%

YTD -28.99%

289.45

1D 0.00%

YTD 0.00%

10,875.69

1D -32.47%

YTD -65.00%

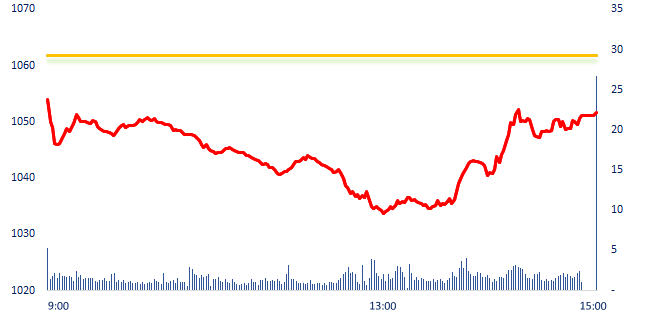

VN-Index opened with a deep drop in the first session of the week and remained in red throughout the session. In the afternoon session, the index retreated and narrowed its drop but the stocks recovered unevenly, red codes still accounted for the majority. Market liquidity is low and cash flow has not spread in today's session.

ETF & DERIVATIVES

17,750

1D -1.39%

YTD -31.28%

12,330

1D -2.53%

YTD -31.84%

12,930

1D -2.12%

YTD -31.95%

16,000

1D 0.00%

YTD -30.13%

13,200

1D -1.42%

YTD -41.28%

22,630

1D -0.31%

YTD -19.32%

13,450

1D -0.37%

YTD -37.38%

1,032

1D -1.23%

YTD 0.00%

1,038

1D -0.80%

YTD 0.00%

1,034

1D -0.96%

YTD 0.00%

1,050

1D 0.19%

YTD 0.00%

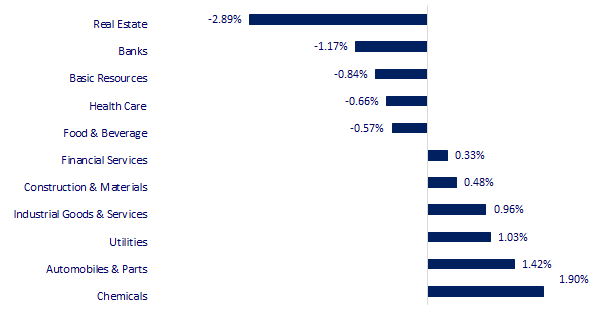

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

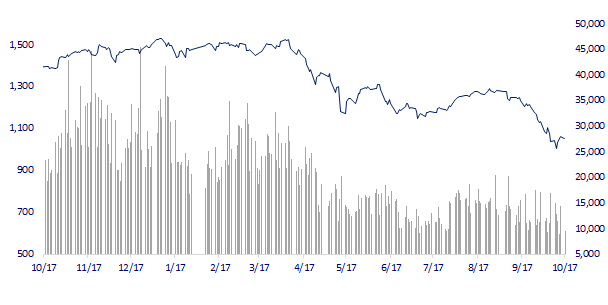

VNINDEX (12M)

GLOBAL MARKET

26,775.79

1D 0.23%

YTD -7.00%

3,084.94

1D 1.02%

YTD -15.24%

2,219.71

1D 0.56%

YTD -25.45%

16,612.90

1D 0.84%

YTD -29.00%

3,015.75

1D -0.78%

YTD -3.46%

1,571.40

1D 0.68%

YTD -5.20%

85.05

1D -0.23%

YTD 11.18%

1,663.10

1D 0.34%

YTD -8.66%

Asian stocks opened the first session of the week not so smoothly, but recovered evenly at the end of the session on October 17. Japan's Nikkei 225 index increased by 0.23% to 26,775.79 points. In South Korea, the Kospi index increased by 0.56% to 2,219.71 points. The Hang Seng Index increased by 0.84% to 16,612.9 points. The strong decline of the markets at the opening was reduced significantly thanks to the buying of bargain stocks by investors.

VIETNAM ECONOMY

5.48%

YTD (bps) 467

6.60%

YTD (bps) 100

4.71%

1D (bps) -6

YTD (bps) 370

4.68%

1D (bps) -20

YTD (bps) 268

24,478

1D (%) 0.88%

YTD (%) 6.70%

24,469

1D (%) 0.94%

YTD (%) -7.55%

3,449

1D (%) 0.58%

YTD (%) -5.71%

On October 17, the State Bank issued Decision No. 1747 regulating the spot exchange rate between VND and foreign currencies of authorized credit institutions. Accordingly, the spot exchange rate between VND and USD was adjusted from ±3% to ±5%. The SBV will continue to closely monitor market developments, coordinate monetary policy tools, and be ready to sell foreign currency interventions to stabilize the market.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank raised the exchange rate band to 5%

- VSIP received the decision to approve the investment policy of an industrial park in Can Tho

- Proposing to increase credit room for petroleum importers

- British Pound grows strongly as new Finance Minister is about to announce new fiscal policy

- Many Asian countries are on the verge of default

- Nearly half of EU members increased their imports of Russian goods in June

VN30

BANK

66,300

1D -2.64%

5D 1.84%

Buy Vol. 1,955,755

Sell Vol. 1,924,403

32,700

1D -0.91%

5D 9.00%

Buy Vol. 2,059,426

Sell Vol. 1,866,535

22,550

1D -0.66%

5D 8.94%

Buy Vol. 8,241,410

Sell Vol. 7,700,615

25,100

1D -2.33%

5D -2.71%

Buy Vol. 11,976,195

Sell Vol. 10,573,305

15,950

1D -1.24%

5D 3.91%

Buy Vol. 13,781,865

Sell Vol. 13,140,300

17,500

1D -1.69%

5D 1.45%

Buy Vol. 17,855,566

Sell Vol. 16,021,523

16,500

1D -2.94%

5D -2.37%

Buy Vol. 3,240,833

Sell Vol. 2,791,573

20,600

1D 0.00%

5D -0.96%

Buy Vol. 6,482,575

Sell Vol. 5,592,434

18,150

1D 2.83%

5D 6.76%

Buy Vol. 36,142,538

Sell Vol. 20,003,407

19,900

1D -1.49%

5D -0.25%

Buy Vol. 2,503,375

Sell Vol. 2,414,209

20,950

1D 0.48%

5D 12.03%

Buy Vol. 6,509,311

Sell Vol. 6,450,861

HDBank and HD SAISON are committed to deploying a package of VND 10,000 billion for workers in industrial parks and factories across the country with an interest rate reduced by 50% compared to the interest rate for ordinary customers, serving the demand for consumer loans, loans for living needs and credit cards. The program is implemented under the direction of the Prime Minister and the Deputy Governor of the State Bank of Vietnam with preferential interest rates for workers, repelling black credit, supporting the economy to boost production and develop.

REAL ESTATE

75,000

1D -1.32%

5D -1.83%

Buy Vol. 2,113,564

Sell Vol. 3,138,123

25,600

1D -3.40%

5D -1.16%

Buy Vol. 2,828,815

Sell Vol. 3,245,097

49,600

1D 1.33%

5D -1.00%

Buy Vol. 2,278,925

Sell Vol. 2,438,023

The accumulated income tax revenue from real estate transfer, inheritance and gift receipt of real estate in 8M/2022 reached more than VND 26,860 billion, up 96.4% over the same period in 2021.

OIL & GAS

111,500

1D 1.55%

5D 5.19%

Buy Vol. 646,143

Sell Vol. 892,682

11,150

1D 3.24%

5D 1.36%

Buy Vol. 23,188,115

Sell Vol. 17,888,027

32,900

1D -2.37%

5D -1.79%

Buy Vol. 1,808,243

Sell Vol. 1,757,290

PLX: Although petroleum retail increased by 26% over the same period, the 9-month petroleum profit of PLX Group was estimated at 780 billion dong.

VINGROUP

56,000

1D -6.20%

5D -6.98%

Buy Vol. 1,259,764

Sell Vol. 1,450,313

49,500

1D -4.62%

5D -8.16%

Buy Vol. 4,063,169

Sell Vol. 5,033,629

24,900

1D -1.19%

5D -1.97%

Buy Vol. 2,292,165

Sell Vol. 1,663,343

On October 13, VinFast and Infineon Technologies AG - announced the expansion of cooperation in the field of Electrochemical Mobility, establishing VinFast - Infineon PTPT (VICC).

FOOD & BEVERAGE

74,100

1D 0.14%

5D 5.11%

Buy Vol. 2,885,794

Sell Vol. 3,261,981

79,000

1D 0.00%

5D -1.86%

Buy Vol. 2,207,537

Sell Vol. 2,263,343

185,100

1D -1.75%

5D 0.33%

Buy Vol. 122,034

Sell Vol. 181,244

VNM: VNM shares ranked first in the list of top 10 stocks that were net bought by foreign investors on October 17 with a net buying value of more than 75 billion dong.

OTHERS

50,700

1D 0.00%

5D 1.40%

Buy Vol. 1,303,135

Sell Vol. 1,061,516

109,000

1D 0.00%

5D -0.91%

Buy Vol. 394,271

Sell Vol. 408,901

73,800

1D -0.27%

5D -0.27%

Buy Vol. 1,855,281

Sell Vol. 1,346,036

58,900

1D -1.67%

5D 3.15%

Buy Vol. 4,870,373

Sell Vol. 5,053,842

16,600

1D 0.91%

5D 0.85%

Buy Vol. 2,786,333

Sell Vol. 2,063,557

18,000

1D 0.56%

5D 3.45%

Buy Vol. 24,729,467

Sell Vol. 23,177,514

19,250

1D -1.03%

5D 4.90%

Buy Vol. 31,861,076

Sell Vol. 27,173,046

FPT: FPT Japan has just signed a non-dominant investment agreement, becoming a strategic shareholder of LTS, Inc. – Top 20 digital transformation consulting and service companies in Japan. The strategic investment will help FPT and LTS, Inc. expanding opportunities in the field of technology consulting and services, with the goal of achieving contracts worth tens of million of dollars in Japan as well as international markets.

Market by numbers

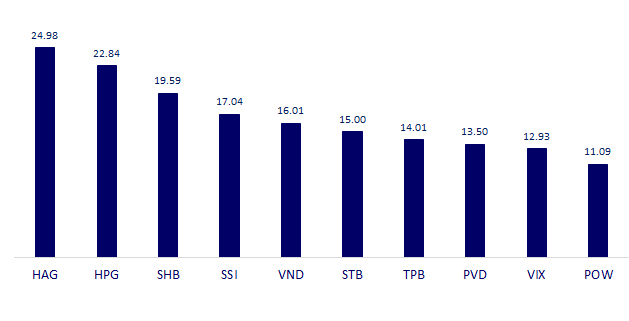

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

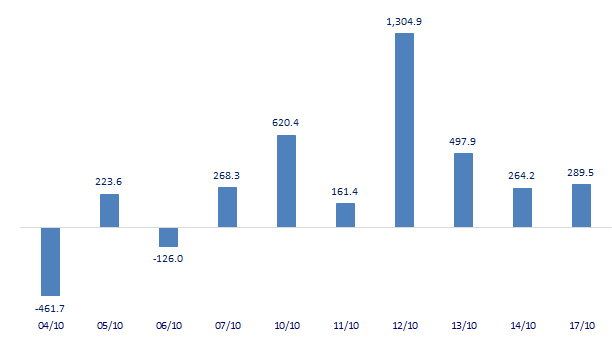

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

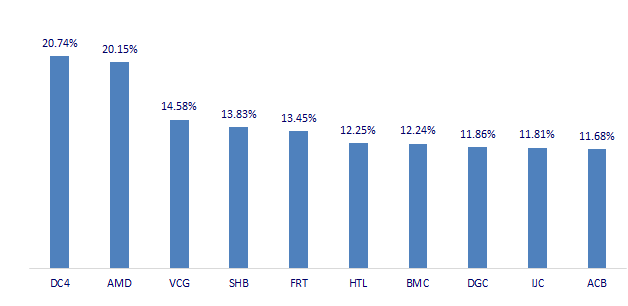

TOP INCREASES 3 CONSECUTIVE SESSIONS

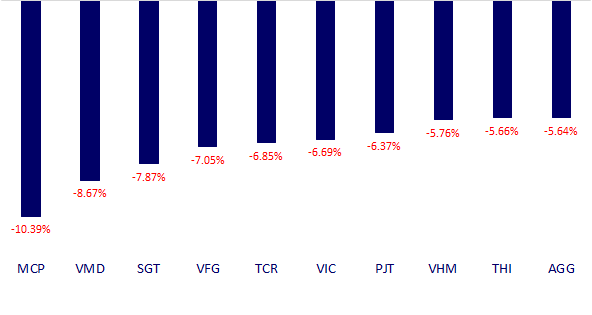

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.