Morning Brief 17/10/2022

GLOBAL MARKET

29,634.83

1D -1.34%

YTD -18.58%

3,583.07

1D -2.37%

YTD -25.02%

10,321.39

1D -3.08%

YTD -34.43%

32.02

1D 0.25%

6,858.79

1D 0.12%

YTD -7.35%

12,437.81

1D 0.67%

YTD -21.70%

5,931.92

1D 0.90%

YTD -17.30%

85.25

1D -4.17%

YTD 11.44%

1,657.45

1D -0.69%

YTD -8.97%

US stocks fell back on Friday (October 14), ending a tumultuous week, a day after recording a historic strong reversal session as investors embraced inflation expectations broadcast in the US. Ending Friday's session, the Dow Jones lost 1.34% to 29,634.83 points. The S&P 500 index dropped 2.37% to 3,583.07 points and recorded the 7th drop in 8 sessions. The Nasdaq Composite Index lost 3.08% to 10,321.39 points.

VIETNAM ECONOMY

5.48%

1D (bps) -103

YTD (bps) 467

6.60%

YTD (bps) 100

4.77%

1D (bps) 6

YTD (bps) 376

4.88%

1D (bps) 14

YTD (bps) 288

24,265

1D (%) 0.26%

YTD (%) 5.78%

24,242

1D (%) -0.28%

YTD (%) -8.41%

3,429

1D (%) -0.23%

YTD (%) -6.26%

After stalling in a short time, the USD price bounced up on both the banking market and the free market. In the past week, banks all raised the USD price by about 200-220 dong in both directions compared to the end of last week, equivalent to an increase of about 0.9%. Compared to the end of September, the USD exchange rate at banks has increased by about 220-250 dong, equivalent to an increase of 0.9-1%.

VIETNAM STOCK MARKET

1,061.85

1D 1.03%

YTD -29.13%

1,061.39

1D 0.97%

YTD -30.89%

227.89

1D 1.40%

YTD -51.92%

80.16

1D 1.51%

YTD -28.86%

264.18

16,104.64

1D 63.53%

YTD -48.17%

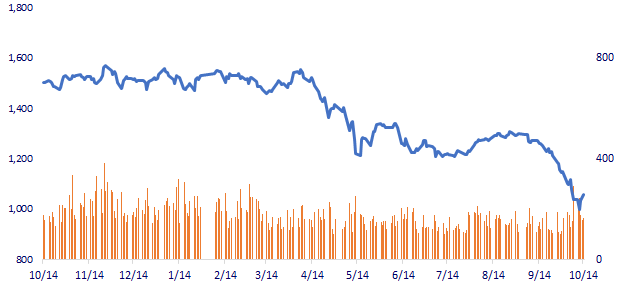

Last week, VN-Index touched the lowest level at 998 points after some negative information related to SCB, then recovered thanks to the buying force in the last sessions of the week. Although the liquidity dropped to a 2-year low, the market's upward trend was quite positive with many stocks recovering strongly.

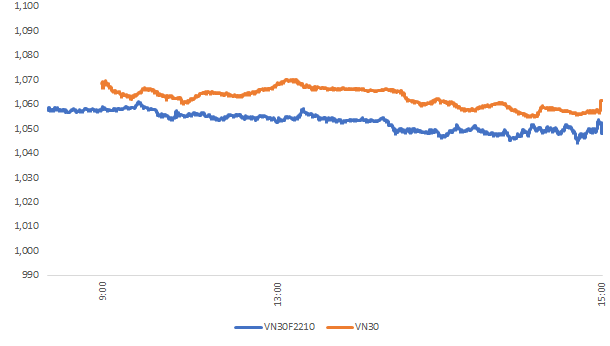

INTRADAY

VN30 (12M)

SELECTED NEWS

- More than 5,400 billion VND to invest in 6 railway projects in the period of 2021 - 2025

- Adjusting and supplementing the central budget capital plan in 2022

- Completion of phase 1 - The longest 220kV transmission line in Southeast Asia

- Norway becomes a major gas supplier to the EU

- Asia spent $50 billion in foreign exchange reserves in September to protect its local currency

- The world is no longer congested, sea freight rates drop sharply

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.