Market Brief 21/10/2022

VIETNAM STOCK MARKET

1,019.82

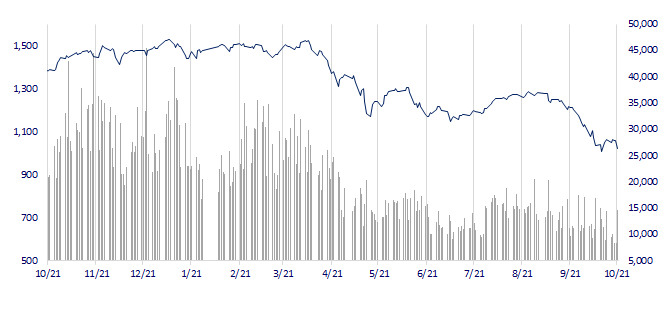

1D -3.65%

YTD -31.93%

1,010.57

1D -4.05%

YTD -34.20%

217.41

1D -3.75%

YTD -54.13%

78.57

1D -2.74%

YTD -30.27%

-416.74

1D 0.00%

YTD 0.00%

16,641.32

1D 77.89%

YTD -46.44%

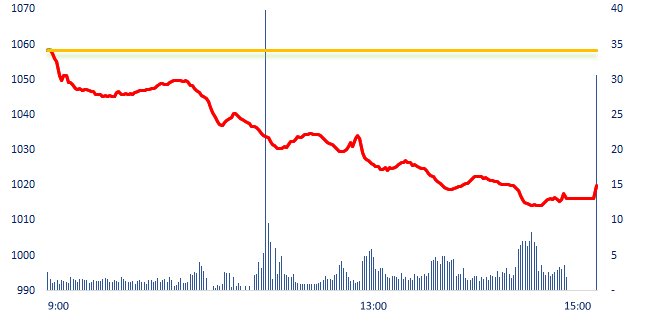

On October 21: Market capitalization "lost" 8 billion USD, there were 256 stocks with maximum reduction in amplitude. At the end of the session, the VN-Index dropped 38.63 points (equivalent to 3.65%) to 1,019.82 points. Since Q1/2022, Vietnam's stocks entered the top of the world's strongest decline with a decrease of more than 33%.

ETF & DERIVATIVES

17,090

1D -4.63%

YTD -33.84%

11,900

1D -4.65%

YTD -34.22%

12,410

1D -4.46%

YTD -34.68%

15,330

1D -1.35%

YTD -33.06%

12,400

1D -6.63%

YTD -44.84%

21,700

1D -6.02%

YTD -22.64%

12,840

1D -4.11%

YTD -40.22%

1,001

1D -7.00%

YTD 0.00%

980

1D -4.91%

YTD 0.00%

979

1D -5.86%

YTD 0.00%

985

1D -5.03%

YTD 0.00%

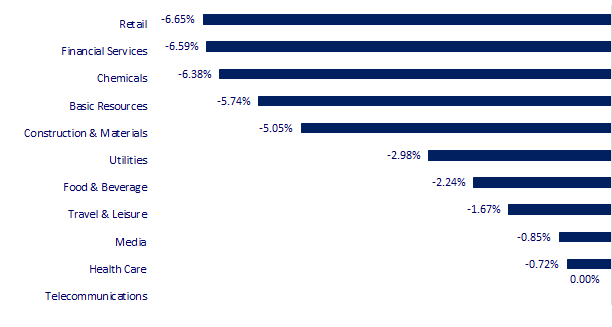

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,890.58

1D -0.12%

YTD -6.60%

3,038.93

1D 0.13%

YTD -16.51%

2,213.12

1D 0.12%

YTD -25.68%

16,211.12

1D -0.42%

YTD -30.71%

2,969.95

1D -1.60%

YTD -4.92%

1,591.32

1D -0.09%

YTD -4.00%

92.78

1D 0.30%

YTD 21.28%

1,629.50

1D -0.13%

YTD -10.51%

In the context of Japan's inflation to an 8-year high, the Nikkei 225 index fell 0.12% to 26,890.58 points. The Hang Seng Index dropped 0.42% to 16,211.12 points. Conversely, South Korea's Kospi index increased by 0.12% to 2,213.12 points.

VIETNAM ECONOMY

4.01%

1D (bps) -9

YTD (bps) 320

6.60%

YTD (bps) 100

4.74%

1D (bps) 1

YTD (bps) 373

4.71%

1D (bps) -7

YTD (bps) 271

24,872

1D (%) 0.70%

YTD (%) 8.42%

24,679

1D (%) -0.21%

YTD (%) -6.76%

3,499

1D (%) 1.16%

YTD (%) -4.35%

In just a short time of opening, Vietnam's tourism has recovered strongly with a total revenue of over VND 394,000 billion. In particular, the number of domestic tourists in only 9 months has exceeded the whole year of 2019 - the time when the epidemic had not occurred. In 9M/2022, revenue from accommodation and food services was estimated at more than VND 430,000 billion, up nearly 55% over the same period last year. Tourism revenue also increased by nearly 300%, estimated at 18,200 billion VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam earned 16.5 billion USD from tourism in the first nine months of 2022

- WB: Vietnam’s economy registers strong growth in Q3/2022

- State budget revenues of this year is expected to exceed 14.3% of the estimate, revenue from crude oil exceeds 141%.

- US eyes expanding China Tech ban to quantum computing and AI

- Japan logged a record trade deficit in the first half of fiscal 2022

- EU summit: EU agrees 'roadmap' to contain energy prices

VN30

BANK

68,000

1D -1.73%

5D -0.15%

Buy Vol. 1,856,428

Sell Vol. 2,226,915

32,600

1D -1.66%

5D -1.21%

Buy Vol. 2,331,368

Sell Vol. 3,002,952

21,650

1D -6.88%

5D -4.63%

Buy Vol. 9,768,916

Sell Vol. 10,298,594

22,900

1D -6.91%

5D -10.89%

Buy Vol. 14,125,922

Sell Vol. 16,032,080

15,550

1D -2.51%

5D -3.72%

Buy Vol. 21,576,327

Sell Vol. 28,392,787

16,100

1D -6.12%

5D -9.55%

Buy Vol. 22,657,230

Sell Vol. 29,069,143

16,500

1D -1.79%

5D -2.94%

Buy Vol. 3,825,847

Sell Vol. 3,803,352

20,100

1D -2.43%

5D -2.43%

Buy Vol. 3,965,893

Sell Vol. 4,278,829

15,950

1D -7.00%

5D -9.63%

Buy Vol. 36,206,946

Sell Vol. 34,465,467

19,200

1D -3.76%

5D -4.95%

Buy Vol. 3,596,361

Sell Vol. 3,985,527

20,400

1D -4.45%

5D -2.16%

Buy Vol. 6,664,299

Sell Vol. 5,976,318

TCB: Techcombank announced the business results Q3/2022 with pre-tax profit of VND 20,800 billion, up 21.8% over the same period. Techcombank's CASA ratio reached 46.5%, maintaining the leading position in the industry. In the end of September, Techcombank's total assets reached VND 671,400 billion, an increase of 23.9% over the same period in 2021. Core business all grew positively, interest income and income from service activities (excluding fees from investment banking services) in the first 9 months of 2022 grew strongly, making the main contribution to raising total operating income to VND 31,500 billion, up 16.9% over the same period last year.

REAL ESTATE

75,000

1D -0.13%

5D -1.32%

Buy Vol. 2,292,692

Sell Vol. 2,333,547

23,850

1D -6.47%

5D -10.00%

Buy Vol. 3,918,753

Sell Vol. 4,618,716

48,700

1D -0.61%

5D -0.51%

Buy Vol. 1,483,708

Sell Vol. 1,745,976

PDR: Transferring part of a subsidiary, Phat Dat Real Estate Development JSC recorded a net profit of the third quarter increased by 18% over the same period.

OIL & GAS

107,200

1D -3.34%

5D -2.37%

Buy Vol. 778,162

Sell Vol. 1,199,676

10,300

1D -5.07%

5D -4.63%

Buy Vol. 31,483,214

Sell Vol. 21,716,333

31,500

1D -5.97%

5D -6.53%

Buy Vol. 2,608,042

Sell Vol. 2,752,143

In the afternoon of October 21, the price of gasoline E5 RON 92 increased by 200 VND/liter, RON 95 increased by 340 VND/liter.

VINGROUP

56,800

1D -3.07%

5D -4.86%

Buy Vol. 1,846,617

Sell Vol. 2,368,246

47,950

1D -4.10%

5D -7.61%

Buy Vol. 6,256,827

Sell Vol. 7,868,034

24,000

1D -4.38%

5D -4.76%

Buy Vol. 1,453,245

Sell Vol. 1,352,573

FOOD & BEVERAGE

77,000

1D -0.65%

5D 4.05%

Buy Vol. 3,250,419

Sell Vol. 4,761,541

74,800

1D -6.73%

5D -5.32%

Buy Vol. 2,193,425

Sell Vol. 2,693,312

193,000

1D 0.89%

5D 2.44%

Buy Vol. 257,503

Sell Vol. 257,080

SAB: In Q3/2022, Sabeco recorded revenue of VND 8,635.08 billion, up 101.6% over the same period and profit after tax of VND 1,394.6 billion, up 195.5% over the same period of 2021.

OTHERS

48,050

1D -5.78%

5D -5.23%

Buy Vol. 1,559,201

Sell Vol. 1,572,365

108,900

1D 0.00%

5D -0.09%

Buy Vol. 369,601

Sell Vol. 353,151

73,900

1D -5.01%

5D -0.14%

Buy Vol. 2,977,454

Sell Vol. 3,029,762

54,400

1D -6.85%

5D -9.18%

Buy Vol. 5,717,810

Sell Vol. 6,768,804

15,100

1D -6.79%

5D -8.21%

Buy Vol. 2,792,197

Sell Vol. 3,769,431

16,200

1D -6.90%

5D -9.50%

Buy Vol. 41,645,301

Sell Vol. 45,287,754

16,900

1D -6.63%

5D -13.11%

Buy Vol. 66,510,246

Sell Vol. 64,253,880

SSI: Q3/2022, most of the business segments of the parent company SSI were lower than the same period in the same period. Operating revenue decreased by 25% over the same period, to 1,286 billion dong. Revenue from lending reached 406.1 billion dong, down 6%. Brokerage revenue fell by nearly 50% to 339.4 billion dong. Revenue from underwriting fell 57% to 2 billion and revenue from investment activities also decreased by 89% to 3.2 billion dong.

Market by numbers

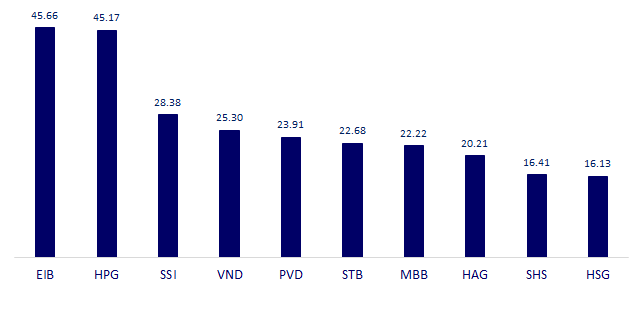

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

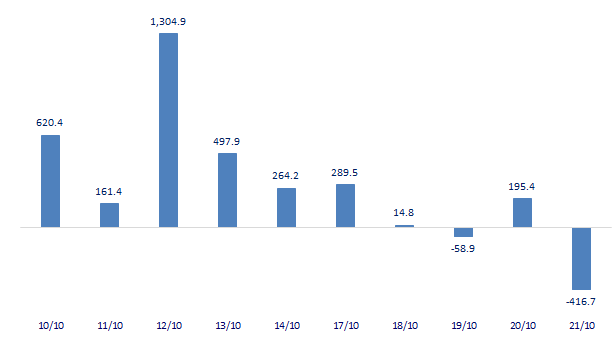

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

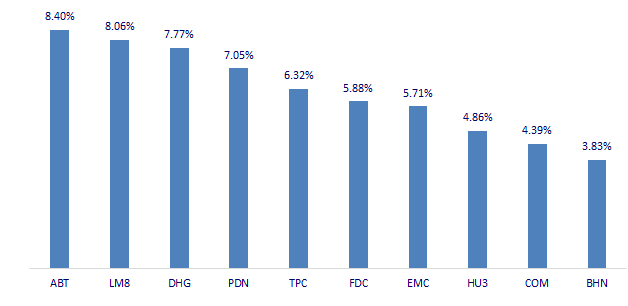

TOP INCREASES 3 CONSECUTIVE SESSIONS

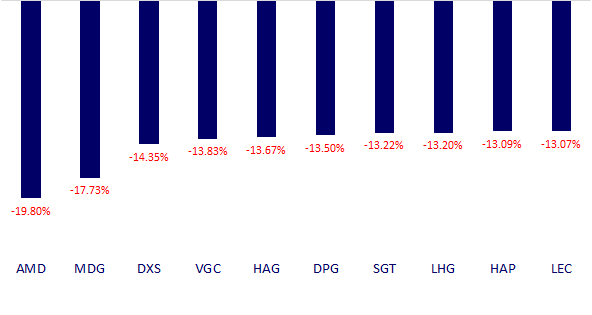

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.