Market brief 24/10/2022

VIETNAM STOCK MARKET

1,019.82

1D -3.65%

YTD -31.93%

1,010.57

1D -4.05%

YTD -34.20%

217.41

1D -3.75%

YTD -54.13%

78.57

1D -2.74%

YTD -30.27%

-416.74

1D 0.00%

YTD 0.00%

16,641.32

1D 77.89%

YTD -46.44%

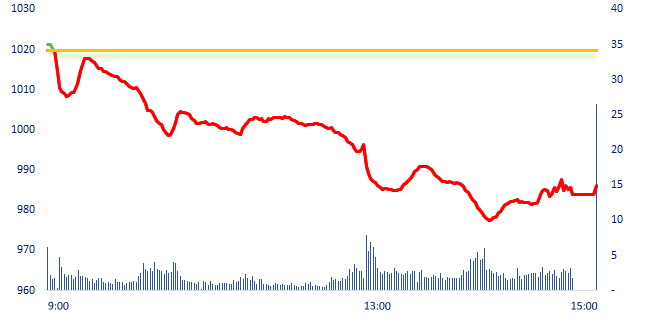

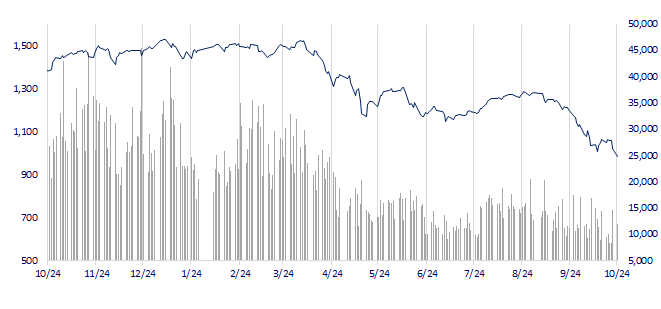

In the past 2 sessions, the VN-Index dropped 73 points (equivalent to nearly 7%) to 986.15 points, the lowest level since the end of November 2020. This is also the price range of VN-Index before the COVID-19 epidemic hit. Compared to the peak of 1,528 points at the beginning of the year, VN-Index "evaporated" more than 550 points, equivalent to a decrease of 35%.

ETF & DERIVATIVES

17,090

1D -4.63%

YTD -33.84%

11,900

1D -4.65%

YTD -34.22%

12,410

1D -4.46%

YTD -34.68%

15,330

1D -1.35%

YTD -33.06%

12,400

1D -6.63%

YTD -44.84%

21,700

1D -6.02%

YTD -22.64%

12,840

1D -4.11%

YTD -40.22%

1,001

1D -7.00%

YTD 0.00%

980

1D -4.91%

YTD 0.00%

979

1D -5.86%

YTD 0.00%

985

1D -5.03%

YTD 0.00%

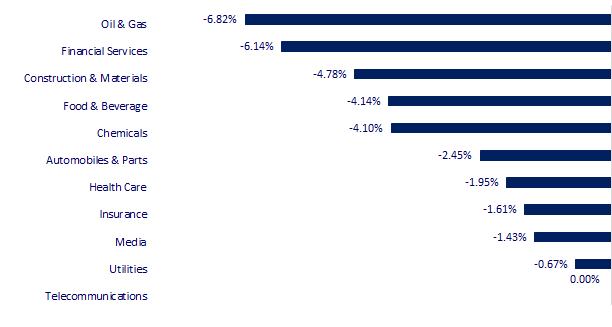

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,890.58

1D -0.12%

YTD -6.60%

3,038.93

1D 0.13%

YTD -16.51%

2,213.12

1D 0.12%

YTD -25.68%

16,211.12

1D -0.42%

YTD -30.71%

2,969.95

1D -1.60%

YTD -4.92%

1,591.32

1D -0.09%

YTD -4.00%

91.91

1D -0.64%

YTD 20.14%

1,660.80

1D 1.79%

YTD -8.79%

VIETNAM ECONOMY

4.01%

1D (bps) -9

YTD (bps) 320

6.60%

YTD (bps) 100

4.74%

1D (bps) 1

YTD (bps) 373

4.71%

1D (bps) -7

YTD (bps) 271

24,872

1D (%) 0.70%

YTD (%) 8.42%

25,217

1D (%) 1.96%

YTD (%) -4.73%

3,501

1D (%) 1.21%

YTD (%) -4.29%

The Government's report sent to the National Assembly by the Minister of Planning and Investment (MPI) authorized by the Prime Minister to the National Assembly shows that the disbursement progress is slow, and many ministries have requested to return trillions billions of public investment capital due to inability to disburse.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank continued to sharply increase the selling price of USD, the bank exchange rate simultaneously hit the ceiling;

- A series of ministries, sectors and localities "rushed" to ask for the return of public investment capital;

- The number of Vietnamese air passengers dropped sharply in October;

- Thousands of people in the UK protested to rejoin the EU, considering Brexit a failure;

- Hungary will veto new EU sanctions on Russian gas;

- Moody's downgrades UK debt outlook to 'negative'.

VN30

BANK

68,000

1D -1.73%

5D -0.15%

Buy Vol. 1,856,428

Sell Vol. 2,226,915

32,600

1D -1.66%

5D -1.21%

Buy Vol. 2,331,368

Sell Vol. 3,002,952

21,650

1D -6.88%

5D -4.63%

Buy Vol. 9,768,916

Sell Vol. 10,298,594

22,900

1D -6.91%

5D -10.89%

Buy Vol. 14,125,922

Sell Vol. 16,032,080

15,550

1D -2.51%

5D -3.72%

Buy Vol. 21,576,327

Sell Vol. 28,392,787

16,100

1D -6.12%

5D -9.55%

Buy Vol. 22,657,230

Sell Vol. 29,069,143

16,500

1D -1.79%

5D -2.94%

Buy Vol. 3,825,847

Sell Vol. 3,803,352

20,100

1D -2.43%

5D -2.43%

Buy Vol. 3,965,893

Sell Vol. 4,278,829

15,950

1D -7.00%

5D -9.63%

Buy Vol. 36,206,946

Sell Vol. 34,465,467

19,200

1D -3.76%

5D -4.95%

Buy Vol. 3,596,361

Sell Vol. 3,985,527

20,400

1D -4.45%

5D -2.16%

Buy Vol. 6,664,299

Sell Vol. 5,976,318

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) has just announced its 9-month financial report for 2022 with outstanding business results and strong operating indicators. TPBank completed 72% of the whole year profit plan with accumulated pre-tax profit of VND5,926 billion, increasing VND1,532 billion over the same period. Asset quality, intrinsic strength, and financial capacity are always at the top of the industry, with the pioneering application of Basel III standards, capital adequacy and liquidity indicators managed by the bank very well.

REAL ESTATE

75,000

1D -0.13%

5D -1.32%

Buy Vol. 2,292,692

Sell Vol. 2,333,547

23,850

1D -6.47%

5D -10.00%

Buy Vol. 3,918,753

Sell Vol. 4,618,716

48,700

1D -0.61%

5D -0.51%

Buy Vol. 1,483,708

Sell Vol. 1,745,976

KDH: As planned, Khang Dien House will open for sale the second phase of The Classia project in November. In addition, the high-rise projects Privia and Clarita are expected to start selling in 2023.

OIL & GAS

107,200

1D -3.34%

5D -2.37%

Buy Vol. 778,162

Sell Vol. 1,199,676

10,300

1D -5.07%

5D -4.63%

Buy Vol. 31,483,214

Sell Vol. 21,716,333

31,500

1D -5.97%

5D -6.53%

Buy Vol. 2,608,042

Sell Vol. 2,752,143

POW: PV Power Services and FHS signed a 3-year regular maintenance and repair contract.

VINGROUP

56,800

1D -3.07%

5D -4.86%

Buy Vol. 1,846,617

Sell Vol. 2,368,246

47,950

1D -4.10%

5D -7.61%

Buy Vol. 6,256,827

Sell Vol. 7,868,034

24,000

1D -4.38%

5D -4.76%

Buy Vol. 1,453,245

Sell Vol. 1,352,573

VIC: ADB has arranged a USD 135 million climate change financing package for VinFast to support the production of electric buses and the vehicle charging stations in Vietnam.

FOOD & BEVERAGE

77,000

1D -0.65%

5D 4.05%

Buy Vol. 3,250,419

Sell Vol. 4,761,541

74,800

1D -6.73%

5D -5.32%

Buy Vol. 2,193,425

Sell Vol. 2,693,312

193,000

1D 0.89%

5D 2.44%

Buy Vol. 257,503

Sell Vol. 257,080

SAB: On December 21, Saigon Beer - Alcohol - Beverage Corporation will close the list of shareholders to advance the 2022 dividend at the rate of 25% in cash.

OTHERS

48,050

1D -5.78%

5D -5.23%

Buy Vol. 1,559,201

Sell Vol. 1,572,365

108,900

1D 0.00%

5D -0.09%

Buy Vol. 369,601

Sell Vol. 353,151

73,900

1D -5.01%

5D -0.14%

Buy Vol. 2,977,454

Sell Vol. 3,029,762

54,400

1D -6.85%

5D -9.18%

Buy Vol. 5,717,810

Sell Vol. 6,768,804

15,100

1D -6.79%

5D -8.21%

Buy Vol. 2,792,197

Sell Vol. 3,769,431

16,200

1D -6.90%

5D -9.50%

Buy Vol. 41,645,301

Sell Vol. 45,287,754

16,900

1D -6.63%

5D -13.11%

Buy Vol. 66,510,246

Sell Vol. 64,253,880

HPG: Hoa Phat's share price has dropped in 6 consecutive sessions, in the context that other enterprises in the steel industry have continuously announced poor third-quarter business results. After exactly 2 years since passing the milestone of 100,000 billion in capitalization, Hoa Phat has returned to its original value.

Market by numbers

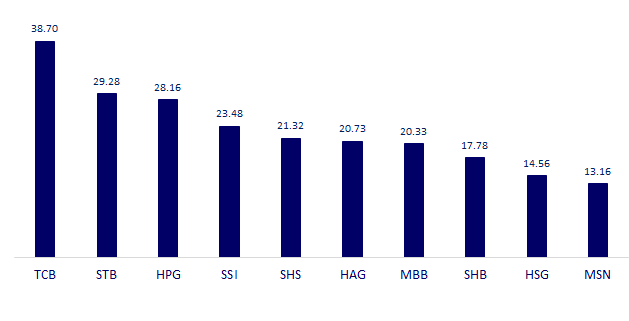

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

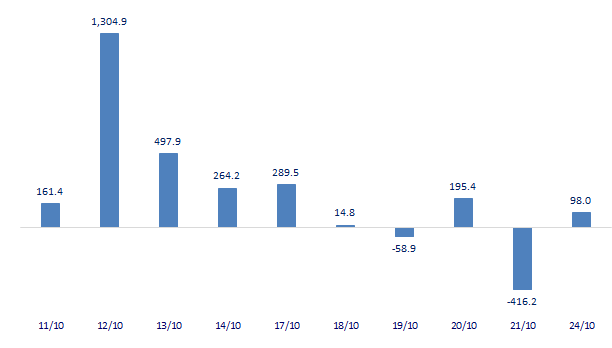

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

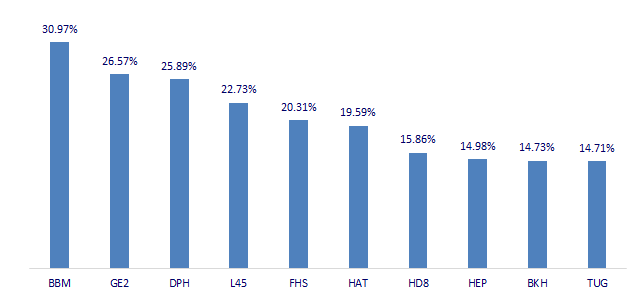

TOP INCREASES 3 CONSECUTIVE SESSIONS

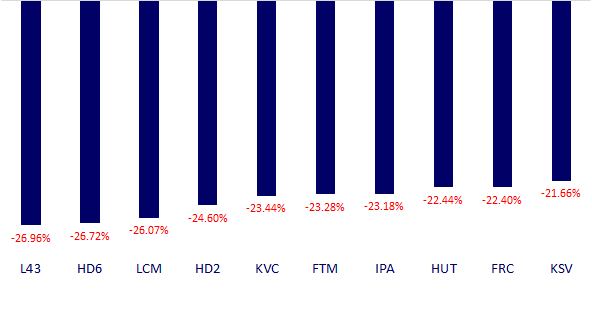

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.