Market brief 25/10/2022

VIETNAM STOCK MARKET

997.70

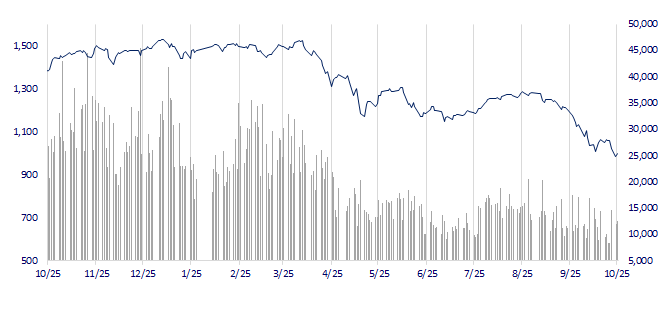

1D 1.17%

YTD -33.41%

991.52

1D 1.81%

YTD -35.44%

208.02

1D -0.71%

YTD -56.11%

76.25

1D -0.26%

YTD -32.33%

-73.73

1D 0.00%

YTD 0.00%

14,098.15

1D 2.86%

YTD -54.63%

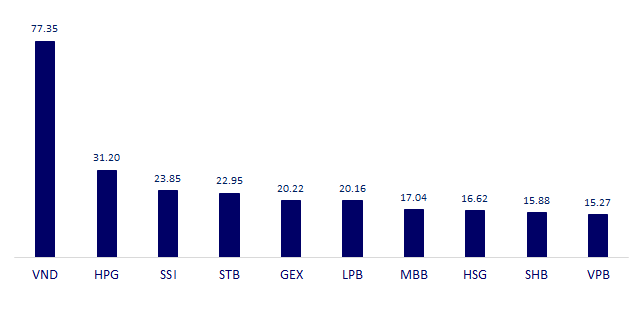

Foreign investors quickly returned to the trend of net selling in the volatile session on October 25. Foreign investors were the strongest net buyers of MSN shares with a net buying value of VND51.07 bil, while mostly net selling of VND shares with a total value of VND124.84 bil.

ETF & DERIVATIVES

16,610

1D 0.67%

YTD -35.69%

11,500

1D 0.00%

YTD -36.43%

12,010

1D 3.45%

YTD -36.79%

14,900

1D 3.19%

YTD -34.93%

11,900

1D 1.71%

YTD -47.06%

21,440

1D 2.78%

YTD -23.57%

12,550

1D 1.37%

YTD -41.57%

953

1D 1.86%

YTD 0.00%

946

1D 0.60%

YTD 0.00%

955

1D 1.64%

YTD 0.00%

961

1D 2.02%

YTD 0.00%

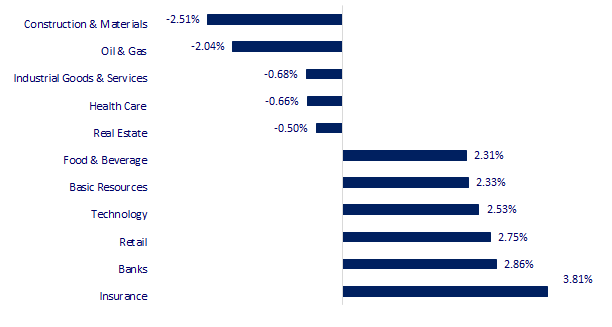

CHANGE IN PRICE BY SECTOR

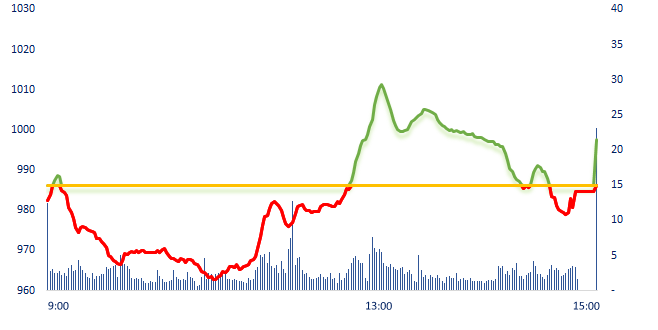

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,250.28

1D 0.11%

YTD -5.35%

2,976.28

1D -0.04%

YTD -18.23%

2,235.07

1D -0.67%

YTD -24.94%

15,165.59

1D -0.10%

YTD -35.18%

2,984.15

1D 0.48%

YTD -4.47%

1,600.66

1D 0.59%

YTD -3.44%

90.05

1D -1.69%

YTD 17.71%

1,642.80

1D -0.96%

YTD -9.78%

At the end of the session, Asian markets were mixed. Nikkei 225 (Japan) increased 0.11% to 27,250.28 points. On the contrary, markets such as Shanghai Composite (China), Kospi (Korea), Hang Seng (Hong Kong) all dropped.

VIETNAM ECONOMY

5.46%

1D (bps) 82

YTD (bps) 465

6.60%

YTD (bps) 100

4.78%

1D (bps) 3

YTD (bps) 377

4.79%

1D (bps) -1

YTD (bps) 279

24,888

1D (%) 0.01%

YTD (%) 8.49%

25,249

1D (%) -0.28%

YTD (%) -4.61%

3,470

1D (%) -0.66%

YTD (%) -5.14%

Before raising the operating interest rate, the SBV applied a tight monetary policy when there were 5 consecutive sessions of net withdrawal of liquidity (October 18 - October 24), with more than VND135,500 bil from the banking system. Specifically, this agency has newly issued nearly VND132,300 bil bills with 7-day tenor, and at the same time net withdrawn more than VND1,600 bil through OMO maturity channel.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has been gradually attractive to Gulf investors;

- Binh Dinh focuses on attracting investment from the European market;

- International newspaper: VinFast's car models will definitely "cause storms" in Europe;

- Chinese technology stocks sold off in the US, with stock down 34% of price;

- Nightmare for US chip companies after China semiconductor ban;

- Prices in Japan skyrocketed, people went to 3-4 stores just to buy cheap cup noodles, winter worries are getting closer.

VN30

BANK

69,900

1D 2.79%

5D 3.25%

Buy Vol. 2,320,288

Sell Vol. 2,146,558

31,300

1D 3.13%

5D -4.57%

Buy Vol. 3,337,889

Sell Vol. 2,137,410

22,450

1D 6.90%

5D -2.39%

Buy Vol. 14,807,329

Sell Vol. 10,994,249

21,300

1D 0.00%

5D -15.81%

Buy Vol. 19,616,179

Sell Vol. 15,103,439

15,450

1D 0.32%

5D -3.13%

Buy Vol. 21,311,066

Sell Vol. 32,253,293

16,400

1D 5.13%

5D -6.55%

Buy Vol. 27,981,970

Sell Vol. 21,320,562

16,000

1D 0.31%

5D -4.76%

Buy Vol. 2,564,360

Sell Vol. 3,338,495

20,150

1D 0.00%

5D -2.18%

Buy Vol. 5,556,332

Sell Vol. 6,299,221

14,900

1D 0.34%

5D -15.82%

Buy Vol. 44,847,344

Sell Vol. 37,652,076

19,250

1D 2.12%

5D -3.51%

Buy Vol. 3,122,074

Sell Vol. 3,686,594

20,400

1D 4.62%

5D -4.67%

Buy Vol. 8,634,863

Sell Vol. 7,391,276

Bank stocks on October 25 had a spectacular reversal. This morning's trading session, this group of industries was in the red with a series of stocks that dropped deeply and then suddenly recovered from 11am. The strong rally continued in the early afternoon when a series of banking stocks hit the ceiling like CTG, BID, MBB, ACB, STB, etc.

REAL ESTATE

75,000

1D 0.81%

5D -0.13%

Buy Vol. 2,532,957

Sell Vol. 2,386,699

21,000

1D -5.41%

5D -20.15%

Buy Vol. 4,193,340

Sell Vol. 5,511,484

46,700

1D -0.64%

5D -6.04%

Buy Vol. 1,705,277

Sell Vol. 1,672,388

NVL: On October 24, Novaland officially denied the rumors of the past days related to the projects of this enterprise.

OIL & GAS

107,200

1D 0.00%

5D -3.42%

Buy Vol. 636,342

Sell Vol. 714,378

9,970

1D 0.91%

5D -10.18%

Buy Vol. 20,983,409

Sell Vol. 19,015,294

28,000

1D -4.44%

5D -15.79%

Buy Vol. 3,266,799

Sell Vol. 3,218,610

PLX: Vietnam National Petroleum Group has just approved the plan to pay dividends in 2021 in cash at the rate of 12% (1 share receives 1,200 VND).

VINGROUP

56,100

1D -0.71%

5D -3.94%

Buy Vol. 2,042,324

Sell Vol. 2,291,316

44,600

1D 0.00%

5D -11.68%

Buy Vol. 8,656,512

Sell Vol. 10,599,916

23,000

1D 2.91%

5D -10.85%

Buy Vol. 2,636,981

Sell Vol. 3,103,236

VHM: On October 24, Vinhomes has just announced a plan to cooperate with VMI - a company owned by Mr. Pham Nhat Vuong, a member of the BOD of Vinhomes holding 90% of the shares.

FOOD & BEVERAGE

76,000

1D 2.70%

5D -0.65%

Buy Vol. 2,797,803

Sell Vol. 2,753,447

75,000

1D 3.02%

5D -8.54%

Buy Vol. 2,790,996

Sell Vol. 2,735,018

187,800

1D 3.76%

5D -1.05%

Buy Vol. 404,118

Sell Vol. 389,458

SAB: The owner of the Saigon Beer brand made a profit of more than 4,400 bil VND in 9 months, which means an average profit of more than 16 bil VND per day.

OTHERS

50,000

1D 4.38%

5D -1.77%

Buy Vol. 2,195,787

Sell Vol. 1,963,789

108,000

1D 0.93%

5D -1.01%

Buy Vol. 256,154

Sell Vol. 292,763

73,200

1D 2.95%

5D -2.27%

Buy Vol. 3,638,866

Sell Vol. 2,565,969

52,000

1D 2.77%

5D -11.86%

Buy Vol. 7,629,001

Sell Vol. 7,718,652

13,300

1D -5.34%

5D -20.83%

Buy Vol. 5,143,877

Sell Vol. 4,336,367

15,050

1D -0.33%

5D -15.45%

Buy Vol. 40,765,942

Sell Vol. 37,991,017

17,100

1D 4.27%

5D -9.28%

Buy Vol. 58,237,901

Sell Vol. 48,568,614

FPT: FPT Telecom, a subsidiary of FPT, has just announced its consolidated financial statements for the third quarter of 2022 with net revenue of nearly VND 3,731 bil, profit after tax of VND 579 bil, up 20% and 23.7% over the same period last year, respectively. Gross profit margin reached 48.5%, up 3% compared to the third quarter of 2021.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

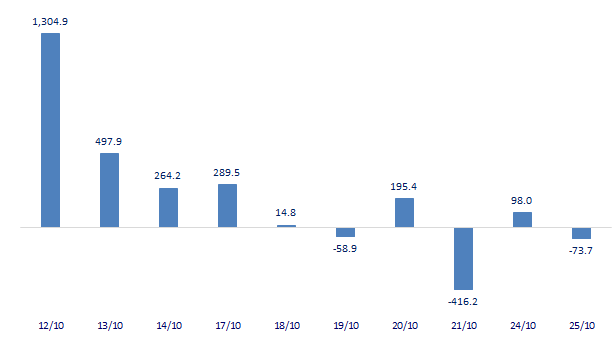

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

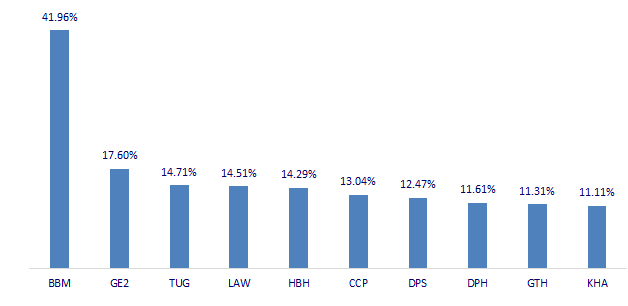

TOP INCREASES 3 CONSECUTIVE SESSIONS

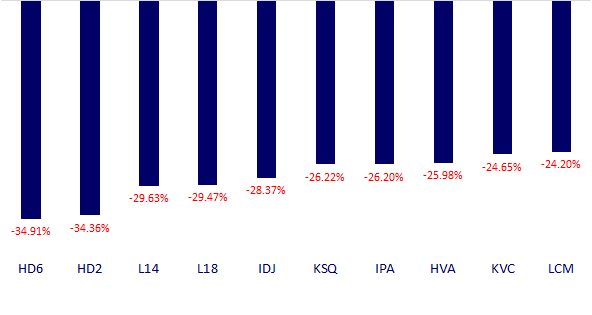

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.