Market brief 26/10/2022

VIETNAM STOCK MARKET

993.36

1D -0.44%

YTD -33.70%

990.41

1D -0.11%

YTD -35.51%

205.95

1D -1.00%

YTD -56.55%

75.85

1D -0.52%

YTD -32.69%

-38.89

1D 0.00%

YTD 0.00%

8,929.25

1D -36.66%

YTD -71.26%

At the end of the session, VN-Index dropped 4.34 points, to 993.36. HNX-Index dropped 2 points to nearly 206 points. Real estate is still the group that has the most negative impact on the market due to the poor performance of VIC, VHM, and VRE today. Besides, many large-cap stocks such as VGC, HPG, and SAB also contributed to the market decline.

ETF & DERIVATIVES

16,680

1D 0.42%

YTD -35.42%

11,700

1D 1.74%

YTD -35.32%

12,210

1D 1.67%

YTD -35.74%

14,700

1D -1.34%

YTD -35.81%

12,030

1D 1.09%

YTD -46.49%

21,500

1D 0.28%

YTD -23.35%

12,610

1D 0.48%

YTD -41.29%

962

1D 0.94%

YTD 0.00%

960

1D 1.43%

YTD 0.00%

963

1D 0.83%

YTD 0.00%

968

1D 0.68%

YTD 0.00%

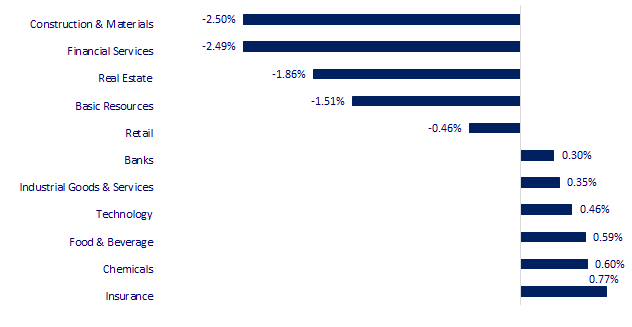

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,431.84

1D 0.67%

YTD -4.72%

2,999.50

1D 0.78%

YTD -17.59%

2,249.56

1D 0.65%

YTD -24.45%

15,317.67

1D 1.00%

YTD -34.53%

3,008.38

1D 0.81%

YTD -3.69%

1,596.46

1D -0.26%

YTD -3.69%

92.02

1D 1.37%

YTD 20.29%

1,673.45

1D 1.16%

YTD -8.09%

At the end of the session, Asian markets mostly gained. Nikkei 225 (Japan), Shanghai Composite (China), Kospi (Korea) all rose in the range of 0.6-0.7%. In particular, Hang Seng (Hong Kong) increased by 1%, to 15,317.67 points.

VIETNAM ECONOMY

5.46%

YTD (bps) 465

6.60%

YTD (bps) 100

4.76%

1D (bps) -1

YTD (bps) 375

4.76%

1D (bps) -3

YTD (bps) 276

24,883

1D (%) -0.02%

YTD (%) 8.47%

25,636

1D (%) 0.62%

YTD (%) -3.14%

3,530

1D (%) 1.18%

YTD (%) -3.50%

On October 26, the SBV announced the central exchange rate at 23,698 VND/USD, down 5 VND compared to yesterday. This is the first downward correction after 13 consecutive increases of the central exchange rate with a total increase of 286 VND. Banks simultaneously lowered the selling price of USD in the morning, however, some banks still listed the exchange rate on the ceiling.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Free USD price continued to increase strongly, to 25,450 VND;

- Hai Phong: Considering 50% reduction of seaport infrastructure fees for inland waterways;

- The State Bank net injected nearly 28 trillion VND after raising the operating interest rate;

- Singapore: Inflation nears 14-year peak;

- Energy crisis causes 25% of German companies to cut jobs;

- EU seeks mechanism to seize Russia's frozen assets.

VN30

BANK

70,000

1D 0.14%

5D 3.09%

Buy Vol. 947,713

Sell Vol. 1,019,540

31,700

1D 1.28%

5D -3.94%

Buy Vol. 1,326,603

Sell Vol. 1,876,465

22,400

1D -0.22%

5D -3.45%

Buy Vol. 6,479,891

Sell Vol. 8,194,708

21,400

1D 0.47%

5D -15.08%

Buy Vol. 6,238,245

Sell Vol. 5,912,546

15,550

1D 0.65%

5D -2.51%

Buy Vol. 11,580,032

Sell Vol. 17,578,368

16,400

1D 0.00%

5D -6.29%

Buy Vol. 12,978,219

Sell Vol. 12,754,590

15,950

1D -0.31%

5D -4.49%

Buy Vol. 1,781,437

Sell Vol. 2,024,470

20,000

1D -0.74%

5D -2.68%

Buy Vol. 2,326,421

Sell Vol. 3,284,981

15,000

1D 0.67%

5D -13.29%

Buy Vol. 16,387,193

Sell Vol. 18,179,191

19,050

1D -1.04%

5D -6.62%

Buy Vol. 1,906,897

Sell Vol. 2,297,481

20,650

1D 1.23%

5D -2.13%

Buy Vol. 5,007,922

Sell Vol. 4,295,461

TCB: The data released at the business results update for the first 9 months of Vietnam Technological and Commercial Joint Stock Bank (Techcombank) shows that the bank's CASA ratio in the third quarter continued to decrease by 1% compared to the previous quarter, down to 46.5%. Explaining this, the CFO said that the whole market has insufficient liquidity, leading to the increase of deposits and decrease in CASA. The bank's deposit expenses inevitably increased from 2.1% to 2.4% in the third quarter.

REAL ESTATE

74,500

1D -0.67%

5D -0.67%

Buy Vol. 1,877,566

Sell Vol. 1,491,438

21,700

1D 3.33%

5D -16.05%

Buy Vol. 4,630,423

Sell Vol. 5,063,386

45,500

1D -2.57%

5D -8.08%

Buy Vol. 1,005,906

Sell Vol. 1,164,168

PDR: At the end of the third quarter of 2022, Phat Dat recorded a revenue of VND1,260 billion, bringing a 9-month pre-tax income of VND1,790 billion, up 28% over the same period in 2021.

OIL & GAS

108,000

1D 0.75%

5D -1.01%

Buy Vol. 452,674

Sell Vol. 437,755

10,000

1D 0.30%

5D -9.09%

Buy Vol. 12,702,453

Sell Vol. 10,462,745

27,750

1D -0.89%

5D -16.54%

Buy Vol. 1,484,844

Sell Vol. 1,207,041

GAS: For the first time since May 2018, PV GAS surpassed Vinhomes, reaching the top 3 by capitalization of the entire stock market.

VINGROUP

54,800

1D -2.32%

5D -6.32%

Buy Vol. 1,563,760

Sell Vol. 2,254,876

43,500

1D -2.47%

5D -13.00%

Buy Vol. 5,436,939

Sell Vol. 5,883,814

22,200

1D -3.48%

5D -11.90%

Buy Vol. 1,073,611

Sell Vol. 1,863,846

VIC: VINIF announced to sponsor nearly VND90 billion for 19 Science and Technology projects and 5 Culture - History projects with practical value to contribute to the country development.

FOOD & BEVERAGE

76,000

1D 0.00%

5D -0.78%

Buy Vol. 1,422,449

Sell Vol. 1,695,166

78,000

1D 4.00%

5D -2.50%

Buy Vol. 1,808,950

Sell Vol. 1,581,441

186,100

1D -0.91%

5D -2.51%

Buy Vol. 265,521

Sell Vol. 269,572

MSN: Masan has just announced a resolution approving the plan to issue 2 lots of corporate bonds with a total value of VND4,000 billion for professional securities investors.

OTHERS

51,200

1D 2.40%

5D 0.00%

Buy Vol. 1,115,743

Sell Vol. 1,151,139

107,500

1D -0.46%

5D -1.47%

Buy Vol. 199,529

Sell Vol. 296,011

73,800

1D 0.82%

5D -2.25%

Buy Vol. 1,684,947

Sell Vol. 1,516,957

51,900

1D -0.19%

5D -12.03%

Buy Vol. 2,592,697

Sell Vol. 3,335,808

13,500

1D 1.50%

5D -18.43%

Buy Vol. 3,367,875

Sell Vol. 2,825,450

14,850

1D -1.33%

5D -15.86%

Buy Vol. 20,790,998

Sell Vol. 22,716,571

16,900

1D -1.17%

5D -8.15%

Buy Vol. 20,944,708

Sell Vol. 26,395,764

FPT: FPT has just reported a change in ownership of the foreign investors who are major shareholders. Accordingly, since the beginning of October, Dragon Capital has net sold more than 1 million FPT shares, thereby reducing its ownership rate to 4.96% and is no longer a major shareholder of FPT since October 25.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.