Market brief 28/10/2022

VIETNAM STOCK MARKET

1,027.36

1D -0.06%

YTD -31.43%

1,029.49

1D 0.10%

YTD -32.96%

213.73

1D 0.05%

YTD -54.91%

76.09

1D -1.54%

YTD -32.47%

-3,085.66

1D 0.00%

YTD 0.00%

14,540.98

1D 18.04%

YTD -53.20%

At the end of the session, VN-Index decreased slightly by 0.65 points (0.06%) to 1,027.36 points; HNX-Index increased 0.11 points to 213.73 points, UpCOM-Index decreased 1.19 points to 76.09 points. On HoSE, foreign investors saw the strongest net selling of VND3,032 bil of EIB. In contrast, MSN and VNM were mostly bought with the value of VND76 bil and VND48 bil, respectively.

ETF & DERIVATIVES

17,500

1D 0.92%

YTD -32.25%

12,120

1D 0.17%

YTD -33.00%

12,640

1D -0.16%

YTD -33.47%

15,150

1D 1.34%

YTD -33.84%

13,090

1D 1.71%

YTD -41.77%

22,520

1D 0.67%

YTD -19.71%

13,110

1D 0.61%

YTD -38.97%

1,010

1D -0.49%

YTD 0.00%

1,009

1D -0.76%

YTD 0.00%

1,013

1D -0.79%

YTD 0.00%

1,016

1D -0.88%

YTD 0.00%

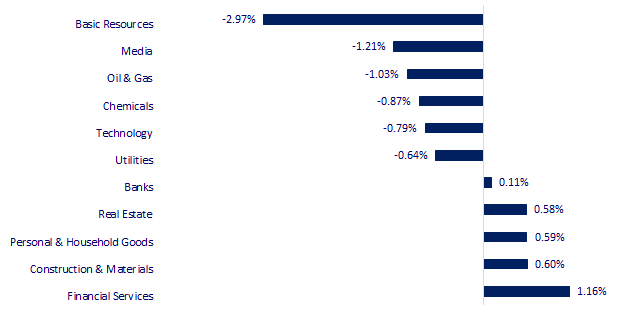

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,105.20

1D -0.88%

YTD -5.86%

2,915.93

1D -2.25%

YTD -19.89%

2,268.40

1D -0.89%

YTD -23.82%

14,863.06

1D -3.66%

YTD -36.48%

3,059.19

1D 1.46%

YTD -2.06%

1,606.07

1D 0.23%

YTD -3.11%

94.41

1D -0.13%

YTD 23.41%

1,652.80

1D -0.80%

YTD -9.23%

At the end of the session, Asian markets mostly dropped. In turn, Nikkei 225 (Japan), Shanghai Composite (China), Kospi (Korea) fell. In particular, Hang Seng (Hong Kong) plummeted 3.66% to 14,863.06 points.

VIETNAM ECONOMY

4.50%

1D (bps) -157

YTD (bps) 369

7.40%

YTD (bps) 180

4.80%

YTD (bps) 379

4.78%

YTD (bps) 278

24,878

1D (%) 0.00%

YTD (%) 8.45%

25,447

1D (%) -0.27%

YTD (%) -3.86%

3,492

1D (%) -0.43%

YTD (%) -4.54%

According to the Ministry of Finance, the estimated disbursement rate of public investment capital in the first 10 months of 2022 is 46% of the plan. Compared to the plan assigned by the Prime Minister, the disbursement rate reached over 51%, lower than the same period in 2021 (55.8%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ministry of Finance: The economy has a bad trend, looking at budget revenue;

- The Ministry of Finance requires petroleum enterprises to report unusually high costs;

- Logistics enterprises strive to find warehouses;

- Consumer inflation in the Japanese capital is the highest in 33 years;

- China Faces Tough Choices in Currency Defense as Yuan Weakens

- Elon Musk completes the acquisition of Twitter.

VN30

BANK

71,600

1D -0.14%

5D 5.29%

Buy Vol. 2,008,073

Sell Vol. 2,719,794

33,800

1D -0.29%

5D 3.68%

Buy Vol. 3,481,241

Sell Vol. 4,099,806

24,050

1D 0.42%

5D 11.09%

Buy Vol. 15,314,264

Sell Vol. 16,967,126

24,400

1D 6.78%

5D 6.55%

Buy Vol. 22,075,382

Sell Vol. 15,551,011

16,350

1D -1.21%

5D 5.14%

Buy Vol. 14,600,664

Sell Vol. 24,064,023

17,650

1D 0.86%

5D 9.63%

Buy Vol. 27,139,889

Sell Vol. 26,892,517

16,500

1D -0.60%

5D 0.00%

Buy Vol. 2,531,987

Sell Vol. 3,019,305

20,850

1D -0.71%

5D 3.73%

Buy Vol. 4,956,776

Sell Vol. 4,514,686

16,150

1D 0.62%

5D 1.25%

Buy Vol. 37,829,589

Sell Vol. 44,189,582

19,700

1D -1.01%

5D 2.60%

Buy Vol. 3,313,457

Sell Vol. 5,516,007

22,300

1D 1.13%

5D 9.31%

Buy Vol. 5,272,948

Sell Vol. 6,629,766

MBB: According to the recently released consolidated financial statements, MB's profit before tax is nearly VND18,192 billion after 9 months, up 53% over the same period, thanks to a 26% reduction in provision expenses for credit risks. In the first 9 months of the year, MB's main activities brought in VND26,394 billion in net interest income, up 39% over the same period. Meanwhile, most non-interest income decreased over the same period.

REAL ESTATE

72,500

1D -1.89%

5D -3.33%

Buy Vol. 2,367,292

Sell Vol. 1,941,708

23,000

1D 0.00%

5D -3.56%

Buy Vol. 2,329,907

Sell Vol. 2,994,403

44,600

1D -1.76%

5D -8.42%

Buy Vol. 1,196,120

Sell Vol. 1,300,500

KDH: Khang Dien Group was honored to be named at the PropertyGuru Vietnam Property Awards 2022.

OIL & GAS

109,000

1D -0.91%

5D 1.68%

Buy Vol. 318,913

Sell Vol. 524,187

10,350

1D -0.48%

5D 0.49%

Buy Vol. 14,678,723

Sell Vol. 16,299,084

29,000

1D -0.34%

5D -7.94%

Buy Vol. 1,243,582

Sell Vol. 1,828,618

POW: Mr. Ngo Van Chien, Branch Director of Ha Tinh Oil and Gas Power Company has just been appointed as Deputy General Director of PV Power.

VINGROUP

55,700

1D 1.27%

5D -1.94%

Buy Vol. 2,211,964

Sell Vol. 2,053,302

44,900

1D 2.05%

5D -6.36%

Buy Vol. 9,499,078

Sell Vol. 4,914,570

23,700

1D -0.21%

5D -1.25%

Buy Vol. 2,355,090

Sell Vol. 2,619,071

VRE: Vincom Retail JSC has just announced its financial statements for the third quarter of 2022 with total net revenue of VND2,005 billion, up 154.7% over the same period last year.

FOOD & BEVERAGE

78,000

1D -0.64%

5D 1.30%

Buy Vol. 2,395,764

Sell Vol. 3,256,256

83,900

1D 1.08%

5D 12.17%

Buy Vol. 2,271,666

Sell Vol. 2,858,640

186,100

1D -0.96%

5D -3.58%

Buy Vol. 146,423

Sell Vol. 142,469

MSN: Masan Group Joint Stock Company has just announced business results for the first 9 months of 2022 with a net profit of VND3,120 billion, up 47% over the same period last year.

OTHERS

52,500

1D -0.94%

5D 9.26%

Buy Vol. 1,540,618

Sell Vol. 1,909,332

107,800

1D -0.19%

5D -1.01%

Buy Vol. 191,016

Sell Vol. 294,643

75,000

1D -1.06%

5D 1.49%

Buy Vol. 1,854,024

Sell Vol. 2,118,197

53,200

1D -0.19%

5D -2.21%

Buy Vol. 3,361,562

Sell Vol. 3,898,626

14,500

1D 0.69%

5D -3.97%

Buy Vol. 3,345,116

Sell Vol. 3,118,787

15,900

1D 0.32%

5D -1.85%

Buy Vol. 28,081,481

Sell Vol. 30,880,139

16,800

1D -3.45%

5D -0.59%

Buy Vol. 44,663,682

Sell Vol. 54,861,995

HPG: Hoa Phat Group has just announced its financial statements for the third quarter of 2022. Accordingly, the revenue was VND34,441 billion, down 12% compared to the same period in 2021. PAT was negative VND1,786 billion, down 117% over the same period last year. In 9 months, Hoa Phat achieved VND116,559 billion in revenue and VND10,443 billion in PAT, reaching 76% and 39% of the year plan, respectively.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.