Market Brief 1/11/2022

VIETNAM STOCK MARKET

1,033.75

1D 0.57%

YTD -31.00%

1,038.09

1D 1.10%

YTD -32.40%

212.36

1D 0.92%

YTD -55.20%

76.49

1D 0.26%

YTD -32.12%

-762.03

1D 0.00%

YTD 0.00%

11,817.59

1D -5.65%

YTD -61.97%

The stock market had a positive session in terms of scores after the final financial reports of Q3/2022 were announced yesterday. Most of the third quarter business results of the banking industry were positive, of which 9 banks recorded growth rates greater than 50%, including 4 representatives from VN30 like ACB, BID, MBB and BID.

ETF & DERIVATIVES

17,520

1D -0.34%

YTD -32.17%

12,200

1D 2.95%

YTD -32.56%

12,580

1D -2.56%

YTD -33.79%

15,160

1D -3.99%

YTD -33.80%

13,500

1D 2.97%

YTD -39.95%

22,450

1D 0.90%

YTD -19.96%

13,170

1D 0.69%

YTD -38.69%

1,010

1D -0.01%

YTD 0.00%

1,010

1D -0.36%

YTD 0.00%

1,013

1D -0.29%

YTD 0.00%

1,018

1D -0.59%

YTD 0.00%

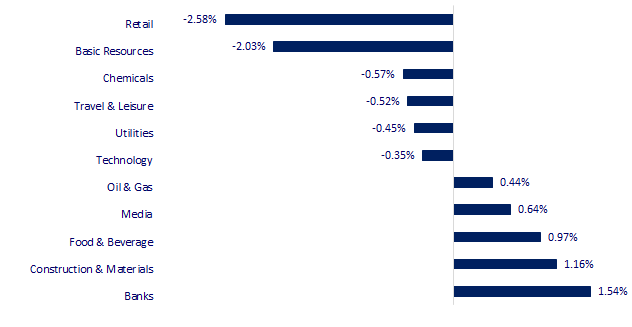

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,678.92

1D 0.33%

YTD -3.86%

2,969.20

1D 2.62%

YTD -18.42%

2,335.22

1D 1.81%

YTD -21.58%

15,455.27

1D 5.23%

YTD -33.95%

3,130.50

1D 1.21%

YTD 0.22%

1,625.73

1D 1.05%

YTD -1.92%

94.36

1D 1.90%

YTD 23.35%

1,654.85

1D 1.13%

YTD -9.11%

China and Hong Kong stocks jumped on Tuesday after rumours based on an unverified note circulating on social media that China was planning a reopening from strict Covid curbs in March triggered a sharp rebound following last month's savage selling.

VIETNAM ECONOMY

6.12%

1D (bps) 89

YTD (bps) 531

7.40%

YTD (bps) 180

4.85%

1D (bps) 4

YTD (bps) 384

4.90%

1D (bps) 12

YTD (bps) 290

24,882

1D (%) 0.01%

YTD (%) 8.47%

25,158

1D (%) -0.45%

YTD (%) -4.95%

3,489

1D (%) 0.46%

YTD (%) -4.62%

The second interest rate hike (October 25) in a row within a month right before the US FOMC meeting this week shows the determination of SBV in reducing the risk of rising inflation. The consequence is a series of banks raced to raise deposit rates, especially many banks increased the ceiling of short-term deposit rates. State-owned banks also boosted 12-month savings interest rates to 7.4%/year, an increase of more than 1 percentage point.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI in October staying above the 50-mark at 50.6, new orders and exports increased at the weakest rates in 13 months

- Vietnam’s seafood exports to the EU market are increasingly blurred and narrowed because of the IUU yellow card

- Gasoline prices increase for the third time in a row

- UK house prices fall the most since start of Covid pandemic

- Swiss National Bank loses nearly $143 billion in first nine months

- American companies increasingly look outside of China after Covid

VN30

BANK

75,000

1D 2.04%

5D 7.30%

Buy Vol. 1,093,219

Sell Vol. 1,240,765

34,050

1D -1.45%

5D 8.79%

Buy Vol. 2,480,941

Sell Vol. 3,543,005

24,450

1D -0.61%

5D 8.91%

Buy Vol. 13,853,125

Sell Vol. 17,173,720

25,650

1D 4.27%

5D 20.42%

Buy Vol. 14,927,483

Sell Vol. 14,849,272

17,200

1D 5.20%

5D 11.33%

Buy Vol. 40,671,952

Sell Vol. 39,413,051

18,000

1D 1.69%

5D 9.76%

Buy Vol. 37,561,722

Sell Vol. 34,131,638

16,600

1D 1.22%

5D 3.75%

Buy Vol. 5,461,468

Sell Vol. 5,112,446

21,800

1D 5.31%

5D 8.19%

Buy Vol. 10,198,948

Sell Vol. 9,351,467

16,900

1D 4.64%

5D 13.42%

Buy Vol. 50,533,497

Sell Vol. 46,009,349

20,150

1D 2.81%

5D 4.68%

Buy Vol. 7,640,189

Sell Vol. 7,233,286

22,450

1D 0.22%

5D 10.05%

Buy Vol. 4,641,436

Sell Vol. 6,266,725

STB: Sacombank reported profit before tax in Q3/2022, up 86% over the same period, earning more than VND 1,532 billion. Net interest income increased by 74%, earning nearly VND 5,762 billion. Non-interest income were also positive such as interest from services increased by 75%, reaching VND 1,031 billion; profit from foreign exchange increased by 46%, reaching 220 billion dong; profit from other activities increased 5% to 41 billion dong. Thus, compared with the target of VND 5,280 billion in pre-tax profit set for the whole year of 2022, Sacombank has achieved 84% after the first 9 months of the year.

REAL ESTATE

70,000

1D 0.00%

5D -6.67%

Buy Vol. 1,720,105

Sell Vol. 1,669,474

22,800

1D 0.44%

5D 8.57%

Buy Vol. 2,196,135

Sell Vol. 2,624,384

42,400

1D -2.97%

5D -9.21%

Buy Vol. 2,114,143

Sell Vol. 2,482,124

NVL: On September 30, NVL's loan and borrowing increased by 19% from the beginning of the year to VND 72 trillion (approximately USD 3 billion), equivalent to 27.7% of total assets.

OIL & GAS

110,000

1D -0.99%

5D 2.61%

Buy Vol. 683,669

Sell Vol. 1,091,716

10,350

1D 0.00%

5D 3.81%

Buy Vol. 10,798,948

Sell Vol. 10,587,741

29,100

1D 2.11%

5D 3.93%

Buy Vol. 1,317,418

Sell Vol. 1,670,137

Expected operating capacity in 2023 of Dung Quat Oil Refinery is 103% with 300 days of operation (except for 50 days for the 5th overall maintenance and 15 days for backup).

VINGROUP

55,400

1D 0.00%

5D -1.25%

Buy Vol. 2,146,282

Sell Vol. 2,341,065

45,000

1D 0.00%

5D 0.90%

Buy Vol. 3,640,439

Sell Vol. 5,122,741

26,250

1D 6.71%

5D 14.13%

Buy Vol. 3,583,914

Sell Vol. 3,205,883

VIC: 9M/2022, real estate business accounted for the highest proportion of revenue (40%), contributing VND 25,700 billion to VIC. VinFast achieved 9,900 billion VND in revenue, ranked in the top 2.

FOOD & BEVERAGE

80,200

1D 2.17%

5D 5.53%

Buy Vol. 5,206,959

Sell Vol. 6,169,391

86,500

1D 1.17%

5D 15.33%

Buy Vol. 1,398,421

Sell Vol. 2,250,821

183,600

1D -0.92%

5D -2.24%

Buy Vol. 234,697

Sell Vol. 288,752

VNM: Forbes Vietnam announced Vinamilk leading the Top 25 food and beverage brands this year with a brand value of more than 2.3 billion USD, equivalent to 57.5 trillion VND.

OTHERS

53,000

1D 0.95%

5D 6.00%

Buy Vol. 2,008,847

Sell Vol. 1,914,046

106,300

1D -1.21%

5D -1.57%

Buy Vol. 200,709

Sell Vol. 299,170

75,500

1D -0.13%

5D 3.14%

Buy Vol. 901,862

Sell Vol. 1,537,562

50,100

1D -2.91%

5D -3.65%

Buy Vol. 3,617,360

Sell Vol. 4,346,744

14,500

1D 0.69%

5D 9.02%

Buy Vol. 2,486,085

Sell Vol. 2,677,316

16,950

1D 3.99%

5D 12.62%

Buy Vol. 37,874,577

Sell Vol. 39,601,515

15,000

1D -4.15%

5D -12.28%

Buy Vol. 158,808,548

Sell Vol. 121,612,593

HPG: In 9M/2022, Hoa Phat's total crude steel consumption reached more than 6 million tons, of which 3.46 million tons of construction steel and 2.04 million tons of HRC. Steel pipe and steel sheet output reached 577,000 and 249,000 tons, respectively. Meanwhile, the total construction steel output of steel industry increased by only 8% over the same period last year, Hoa Phat's construction steel output still increased by 24%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.