Market Brief 2/11/2022

VIETNAM STOCK MARKET

1,023.19

1D -1.02%

YTD -31.71%

1,025.18

1D -1.24%

YTD -33.24%

211.66

1D -0.33%

YTD -55.35%

76.01

1D -0.63%

YTD -32.54%

-248.32

1D 0.00%

YTD 0.00%

11,141.93

1D -5.72%

YTD -64.14%

The market on November 2 was not very positive, sellers actively dominated throughout the session, causing VN-Index to have 4 times to challenge 1,040 points, all of which failed. HPG recovered after 2 consecutive sessions of strong selling with a record auction volume, leading to a positive increase in most of the steel industry.

ETF & DERIVATIVES

17,390

1D -0.74%

YTD -32.68%

12,100

1D -0.82%

YTD -33.11%

12,150

1D -3.42%

YTD -36.05%

15,500

1D 2.24%

YTD -32.31%

13,300

1D -1.48%

YTD -40.84%

22,050

1D -1.78%

YTD -21.39%

12,910

1D -1.97%

YTD -39.90%

1,010

1D -0.01%

YTD 0.00%

1,007

1D -0.33%

YTD 0.00%

1,013

1D 0.04%

YTD 0.00%

1,021

1D 0.29%

YTD 0.00%

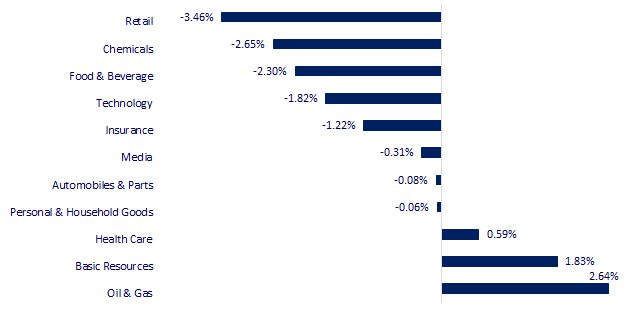

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,663.39

1D -0.06%

YTD -3.92%

3,003.37

1D 1.15%

YTD -17.48%

2,336.87

1D 0.07%

YTD -21.52%

15,827.17

1D 2.41%

YTD -32.36%

3,141.13

1D 0.34%

YTD 0.56%

1,625.02

1D -0.04%

YTD -1.97%

94.46

1D -0.92%

YTD 23.48%

1,658.15

1D 0.36%

YTD -8.93%

Shares in the Asia-Pacific were mostly higher on Wednesday as investors brace for another likely 75-basis-point rate hike by the Federal Reserve. Hong Kong’s Hang Seng index was halted after gaining 2.41% to 15,827.17 in earlier trade, following the issuance of a Tropical Cyclone Warning Signal Number 8.

VIETNAM ECONOMY

6.70%

1D (bps) 58

YTD (bps) 589

7.40%

YTD (bps) 180

4.82%

1D (bps) -3

YTD (bps) 381

4.87%

1D (bps) -3

YTD (bps) 287

24,872

1D (%) 0.00%

YTD (%) 8.42%

25,027

1D (%) -1.12%

YTD (%) -5.44%

3,480

1D (%) -0.17%

YTD (%) -4.87%

Although SBV has raised interest rate twice within a month, the pressure in the last 2 months of the year remains, facing the news that interest rates may continue to increase from Fed. In Vietnam, SBV can increase the interest rate by 0.5-1% in the last 2 months as this is the most likely tool to ease exchange rate. Given the current liquidity of the banking system, it is not excluded that the Dong may depreciate by 10-15% in 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The government has just issued a new tax regulation;

- Real estate loans outstanding decreased by more than 7,000 billion VND;

- VASEP: Seafood exports can reach a record of more than 10 billion USD after 11 months;

- Korea's semiconductor output fell sharply in the third quarter of 2022;

- China to Keep Coal Price Cap in 2023 as Fuel Supply Fears Linger;

- Warren Buffett's Berkshire Hathaway has scored about a $13 billion gain on Chevron and Occidental;

VN30

BANK

73,600

1D -1.87%

5D 5.14%

Buy Vol. 1,862,237

Sell Vol. 1,936,583

33,700

1D -1.03%

5D 6.31%

Buy Vol. 2,638,953

Sell Vol. 2,699,694

24,000

1D -1.84%

5D 7.14%

Buy Vol. 10,234,219

Sell Vol. 9,989,884

25,200

1D -1.75%

5D 17.76%

Buy Vol. 10,815,976

Sell Vol. 11,207,193

17,500

1D 1.74%

5D 12.54%

Buy Vol. 36,736,811

Sell Vol. 37,837,911

17,900

1D -0.56%

5D 9.15%

Buy Vol. 25,982,628

Sell Vol. 18,106,111

16,450

1D -0.90%

5D 3.13%

Buy Vol. 3,680,020

Sell Vol. 2,963,479

21,550

1D -1.15%

5D 7.75%

Buy Vol. 6,920,234

Sell Vol. 6,801,034

16,900

1D 0.00%

5D 12.67%

Buy Vol. 44,306,211

Sell Vol. 36,771,208

20,700

1D 2.73%

5D 8.66%

Buy Vol. 18,146,418

Sell Vol. 13,148,322

21,800

1D -2.90%

5D 5.57%

Buy Vol. 5,389,608

Sell Vol. 5,626,307

SHB: 9M/2022, SHB earned more than VND9,035 billion in pre-tax profit, up 79% over the same period last year, thanks to a reduction in provision expense. In the first 9 months of 2022, SHB achieved nearly VND13,237 billion in net interest income, up 22% yoy. Interest from services also increased by 55% to nearly VND635 billion , thanks to 32% increase in payment income (VND390.9 billion) and 48% increase in agency service income (VND489.8 billion). Interest from other activities reached more than VND586 billion, nearly 11 times higher than the same period last year.

REAL ESTATE

69,200

1D -1.14%

5D -7.11%

Buy Vol. 2,491,991

Sell Vol. 2,322,521

23,000

1D 0.88%

5D 5.99%

Buy Vol. 2,679,386

Sell Vol. 2,109,579

41,800

1D -1.42%

5D -8.13%

Buy Vol. 3,539,518

Sell Vol. 4,134,362

30/06/2022, the outstanding loan for real estate business was VND 784,575 billion. As of August 31, it was VND 777,235 billion (decreased VND 7,340 billion).

OIL & GAS

110,000

1D 0.00%

5D 1.85%

Buy Vol. 832,538

Sell Vol. 1,148,364

10,200

1D -1.45%

5D 2.00%

Buy Vol. 12,228,212

Sell Vol. 12,333,102

29,300

1D 0.69%

5D 5.59%

Buy Vol. 1,330,448

Sell Vol. 1,214,919

From November 1, the price of RON 95-III gasoline increased by 410 VND per liter to 22,750 VND. E5 RON 92 gasoline is also more increased by 380 dong, to 21,870 dong.

VINGROUP

55,400

1D 0.00%

5D 1.09%

Buy Vol. 2,194,872

Sell Vol. 2,048,015

44,900

1D -0.22%

5D 3.22%

Buy Vol. 3,386,835

Sell Vol. 4,391,252

25,800

1D -1.71%

5D 16.22%

Buy Vol. 2,149,114

Sell Vol. 2,955,113

VHM: In Q3/2022, VHM achieved a record profit of 14,500 billion, an increase of more than 27 times compared to Q2, thanks to the handover of 1,300 low-rise real estate at Vinhomes Ocean Park 2.

FOOD & BEVERAGE

78,300

1D -2.37%

5D 3.03%

Buy Vol. 2,925,180

Sell Vol. 3,312,534

81,000

1D -6.36%

5D 3.85%

Buy Vol. 1,664,036

Sell Vol. 2,177,270

183,500

1D -0.05%

5D -1.40%

Buy Vol. 275,820

Sell Vol. 245,488

MSN: In Q3, Masan's net revenue reached VND 19,523 billion, decreased by 17% yoy. Gross profit margin reached VND 5,424 billion, decreased by 11% yoy.

OTHERS

52,000

1D -1.89%

5D 1.56%

Buy Vol. 1,096,005

Sell Vol. 1,474,737

105,000

1D -1.22%

5D -2.33%

Buy Vol. 407,941

Sell Vol. 494,077

74,000

1D -1.99%

5D 0.27%

Buy Vol. 1,766,079

Sell Vol. 1,520,985

48,000

1D -4.19%

5D -7.51%

Buy Vol. 7,421,956

Sell Vol. 7,926,302

14,200

1D -2.07%

5D 5.19%

Buy Vol. 2,122,095

Sell Vol. 2,868,576

16,500

1D -2.65%

5D 11.11%

Buy Vol. 30,907,973

Sell Vol. 33,050,939

15,350

1D 2.33%

5D -9.17%

Buy Vol. 83,313,565

Sell Vol. 57,900,179

BVH: Despite gloomy of Q3 business result, BVH still lead the industry's profit with pre-tax profit of VND 503 billion (down 13% yoy), followed by PVI with VND 321 billion (down 25% yoy). In general, in Q3/2022, the business results of the insurance industry were not so positive. The reason in many insurance companies was the rapid increase in operating expenses over the same period.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.