Market Brief 3/11/2022

VIETNAM STOCK MARKET

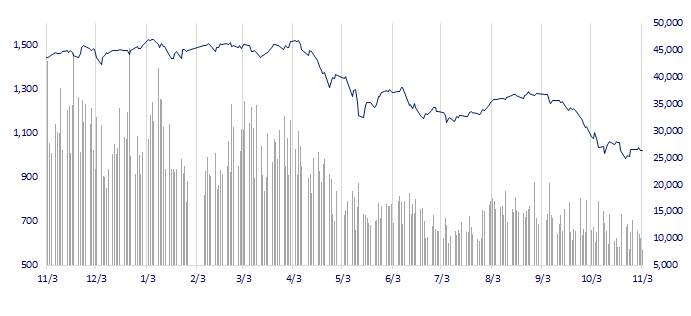

1,019.81

1D -0.33%

YTD -31.93%

1,023.80

1D -0.13%

YTD -33.33%

210.74

1D -0.43%

YTD -55.54%

75.66

1D -0.46%

YTD -32.85%

251.36

1D 0.00%

YTD 0.00%

8,732.72

1D -21.62%

YTD -71.90%

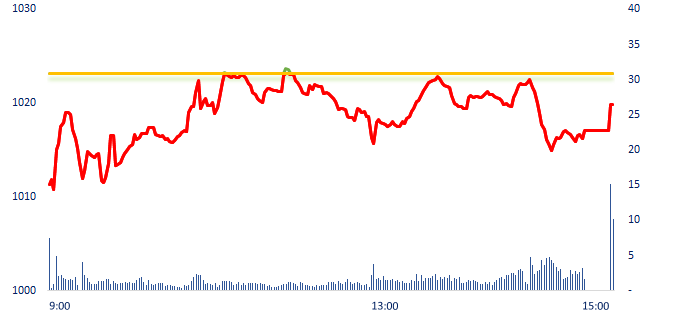

The market on November 3 was not too negative after the Fed's official decision to raise interest rates. The VN-Index dropped slightly, showing that investors sentiment has been adapted to the tightening monetary policy from the Fed. Notably, NVL stock closed at floor price, due to some doubts related to the same brand name "Nova Consumer".

ETF & DERIVATIVES

17,420

1D 0.17%

YTD -32.56%

12,100

1D 0.00%

YTD -33.11%

12,640

1D 4.03%

YTD -33.47%

14,920

1D -3.74%

YTD -34.85%

13,460

1D 1.20%

YTD -40.12%

22,200

1D 0.68%

YTD -20.86%

13,010

1D 0.77%

YTD -39.43%

991

1D -1.87%

YTD 0.00%

997

1D -0.96%

YTD 0.00%

1,000

1D -1.29%

YTD 0.00%

1,001

1D -1.95%

YTD 0.00%

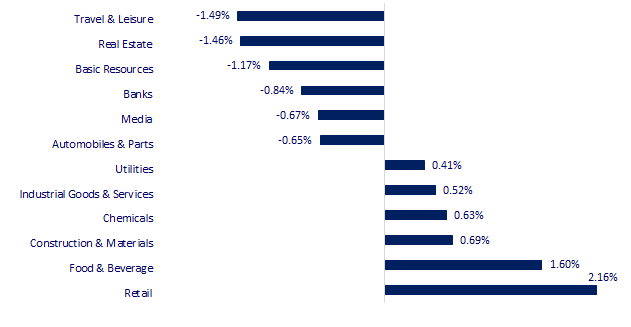

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,663.39

1D 0.00%

YTD -3.92%

2,997.81

1D -0.19%

YTD -17.64%

2,329.17

1D -0.33%

YTD -21.78%

15,339.49

1D -3.08%

YTD -34.44%

3,102.51

1D -1.23%

YTD -0.68%

1,625.62

1D 0.04%

YTD -1.93%

95.01

1D -0.63%

YTD 24.20%

1,622.85

1D -1.14%

YTD -10.87%

Asian stocks mostly fell on November 3, not out of the general decline of the global market after the decision from Fed. The Hang Seng Index fell more sharply as the Hong Kong monetary authority also raised the base interest rate for the sixth time this year, hours after the Fed boosted its rates by the same magnitude to tame severe inflation.

VIETNAM ECONOMY

7.12%

1D (bps) 42

YTD (bps) 631

7.40%

YTD (bps) 180

4.82%

YTD (bps) 381

4.87%

YTD (bps) 287

24,871

1D (%) 0.00%

YTD (%) 8.42%

24,658

1D (%) -1.88%

YTD (%) -6.84%

3,468

1D (%) -0.23%

YTD (%) -5.19%

The Fed raised interest rates by 0.75%, pushing US interest rates to highest level since January 2008. When the US Central Bank raises interest rates and the USD index increases, it will put pressure on other currencies in the world, including VND. Currently, the USD exchange rate in the global market is still volatile. As of 4:30 pm (Vietnam time), the Dollar Index (DXY) stood at 112.81, up 1.32%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV amends the regulations on special loans to the credit institutions placed under special control;

- The US may increase trade remedies defense merchandise of Vietnam;

- Vietnam gas station closures raise concerns of fuel supply crunch;

- BOE set to deliver biggest rate rise in 33 years;

- Inflation in UK shops rises to highest level on record;

- China property bonds are "no longer analyzable" as crisis grows;

VN30

BANK

73,000

1D -0.82%

5D 1.81%

Buy Vol. 1,153,316

Sell Vol. 1,175,985

33,000

1D -2.08%

5D -2.65%

Buy Vol. 2,302,828

Sell Vol. 1,852,583

23,600

1D -1.67%

5D -1.46%

Buy Vol. 14,113,562

Sell Vol. 11,708,969

25,850

1D 2.58%

5D 13.13%

Buy Vol. 10,913,659

Sell Vol. 10,055,626

17,500

1D 0.00%

5D 5.74%

Buy Vol. 21,236,157

Sell Vol. 25,635,203

17,650

1D -1.40%

5D 0.86%

Buy Vol. 16,363,386

Sell Vol. 16,443,438

16,000

1D -2.74%

5D -3.61%

Buy Vol. 3,351,740

Sell Vol. 3,057,262

21,250

1D -1.39%

5D 1.19%

Buy Vol. 6,215,669

Sell Vol. 6,232,106

17,250

1D 2.07%

5D 7.48%

Buy Vol. 44,875,657

Sell Vol. 31,940,337

20,300

1D -1.93%

5D 2.01%

Buy Vol. 8,137,836

Sell Vol. 6,849,728

21,350

1D -2.06%

5D -3.17%

Buy Vol. 5,240,594

Sell Vol. 5,188,956

Statistics from the financial statements of the banking industry in Q3/2022, as of September 30, 5 commercial banks have recorded equity of over VND100 trillion. Specifically, VCB has the highest equity in the system, reaching over VND128 trillion, an increase of more than VND19.2 trillion (17.6%) compared to the beginning of the year. The second in the list is TCB, whose equity increased to nearly VND110 trillion, up 17.2% compared to the beginning of the year. The list of banks with equity over VND100 trillion has just recorded 3 new members in Q3, including VPB, CTG and BID.

REAL ESTATE

64,400

1D -6.94%

5D -12.86%

Buy Vol. 1,049,506

Sell Vol. 2,082,726

23,050

1D 0.22%

5D 0.22%

Buy Vol. 1,841,679

Sell Vol. 1,703,995

40,300

1D -3.59%

5D -11.23%

Buy Vol. 2,457,689

Sell Vol. 2,984,480

KDH: In the evening of November 2, Khang Dien Group won the Vietnam National Brand Award 2022 organized by the Ministry of Industry and Trade.

OIL & GAS

111,400

1D 1.27%

5D 1.27%

Buy Vol. 276,419

Sell Vol. 582,553

10,100

1D -0.98%

5D -2.88%

Buy Vol. 9,612,183

Sell Vol. 9,843,611

29,250

1D -0.17%

5D 0.52%

Buy Vol. 1,732,575

Sell Vol. 1,165,332

By the end of Q3/2022, the total inventory of PLX and PV Oil was more than VND18,200 billion, down VND8,700 billion compared to the end of Q2.

VINGROUP

55,100

1D -0.54%

5D 0.18%

Buy Vol. 1,639,480

Sell Vol. 1,425,410

45,000

1D 0.22%

5D 2.27%

Buy Vol. 3,207,322

Sell Vol. 3,929,392

26,000

1D 0.78%

5D 9.47%

Buy Vol. 1,036,267

Sell Vol. 1,079,428

VHM: Dream City and Dai An of VHM have paid a total of VND34,867 billion to the budget, accounting for nearly 80% of the land use fee of Hung Yen province collected by the end of August.

FOOD & BEVERAGE

80,000

1D 2.17%

5D 1.91%

Buy Vol. 2,586,205

Sell Vol. 2,949,482

85,400

1D 5.43%

5D 2.89%

Buy Vol. 1,418,677

Sell Vol. 1,309,146

182,000

1D -0.82%

5D -3.14%

Buy Vol. 110,676

Sell Vol. 145,473

VNM: Among the top 20 enterprises with the highest profit on the stock exchange, VNM is the only stock that recorded a 20% decrease in business results compared to the same period last year.

OTHERS

52,400

1D 0.77%

5D -1.13%

Buy Vol. 1,560,023

Sell Vol. 1,127,417

102,700

1D -2.19%

5D -4.91%

Buy Vol. 356,601

Sell Vol. 396,822

74,100

1D 0.14%

5D -2.24%

Buy Vol. 1,676,718

Sell Vol. 1,332,350

49,500

1D 3.13%

5D -7.13%

Buy Vol. 5,727,574

Sell Vol. 4,550,071

14,250

1D 0.35%

5D -1.04%

Buy Vol. 3,016,757

Sell Vol. 2,236,509

16,500

1D 0.00%

5D 4.10%

Buy Vol. 23,257,005

Sell Vol. 25,400,185

15,200

1D -0.98%

5D -12.64%

Buy Vol. 50,684,628

Sell Vol. 39,012,864

MWG: MWG released consolidated financial statements for the third quarter of 2022, recording a 31.6% increase in net revenue to VND32,012 billion and a 15.6% increase in net profit to VND906 billion. In the first 9 months, MWG's net revenue and net profit reached more than VND102 trillion, up 18.4% and VND3,481 billion, up 4.3% over the same period.

Market by numbers

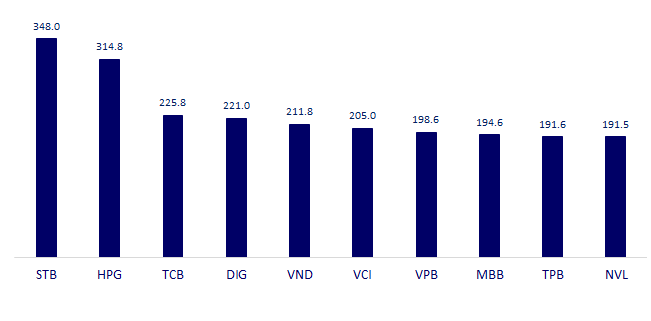

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

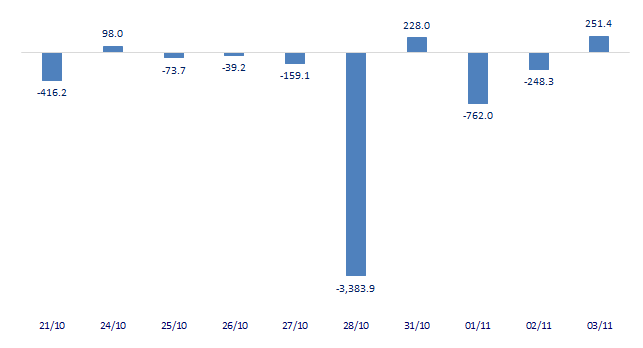

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

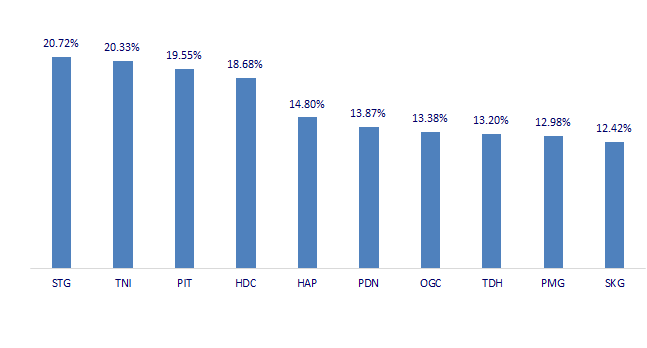

TOP INCREASES 3 CONSECUTIVE SESSIONS

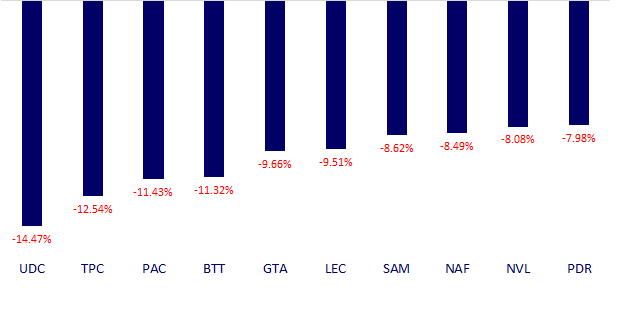

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.