Morning Brief 10/11/2022

GLOBAL MARKET

32,513.94

1D -1.95%

YTD -10.67%

3,748.57

1D -2.08%

YTD -21.56%

10,353.17

1D -2.48%

YTD -34.23%

26.09

1D 2.15%

7,296.25

1D -0.14%

YTD -1.44%

13,666.32

1D -0.16%

YTD -13.97%

6,430.57

1D -0.17%

YTD -10.35%

92.50

1D -2.85%

YTD 20.92%

1,711.70

1D 0.01%

YTD -5.99%

Wall Street ended sharply lower on Wednesday as Republican gains in midterm elections appeared more modest than some expected, with investors also focusing on upcoming inflation data that will provide clues about the severity of future interest rate hikes. With the election outcome still uncertain, investors were turning their attention to October inflation data due out on Thursday, which could shed more light on whether the Fed might soften its aggressive stance on interest rate hikes.

VIETNAM ECONOMY

5.07%

1D (bps) -45

YTD (bps) 426

7.40%

YTD (bps) 180

4.90%

YTD (bps) 389

4.96%

1D (bps) 3

YTD (bps) 296

24,870

1D (%) -0.01%

YTD (%) 8.41%

25,657

1D (%) -0.40%

YTD (%) -3.06%

3,503

1D (%) 0.09%

YTD (%) -4.24%

SBV continues to provide liquidity, the overnight interbank interest rate is falling below the refinancing interest rate and the OMO interest rate. The downtrend is similar at 1-month and 6-month tenors. This decline continued after SBV's net injection of VND74,000 billion last week.

VIETNAM STOCK MARKET

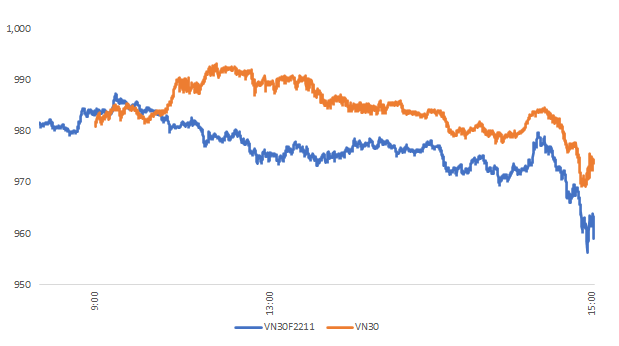

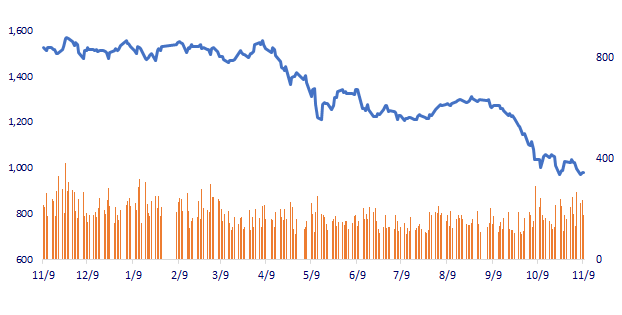

985.59

1D 0.40%

YTD -34.22%

979.68

1D -0.04%

YTD -36.21%

201.39

1D 0.81%

YTD -57.51%

72.20

1D -0.11%

YTD -35.92%

672.01

11,469.08

1D -0.28%

YTD -63.09%

At the end of the session, proprietary traders continued to net sold nearly VND167 billion. In which, they sold TDP the most (VND53 billion), followed by ACV (nearly VND38 billion). Conversely, proprietary traders bought TCB the most with nearly VND9 billion.

INTRADAY

VN30 (12M)

SELECTED NEWS

- Import and export turnover of goods reached USD616 billion, about to surpass the record in 2021;

- The Ministry of Transport directs and creates favorable conditions for transporting petroleum to localities;

- SBV continued to provide liquidity, interbank interest rates fell close to the regulatory interest rate;

- Global supply chains set for overhaul next year, HSBC poll shows;

- Covid curbs Increased in China factory hub Guangzhou as outbreak balloons;

- Germany blocks Chinese stake in two chipmakers over security concerns.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.