Market Brief 14/11/2022

VIETNAM STOCK MARKET

941.04

1D -1.41%

YTD -37.19%

936.31

1D -1.32%

YTD -39.03%

183.45

1D -3.35%

YTD -61.30%

66.81

1D -2.64%

YTD -40.71%

1,771.32

1D 0.00%

YTD 0.00%

10,661.01

1D -14.10%

YTD -65.69%

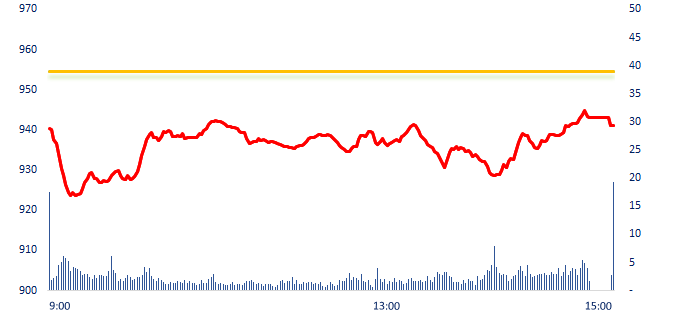

The market opened the first session of the week negatively, VN-Index lost 30 points at the deepest drop, returning to the lowest base level of the whole of 2019. At the end of the session, the falling momentum narrowed thanks to the pull of stocks such as: VNM, VIC, CTG, MSN, etc. Conversely, NVL and PDR continued their series of declines to the floor price.

ETF & DERIVATIVES

15,800

1D 3.95%

YTD -38.83%

11,050

1D -0.54%

YTD -38.92%

11,410

1D 1.33%

YTD -39.95%

11,600

1D -5.00%

YTD -49.34%

11,910

1D -3.95%

YTD -47.02%

20,490

1D -0.53%

YTD -26.95%

11,720

1D -3.14%

YTD -45.44%

911

1D 0.11%

YTD 0.00%

913

1D -0.65%

YTD 0.00%

918

1D 0.00%

YTD 0.00%

932

1D -0.64%

YTD 0.00%

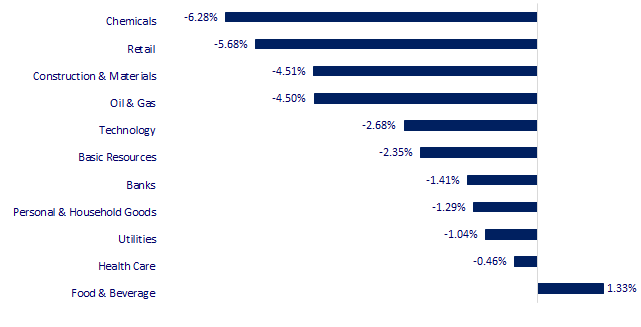

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

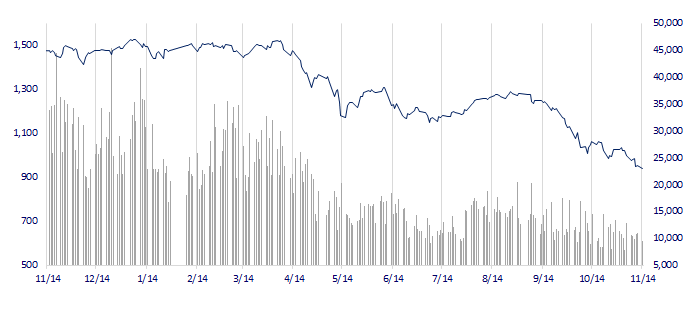

VNINDEX (12M)

GLOBAL MARKET

27,963.47

1D -1.06%

YTD -2.88%

3,083.40

1D -0.13%

YTD -15.29%

2,474.65

1D -0.34%

YTD -16.89%

17,619.71

1D 1.70%

YTD -24.69%

3,260.80

1D 1.01%

YTD 4.39%

1,623.38

1D -0.85%

YTD -2.07%

95.62

1D -1.34%

YTD 24.99%

1,760.85

1D -0.46%

YTD -3.29%

Asian stocks mostly fell on Monday. However, the Hang Seng index rose as China adjusted COVID-19 control measures. Chinese regulators have told financial institutions to extend more support to property developers to shore up the country's struggling real estate sector.

VIETNAM ECONOMY

4.34%

1D (bps) -54

YTD (bps) 353

7.40%

YTD (bps) 180

4.89%

1D (bps) 1

YTD (bps) 388

4.98%

1D (bps) 4

YTD (bps) 298

24,836

1D (%) -0.10%

YTD (%) 8.27%

26,263

1D (%) -0.46%

YTD (%) -0.77%

3,578

1D (%) 0.45%

YTD (%) -2.19%

From October 31 to November 11, SBV provided a total of more than 81,200VND billion through the pledge of valuable papers (OMO), all with a term of 14 days, interest rates are at 6%/year. Meanwhile, SBV settled the maturity of VND37,176 billion of valuable papers, from October 24-28, all with a term of 7 days. Thus, through OMO channel, SBV net injected nearly VND44,028 billion into the banking system.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is no longer on the US currency manipulation monitoring list;

- Morinaga Milk eyes expansion in Vietnam with new yogurt brand;

- Three Vietnamese seaports entered the top 100 largest container ports in the world;

- China’s property woes drive household savings to record high;

- ECB seen getting €885 billion cheap-loan repayments this year;

- BOJ's Kuroda vows to continue monetary easing for now, focuses on wages.

VN30

BANK

75,100

1D -0.53%

5D 4.60%

Buy Vol. 2,325,778

Sell Vol. 2,575,121

35,900

1D -0.28%

5D 7.81%

Buy Vol. 2,744,447

Sell Vol. 3,684,711

23,900

1D 1.27%

5D 2.36%

Buy Vol. 14,674,049

Sell Vol. 18,715,718

22,200

1D -2.63%

5D -6.53%

Buy Vol. 10,341,055

Sell Vol. 8,655,344

15,700

1D -3.68%

5D -8.19%

Buy Vol. 21,710,811

Sell Vol. 26,347,401

15,200

1D -5.00%

5D -10.32%

Buy Vol. 21,115,012

Sell Vol. 19,876,507

14,600

1D -1.35%

5D 1.74%

Buy Vol. 7,929,715

Sell Vol. 13,582,240

19,700

1D -1.01%

5D -1.99%

Buy Vol. 3,944,610

Sell Vol. 5,090,551

15,850

1D 1.60%

5D 2.26%

Buy Vol. 55,079,256

Sell Vol. 67,351,711

17,400

1D -0.57%

5D -5.69%

Buy Vol. 9,324,368

Sell Vol. 6,486,296

20,300

1D -2.40%

5D -1.69%

Buy Vol. 7,833,424

Sell Vol. 8,101,614

VPBank has successfully signed a syndicated loan agreement worth USD500 million, equivalent to nearly VND12.5 trillion from five major financial institutions, including the Asian Development Bank (ADB), Sumitomo Mitsui Banking Corporation (SMBC), Japan International Cooperation Agency (JICA), ANZ Bank and Maybank Securities Pte. Ltd. - a member of Maybank Investment Banking Group.

REAL ESTATE

38,950

1D -6.93%

5D -30.20%

Buy Vol. 29,561

Sell Vol. 73,103,732

20,300

1D 0.50%

5D 1.75%

Buy Vol. 3,718,678

Sell Vol. 3,967,107

24,400

1D -6.87%

5D -30.09%

Buy Vol. 5,056

Sell Vol. 104,591,387

PDR: Phat Dat used more than 126,336m2 of Vung Tau land to supplement collateral when Chairman's shares was constantly being "force sell".

OIL & GAS

113,800

1D -0.09%

5D 0.80%

Buy Vol. 563,862

Sell Vol. 696,539

10,300

1D -2.83%

5D 5.21%

Buy Vol. 14,017,786

Sell Vol. 13,905,720

26,500

1D -2.57%

5D -4.25%

Buy Vol. 1,320,181

Sell Vol. 1,351,981

After peaking in the final adjustment period of Q2 (June 21), gasoline prices plunged for 5 consecutive periods. In Q3, gasoline prices have 9 adjustment periods, of which 7/9 periods decrease.

VINGROUP

55,000

1D 1.29%

5D 3.00%

Buy Vol. 3,048,326

Sell Vol. 2,260,654

44,000

1D -0.34%

5D 0.23%

Buy Vol. 4,675,837

Sell Vol. 4,934,816

25,350

1D 0.20%

5D -0.59%

Buy Vol. 2,515,492

Sell Vol. 2,793,642

On November 10, VinFast selects Shell Recharge Solutions to offer at-home charge points to European customers.

FOOD & BEVERAGE

79,000

1D 0.77%

5D -3.89%

Buy Vol. 4,633,895

Sell Vol. 4,213,004

89,100

1D 3.01%

5D 5.44%

Buy Vol. 2,257,136

Sell Vol. 1,833,210

195,000

1D 3.83%

5D 5.98%

Buy Vol. 405,024

Sell Vol. 309,921

MSN: Masan seeks the Government’s support in approving of the import of tungsten scrap to ensure stable raw material supply for the Tungsten Scrap Recycling Project.

OTHERS

47,600

1D -2.86%

5D -2.66%

Buy Vol. 1,572,234

Sell Vol. 1,380,009

101,900

1D 0.59%

5D 1.70%

Buy Vol. 469,089

Sell Vol. 471,710

70,800

1D -2.75%

5D -2.48%

Buy Vol. 2,522,521

Sell Vol. 2,926,493

40,650

1D -5.47%

5D -5.13%

Buy Vol. 4,991,058

Sell Vol. 6,241,581

10,750

1D -6.93%

5D -13.65%

Buy Vol. 4,258,551

Sell Vol. 3,533,406

14,250

1D 1.06%

5D -0.35%

Buy Vol. 32,192,842

Sell Vol. 31,652,233

12,200

1D -0.81%

5D -10.95%

Buy Vol. 93,737,486

Sell Vol. 77,128,591

BVH: Bao Viet will close the list of paying dividends in cash at the rate of 30.261% on November 28, 2022. Accordingly, from December 28, shareholders owning a share will be paid VND3,026.1. Cash dividend at the rate of 30.261% on par value, equivalent to the payment amount of more than VND2,246 billion.

Market by numbers

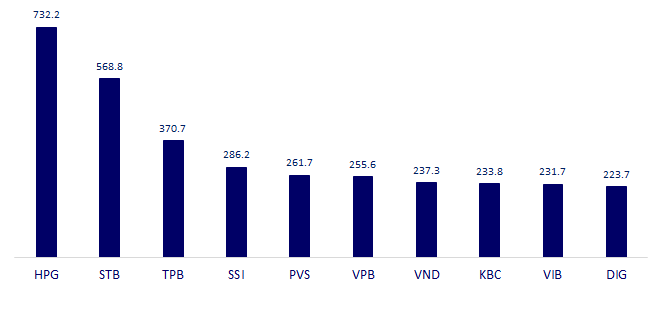

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

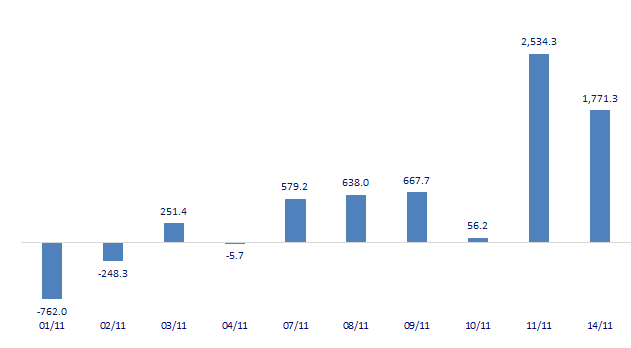

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

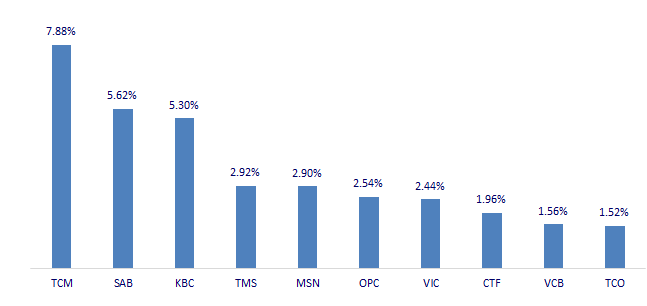

TOP INCREASES 3 CONSECUTIVE SESSIONS

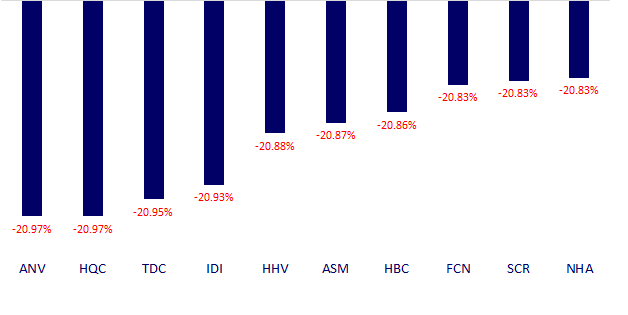

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.