Market Brief 17/11/2022

VIETNAM STOCK MARKET

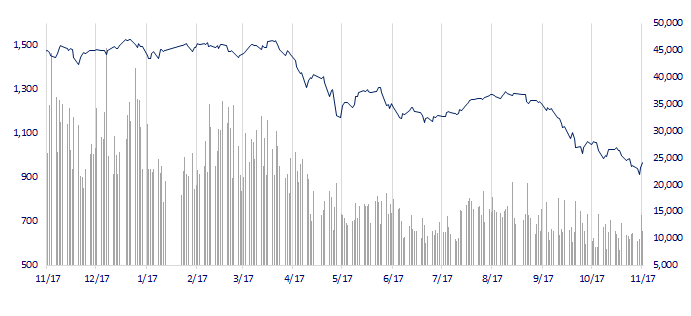

969.26

1D 2.80%

YTD -35.31%

971.04

1D 3.27%

YTD -36.77%

187.86

1D 2.40%

YTD -60.37%

66.54

1D 1.87%

YTD -40.95%

1,531.59

1D 0.00%

YTD 0.00%

12,601.77

1D -23.01%

YTD -59.44%

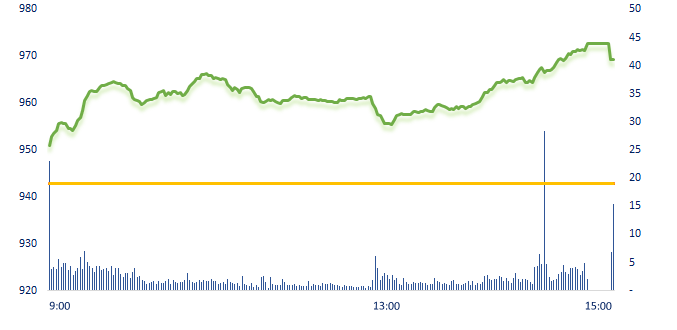

Following the recovery from November 16, the market continued to prosper today with 227 stocks hitting the ceiling price. The derivatives expiration session was smoothly. On the 1-hour chart, there was a decline at 10am but VN-Index quickly regained balance thanks to excitement from investors. PLX and BID are the only 2 stocks that fell in the VN30 basket today.

ETF & DERIVATIVES

16,510

1D 2.23%

YTD -36.08%

11,470

1D 3.80%

YTD -36.59%

11,800

1D 4.52%

YTD -37.89%

12,060

1D -1.15%

YTD -47.34%

12,510

1D 4.86%

YTD -44.35%

21,370

1D 5.27%

YTD -23.81%

12,200

1D 2.35%

YTD -43.20%

950

1D 1.56%

YTD 0.00%

949

1D 1.06%

YTD 0.00%

963

1D 1.54%

YTD 0.00%

973

1D 1.56%

YTD 0.00%

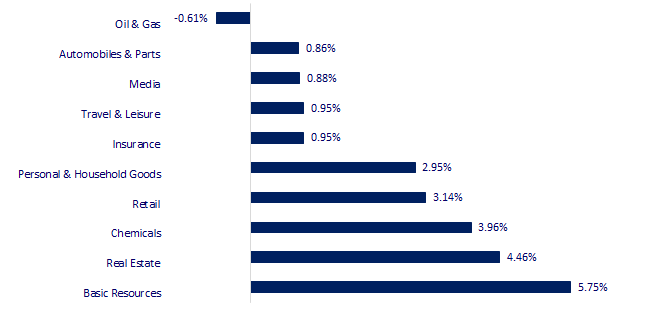

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,930.57

1D -0.35%

YTD -2.99%

3,115.43

1D -0.15%

YTD -14.41%

2,442.90

1D -1.39%

YTD -17.96%

18,045.66

1D -1.15%

YTD -22.87%

3,286.04

1D 0.61%

YTD 5.20%

1,614.95

1D -0.31%

YTD -2.57%

92.42

1D 0.36%

YTD 20.81%

1,765.35

1D -0.65%

YTD -3.05%

Asian stocks mostly fell on Thursday in the face of disappointing economic data. Hong Kong's seasonally adjusted unemployment rate eased to 3.8% in the August-October quarter, improving for the sixth consecutive period as economic activities revive in an easing COVID situation. Japan's imports in October surged by more than half from a year earlier, dwarfing growth in exports and enlarging a trade deficit that has weighed heavily on the Yen.

VIETNAM ECONOMY

4.63%

1D (bps) -2

YTD (bps) 382

7.40%

YTD (bps) 180

4.87%

1D (bps) -5

YTD (bps) 386

4.90%

1D (bps) -2

YTD (bps) 290

24,861

1D (%) 0.00%

YTD (%) 8.37%

26,177

1D (%) -1.14%

YTD (%) -1.10%

3,542

1D (%) -0.67%

YTD (%) -3.17%

In the first three sessions of the week, SBV net sold nearly VND47,543 billion of valuable papers. In the session on November 16, the State Bank successfully offered to buy more than VND12,000 billion of valuable papers with a term of 14 days, interest rate 6 %/year. At the same time, more than VND15,522 billion dong is due. Thus, SBV has collected VND3,457 billion through the channel of pledging valuable papers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Real estate credit continued to decline;

- World Bank report on Vietnam's macroeconomic situation;

- Many state-owned enterprises have made strong profits, contributing nearly VND110,000 billion to the state budget in 2021;

- UK blocks Chinese-led buyout of biggest Microchip factory over national security;

- Hong Kong to cut covid testing requirements for new arrivals;

- Japan trade gap persists as weak yen squeezes purchasing power.

VN30

BANK

76,500

1D 1.86%

5D 5.08%

Buy Vol. 2,012,354

Sell Vol. 2,553,221

35,650

1D -0.14%

5D 2.74%

Buy Vol. 2,421,832

Sell Vol. 4,464,269

25,000

1D 0.81%

5D 9.89%

Buy Vol. 15,978,074

Sell Vol. 21,880,942

22,950

1D 3.85%

5D 0.88%

Buy Vol. 10,438,435

Sell Vol. 11,429,413

15,500

1D 0.00%

5D -4.91%

Buy Vol. 19,306,849

Sell Vol. 25,856,841

15,700

1D 3.97%

5D -0.63%

Buy Vol. 24,872,084

Sell Vol. 25,428,234

15,300

1D 2.68%

5D 4.79%

Buy Vol. 5,269,989

Sell Vol. 6,717,090

20,850

1D 0.00%

5D 4.77%

Buy Vol. 9,068,134

Sell Vol. 8,646,827

17,200

1D 6.50%

5D 13.53%

Buy Vol. 53,371,649

Sell Vol. 53,968,087

18,450

1D 2.50%

5D 5.43%

Buy Vol. 5,248,083

Sell Vol. 6,410,823

21,050

1D 3.19%

5D 5.25%

Buy Vol. 6,415,199

Sell Vol. 7,161,514

VIB: Vietnam International Commercial Joint Stock Bank (VIB) has announced the final registration date to finalise the list of shareholders to collect written opinions, including the content of adjusting the foreign ownership limit. According to VIB's leaders, if the annual general shareholders' meeting (AGM) approves the content, the foreign ownership limits can be adjusted by up to 30%.

REAL ESTATE

31,400

1D -6.96%

5D -30.14%

Buy Vol. 391,321

Sell Vol. 63,964,766

21,550

1D 6.42%

5D 13.42%

Buy Vol. 8,569,318

Sell Vol. 6,922,353

19,700

1D -6.86%

5D -30.02%

Buy Vol. 140,150

Sell Vol. 156,532,350

NVL: NovaGroup has successfully bought over 1.8 million shares of NVL during the period from October 14 to November 11 (the initial registration number was 8 million shares).

OIL & GAS

119,700

1D 2.31%

5D 5.56%

Buy Vol. 661,415

Sell Vol. 948,273

10,100

1D 0.00%

5D -1.46%

Buy Vol. 11,292,778

Sell Vol. 23,217,213

25,650

1D -1.35%

5D -5.00%

Buy Vol. 1,915,976

Sell Vol. 2,577,319

PLX: Petrolimex wants to lower its profit target in 2022 from VND3,060 billion to VND300 billion compared to the plan approved by the General Meeting of Shareholders.

VINGROUP

64,600

1D 6.95%

5D 21.89%

Buy Vol. 6,426,169

Sell Vol. 5,262,870

47,950

1D 6.79%

5D 9.10%

Buy Vol. 6,291,081

Sell Vol. 5,663,810

28,400

1D 6.97%

5D 14.52%

Buy Vol. 5,550,120

Sell Vol. 4,215,679

VIC: VIC: According to Bloomberg news, VinFast is considering IPO in the US in January 2023.

FOOD & BEVERAGE

76,000

1D 2.01%

5D -3.06%

Buy Vol. 3,990,519

Sell Vol. 3,982,078

97,000

1D 6.71%

5D 19.75%

Buy Vol. 1,969,593

Sell Vol. 1,931,146

183,000

1D 1.22%

5D -0.81%

Buy Vol. 530,501

Sell Vol. 405,138

SAB: Sabeco kicks off the 'Happy Chill Year' campaign from November 13 to December 31, 2022.

OTHERS

47,400

1D 0.21%

5D -2.57%

Buy Vol. 1,058,757

Sell Vol. 1,481,615

102,100

1D 0.20%

5D 2.10%

Buy Vol. 467,577

Sell Vol. 573,039

71,000

1D 2.45%

5D -2.74%

Buy Vol. 2,516,787

Sell Vol. 3,267,892

41,800

1D 3.34%

5D -1.30%

Buy Vol. 4,269,711

Sell Vol. 6,064,174

11,400

1D 6.54%

5D -8.06%

Buy Vol. 4,240,505

Sell Vol. 2,139,884

15,800

1D 6.40%

5D 13.67%

Buy Vol. 37,957,068

Sell Vol. 38,011,507

14,250

1D 6.74%

5D 17.77%

Buy Vol. 96,648,976

Sell Vol. 24,707,290

FPT: FPT Corporation has just announced business results for 10M/2022 with revenue of VND33,105 billion, profit before tax of VND6,456 billion, up 24.4% and 24% respectively over the same period. Profit after tax for shareholders of parent company reached VND4,550 billion, up 30.7%. Compared to the annual plan, FPT has achieved 78% of the revenue target and 85% of the pre-tax profit target after 10 months.

Market by numbers

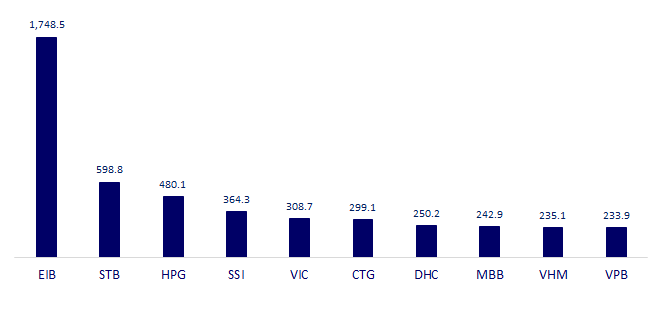

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

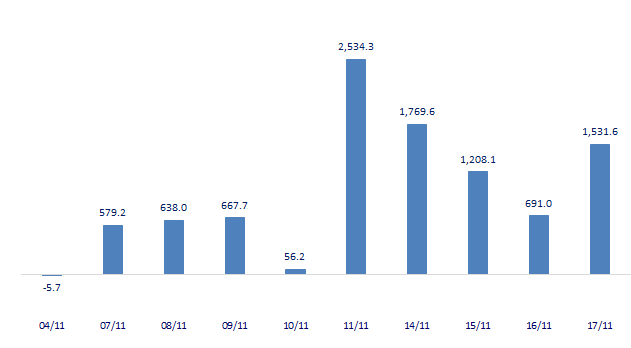

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

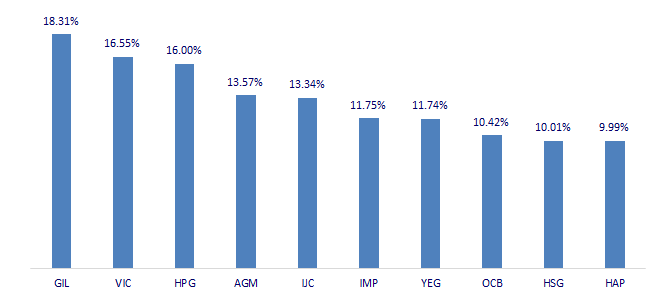

TOP INCREASES 3 CONSECUTIVE SESSIONS

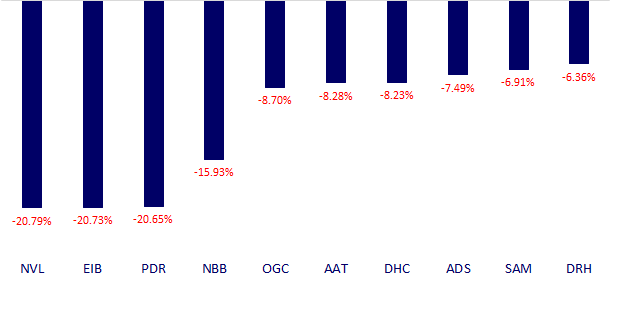

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.