Market brief 24/11/2022

VIETNAM STOCK MARKET

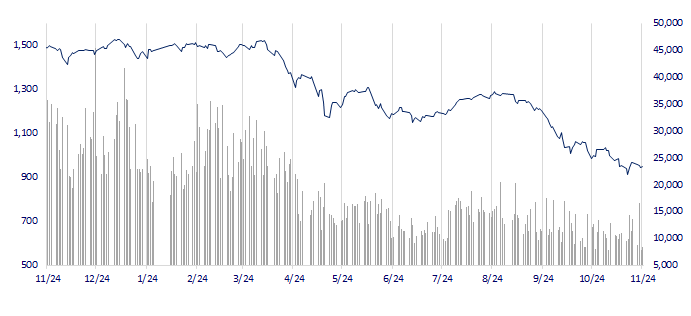

947.71

1D 0.18%

YTD -36.75%

940.76

1D 0.22%

YTD -38.74%

191.22

1D 0.12%

YTD -59.66%

67.51

1D -0.21%

YTD -40.09%

320.35

1D 0.00%

YTD 0.00%

9,323.54

1D 4.79%

YTD -69.99%

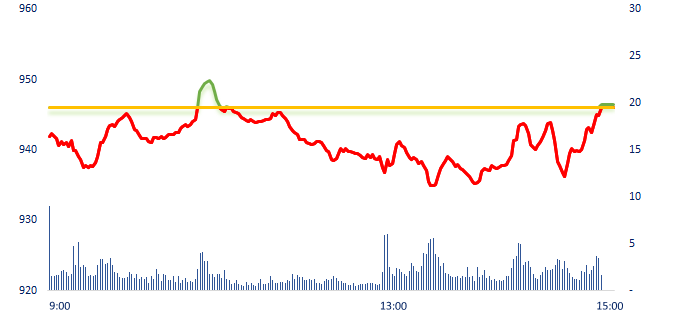

VN-Index increased with low liquidity. VN30 basket recorded 18 gaining stocks, of which, STB, HPG, VRE, GVR, PLX, VNM, VIC all increased from 2% to 4% in value. In contrast, MWG, PDR, and NVL dropped at floor price. Besides, steel stocks were quite positive today.

ETF & DERIVATIVES

16,020

1D -0.25%

YTD -37.98%

11,100

1D 0.45%

YTD -38.64%

11,570

1D 0.26%

YTD -39.11%

12,960

1D 2.86%

YTD -43.41%

12,330

1D -0.08%

YTD -45.15%

20,480

1D 1.39%

YTD -26.99%

11,690

1D -0.43%

YTD -45.58%

928

1D 1.60%

YTD 0.00%

930

1D 1.55%

YTD 0.00%

934

1D 1.53%

YTD 0.00%

939

1D 1.60%

YTD 0.00%

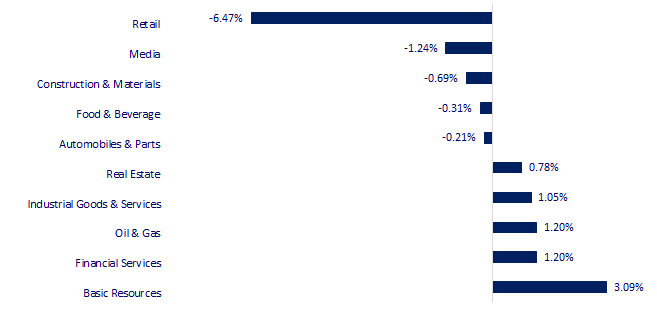

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,383.09

1D 0.95%

YTD -1.42%

3,089.31

1D -0.25%

YTD -15.12%

2,441.33

1D 0.96%

YTD -18.01%

17,660.90

1D 0.78%

YTD -24.52%

3,252.88

1D -0.10%

YTD 4.14%

1,623.61

1D -0.02%

YTD -2.05%

85.21

1D 0.22%

YTD 11.39%

1,756.60

1D 0.10%

YTD -3.53%

At the end of the session, Asian stocks mostly gained from positive information about the possibility of a slight reduction in interest rate hikes in the near future by FED. Only Shanghai Composite (China) dropped before the negative development of the Covid-19 epidemic recently.

VIETNAM ECONOMY

5.96%

1D (bps) 5

YTD (bps) 515

7.40%

YTD (bps) 180

4.91%

1D (bps) -1

YTD (bps) 390

4.99%

1D (bps) 3

YTD (bps) 299

24,855

1D (%) 0.00%

YTD (%) 8.35%

26,605

1D (%) -0.05%

YTD (%) 0.52%

3,552

1D (%) 0.34%

YTD (%) -2.90%

SBV has just announced information about the average deposit interest rate in VND of domestic commercial banks at 0.2-0.3%/year for deposit term of less than 1 month; 4.3-4.8%/year for deposit term from 1 month to less than 6 months; 5.4 -6.5%/year for deposit term from 6 months to 12 months; 5.6-6.8%/year for deposit term from over 12 months to 24 months and 6.2-6.7%/year for the term over 24 months.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Phu Yen: National Highway 1 will complete and repair damaged sections before December 31, 2022;

- Difficult to access the 2% interest rate support package;

- Three scenarios to forecast the 'health' of Ho Chi Minh City in 2023;

- Bank of China committed at least $38 billion in loan to the real estate sector;

- Most Fed officials think rate hikes should be slowed soon;

- Meta stock rose on news of Mark Zuckerberg's resignation.

VN30

BANK

73,000

1D -0.68%

5D -4.58%

Buy Vol. 1,460,653

Sell Vol. 1,811,655

38,000

1D 1.60%

5D 6.59%

Buy Vol. 2,929,055

Sell Vol. 4,034,902

24,600

1D 0.82%

5D -1.60%

Buy Vol. 8,178,039

Sell Vol. 8,122,832

22,150

1D 0.68%

5D -3.49%

Buy Vol. 6,699,217

Sell Vol. 6,418,781

15,100

1D 0.33%

5D -2.58%

Buy Vol. 17,488,219

Sell Vol. 19,369,134

15,700

1D 0.00%

5D 0.00%

Buy Vol. 12,505,160

Sell Vol. 13,798,318

14,800

1D 1.02%

5D -3.27%

Buy Vol. 1,600,733

Sell Vol. 2,597,971

20,000

1D 0.00%

5D -4.08%

Buy Vol. 7,022,006

Sell Vol. 7,355,274

18,200

1D 4.00%

5D 5.81%

Buy Vol. 40,927,058

Sell Vol. 29,903,408

17,850

1D -0.28%

5D -3.25%

Buy Vol. 3,996,349

Sell Vol. 3,669,373

21,000

1D 1.69%

5D -0.24%

Buy Vol. 4,304,606

Sell Vol. 4,618,872

TCB: TCBS plans to offer 105 million shares to only Techcombank. The issuance price is expected to be 95,600 VND/share, and the total amount from the offering is more than VND10,038 billion. Completing the above private placement purchase, this Bank's ownership rate in TCBS will increase to 94,2035% of charter capital.

REAL ESTATE

21,950

1D -6.99%

5D -30.10%

Buy Vol. 3,281,020

Sell Vol. 107,153,635

21,000

1D -3.89%

5D -2.55%

Buy Vol. 4,864,667

Sell Vol. 5,851,387

13,850

1D -6.73%

5D -29.70%

Buy Vol. 345,670

Sell Vol. 174,225,620

NVL: Novaland will issue nearly 271 thousand NVL shares to convert for 5 bonds with par value of 200,000 USD, equivalent to total VND23 billion.

OIL & GAS

105,800

1D -2.22%

5D -11.61%

Buy Vol. 869,198

Sell Vol. 884,244

10,600

1D 1.44%

5D 4.95%

Buy Vol. 15,077,386

Sell Vol. 14,047,709

27,500

1D 3.19%

5D 7.21%

Buy Vol. 2,102,097

Sell Vol. 2,276,888

The G7 is considering a ceiling price for Russian oil transported by sea in the range of 65-70 USD/barrel.

VINGROUP

61,000

1D 2.18%

5D -5.57%

Buy Vol. 1,703,044

Sell Vol. 1,420,069

45,000

1D 1.35%

5D -6.15%

Buy Vol. 2,266,873

Sell Vol. 2,470,250

27,100

1D 3.63%

5D -4.58%

Buy Vol. 1,960,698

Sell Vol. 2,062,603

VIC: VinFast announced a partnership with INFORM to monitor the condition of the vehicles from production to transportation, before officially handover to customers around the world.

FOOD & BEVERAGE

81,200

1D 2.27%

5D 6.84%

Buy Vol. 4,950,141

Sell Vol. 5,206,568

89,000

1D -4.20%

5D -8.25%

Buy Vol. 1,354,826

Sell Vol. 1,723,279

180,500

1D -0.82%

5D -1.37%

Buy Vol. 218,482

Sell Vol. 281,926

MSN: Techcombank will receive free transfer of all intellectual property rights to all T-Pay trademarks being used under the Masan registered name.

OTHERS

48,700

1D 0.10%

5D 2.74%

Buy Vol. 1,058,276

Sell Vol. 1,265,467

101,200

1D 0.80%

5D -0.88%

Buy Vol. 375,249

Sell Vol. 448,563

70,500

1D 0.00%

5D -0.70%

Buy Vol. 1,290,663

Sell Vol. 1,839,078

37,700

1D -6.91%

5D -9.81%

Buy Vol. 8,709,480

Sell Vol. 13,359,968

13,000

1D 3.59%

5D 14.04%

Buy Vol. 4,811,699

Sell Vol. 4,154,622

16,000

1D 1.27%

5D 1.27%

Buy Vol. 36,726,828

Sell Vol. 26,997,590

14,350

1D 3.99%

5D 0.70%

Buy Vol. 71,273,170

Sell Vol. 50,220,146

MWG: After 3 recovery sessions on November 16, 17 and 18, 2022, MWG stock suddenly dropped to the floor price today to VND37,700/share. After 9 months, the company has only achieved 73% of the revenue target and 55% of the annual profit plan. With the declining business result, the enterprise left open the possibility of completing the profit plan in 2022.

Market by numbers

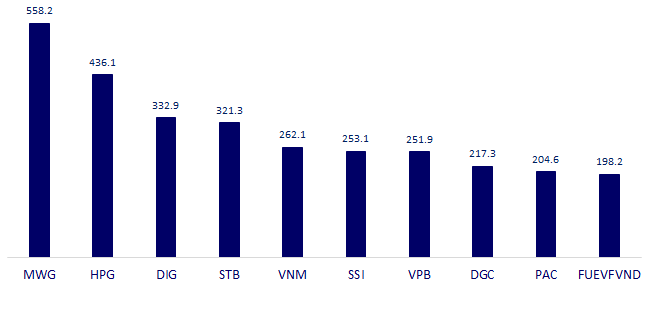

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

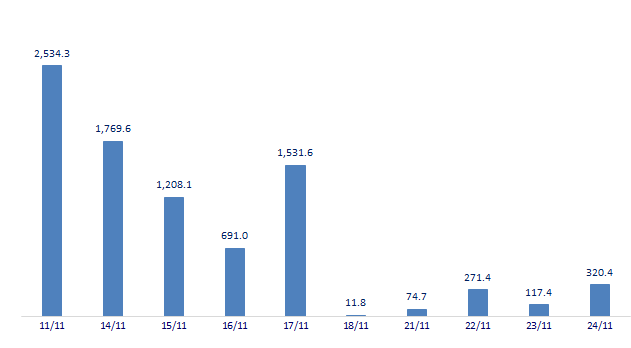

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

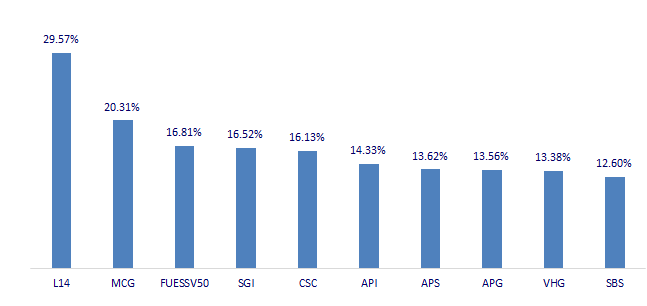

TOP INCREASES 3 CONSECUTIVE SESSIONS

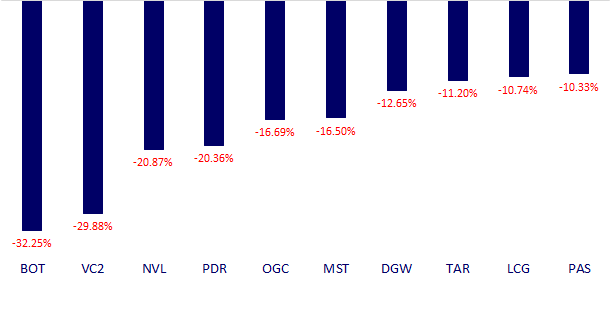

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.