Market Brief 28/11/2022

VIETNAM STOCK MARKET

1,005.69

1D 3.52%

YTD -32.88%

1,004.34

1D 3.81%

YTD -34.60%

204.06

1D 3.70%

YTD -56.95%

70.03

1D 2.37%

YTD -37.85%

1,700.90

1D 0.00%

YTD 0.00%

17,295.25

1D 61.37%

YTD -44.34%

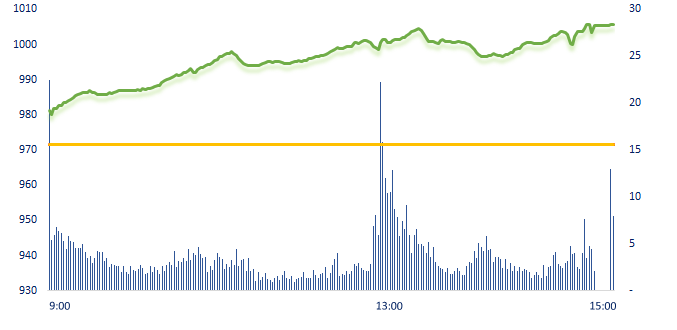

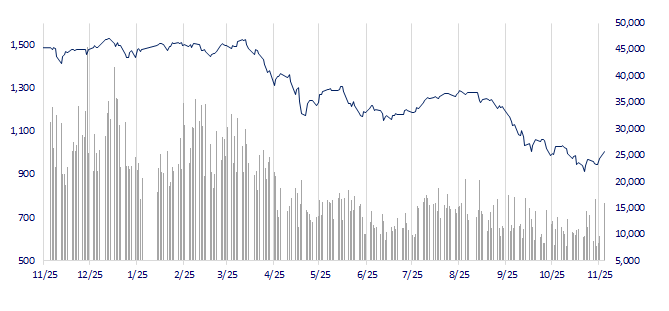

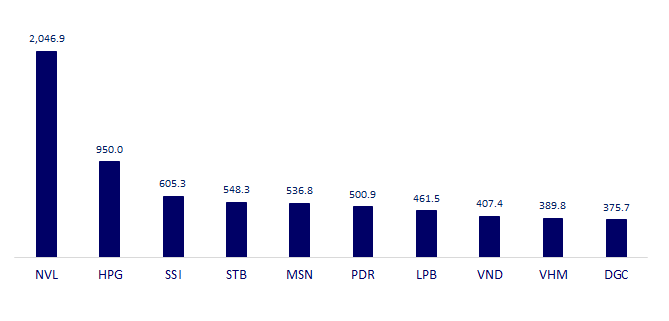

VN-Index regained the 1,000 point mark with green color spreading across all industry groups, liquidity improved with an increase of nearly 60% compared to November 25. There were 7 tickers hitting the ceiling price in the VN30 basket, especially NVL was "rescued" after 17 consecutive sessions of hitting the floor price.

ETF & DERIVATIVES

16,850

1D 2.68%

YTD -34.77%

11,830

1D 3.59%

YTD -34.60%

11,920

1D 1.02%

YTD -37.26%

13,900

1D 6.92%

YTD -39.30%

13,250

1D 3.19%

YTD -41.06%

21,700

1D 4.93%

YTD -22.64%

12,500

1D 3.91%

YTD -41.81%

988

1D 3.43%

YTD 0.00%

983

1D 2.61%

YTD 0.00%

989

1D 2.38%

YTD 0.00%

994

1D 2.55%

YTD 0.00%

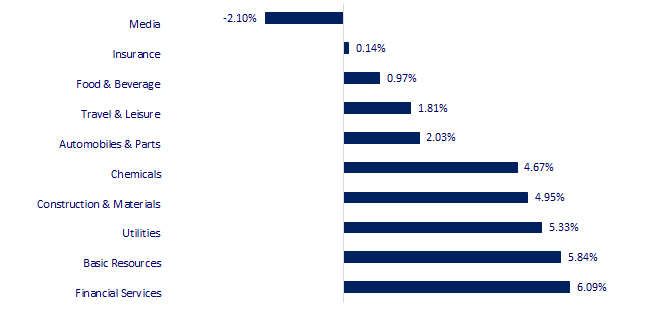

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,162.83

1D -0.42%

YTD -2.18%

3,078.55

1D -0.75%

YTD -15.42%

2,408.27

1D -1.21%

YTD -19.12%

17,297.94

1D -1.57%

YTD -26.07%

3,240.06

1D -0.14%

YTD 3.73%

1,616.91

1D -0.24%

YTD -2.46%

81.06

1D -1.36%

YTD 5.96%

1,763.25

1D 0.81%

YTD -3.16%

Chinese stocks on Monday saw the worst day in a month, as recent monetary-easing measures failed to offset investor worries about protests against strict COVID-19 curbs in the world's second-largest economy, while the onshore Yuan weakened as much as 1.1% at one point, the softest level since November 10.

VIETNAM ECONOMY

5.66%

1D (bps) -31

YTD (bps) 485

7.40%

YTD (bps) 180

4.90%

1D (bps) 2

YTD (bps) 389

4.83%

1D (bps) -8

YTD (bps) 283

24,850

1D (%) -0.01%

YTD (%) 8.33%

26,372

1D (%) -0.66%

YTD (%) -0.36%

3,513

1D (%) -0.37%

YTD (%) -3.96%

In the trading session of November 28, on the channel of pledging valuable papers (OMO), SBV provided more than VND6,000 billion for 5 commercial banks with an interest rate of 6%/year, with a term of 14 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister Pham Minh Chinh: Prioritize disbursement of public investment to develop HCMC;

- One field accounts for nearly 50% of Vietnam's total investment capital abroad in the first 11 months of 2022;

- Seafood enterprises lack orders: Cut costs, sell at a loss to reduce inventory;

- Black Friday online sales in the US hit a record;

- PBOC cuts reserve requirement ratio for second time this year;

- Putin's war leaves West more reliant than ever on Asian fuel.

VN30

BANK

76,700

1D 4.92%

5D 2.27%

Buy Vol. 2,505,107

Sell Vol. 1,971,812

39,500

1D -1.25%

5D 11.27%

Buy Vol. 3,758,281

Sell Vol. 5,230,149

27,300

1D 5.81%

5D 13.28%

Buy Vol. 17,906,496

Sell Vol. 18,154,337

24,600

1D 6.96%

5D 10.56%

Buy Vol. 16,390,473

Sell Vol. 12,596,246

16,100

1D 3.87%

5D 3.87%

Buy Vol. 25,859,637

Sell Vol. 31,460,011

17,200

1D 6.17%

5D 9.55%

Buy Vol. 31,647,589

Sell Vol. 27,848,822

15,450

1D 3.34%

5D 4.39%

Buy Vol. 3,562,408

Sell Vol. 2,963,060

21,000

1D 3.45%

5D 1.94%

Buy Vol. 19,454,733

Sell Vol. 15,891,339

19,700

1D 4.23%

5D 17.96%

Buy Vol. 44,654,651

Sell Vol. 41,121,661

19,050

1D 4.10%

5D 2.97%

Buy Vol. 9,301,572

Sell Vol. 9,440,589

22,250

1D 3.49%

5D 8.01%

Buy Vol. 9,139,914

Sell Vol. 8,005,672

CTG: Vietinbank announced the amendment of the issuance plan in 2022. According to the revised plan, VietinBank will issue a maximum of VND9,000 billion bonds instead of VND8,000 billion as previously planned, including VND3,500 billion bonds with 8-year term and VND5,500 billion bonds with 10-year term. These bonds will be issued in two phases: the first is VND5,000 billion and the second is VND4,000 billion.

REAL ESTATE

20,450

1D 0.00%

5D -24.95%

Buy Vol. 180,320,371

Sell Vol. 179,879,738

24,000

1D 6.90%

5D 7.14%

Buy Vol. 11,123,654

Sell Vol. 6,244,070

12,000

1D -6.98%

5D -29.82%

Buy Vol. 41,743,134

Sell Vol. 185,690,527

PDR: PDR fell more than 80% from the peak, Phat Dat explained for the 3rd time, giving two main reasons for the stock price continuously falling to the floor.

OIL & GAS

112,100

1D 6.97%

5D 0.72%

Buy Vol. 777,609

Sell Vol. 482,521

11,300

1D 4.15%

5D 9.71%

Buy Vol. 27,229,379

Sell Vol. 24,826,575

29,350

1D 3.89%

5D 16.01%

Buy Vol. 2,466,208

Sell Vol. 1,968,690

PVN said that crude oil production is expected to reach 10.81 million tons in 2022, exceeding 24% of the year plan, approaching the implementation level in 2021.

VINGROUP

65,000

1D 0.00%

5D 1.56%

Buy Vol. 3,757,893

Sell Vol. 5,160,525

50,200

1D 6.81%

5D 6.92%

Buy Vol. 9,935,884

Sell Vol. 8,320,219

29,300

1D 6.93%

5D 11.41%

Buy Vol. 6,086,554

Sell Vol. 4,643,555

VIC: TCBS announced to complete the payment of interest and principal on the bond lot of VND2,280 billion of VinFast.

FOOD & BEVERAGE

81,700

1D -0.61%

5D 4.88%

Buy Vol. 3,276,923

Sell Vol. 5,250,237

97,200

1D 3.40%

5D 2.21%

Buy Vol. 2,755,767

Sell Vol. 2,677,819

177,100

1D -1.61%

5D -3.01%

Buy Vol. 484,516

Sell Vol. 488,376

MSN: On November 24, MSN successfully issued VND1,700 billion in bonds. This is a non-convertible, unwarranted and unsecured bond.

OTHERS

46,800

1D -0.21%

5D 4.61%

Buy Vol. 1,402,241

Sell Vol. 1,755,825

102,200

1D 0.20%

5D 1.59%

Buy Vol. 311,862

Sell Vol. 314,694

74,300

1D 3.19%

5D 5.99%

Buy Vol. 1,775,706

Sell Vol. 2,099,424

40,150

1D 6.22%

5D -1.23%

Buy Vol. 8,287,768

Sell Vol. 7,597,445

14,100

1D 4.44%

5D 8.46%

Buy Vol. 5,279,422

Sell Vol. 5,752,211

18,250

1D 6.73%

5D 13.35%

Buy Vol. 55,857,941

Sell Vol. 45,617,186

16,350

1D 6.86%

5D 9.36%

Buy Vol. 98,277,150

Sell Vol. 78,495,636

MWG: MWG will stop expanding the An Khang pharmacy chain in 2022, the current number of stores is 529. Currently, the average revenue of an An Khang store is VND350-400 million. If the average revenue is about VND450-500 million, the gross profit margin is 22%, along with the stable control of this business, the revenue of VND500 million will break even and even make a profit.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

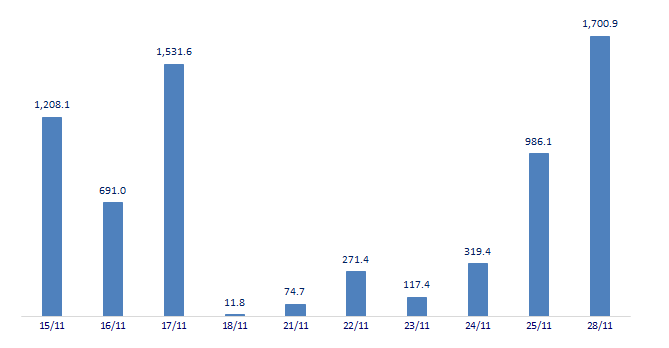

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

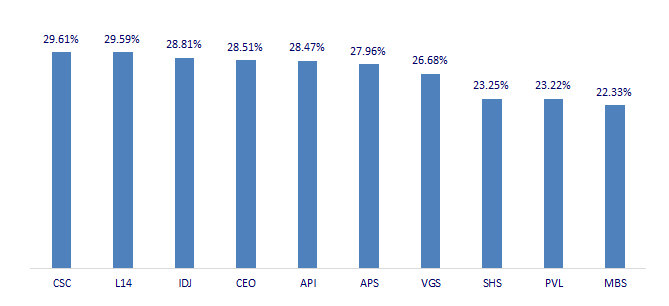

TOP INCREASES 3 CONSECUTIVE SESSIONS

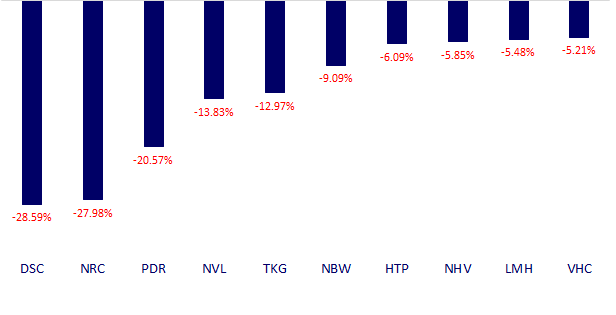

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.