Market Brief 29/11/2022

VIETNAM STOCK MARKET

1,032.16

1D 2.63%

YTD -31.11%

1,029.04

1D 2.46%

YTD -32.99%

208.22

1D 2.04%

YTD -56.07%

70.38

1D 0.50%

YTD -37.54%

2,656.90

1D 0.00%

YTD 0.00%

20,573.78

1D 18.96%

YTD -33.79%

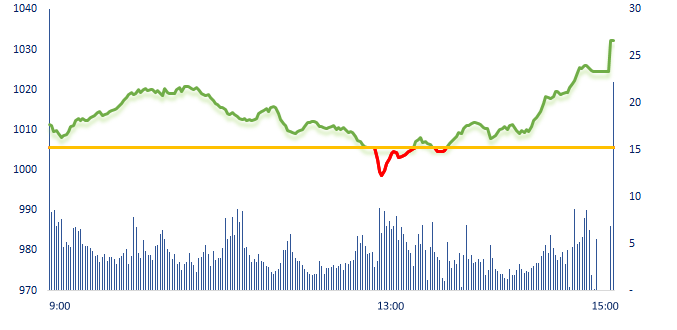

After regaining the 1,000 point mark, investors continued to experience an exciting session, liquidity reached the best level in the last 8 months. PDR was officially rescued today, the trading volume of both stocks (NVL, PDR) get a historical record.

ETF & DERIVATIVES

17,340

1D 2.91%

YTD -32.87%

12,130

1D 2.54%

YTD -32.95%

12,750

1D 6.96%

YTD -32.89%

14,200

1D 2.16%

YTD -37.99%

13,700

1D 3.40%

YTD -39.06%

22,250

1D 2.53%

YTD -20.68%

13,230

1D 5.84%

YTD -38.41%

1,006

1D 1.79%

YTD 0.00%

1,009

1D 2.64%

YTD 0.00%

1,010

1D 2.15%

YTD 0.00%

1,016

1D 2.19%

YTD 0.00%

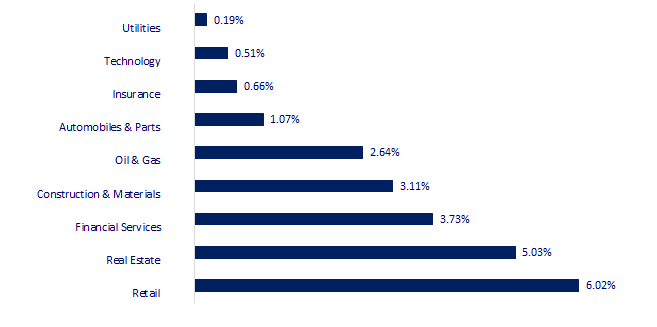

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

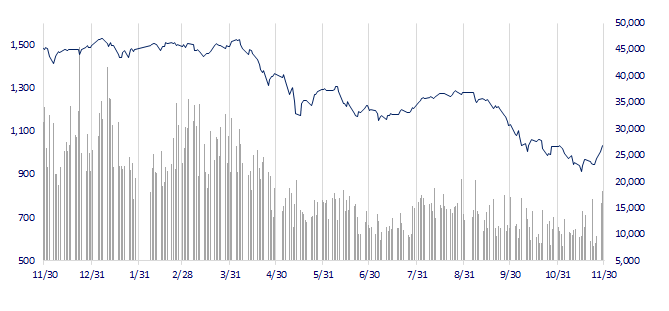

VNINDEX (12M)

GLOBAL MARKET

28,027.84

1D -0.48%

YTD -2.65%

3,149.75

1D 2.31%

YTD -13.46%

2,433.39

1D 1.04%

YTD -18.28%

18,204.68

1D 5.24%

YTD -22.19%

3,276.36

1D 1.12%

YTD 4.89%

1,624.39

1D 0.46%

YTD -2.00%

85.17

1D 1.88%

YTD 11.33%

1,749.80

1D 0.15%

YTD -3.90%

China stocks surge on Tuesday boosted by large-cap stocks. Shares of Chinese property companies surged after the country's securities regulator lifted a ban on equity refinancing for listed property firms. That helped Chinese blue chips jump almost 3%, in the largest one-day rally in a month and a marked reversal of Monday's steep falls.

VIETNAM ECONOMY

5.50%

1D (bps) -16

YTD (bps) 469

7.40%

YTD (bps) 180

4.82%

1D (bps) -8

YTD (bps) 381

4.82%

1D (bps) -1

YTD (bps) 282

24,845

1D (%) -0.02%

YTD (%) 8.30%

26,326

1D (%) -0.04%

YTD (%) -0.54%

3,526

1D (%) 0.60%

YTD (%) -3.61%

In the trading session of November 29, on the channel of pledging valuable papers (OMO), SBV provided nearly VND8,000 billion for 5 commercial banks with an interest rate of 6%/year, with a term of 14 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 11 months, Vietnam had a trade surplus of USD10.6 billion;

- From January 1, 2023, the rules of origin of goods in the RCEP Agreement will apply a number of new points;

- CPI in November increased by 4.37% over the same period;

- Europe faces an enduring crisis of energy and geopolitics;

- China sees nearly 40,000 covid cases in new record for 4th straight day;

- Kishida Cabinet support rate plunges to lowest since launch.

VN30

BANK

79,800

1D 4.04%

5D 8.57%

Buy Vol. 2,790,457

Sell Vol. 2,891,127

41,000

1D 3.80%

5D 12.48%

Buy Vol. 4,531,393

Sell Vol. 4,462,722

27,400

1D 0.37%

5D 14.64%

Buy Vol. 15,670,777

Sell Vol. 19,282,127

25,200

1D 2.44%

5D 15.33%

Buy Vol. 14,442,606

Sell Vol. 14,861,843

16,150

1D 0.31%

5D 4.19%

Buy Vol. 27,763,894

Sell Vol. 30,434,468

17,200

1D 0.00%

5D 8.86%

Buy Vol. 28,007,721

Sell Vol. 31,209,252

15,450

1D 0.00%

5D 5.46%

Buy Vol. 3,226,343

Sell Vol. 3,715,548

21,500

1D 2.38%

5D 4.12%

Buy Vol. 15,265,607

Sell Vol. 12,969,740

19,750

1D 0.25%

5D 16.86%

Buy Vol. 52,033,589

Sell Vol. 47,558,099

18,950

1D -0.52%

5D 4.12%

Buy Vol. 9,661,749

Sell Vol. 8,514,216

22,150

1D -0.45%

5D 8.85%

Buy Vol. 7,615,975

Sell Vol. 7,384,480

VPB: The International Finance Corporation (IFC) has just completed disbursement to VPBank a loan worth USD150 million, equivalent to nearly VND3,700 billion. The loan has a term of 5 years will be used by VPBank to supplement its loan portfolio for SMEs, Women-owned enterprises and many projects in the field of environment and combating climate change in Vietnam.

REAL ESTATE

21,850

1D 6.85%

5D -13.81%

Buy Vol. 61,279,348

Sell Vol. 27,022,938

25,650

1D 6.88%

5D 14.25%

Buy Vol. 11,124,382

Sell Vol. 10,599,855

12,800

1D 6.67%

5D -19.75%

Buy Vol. 214,818,412

Sell Vol. 94,205,667

PDR: Securities company sold more than 6.7 million shares of Chair of the Board - Mr.Nguyen Van Dat right before PDR was "rescued".

OIL & GAS

112,000

1D -0.09%

5D 2.56%

Buy Vol. 704,947

Sell Vol. 970,866

11,300

1D 0.00%

5D 9.18%

Buy Vol. 23,705,577

Sell Vol. 24,811,257

29,600

1D 0.85%

5D 12.98%

Buy Vol. 2,943,973

Sell Vol. 2,704,990

On November 28, the US WTI crude oil futures contract recovered after hitting the lowest bottom of the year, before that the oil supply outlook was uncertain according to all forecasts.

VINGROUP

69,400

1D 6.77%

5D 13.77%

Buy Vol. 4,463,357

Sell Vol. 4,468,153

53,100

1D 5.78%

5D 17.22%

Buy Vol. 8,827,324

Sell Vol. 9,455,842

30,500

1D 4.10%

5D 16.63%

Buy Vol. 4,938,583

Sell Vol. 6,788,478

VIC: On November 28, Ahamove cooperated with VinFast to launch the AhaRide electric motorbike taxi service in Da Nang.

FOOD & BEVERAGE

83,000

1D 1.59%

5D 4.40%

Buy Vol. 4,839,969

Sell Vol. 4,425,178

99,000

1D 1.85%

5D 7.84%

Buy Vol. 2,841,155

Sell Vol. 2,744,193

176,000

1D -0.62%

5D -2.87%

Buy Vol. 471,807

Sell Vol. 524,983

VNM: SCIC Investment Company Limited (SIC) - a member of SCIC registered to sell all 1.1 million VNM shares.

OTHERS

47,200

1D 0.85%

5D 4.52%

Buy Vol. 1,303,479

Sell Vol. 1,496,667

102,800

1D 0.59%

5D 4.79%

Buy Vol. 890,835

Sell Vol. 677,687

74,300

1D 0.00%

5D 5.39%

Buy Vol. 1,988,335

Sell Vol. 2,266,342

42,800

1D 6.60%

5D 6.47%

Buy Vol. 8,632,326

Sell Vol. 9,302,831

14,150

1D 0.35%

5D 12.30%

Buy Vol. 6,766,626

Sell Vol. 7,639,084

18,950

1D 3.84%

5D 15.90%

Buy Vol. 52,157,541

Sell Vol. 57,315,462

17,400

1D 6.42%

5D 17.57%

Buy Vol. 103,660,222

Sell Vol. 95,900,880

MWG: MWG plans to open the first 5 electronics stores Era Blue in Indonesia in December. Indonesia's mobile phone revenue is about USD9 billion, nearly double the size in Vietnam. The electronics segment in the Indonesia is still very primitive and has a lot of potential when it is only 70% compared to the Vietnamese market. Up to now, according to the leader of MWG in Indonesia, no retailer can dominate this market.

Market by numbers

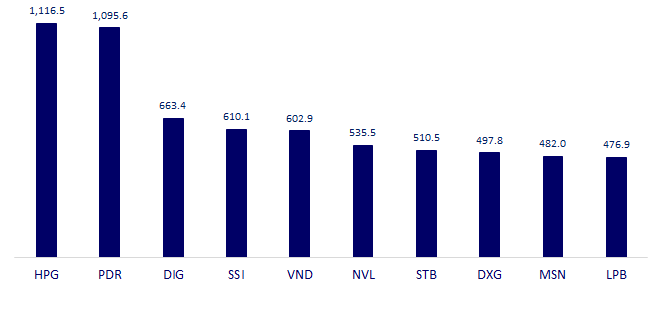

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

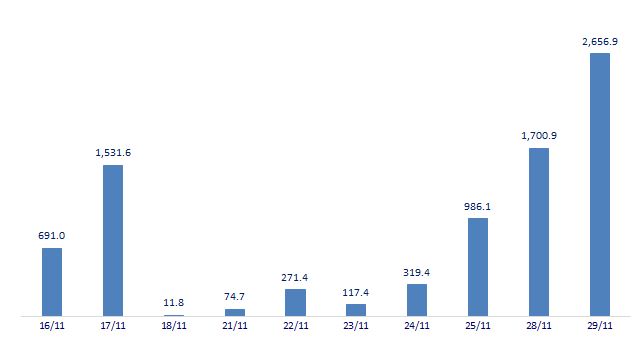

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

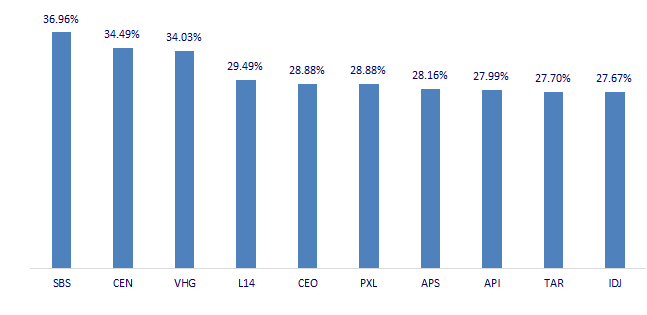

TOP INCREASES 3 CONSECUTIVE SESSIONS

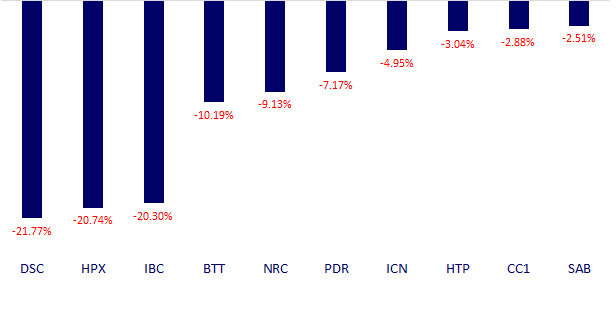

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.