Market Brief 05/12/2022

VIETNAM STOCK MARKET

1,093.67

1D 1.26%

YTD -27.00%

1,110.94

1D 1.64%

YTD -27.66%

219.96

1D 1.85%

YTD -53.59%

73.24

1D 1.43%

YTD -35.00%

1,403.29

1D 0.00%

YTD 0.00%

23,185.18

1D 13.73%

YTD -25.38%

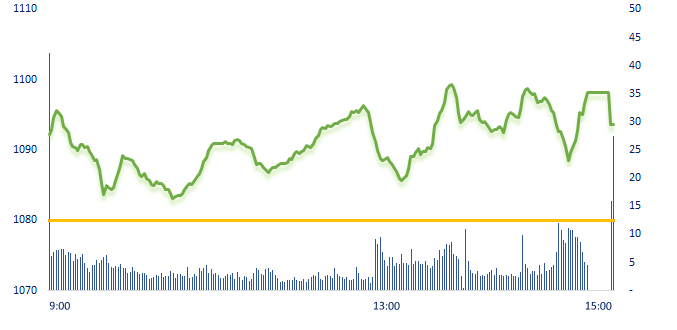

The market started the first session of the week with an increasing gap of more than 14 points right from the opening, the liquidity continued to remain at a high level. Thanks to the green color spreading to all sectors, VN-Index kept gaining momentum until the end of the session.

ETF & DERIVATIVES

18,890

1D 2.11%

YTD -26.87%

13,140

1D 1.86%

YTD -27.36%

13,550

1D -1.09%

YTD -28.68%

15,950

1D 6.12%

YTD -30.35%

15,030

1D 2.24%

YTD -33.14%

23,640

1D 1.63%

YTD -15.72%

13,720

1D 1.55%

YTD -36.13%

1,080

1D 0.09%

YTD 0.00%

1,084

1D 0.19%

YTD 0.00%

1,110

1D 0.92%

YTD 0.00%

1,104

1D 0.27%

YTD 0.00%

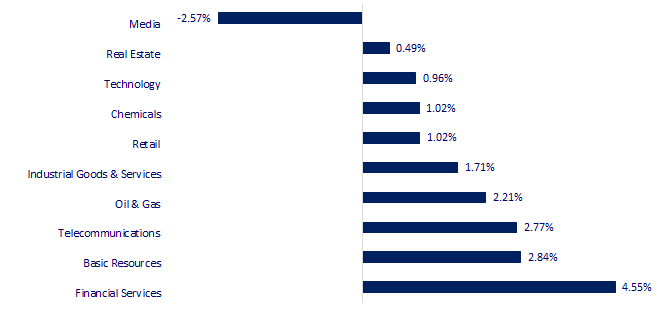

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

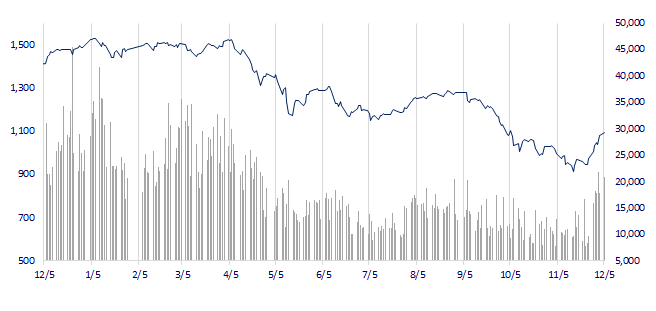

VNINDEX (12M)

GLOBAL MARKET

27,820.40

1D 0.15%

YTD -3.37%

3,211.81

1D 1.76%

YTD -11.76%

2,419.32

1D -0.62%

YTD -18.75%

19,518.29

1D 4.51%

YTD -16.58%

3,267.54

1D 0.26%

YTD 4.61%

1,641.63

1D 0.00%

YTD -0.96%

87.26

1D -0.21%

YTD 14.07%

1,809.85

1D -0.42%

YTD -0.60%

Chinese equities rallied and the Yuan strengthened past a key level, as the authorities accelerated a shift toward reopening the economy and more investors turned bullish. The yuan breached the 7-per-dollar level, while a gauge of Chinese tech stocks in Hong Kong surged 9.3% in a fifth day of gains. The dollar bonds of developers also rose as financial hub Shanghai and neighboring Hangzhou joined other cities in easing Covid-Zero curbs. Thailand market is closed for national day.

VIETNAM ECONOMY

5.32%

1D (bps) -6

YTD (bps) 451

7.40%

YTD (bps) 180

4.89%

1D (bps) 5

YTD (bps) 388

4.99%

1D (bps) 11

YTD (bps) 299

24,120

1D (%) -0.70%

YTD (%) 5.14%

26,055

1D (%) -0.58%

YTD (%) -1.56%

3,520

1D (%) 0.28%

YTD (%) -3.77%

On December 5, the USD exchange rate continued to decline sharply. The Dollar Index (DXY-Index) measuring the strength of the dollar has continuously decreased in November, up to now, the DXY-Index has dropped more than 6% (as of 4 pm Vietnam time), touching the lowest level since from August 2022. In Vietnam, the selling rate at banks today simultaneously decreased by 0.6% compared to the early morning.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi spent more than VND8,100 billion upgrading and expanding Highway 6;

- The Ministry of Industry and Trade requires enterprises to increase petroleum imports until June 2023;

- Vietnam's rubber exports to the US decreased in both volume and value;

- Apple accelerates plans to expand production outside of China;

- Thailand: Rice exports increased by 33% in the first 10 months of 2022;

- OPEC and its partners agreed to keep the target of oil production unchanged.

VN30

BANK

85,000

1D 0.00%

5D 10.82%

Buy Vol. 2,435,985

Sell Vol. 2,687,090

41,250

1D 0.12%

5D 4.43%

Buy Vol. 3,846,232

Sell Vol. 4,174,721

28,600

1D 2.33%

5D 4.76%

Buy Vol. 12,980,213

Sell Vol. 15,721,530

29,000

1D 0.69%

5D 17.89%

Buy Vol. 13,389,399

Sell Vol. 14,702,679

18,150

1D 4.91%

5D 12.73%

Buy Vol. 72,671,487

Sell Vol. 61,508,058

19,000

1D 1.06%

5D 10.47%

Buy Vol. 36,084,163

Sell Vol. 36,175,342

16,950

1D 2.73%

5D 9.71%

Buy Vol. 6,166,077

Sell Vol. 6,050,767

23,150

1D 1.54%

5D 10.24%

Buy Vol. 32,989,168

Sell Vol. 24,599,089

22,300

1D 6.95%

5D 13.20%

Buy Vol. 62,412,791

Sell Vol. 49,987,970

21,900

1D 2.34%

5D 14.96%

Buy Vol. 15,094,203

Sell Vol. 16,245,610

23,600

1D 0.43%

5D 6.07%

Buy Vol. 6,819,618

Sell Vol. 8,511,829

STB: Sacombank will auction 32.5% of shares being managed by VAMC, the Board of Directors said that the selling price must be from 32,000 - 34,000 VND/share to be able to process all VAMC and auction 18 loans secured by Phong Phu Industrial Park, outstanding principal and interest is about VND16,000 billion. The above auctioned shares are expected to be sold to foreign partners in 2023. The value of this loans is approximately VND10,000 billion, equivalent to the asking price of about 18,000 - 19,000 VND/share.

REAL ESTATE

22,150

1D -6.93%

5D 8.31%

Buy Vol. 90,230,923

Sell Vol. 116,137,453

31,100

1D 6.87%

5D 29.58%

Buy Vol. 5,134,548

Sell Vol. 4,334,026

16,650

1D 6.73%

5D 38.75%

Buy Vol. 62,645,068

Sell Vol. 51,488,038

NVL: Foreign investors' net buying value of NVL decreased by nearly 90% compared to the previous session.

OIL & GAS

113,200

1D 1.80%

5D 0.98%

Buy Vol. 981,828

Sell Vol. 1,137,850

11,500

1D -1.71%

5D 1.77%

Buy Vol. 26,361,866

Sell Vol. 29,658,079

32,050

1D 1.91%

5D 9.20%

Buy Vol. 1,523,848

Sell Vol. 2,041,582

PLX: Petrolimex announced to auction 443,500 BMF shares, starting price of 36,600 VND/share.

VINGROUP

68,100

1D -1.02%

5D 4.77%

Buy Vol. 3,362,954

Sell Vol. 4,462,005

58,300

1D 1.92%

5D 16.14%

Buy Vol. 5,404,059

Sell Vol. 6,151,044

31,550

1D 0.00%

5D 7.68%

Buy Vol. 3,726,150

Sell Vol. 4,514,078

VIC: VMI Real Estate JSC has officially awarded the certificate of ownership of Fantasy Home to the first investors.

FOOD & BEVERAGE

85,000

1D 1.19%

5D 4.04%

Buy Vol. 4,018,037

Sell Vol. 4,238,872

105,000

1D 1.06%

5D 8.02%

Buy Vol. 1,556,034

Sell Vol. 1,376,229

179,700

1D 1.53%

5D 1.47%

Buy Vol. 438,988

Sell Vol. 370,489

SAB: SAB has approved the second advance payment of cash dividend for 2022 at the rate of 10% (1 share will receive 1,000 VND).

OTHERS

50,500

1D 4.77%

5D 7.91%

Buy Vol. 2,792,794

Sell Vol. 2,755,400

106,900

1D 0.38%

5D 4.60%

Buy Vol. 900,456

Sell Vol. 890,643

78,300

1D 1.16%

5D 5.38%

Buy Vol. 1,656,942

Sell Vol. 2,567,061

47,600

1D 1.28%

5D 18.56%

Buy Vol. 6,561,147

Sell Vol. 7,727,659

15,600

1D 0.65%

5D 10.64%

Buy Vol. 5,030,903

Sell Vol. 5,222,568

20,800

1D 6.94%

5D 13.97%

Buy Vol. 55,337,054

Sell Vol. 57,964,895

20,000

1D 2.83%

5D 22.32%

Buy Vol. 72,215,312

Sell Vol. 79,639,914

FPT: On December 2, Long Chau pharmacy chain of FPT Retail (association of FPT) officially reached 1,000 pharmacies nationwide, exceeding the target of 800 newly opened pharmacies in 2022, equivalent to 25% of the plan to expand the scale system size for the whole year 2022.

Market by numbers

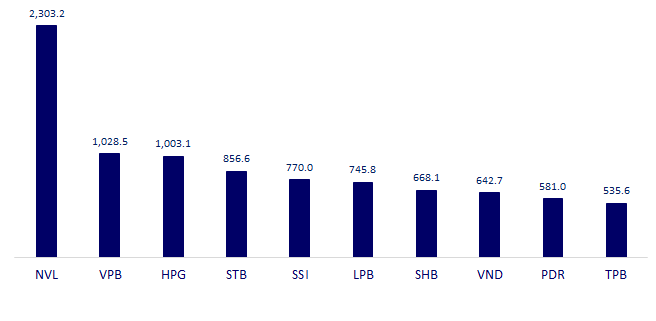

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

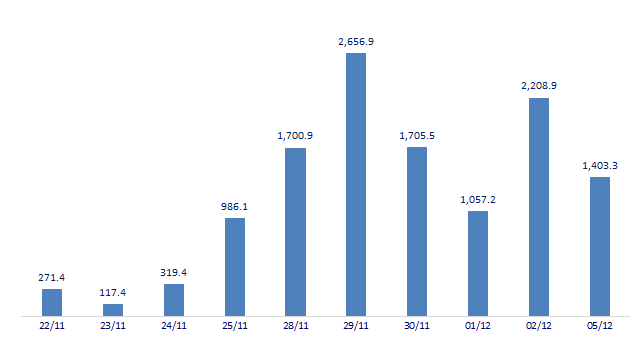

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

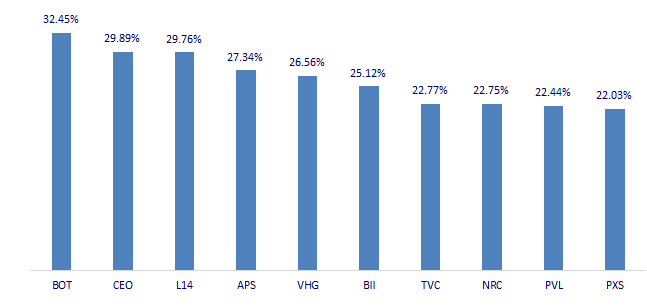

TOP INCREASES 3 CONSECUTIVE SESSIONS

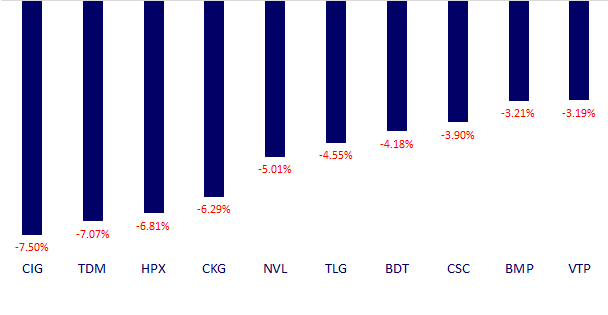

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.