Market brief 08/12/2022

VIETNAM STOCK MARKET

1,050.53

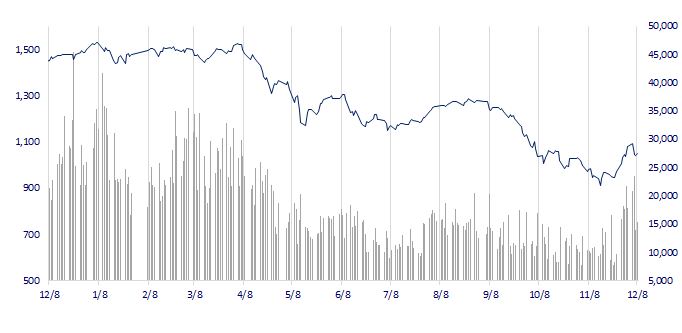

1D 0.91%

YTD -29.88%

1,062.73

1D 1.45%

YTD -30.80%

215.37

1D 2.59%

YTD -54.56%

71.62

1D 1.66%

YTD -36.44%

617.29

1D 0.00%

YTD 0.00%

17,329.23

1D 6.78%

YTD -44.23%

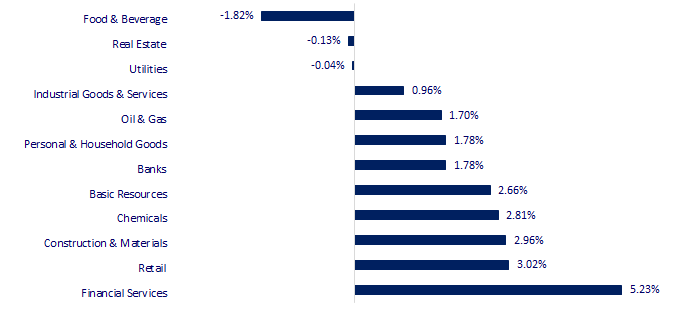

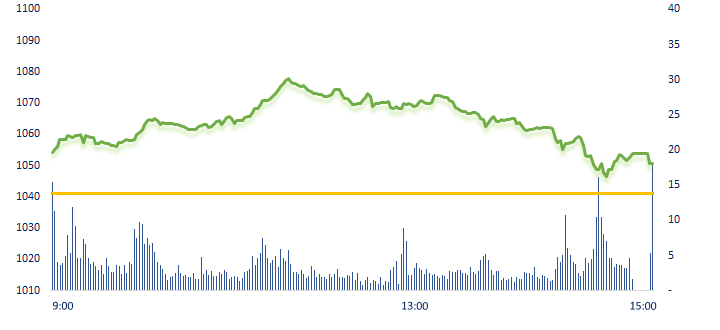

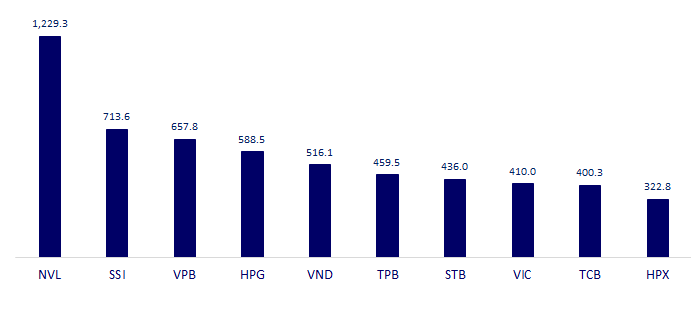

After deep drop in the previous session, the positive sentiment led the market to reverse and gain, however, the uptrend slowed down at the end of the session. Foreign investors' trade was a bright spot as they continued to net bought with a total value of VND617 billion, however, the amount has decreased gradually in recent sessions. Financial services, retail and construction were the 3 most positive sectors today.

ETF & DERIVATIVES

18,100

1D 0.56%

YTD -29.93%

12,540

1D 1.70%

YTD -30.68%

13,010

1D 1.25%

YTD -31.53%

15,100

1D -3.82%

YTD -34.06%

14,690

1D 3.45%

YTD -34.65%

22,750

1D 0.66%

YTD -18.89%

13,510

1D 3.21%

YTD -37.10%

1,033

1D 0.75%

YTD 0.00%

1,040

1D 0.70%

YTD 0.00%

1,040

1D -0.48%

YTD 0.00%

1,055

1D 0.16%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,574.43

1D -0.40%

YTD -4.23%

3,197.35

1D -0.07%

YTD -12.16%

2,371.08

1D -0.49%

YTD -20.37%

19,450.23

1D 3.38%

YTD -16.87%

3,236.08

1D 0.33%

YTD 3.60%

1,619.25

1D -0.19%

YTD -2.31%

77.85

1D 0.27%

YTD 1.76%

1,794.55

1D 0.03%

YTD -1.44%

Asian markets mostly dropped on the news about the possibility of an economic recession as well as the fact that the Fed will prolong the interest rate hike cycle more than expected. The markets of Japan and Korea all dropped points. In contrast, Hang Seng (Hong Kong) rose the most in Asia today on the news of the easing of Zero-Covid policy.

VIETNAM ECONOMY

5.50%

YTD (bps) 469

7.40%

YTD (bps) 180

4.88%

1D (bps) 6

YTD (bps) 387

4.98%

1D (bps) 3

YTD (bps) 298

23,880

1D (%) -0.71%

YTD (%) 4.10%

25,671

1D (%) -0.65%

YTD (%) -3.01%

3,475

1D (%) -0.71%

YTD (%) -5.00%

For the first time in many months, even years, SBV used repo contracts of valuable papers with a term of up to 3 months. Although the volume is still at an exploratory level of less than VND3,000 billion, this change shows a more stable and long-term liquidity support orientation of SBV.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi aims to increase GRDP by about 7.0% in 2023;

- Prevent unfair airfare competition;

- The Prime Minister assigned the plan to invest state budget capital in 2023;

- The US and UK are committed to maintaining high levels of LNG trade;

- Explain the reason why investors from professional to small in the US massively withdraw money from real estate funds;

- Europe's tech industry evaporated over $400 billion in a year.

VN30

BANK

77,000

1D -1.91%

5D -3.75%

Buy Vol. 3,313,564

Sell Vol. 2,981,897

39,000

1D 0.00%

5D 0.00%

Buy Vol. 4,193,950

Sell Vol. 5,031,658

27,800

1D 1.65%

5D 6.31%

Buy Vol. 8,974,920

Sell Vol. 14,898,534

28,200

1D 6.82%

5D 2.92%

Buy Vol. 20,024,251

Sell Vol. 11,981,120

17,000

1D 4.94%

5D 1.19%

Buy Vol. 49,189,221

Sell Vol. 40,394,657

18,100

1D 4.62%

5D 1.69%

Buy Vol. 23,482,668

Sell Vol. 22,769,820

16,500

1D 3.77%

5D 3.45%

Buy Vol. 7,765,799

Sell Vol. 7,392,608

22,000

1D 5.01%

5D 0.92%

Buy Vol. 31,758,811

Sell Vol. 28,598,300

21,700

1D 6.90%

5D 11.28%

Buy Vol. 65,368,849

Sell Vol. 21,460,514

20,950

1D 2.44%

5D 4.75%

Buy Vol. 11,237,350

Sell Vol. 11,766,560

22,650

1D 1.57%

5D 0.67%

Buy Vol. 7,671,216

Sell Vol. 8,912,768

HDB: HDBank consulted shareholders to issue USD500 million of convertible bonds to international investors. Besides, this bank also requested to adjust the foreign room from 18% to 20%. Previously, HDBank also successfully issued USD325 million of international convertible bonds to prestigious financial institutions in the world.

REAL ESTATE

17,900

1D -6.77%

5D -23.34%

Buy Vol. 104,731,711

Sell Vol. 143,218,984

30,300

1D 1.34%

5D 11.40%

Buy Vol. 6,160,553

Sell Vol. 7,780,900

16,600

1D 5.06%

5D 13.70%

Buy Vol. 41,324,039

Sell Vol. 29,844,813

NVL: Novaland announces that it has received resignations from Mr. Nguyen Ngoc Huyen and Mr. Nguyen Duc Dung for the position of Board of Directors.

OIL & GAS

106,000

1D -0.75%

5D -0.47%

Buy Vol. 1,114,842

Sell Vol. 966,108

11,200

1D 2.28%

5D 0.00%

Buy Vol. 20,841,964

Sell Vol. 15,035,983

29,800

1D 2.05%

5D -3.87%

Buy Vol. 1,871,315

Sell Vol. 1,994,186

POW: PV Power and GE International signed LTMA Contract for Nhon Trach 3 & 4 Power Plant project.

VINGROUP

69,900

1D -1.83%

5D 5.91%

Buy Vol. 6,713,121

Sell Vol. 9,422,544

55,400

1D -0.18%

5D 3.55%

Buy Vol. 5,286,870

Sell Vol. 6,283,370

28,750

1D -2.54%

5D -4.17%

Buy Vol. 3,481,439

Sell Vol. 5,660,727

VIC: Vingroup capitalization increased by VND17,000 billion after news that Vinfast is about to IPO on the US stock exchange.

FOOD & BEVERAGE

81,000

1D -1.82%

5D -1.70%

Buy Vol. 2,268,867

Sell Vol. 3,975,698

96,000

1D -4.00%

5D -3.03%

Buy Vol. 1,416,160

Sell Vol. 1,868,056

178,000

1D -0.56%

5D 1.48%

Buy Vol. 288,239

Sell Vol. 412,909

MSN: Masan Group has successfully disbursed a loan of USD600 million.

OTHERS

48,500

1D 0.41%

5D 1.46%

Buy Vol. 1,319,912

Sell Vol. 1,955,511

107,000

1D 0.94%

5D 3.68%

Buy Vol. 814,228

Sell Vol. 836,814

77,000

1D 0.65%

5D 3.08%

Buy Vol. 1,977,607

Sell Vol. 2,550,190

46,000

1D 2.56%

5D 4.43%

Buy Vol. 4,652,939

Sell Vol. 5,335,387

14,700

1D 5.00%

5D -0.68%

Buy Vol. 3,744,940

Sell Vol. 2,945,556

20,550

1D 6.75%

5D 12.91%

Buy Vol. 63,139,801

Sell Vol. 43,436,002

18,900

1D 3.56%

5D 3.85%

Buy Vol. 50,977,268

Sell Vol. 62,822,425

FPT: FPT Capital registered to sell 783,322 shares of TPBank, equivalent to 0.049% of the bank's charter capital. Transactions will be made from December 12, 2022 to January 10, 2023.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

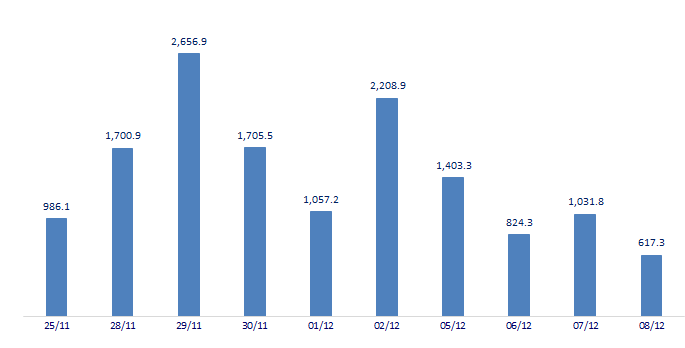

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

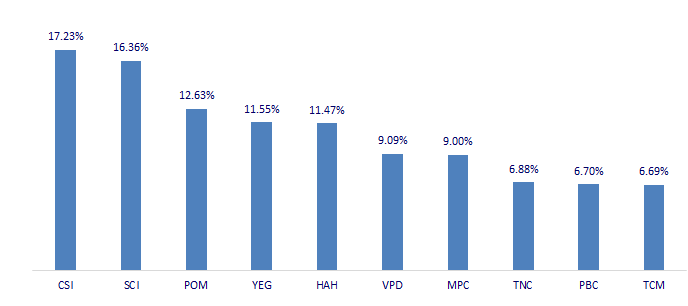

TOP INCREASES 3 CONSECUTIVE SESSIONS

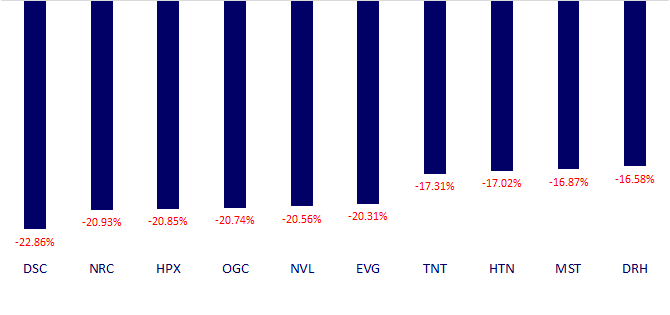

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.