Market brief 09/12/2022

VIETNAM STOCK MARKET

1,051.81

1D 0.12%

YTD -29.80%

1,065.08

1D 0.22%

YTD -30.65%

217.00

1D 0.76%

YTD -54.22%

71.60

1D -0.03%

YTD -36.46%

474.48

1D 0.00%

YTD 0.00%

15,393.88

1D -11.17%

YTD -50.46%

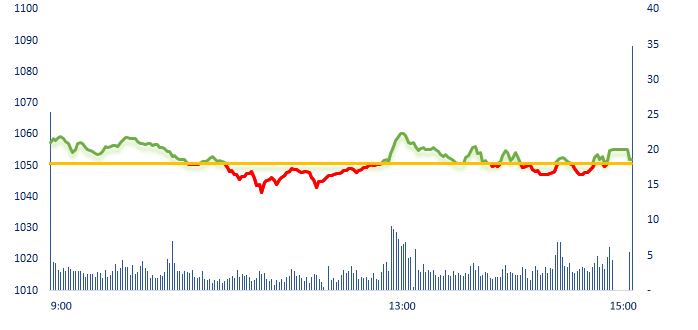

After the recovery, the market closed the week with a struggling session in a narrow range. Positive sentiment spread and helped VN-Index gain strongly in the morning, but the demand was not strong enough so the index dropped below reference level before rebounding slightly at the end. Market liquidity dropped sharply when the trading value on HOSE was only VND12,948 billion.

ETF & DERIVATIVES

18,180

1D 0.44%

YTD -29.62%

12,580

1D 0.32%

YTD -30.46%

13,280

1D 2.08%

YTD -30.11%

15,010

1D -0.60%

YTD -34.45%

14,880

1D 1.29%

YTD -33.81%

22,990

1D 1.05%

YTD -18.04%

13,490

1D -0.15%

YTD -37.20%

1,043

1D 0.95%

YTD 0.00%

1,048

1D 0.81%

YTD 0.00%

1,060

1D 1.95%

YTD 0.00%

1,070

1D 1.42%

YTD 0.00%

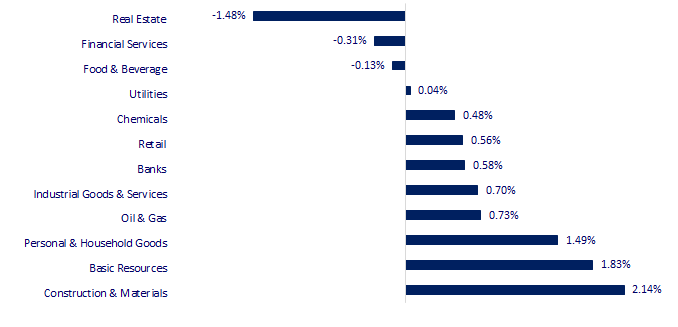

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

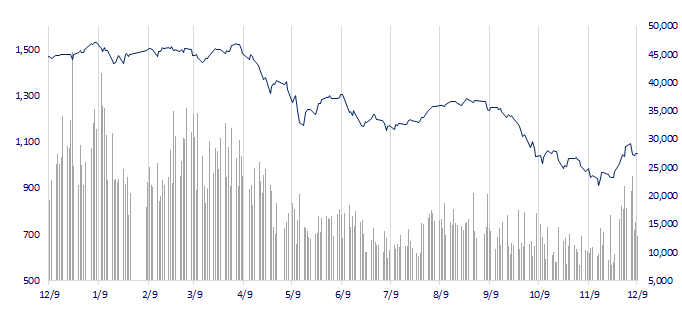

VNINDEX (12M)

GLOBAL MARKET

27,901.01

1D 1.18%

YTD -3.09%

3,206.95

1D 0.30%

YTD -11.89%

2,389.04

1D 0.76%

YTD -19.77%

19,900.87

1D 2.32%

YTD -14.95%

3,241.20

1D 0.16%

YTD 3.76%

1,625.13

1D 0.36%

YTD -1.96%

76.20

1D -0.92%

YTD -0.39%

1,804.05

1D -0.07%

YTD -0.92%

Following US markets, Asian markets were positive today ahead of data on a slight increase in unemployment benefits claim. China and Hong Kong markets continued to gain on the easing of Zero-Covid policy as well as investors' expectation about the economy recovering in the near future.

VIETNAM ECONOMY

5.48%

1D (bps) -2

YTD (bps) 467

7.40%

YTD (bps) 180

4.93%

1D (bps) 5

YTD (bps) 392

4.98%

YTD (bps) 298

23,705

1D (%) -0.52%

YTD (%) 3.33%

25,622

1D (%) -0.43%

YTD (%) -3.20%

3,460

1D (%) -0.29%

YTD (%) -5.41%

This morning (December 9), the State Bank adjusted the USD spot selling rate from 24,840 VND to 24,830 VND/USD. This is the 4th consecutive decrease for this rate, with a total decrease of VND40. The central exchange rate was also adjusted by the regulator down VND2 compared to yesterday to 23,657 VND/USD. USD price at commercial banks also continued to plunge.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- VBMA: About VND309 trillion of corporate bonds will mature in 2023;

- Da Nang ranks third in the country in terms of economic growth rate (GRDP);

- Ho Chi Minh City seeks to disburse VND55 trillion public investment capital;

- Inflationary pressure in China eased in November;

- The US is optimistic about the ability to avoid the risk of economic recession;

- IMF: The poorest countries need USD436 billion to deal with the consequences of Covid.

VN30

BANK

77,300

1D 0.39%

5D -9.06%

Buy Vol. 2,686,777

Sell Vol. 2,192,440

39,200

1D 0.51%

5D -4.85%

Buy Vol. 3,397,118

Sell Vol. 3,003,413

28,050

1D 0.90%

5D 0.36%

Buy Vol. 8,228,833

Sell Vol. 11,192,845

28,250

1D 0.18%

5D -1.91%

Buy Vol. 7,671,166

Sell Vol. 11,322,445

16,900

1D -0.59%

5D -2.31%

Buy Vol. 27,362,512

Sell Vol. 31,230,671

18,200

1D 0.55%

5D -3.19%

Buy Vol. 16,862,159

Sell Vol. 21,621,956

16,800

1D 1.82%

5D 1.82%

Buy Vol. 5,104,411

Sell Vol. 6,607,501

22,500

1D 2.27%

5D -1.32%

Buy Vol. 21,973,911

Sell Vol. 21,024,620

22,400

1D 3.23%

5D 7.43%

Buy Vol. 49,823,819

Sell Vol. 48,655,938

20,950

1D 0.00%

5D -2.10%

Buy Vol. 8,210,164

Sell Vol. 9,166,947

23,050

1D 1.77%

5D -1.91%

Buy Vol. 4,788,598

Sell Vol. 5,818,622

VCB: Vietcombank plans to hold an Extraordinary General Meeting of Shareholders on January 30, 2023 to elect additional members of the Board of Directors for the 2018-2023 term. At the same time, VCB plans to submit to the General Meeting of Shareholders on extending the implementation time of the plan to increase charter capital through the issuance of VCB shares and a number of other submissions.

REAL ESTATE

16,650

1D -6.98%

5D -30.04%

Buy Vol. 73,664,828

Sell Vol. 110,034,305

30,050

1D -0.83%

5D 3.26%

Buy Vol. 3,415,860

Sell Vol. 4,939,132

16,500

1D -0.60%

5D 5.77%

Buy Vol. 20,247,134

Sell Vol. 39,163,019

NVL: Novaland mortgages shares in two companies to secure a USD100 million loan.

OIL & GAS

106,000

1D 0.00%

5D -4.68%

Buy Vol. 789,231

Sell Vol. 777,041

11,200

1D 0.00%

5D -4.27%

Buy Vol. 16,064,951

Sell Vol. 15,917,305

30,400

1D 2.01%

5D -3.34%

Buy Vol. 1,154,357

Sell Vol. 1,542,692

PLX: Petrolimex reduced its annual profit target by 90% to VND300 billion.

VINGROUP

67,800

1D -3.00%

5D -1.45%

Buy Vol. 3,504,208

Sell Vol. 5,253,089

54,100

1D -2.35%

5D -5.42%

Buy Vol. 4,326,758

Sell Vol. 4,793,051

28,900

1D 0.52%

5D -8.40%

Buy Vol. 5,453,815

Sell Vol. 5,100,097

VIC: On December 9, VinFast announced the selection of T-Mobile (USA) as the exclusive partner to provide connectivity for smart electric vehicles in North America and Europe.

FOOD & BEVERAGE

80,000

1D -1.23%

5D -4.76%

Buy Vol. 3,738,774

Sell Vol. 3,868,093

97,000

1D 1.04%

5D -6.64%

Buy Vol. 1,834,557

Sell Vol. 2,141,244

178,000

1D 0.00%

5D 0.56%

Buy Vol. 300,051

Sell Vol. 396,572

VNM: Vibev, an ice cream and non-alcoholic beverage company owned by Vinamilk 51% and Kido 49%, announced its dissolution after more than two years of establishment.

OTHERS

47,900

1D -1.24%

5D -0.62%

Buy Vol. 1,519,752

Sell Vol. 1,491,252

111,500

1D 4.21%

5D 4.69%

Buy Vol. 766,477

Sell Vol. 655,012

78,000

1D 1.30%

5D 0.78%

Buy Vol. 1,719,409

Sell Vol. 2,155,872

46,200

1D 0.43%

5D -1.70%

Buy Vol. 2,809,149

Sell Vol. 4,288,805

15,050

1D 2.38%

5D -2.90%

Buy Vol. 4,025,550

Sell Vol. 3,887,909

20,250

1D -1.46%

5D 4.11%

Buy Vol. 34,455,433

Sell Vol. 41,648,856

19,200

1D 1.59%

5D -1.29%

Buy Vol. 57,156,122

Sell Vol. 59,948,406

HPG: Hoa Phat Yen My Urban Development Company, a subsidiary of Hoa Phat Group, qualified to implement a real estate project of VND4,830 billion in Hung Yen.

Market by numbers

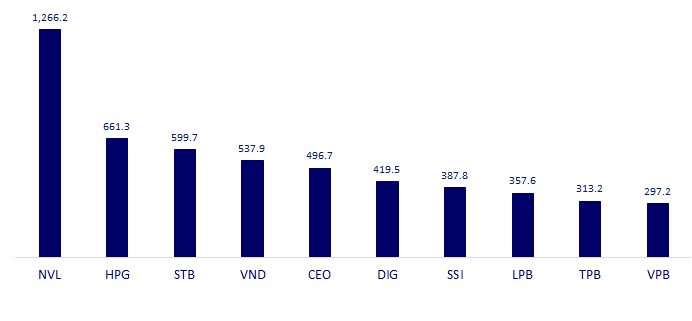

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

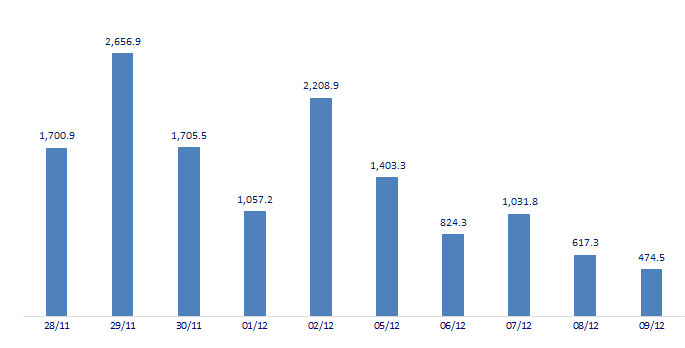

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

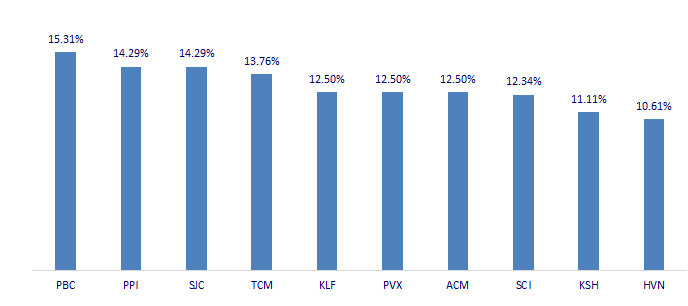

TOP INCREASES 3 CONSECUTIVE SESSIONS

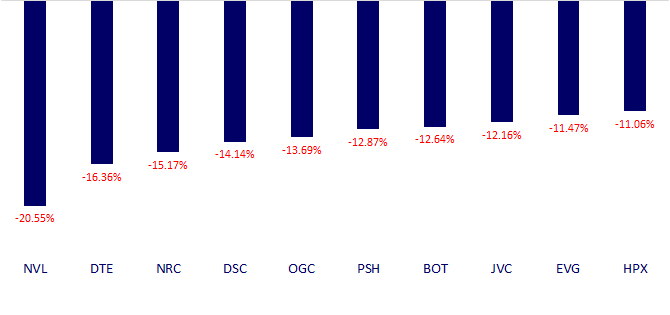

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.