Market brief 13/12/2022

VIETNAM STOCK MARKET

1,047.45

1D 1.49%

YTD -30.09%

1,056.43

1D 1.83%

YTD -31.21%

213.59

1D 1.45%

YTD -54.94%

71.84

1D 0.48%

YTD -36.24%

922.44

1D 0.00%

YTD 0.00%

15,162.77

1D -18.79%

YTD -51.20%

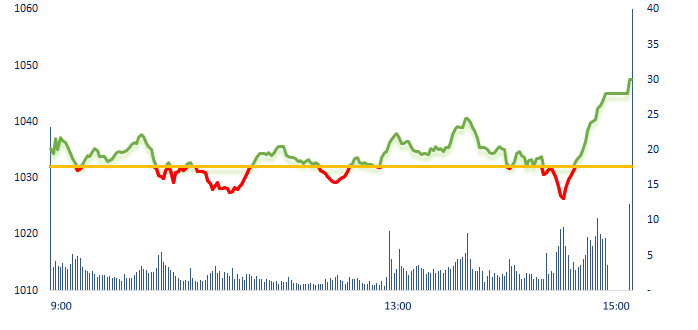

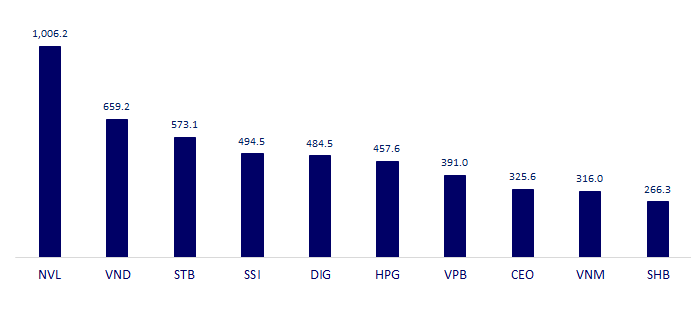

After the first session of the week dropped quite strongly, the selling pressure has somewhat subsided. The buying force suddenly prevailed on a large scale at the end of the session pulled many stocks to reverse and gain strongly. Foreign investors' trade continued to be a bright spot with a net buying of VND876 billion on HoSE. In which, NVL was mostly bought with a value of more than VND156 billion.

ETF & DERIVATIVES

17,900

1D 0.56%

YTD -30.70%

12,440

1D 1.63%

YTD -31.23%

12,760

1D 0.16%

YTD -32.84%

15,000

1D 0.00%

YTD -34.50%

14,800

1D 2.07%

YTD -34.16%

22,820

1D 0.84%

YTD -18.65%

13,370

1D 0.60%

YTD -37.76%

1,035

1D 1.39%

YTD 0.00%

1,046

1D 2.35%

YTD 0.00%

1,054

1D 2.09%

YTD 0.00%

1,058

1D 2.20%

YTD 0.00%

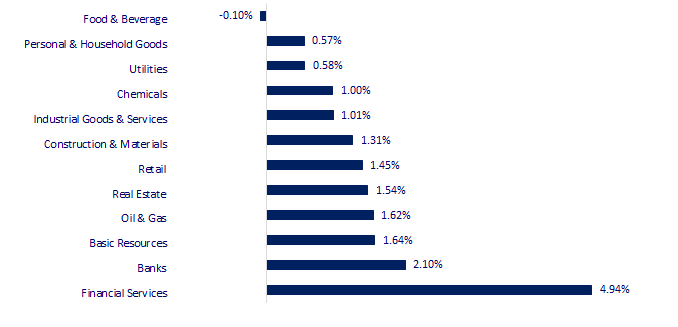

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

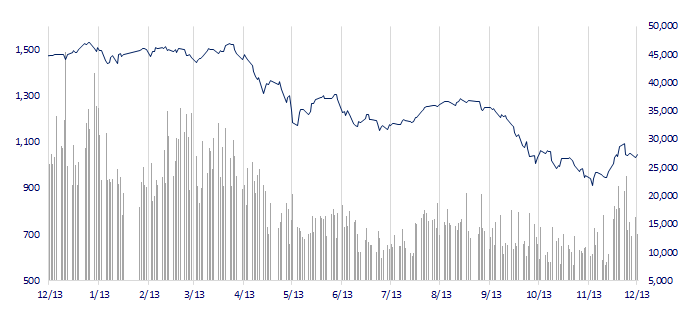

VNINDEX (12M)

GLOBAL MARKET

27,954.85

1D 0.40%

YTD -2.91%

3,176.33

1D -0.09%

YTD -12.73%

2,372.40

1D -0.03%

YTD -20.33%

19,596.20

1D 0.68%

YTD -16.25%

3,271.28

1D 0.98%

YTD 4.73%

1,625.91

1D 0.17%

YTD -1.91%

78.95

1D 0.97%

YTD 3.20%

1,795.25

1D 0.11%

YTD -1.40%

At the end of the session, Asian stocks were mixed while investors were watching the meeting of the US Federal Reserve (Fed). Nikkei 225 (Japan), Hang Seng (Hong Kong) all gained, while Shanghai Composite (China), Kospi (South Korea) decreased slightly by 0.09% and 0.03%, respectively.

VIETNAM ECONOMY

5.47%

1D (bps) -3

YTD (bps) 466

7.40%

YTD (bps) 180

4.85%

1D (bps) -6

YTD (bps) 384

4.90%

1D (bps) -5

YTD (bps) 290

23,763

1D (%) -0.61%

YTD (%) 3.59%

25,621

1D (%) -0.62%

YTD (%) -3.20%

3,454

1D (%) -0.66%

YTD (%) -5.58%

The Ministry of Finance has submitted to the Government a draft amendment and supplement to Decree 65 with a number of notable proposals such as delaying one year of implementing regulations on professional securities investors, credit ratings with issuers, and allowing extension of bond maturities.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Finance will submit to the Government a draft amending Decree 65 to "remove difficulties" for the bond market;

- Nghe An collected more than VND12,000 billion from tourism;

- Officially established the State Administration of Foreign Exchange Reserve;

- China extends credit limit to more than USD430 billion for real estate industry;

- China plans to expand REIT scale to stimulate real estate industry;

- Global debt-to-GDP ratio fell sharply but remained above pre-Covid levels.

VN30

BANK

78,200

1D 1.03%

5D -2.25%

Buy Vol. 3,410,112

Sell Vol. 2,947,645

38,700

1D 1.57%

5D -1.02%

Buy Vol. 3,103,321

Sell Vol. 2,965,007

28,150

1D 2.55%

5D 4.26%

Buy Vol. 7,207,852

Sell Vol. 7,214,641

28,800

1D 5.88%

5D 6.47%

Buy Vol. 11,445,298

Sell Vol. 10,275,144

17,100

1D 2.70%

5D 1.18%

Buy Vol. 31,060,610

Sell Vol. 28,917,136

18,000

1D 1.69%

5D 1.69%

Buy Vol. 20,609,817

Sell Vol. 14,675,073

16,450

1D 1.54%

5D 0.30%

Buy Vol. 6,088,674

Sell Vol. 8,134,486

23,000

1D 0.44%

5D 6.48%

Buy Vol. 16,318,736

Sell Vol. 15,742,532

22,550

1D 5.87%

5D 8.67%

Buy Vol. 51,842,513

Sell Vol. 39,182,149

20,750

1D 1.97%

5D 1.72%

Buy Vol. 8,394,839

Sell Vol. 7,309,932

23,050

1D 2.44%

5D 3.36%

Buy Vol. 4,754,467

Sell Vol. 5,126,772

ACB: Asia Commercial Joint Stock Bank (ACB) officially completed the implementation of key contents of ILAAP and Basel III standard - one of the most demanding standards in terms of capital and liquidity risk management.

REAL ESTATE

18,200

1D 2.25%

5D -11.65%

Buy Vol. 90,759,839

Sell Vol. 101,690,849

27,900

1D -0.18%

5D -5.58%

Buy Vol. 4,638,007

Sell Vol. 3,432,328

15,500

1D 0.00%

5D 0.00%

Buy Vol. 24,415,701

Sell Vol. 28,550,539

KDH: Foreign fund VOF Investment Limited (under VinaCapital) has just registered to sell all 10 million KDH shares, equivalent to 1.41% ownership rate of charter capital.

OIL & GAS

105,600

1D 0.57%

5D -3.56%

Buy Vol. 767,762

Sell Vol. 756,134

11,400

1D 2.24%

5D 4.59%

Buy Vol. 16,522,508

Sell Vol. 21,482,451

31,400

1D 0.96%

5D 3.97%

Buy Vol. 1,575,016

Sell Vol. 1,592,260

PLX: Vietcombank and Petrolimex signed a comprehensive cooperation agreement with a credit limit of VND25,000 billion.

VINGROUP

61,600

1D -2.38%

5D -7.51%

Buy Vol. 4,428,005

Sell Vol. 4,712,176

53,000

1D 4.95%

5D -3.64%

Buy Vol. 6,164,686

Sell Vol. 5,229,107

28,000

1D 3.51%

5D -4.60%

Buy Vol. 3,466,540

Sell Vol. 3,187,635

VIC: After 2 years of implementation, VinFast officially announced to stop the program of exchanging old cars for new cars to switch to other preferential packages.

FOOD & BEVERAGE

78,000

1D -0.64%

5D -5.45%

Buy Vol. 5,449,947

Sell Vol. 5,186,267

97,000

1D 0.00%

5D -4.90%

Buy Vol. 1,813,047

Sell Vol. 1,867,016

178,000

1D -0.17%

5D -0.28%

Buy Vol. 531,850

Sell Vol. 582,241

VNM: Vinamilk discloses the ex-dividend date on December 23, 2022 with interim dividend ratio of 14%/share (1 share will receive VND1,400).

OTHERS

49,900

1D 2.89%

5D 3.96%

Buy Vol. 2,671,398

Sell Vol. 2,629,378

112,000

1D 0.54%

5D 5.66%

Buy Vol. 583,766

Sell Vol. 594,575

77,200

1D 0.26%

5D 1.58%

Buy Vol. 1,477,832

Sell Vol. 1,808,049

46,400

1D 1.09%

5D 4.62%

Buy Vol. 3,738,549

Sell Vol. 3,457,923

15,000

1D 1.35%

5D 3.09%

Buy Vol. 4,156,034

Sell Vol. 4,374,161

20,400

1D 6.53%

5D 4.35%

Buy Vol. 49,583,650

Sell Vol. 39,124,297

19,000

1D 2.15%

5D 2.15%

Buy Vol. 39,467,270

Sell Vol. 39,178,097

FPT: Specifically from January 1, 2023, Mr. Duong Dung Trieu - Chairman of FPT IS became the Chairman of Synnex FPT; Mr. Tran Dang Hoa - Deputy General Director and COO of FPT Software assumes the role of Chairman of FPT IS. After the rotation, the senior leadership team at FPT IS includes Chairman Tran Dang Hoa and General Director Nguyen Hoang Minh, while Chairman Duong Dung Trieu and General Director Le Vinh Thanh at Synnex FPT.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

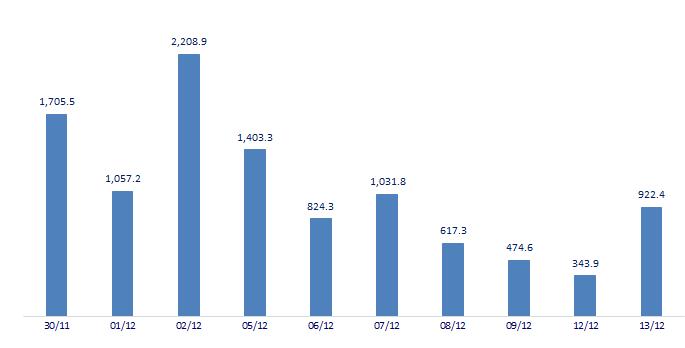

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

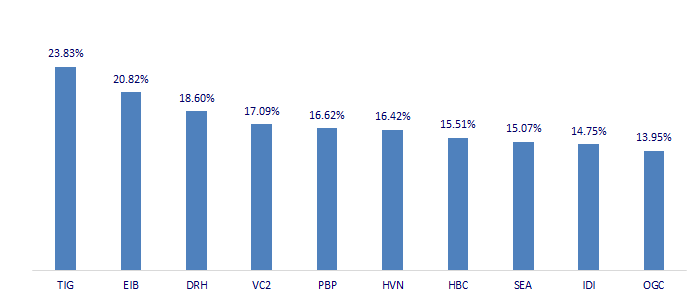

TOP INCREASES 3 CONSECUTIVE SESSIONS

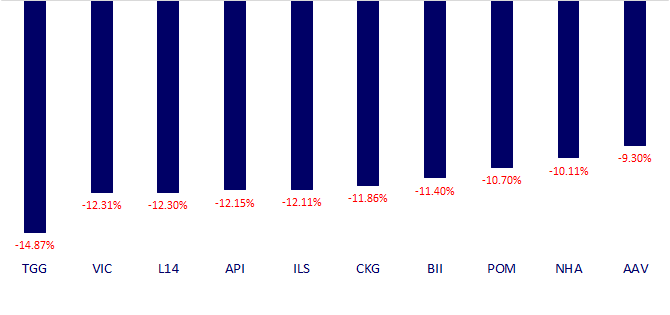

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.