Market brief 21/12/2022

VIETNAM STOCK MARKET

1,018.88

1D -0.42%

YTD -32.00%

1,033.10

1D 0.32%

YTD -32.73%

204.46

1D -1.48%

YTD -56.86%

70.70

1D -0.46%

YTD -37.26%

1,685.92

1D 0.00%

YTD 0.00%

16,426.33

1D -17.45%

YTD -47.13%

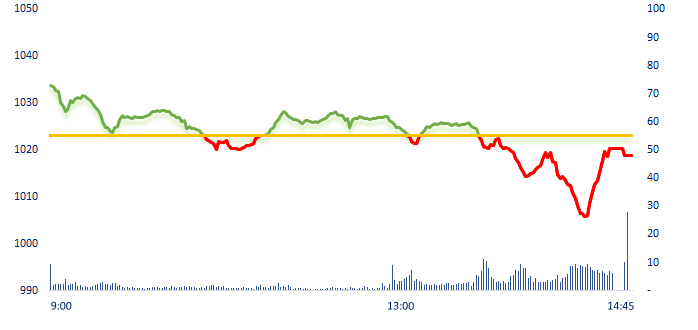

VN-Index recorded a significant change at the end of the session thanks to bottom-fishing at large Cap stocks such as VPB, STB, VNM, VHM,... Securities stocks were still the most negative in the market. However, the recovery of the market at the end of the session helped many stocks escape from downing to the floor price such as BSI, VND, SSI, VCI, MBS...

ETF & DERIVATIVES

17,430

1D -0.91%

YTD -32.52%

12,160

1D 0.08%

YTD -32.78%

12,600

1D -1.18%

YTD -33.68%

14,050

1D -1.06%

YTD -38.65%

14,650

1D -0.20%

YTD -34.83%

22,390

1D -1.63%

YTD -20.18%

13,150

1D 0.31%

YTD -38.78%

1,007

1D 0.31%

YTD 0.00%

1,021

1D 0.26%

YTD 0.00%

1,029

1D 0.34%

YTD 0.00%

1,037

1D 0.97%

YTD 0.00%

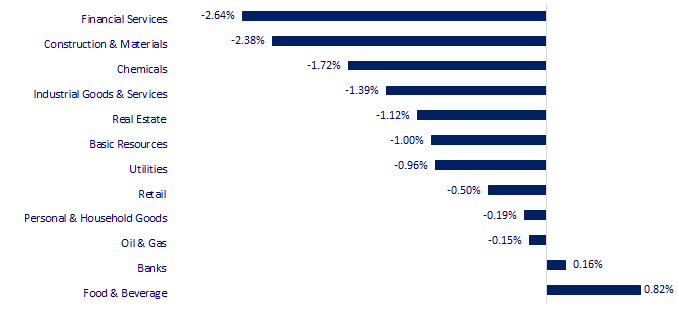

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

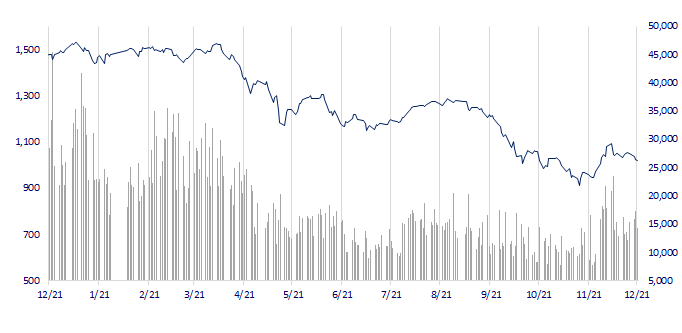

VNINDEX (12M)

GLOBAL MARKET

26,387.72

1D -0.68%

YTD -8.35%

3,068.41

1D -0.17%

YTD -15.70%

2,328.95

1D -0.19%

YTD -21.79%

19,160.49

1D 0.34%

YTD -18.11%

3,256.19

1D 0.07%

YTD 4.24%

1,609.94

1D 0.54%

YTD -2.88%

81.14

1D 1.27%

YTD 6.07%

1,824.25

1D -0.21%

YTD 0.19%

At the end of the session, Asian markets were mixed with investors' doubts about the economic recession as well as the information of BOJ's unexpected move on bond yields. Nikkei 225 (Japan), Shanghai Composite (China), Kospi (Korea) all dropped. In contrast, Hang Seng (Hong Kong) gained 0.34%.

VIETNAM ECONOMY

3.97%

YTD (bps) 316

7.40%

YTD (bps) 180

4.84%

YTD (bps) 383

4.93%

YTD (bps) 293

23,863

1D (%) -0.11%

YTD (%) 4.02%

25,910

1D (%) -0.19%

YTD (%) -2.11%

3,472

1D (%) -0.26%

YTD (%) -5.08%

The State Bank has successfully offered a bid of VND20,000 billion of 7-day tenor with interest rate of 4.39%. The last time the SBV offered T-bills took place during November 15 - November 18 with a scale of VND40,000 billion with a term of 28 days and interest rate ranging from 4.5 - 6%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Gasoline price decreased further by 500 VND/liter, RON 92 was only from 19,000 VND/liter;

- Funding USD107 million for a wind power project in Ninh Thuan;

- Borrowing money from the 2% interest rate support package, businesses are afraid of inspection and examination;

- China completed the second largest hydroelectric plant in the world;

- Malaysia approved an interim budget bill worth more than USD24 billion;

- Elon Musk announced to resign as CEO of Twitter.

VN30

BANK

78,700

1D -0.38%

5D -0.13%

Buy Vol. 1,856,903

Sell Vol. 1,931,527

38,600

1D 0.26%

5D -0.52%

Buy Vol. 2,684,609

Sell Vol. 3,039,274

27,500

1D -1.79%

5D -1.43%

Buy Vol. 6,057,391

Sell Vol. 7,823,016

27,700

1D 0.00%

5D -3.82%

Buy Vol. 11,452,642

Sell Vol. 10,497,232

17,650

1D 2.02%

5D 3.52%

Buy Vol. 36,084,925

Sell Vol. 35,409,838

17,700

1D 0.57%

5D -2.48%

Buy Vol. 16,568,010

Sell Vol. 15,854,279

16,800

1D 0.90%

5D 2.13%

Buy Vol. 4,590,075

Sell Vol. 4,935,909

21,600

1D -1.82%

5D -5.26%

Buy Vol. 6,381,577

Sell Vol. 7,009,508

23,550

1D 4.90%

5D 1.29%

Buy Vol. 57,847,005

Sell Vol. 68,496,235

19,700

1D 0.00%

5D -4.37%

Buy Vol. 6,487,329

Sell Vol. 5,802,340

22,800

1D 1.11%

5D -1.51%

Buy Vol. 2,766,177

Sell Vol. 4,488,959

TCB: Techcombank has just announced the results of collecting shareholders' opinions on the private placement of shares of Techcombank Securities (TCBS). Specifically, the bank's shareholders approved the above plan with an approval rate of more than 70.6% of the total number of voting shares, 2.2% of shareholders disapproved, the remaining was no voting.

REAL ESTATE

15,200

1D -6.75%

5D -17.84%

Buy Vol. 46,756,332

Sell Vol. 68,673,508

25,100

1D -2.71%

5D -10.36%

Buy Vol. 2,331,144

Sell Vol. 2,047,329

12,000

1D -6.98%

5D -20.00%

Buy Vol. 23,504,554

Sell Vol. 18,659,558

KDH: KDH commits to guarantee debt repayment obligations, payment obligations on behalf of Khang Phuc House at Phuong Dong Bank - District 4 Branch with a loan amount of VND930 billion.

OIL & GAS

103,500

1D -1.24%

5D -3.72%

Buy Vol. 365,631

Sell Vol. 540,409

10,450

1D -2.34%

5D -8.33%

Buy Vol. 27,003,956

Sell Vol. 11,864,087

29,500

1D 0.51%

5D -5.90%

Buy Vol. 1,316,249

Sell Vol. 1,263,902

PLX: Petrolimex still guarantees to pay a share dividend in 2022 at 12% as planned, even though it has to reduce its pre-tax income target due to various reasons.

VINGROUP

54,900

1D -1.79%

5D -9.70%

Buy Vol. 4,066,852

Sell Vol. 3,473,704

48,500

1D 0.62%

5D -8.49%

Buy Vol. 3,100,956

Sell Vol. 2,950,271

26,000

1D 0.97%

5D -6.98%

Buy Vol. 4,702,415

Sell Vol. 5,723,787

VRE: Vincom Retail plans to open 6 more shopping centers in Ha Giang, Dien Bien Phu, Bac Giang…

FOOD & BEVERAGE

79,700

1D 1.27%

5D 2.84%

Buy Vol. 4,335,100

Sell Vol. 4,790,295

94,900

1D 0.96%

5D -1.15%

Buy Vol. 973,251

Sell Vol. 1,281,925

175,000

1D 1.16%

5D -0.82%

Buy Vol. 311,825

Sell Vol. 320,167

SAB: After 2 sessions, Hoa Phat (HPG) was knocked out of Top 10 capitalization by Sabeco (SAB).

OTHERS

48,000

1D 0.00%

5D -3.52%

Buy Vol. 1,169,147

Sell Vol. 1,170,280

111,600

1D 0.27%

5D -0.53%

Buy Vol. 505,598

Sell Vol. 498,863

77,200

1D 0.78%

5D 1.18%

Buy Vol. 1,069,451

Sell Vol. 1,416,884

46,400

1D -0.22%

5D -0.11%

Buy Vol. 3,298,363

Sell Vol. 4,720,096

14,200

1D -0.70%

5D -8.39%

Buy Vol. 4,246,486

Sell Vol. 3,734,845

19,300

1D -2.53%

5D -3.98%

Buy Vol. 39,216,804

Sell Vol. 47,841,568

18,900

1D -0.53%

5D -1.56%

Buy Vol. 50,709,038

Sell Vol. 51,359,691

FPT: At a recent meeting with Binh Duong Provincial People's Committee, Mr. Truong Gia Binh, Chairman of FPT shared his desire to accompany the province in developing highly qualified human resources through building an inter-level education system in Binh Duong; at the same time, comprehensive digital transformation for the province in the three pillars of digital government, digital economy and digital society.

Market by numbers

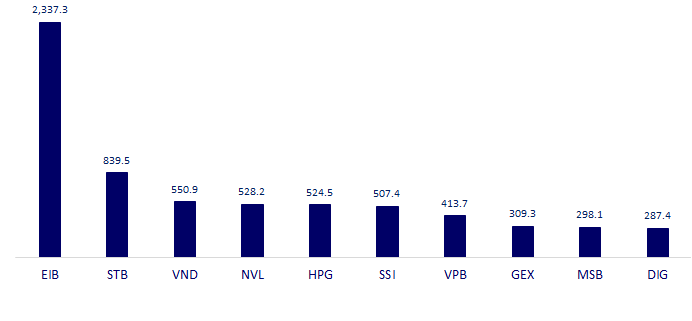

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

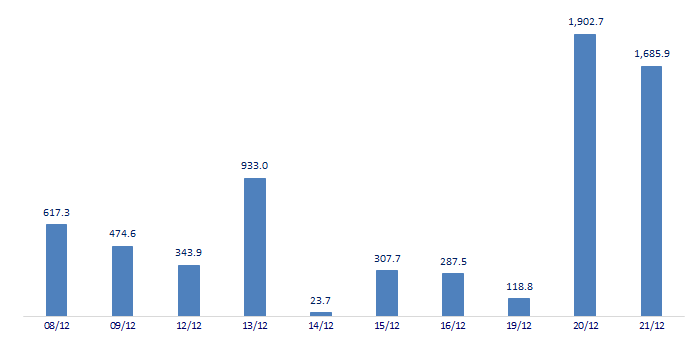

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

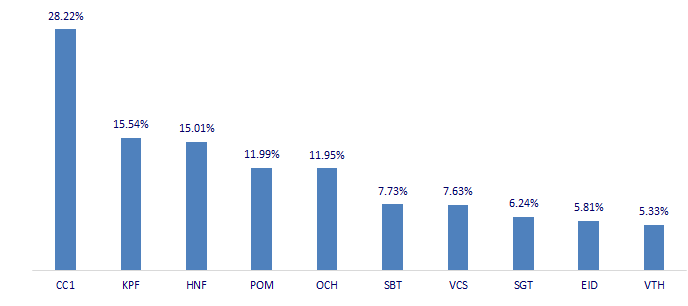

TOP INCREASES 3 CONSECUTIVE SESSIONS

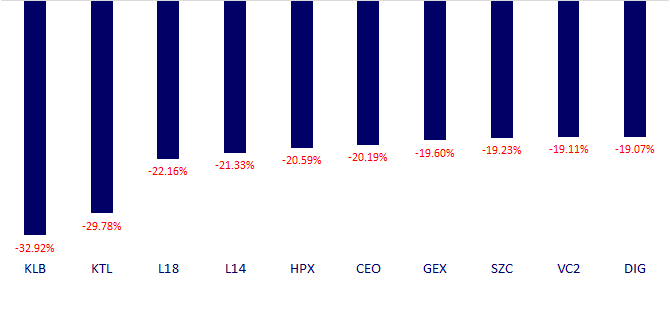

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.