Market brief 22/12/2022

VIETNAM STOCK MARKET

1,022.61

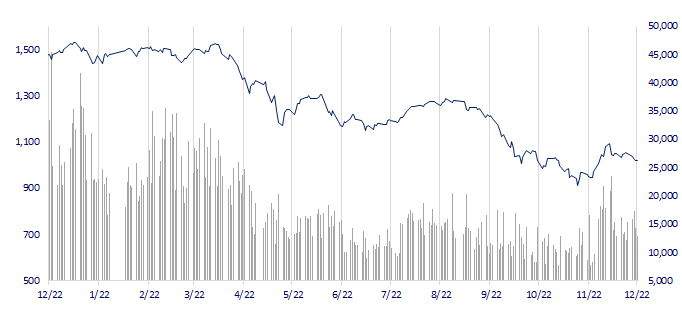

1D 0.37%

YTD -31.75%

1,038.34

1D 0.51%

YTD -32.39%

205.79

1D 0.65%

YTD -56.58%

70.83

1D 0.18%

YTD -37.14%

-2,464.28

1D 0.00%

YTD 0.00%

14,214.50

1D -13.47%

YTD -54.25%

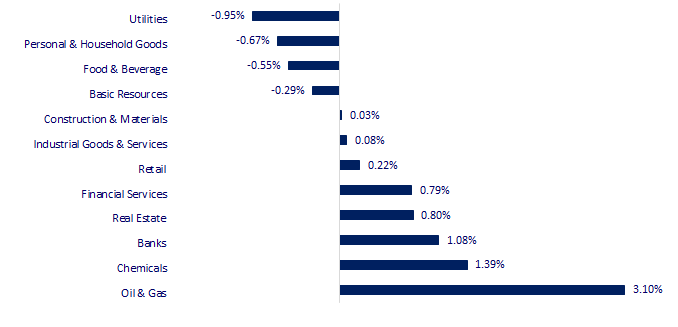

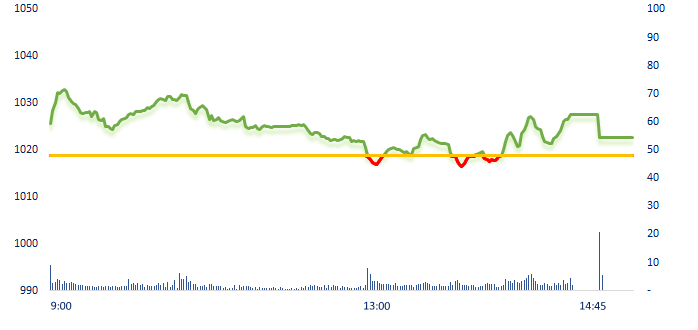

Selling pressure prevailed at the beginning of the afternoon session so VN-Index dropped below reference. However, the buying force gradually got stronger at the end of the session and pulled the index up again. The green color mostly occurs in sectors such as financial services, information technology, real estate and construction.

ETF & DERIVATIVES

17,700

1D 1.55%

YTD -31.48%

12,330

1D 1.40%

YTD -31.84%

12,800

1D 1.59%

YTD -32.63%

14,020

1D -0.21%

YTD -38.78%

14,800

1D 1.02%

YTD -34.16%

22,900

1D 2.28%

YTD -18.36%

13,280

1D 0.99%

YTD -38.18%

1,014

1D 0.70%

YTD 0.00%

1,024

1D 0.28%

YTD 0.00%

1,036

1D 0.63%

YTD 0.00%

1,038

1D 0.07%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,507.87

1D 0.46%

YTD -7.93%

3,054.43

1D -0.46%

YTD -16.08%

2,356.73

1D 1.19%

YTD -20.85%

19,679.22

1D 2.71%

YTD -15.89%

3,269.53

1D 0.41%

YTD 4.67%

1,616.67

1D 0.42%

YTD -2.47%

83.54

1D 1.41%

YTD 9.20%

1,824.55

1D -0.15%

YTD 0.21%

At the end of the session, Asian stocks mostly gained ahead of investors' expectations that economic growth could exceed forecasts even if there is a possibility of recession.

VIETNAM ECONOMY

3.70%

1D (bps) -24

YTD (bps) 289

7.40%

YTD (bps) 180

4.78%

1D (bps) -5

YTD (bps) 377

4.86%

1D (bps) -7

YTD (bps) 286

23,825

1D (%) -0.15%

YTD (%) 3.86%

25,583

1D (%) -1.12%

YTD (%) -3.34%

3,455

1D (%) -0.37%

YTD (%) -5.55%

The trend of net withdrawal of the SBV took place in the context that VND interest rates in the interbank market dropped sharply in short terms. On December 21, the State Bank of Vietnam (SBV) continued to use the T-bill to reduce system liquidity. Specifically, SBV has successfully issued VND20,000 billion bills with 7-day term and interest rate of 3.98%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Contractor advances 100% of capital, key projects are still behind schedule;

- Urging contractors to speed up the 'super project' of Long Thanh airport;

- Long An's budget revenue exceeded the record for the first time;

- Germany turns back to coal as energy security overtakes climate goals;

- WB approved a credit of USD274 million to support Cambodia's economic recovery;

- The IPO market is unlikely to recover in 2023.

VN30

BANK

79,300

1D 0.76%

5D -0.25%

Buy Vol. 1,991,023

Sell Vol. 1,997,509

39,000

1D 1.04%

5D 0.00%

Buy Vol. 2,732,758

Sell Vol. 2,846,117

27,600

1D 0.36%

5D -2.30%

Buy Vol. 5,252,986

Sell Vol. 9,201,123

27,700

1D 0.00%

5D -6.10%

Buy Vol. 6,830,157

Sell Vol. 7,389,767

18,450

1D 4.53%

5D 1.37%

Buy Vol. 93,107,707

Sell Vol. 87,710,244

18,000

1D 1.69%

5D -5.01%

Buy Vol. 17,669,564

Sell Vol. 15,928,048

16,850

1D 0.30%

5D 0.60%

Buy Vol. 3,070,908

Sell Vol. 3,134,448

22,350

1D 3.47%

5D -2.83%

Buy Vol. 11,671,485

Sell Vol. 13,933,641

23,400

1D -0.64%

5D 0.65%

Buy Vol. 31,440,962

Sell Vol. 41,596,340

19,950

1D 1.27%

5D -5.00%

Buy Vol. 3,956,841

Sell Vol. 4,740,260

22,900

1D 0.44%

5D -1.29%

Buy Vol. 3,188,284

Sell Vol. 5,641,983

HDB: According to information from the Ho Chi Minh City Stock Exchange (HOSE), Mr. Tran Hoai Nam - Deputy General Director of HDBank registered to buy 120,000 shares of this bank from December 26, 2022.

REAL ESTATE

15,500

1D 1.97%

5D -13.41%

Buy Vol. 72,004,888

Sell Vol. 58,348,086

26,850

1D 6.97%

5D -4.79%

Buy Vol. 3,405,543

Sell Vol. 1,858,248

12,800

1D 6.67%

5D -10.80%

Buy Vol. 25,451,504

Sell Vol. 9,580,094

PDR: According to a new information announcement issued on December 22, 2022 from Phat Dat, Mr. Le Quang Phuc, a member of the BOD cum Advisor has just registered to buy 2 million shares.

OIL & GAS

101,200

1D -2.22%

5D -4.80%

Buy Vol. 522,329

Sell Vol. 566,446

10,700

1D 2.39%

5D -6.14%

Buy Vol. 29,700,513

Sell Vol. 13,036,276

30,650

1D 3.90%

5D -1.92%

Buy Vol. 1,169,697

Sell Vol. 1,069,744

POW: In 15 years of development, PV Power has produced more than 240 billion kWh of electricity, making an important contribution to ensuring national energy security.

VINGROUP

55,000

1D 0.18%

5D -9.24%

Buy Vol. 4,129,976

Sell Vol. 3,424,421

49,000

1D 1.03%

5D -3.35%

Buy Vol. 3,041,672

Sell Vol. 3,310,149

26,000

1D 0.00%

5D -6.81%

Buy Vol. 3,773,839

Sell Vol. 3,275,816

VIC: VinFast has completed the payment of VND10,000 billion of bonds. This lot of bonds was issued by VinFast, advised by TCBS and matured in December.

FOOD & BEVERAGE

77,000

1D -1.66%

5D 1.00%

Buy Vol. 2,814,209

Sell Vol. 3,725,852

94,400

1D -0.53%

5D -3.87%

Buy Vol. 704,911

Sell Vol. 1,014,874

175,300

1D 0.17%

5D -0.65%

Buy Vol. 197,614

Sell Vol. 256,305

MSN: Chairman of the Board of Directors of Masan Group, Mr. Nguyen Dang Quang said that Masan held 50% of the market share of modern retail stores nationwide.

OTHERS

48,200

1D 0.42%

5D -2.63%

Buy Vol. 798,072

Sell Vol. 949,744

111,300

1D -0.27%

5D -1.42%

Buy Vol. 376,934

Sell Vol. 346,087

77,200

1D 0.00%

5D -0.64%

Buy Vol. 1,182,413

Sell Vol. 1,474,584

46,500

1D 0.22%

5D -1.06%

Buy Vol. 2,799,135

Sell Vol. 3,341,515

14,500

1D 2.11%

5D -7.05%

Buy Vol. 2,395,049

Sell Vol. 2,263,328

19,100

1D -1.04%

5D -5.68%

Buy Vol. 24,450,907

Sell Vol. 33,042,363

18,900

1D 0.00%

5D -2.33%

Buy Vol. 34,988,302

Sell Vol. 40,799,770

HPG: Hoa Phat has just signed a contract to export 10,000 tons of coiled steel to Europe. This is the first order of long steel products exported to this region, opening up a new and potential market for Hoa Phat steel products.

Market by numbers

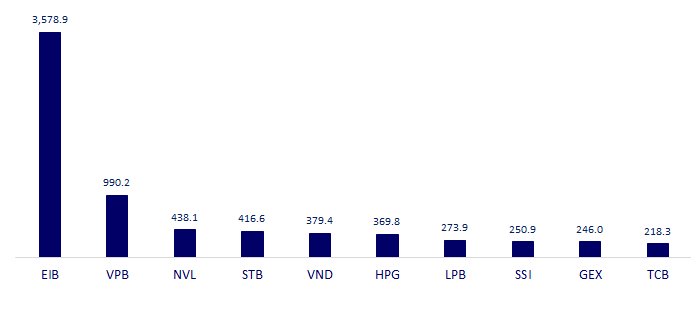

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

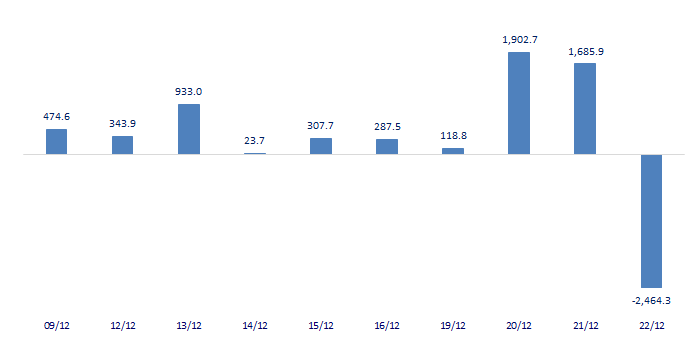

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

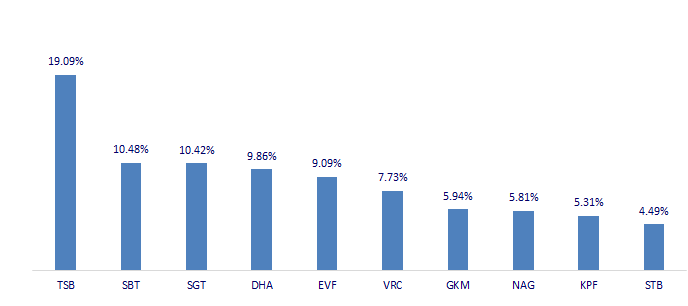

TOP INCREASES 3 CONSECUTIVE SESSIONS

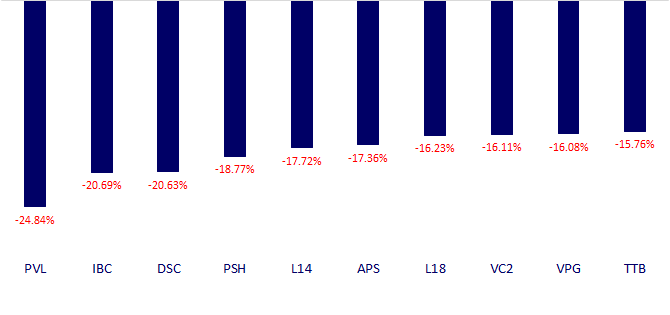

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.