Market Brief 27/12/2022

VIETNAM STOCK MARKET

1,004.57

1D 1.97%

YTD -32.95%

1,007.36

1D 1.98%

YTD -34.40%

203.14

1D 2.34%

YTD -57.14%

70.52

1D 1.16%

YTD -37.42%

785.12

1D 0.00%

YTD 0.00%

11,375.35

1D -4.48%

YTD -63.39%

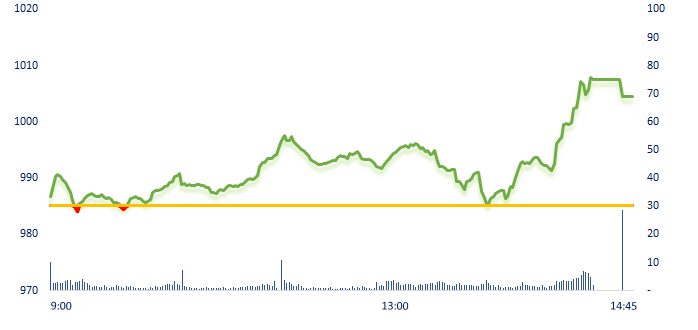

The market recovered strongly at the end of the session thanks to the fishing-bottom of large-cap stocks. With today's rally, the market has regained more than 50% of the lost points in the first session of the week. HPG, SSI, GVR, KDH hit the ceiling price, forgot all about the drop to the floor price yesterday.

ETF & DERIVATIVES

17,500

1D 1.98%

YTD -32.25%

11,950

1D 2.14%

YTD -33.94%

12,440

1D 2.47%

YTD -34.53%

13,690

1D 2.16%

YTD -40.22%

14,150

1D 0.07%

YTD -37.06%

22,000

1D 0.82%

YTD -21.57%

12,810

1D -0.08%

YTD -40.36%

980

1D 1.43%

YTD 0.00%

993

1D 1.33%

YTD 0.00%

1,001

1D 1.60%

YTD 0.00%

1,001

1D 1.48%

YTD 0.00%

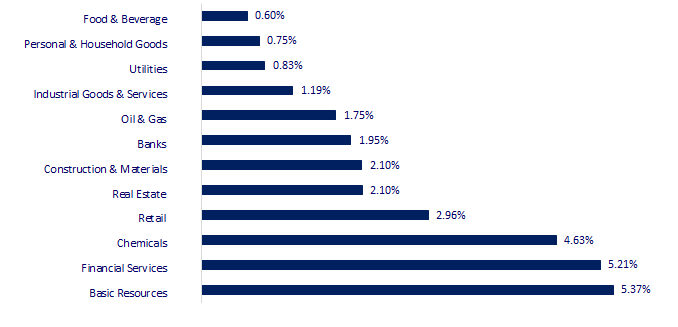

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

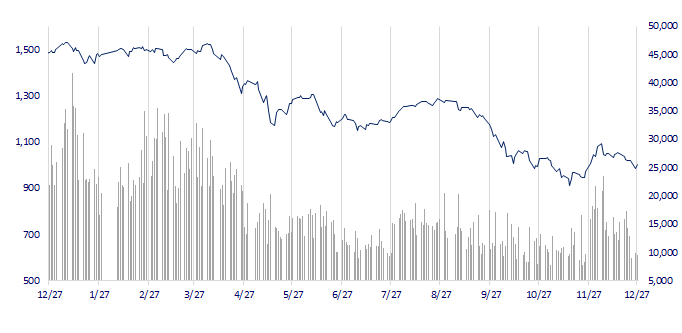

VNINDEX (12M)

GLOBAL MARKET

26,447.87

1D 0.16%

YTD -8.14%

3,095.57

1D 0.98%

YTD -14.95%

2,332.79

1D 0.68%

YTD -21.66%

19,593.06

1D 0.00%

YTD -16.26%

3,266.38

1D 0.27%

YTD 4.57%

1,643.16

1D 1.01%

YTD -0.87%

85.25

1D 0.15%

YTD 11.44%

1,816.30

1D 0.42%

YTD -0.25%

Chinese stocks increased despite profits at China's industrial firms in January-November fell 3.6% from a year earlier, after contracting 3.0% in the first 10 months, according to data the National Bureau of Statistics (NBS) released on Tuesday.

VIETNAM ECONOMY

3.44%

1D (bps) 4

YTD (bps) 263

7.40%

YTD (bps) 180

4.82%

1D (bps) -1

YTD (bps) 381

4.89%

1D (bps) -1

YTD (bps) 289

23,800

1D (%) 0.19%

YTD (%) 3.75%

25,609

1D (%) -0.96%

YTD (%) -3.25%

3,460

1D (%) 0.03%

YTD (%) -5.41%

As of December 21, credit balance reached over VND11.78 million billion, an increase of 12.87% compared to the end of 2021, an increase of 13.96% compared to the same period in 2021. Thus, in the last 10 days of the year, the remaining credit room still has about 2.63% - 3.13%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export of agricultural products reached a record of more than USD53 billion;

- FDI inflows in 2022 will reach nearly USD27.72 billion;

- Hai Phong attracts USD3.2 billion to industrial parks in 2022;

- Inflation in Russia continues to fall;

- Moscow is ready to resume gas supplies to Europe through the Yamal-Europe Pipeline;

- Tesla suspends production at Shanghai plant.

VN30

BANK

79,100

1D 0.25%

5D 0.13%

Buy Vol. 1,790,627

Sell Vol. 1,678,816

40,000

1D 3.09%

5D 3.90%

Buy Vol. 2,349,119

Sell Vol. 2,314,781

26,600

1D 2.11%

5D -5.00%

Buy Vol. 5,003,609

Sell Vol. 3,877,126

26,300

1D 2.33%

5D -5.05%

Buy Vol. 9,800,002

Sell Vol. 7,271,232

17,900

1D 4.07%

5D 3.47%

Buy Vol. 35,984,089

Sell Vol. 23,722,310

17,250

1D 2.68%

5D -1.99%

Buy Vol. 13,944,387

Sell Vol. 9,703,585

16,350

1D 0.62%

5D -1.80%

Buy Vol. 3,444,587

Sell Vol. 3,233,438

21,050

1D 0.24%

5D -4.32%

Buy Vol. 5,534,233

Sell Vol. 4,827,564

22,500

1D 2.74%

5D 0.22%

Buy Vol. 47,438,082

Sell Vol. 33,266,069

19,000

1D 3.54%

5D -3.55%

Buy Vol. 5,217,721

Sell Vol. 3,384,374

22,100

1D 0.00%

5D -2.00%

Buy Vol. 4,328,507

Sell Vol. 4,120,272

CTG: VietinBank - Nhon Trach branch announced that it is selling debts of Louis Rice Import-Export Joint Stock Company. As of September 20, 2022, the total outstanding balance of Louis Rice at VietinBank - Nhon Trach branch is more than USD1.64 million, of which the principal is more than USD1.59 million, the interest balance is USD41,854 and the penalty interest balance is USD9,461.

REAL ESTATE

14,400

1D 2.49%

5D -11.66%

Buy Vol. 53,995,636

Sell Vol. 49,959,997

26,350

1D 6.90%

5D 2.13%

Buy Vol. 2,709,564

Sell Vol. 1,343,709

12,600

1D 3.70%

5D -2.33%

Buy Vol. 15,514,996

Sell Vol. 13,510,505

In 2022, the real estate business attracted more than USD4.45 billion of foreign investment, a sharp increase compared to the same period last year.

OIL & GAS

103,100

1D 0.49%

5D -1.62%

Buy Vol. 362,947

Sell Vol. 385,693

10,650

1D 3.40%

5D -0.47%

Buy Vol. 20,376,112

Sell Vol. 13,531,129

30,600

1D 1.32%

5D 4.26%

Buy Vol. 925,843

Sell Vol. 733,842

GAS: In Q4/2022, PV GAS's revenue is estimated at VND21,328 billion, profit after tax is VND1,574 billion; increased by 5.7% in revenue but decreased by 22% in profit yoy.

VINGROUP

53,400

1D 0.95%

5D -4.47%

Buy Vol. 2,875,572

Sell Vol. 2,928,446

47,500

1D 1.06%

5D -1.45%

Buy Vol. 4,975,365

Sell Vol. 5,134,376

25,800

1D 5.09%

5D 0.19%

Buy Vol. 3,971,308

Sell Vol. 3,894,278

VIC: Vingroup launches Vinbase, promoting digital transformation of Vietnamese businesses with AI, Big Data.

FOOD & BEVERAGE

76,600

1D 0.79%

5D -0.92%

Buy Vol. 2,836,343

Sell Vol. 2,872,366

91,600

1D 0.11%

5D -2.55%

Buy Vol. 1,088,071

Sell Vol. 1,054,485

171,500

1D -0.87%

5D -0.87%

Buy Vol. 200,569

Sell Vol. 228,438

MSN: SK South East Asia Investment - a subsidiary of SK Group - holds a 9.5% stake in MSN, denying rumors of selling shares in Vietnam.

OTHERS

46,500

1D 2.20%

5D -3.13%

Buy Vol. 1,111,144

Sell Vol. 818,139

108,000

1D -0.83%

5D -2.96%

Buy Vol. 397,300

Sell Vol. 392,047

76,500

1D 0.13%

5D -0.13%

Buy Vol. 1,388,725

Sell Vol. 1,892,455

43,800

1D 2.82%

5D -5.81%

Buy Vol. 4,053,536

Sell Vol. 3,409,234

14,250

1D 6.74%

5D -0.35%

Buy Vol. 2,849,731

Sell Vol. 1,901,012

18,200

1D 6.74%

5D -8.08%

Buy Vol. 34,346,622

Sell Vol. 22,644,918

18,250

1D 6.73%

5D -3.95%

Buy Vol. 50,839,760

Sell Vol. 35,549,811

MWG: In November, MWG's revenue was about VND9,971 billion, down 13% over the same period and profit after tax was VND159 billion, down 67%. This is the lowest revenue in more than a year and the lowest profit since April 2017 of MWG.

Market by numbers

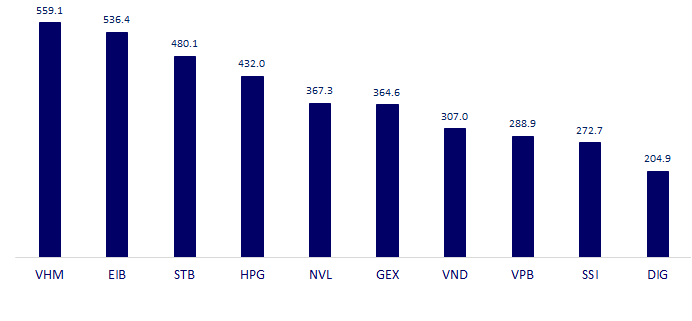

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

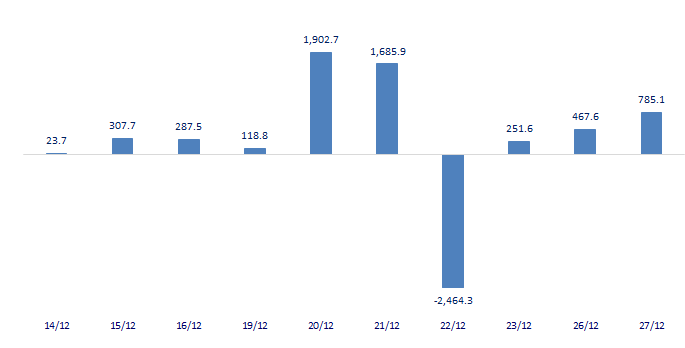

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

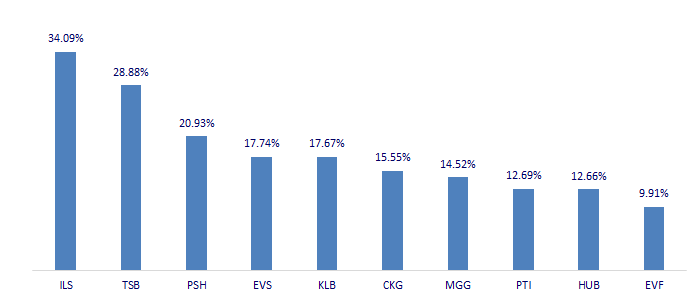

TOP INCREASES 3 CONSECUTIVE SESSIONS

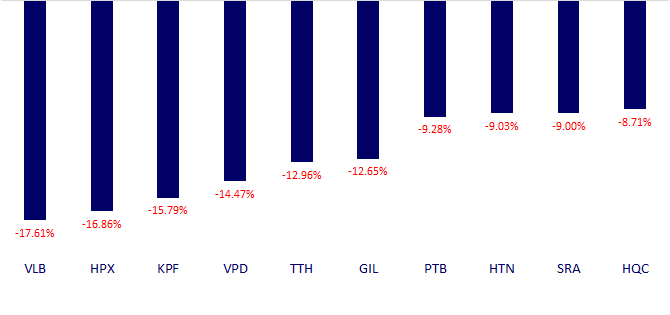

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.