Market Brief 29/12/2022

VIETNAM STOCK MARKET

1,009.29

1D -0.63%

YTD -32.64%

1,008.30

1D -0.56%

YTD -34.34%

206.54

1D 0.24%

YTD -56.43%

70.89

1D 0.64%

YTD -37.09%

147.12

1D 0.00%

YTD 0.00%

9,206.57

1D -25.94%

YTD -70.37%

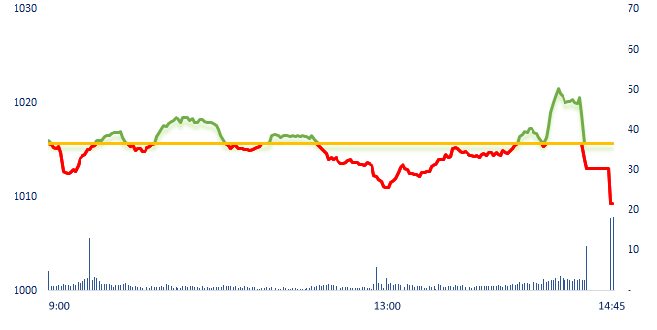

Money flow in the market disappeared after two recovering sessions going up from 985 points. Today's liquidity continued to decrease, investors seemed to be prepared for early New Year's holiday when liquidity reached the lowest level in the past 2 months.

ETF & DERIVATIVES

17,230

1D -0.98%

YTD -33.29%

11,940

1D -0.50%

YTD -34.00%

12,490

1D 0.64%

YTD -34.26%

13,860

1D -2.53%

YTD -39.48%

14,350

1D -0.21%

YTD -36.17%

22,220

1D -0.04%

YTD -20.78%

12,910

1D 0.08%

YTD -39.90%

974

1D -0.96%

YTD 0.00%

986

1D -0.73%

YTD 0.00%

990

1D -1.30%

YTD 0.00%

993

1D -1.49%

YTD 0.00%

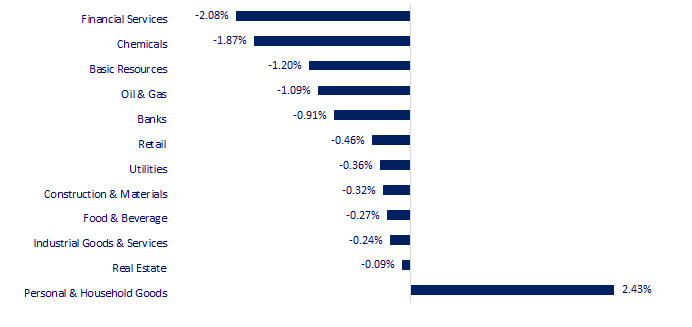

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

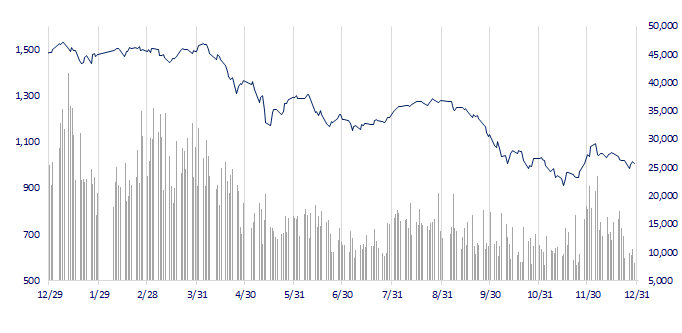

VNINDEX (12M)

GLOBAL MARKET

26,093.67

1D -0.94%

YTD -9.37%

3,073.70

1D -0.44%

YTD -15.55%

2,236.40

1D -1.93%

YTD -24.89%

19,741.14

1D -0.79%

YTD -15.63%

3,249.24

1D -0.54%

YTD 4.02%

1,661.20

1D 0.85%

YTD 0.22%

82.69

1D -1.05%

YTD 8.09%

1,812.35

1D -0.06%

YTD -0.46%

Japanese factories slashed output for a third consecutive month in November, dragged down by weak demand for machinery products amid a deteriorating global economic outlook. The weak production bodes ill for Japanese firms as they face growing calls to raise workers' pay to counter inflation, seen as essential for the post-pandemic growth of the world's third-largest economy.

VIETNAM ECONOMY

2.93%

1D (bps) -46

YTD (bps) 212

7.40%

YTD (bps) 180

4.75%

1D (bps) -6

YTD (bps) 374

4.86%

1D (bps) -4

YTD (bps) 286

23,770

1D (%) -0.11%

YTD (%) 3.62%

25,516

1D (%) -1.33%

YTD (%) -3.60%

3,456

1D (%) -0.03%

YTD (%) -5.52%

The State Treasury is depositing nearly VND700,000 billion at SBV and VND270,000 billion at commercial banks. The report of the State Treasury shows the state budget revenue and expenditure, as of the end of December 20, accumulated revenue in the balance reached VND1.727 million billion, equaling 122.37% of the estimate in 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- More than 143,000 companies closed in 2022;

- Building Ninh Thuan development model to become the center of renewable energy;

- CPI in 2022 up 3.15%, core inflation increased by 2.59% compared to 2021;

- UK: Energy companies hold more than USD2 billion of customers;

- Modi's building boom setting up India as global steel savior;

- There is no risk to power supplies in France until at least mid-January.

VN30

BANK

80,700

1D 0.88%

5D 1.77%

Buy Vol. 2,126,784

Sell Vol. 1,922,189

40,000

1D -4.53%

5D 2.56%

Buy Vol. 1,999,342

Sell Vol. 4,319,361

27,000

1D -0.55%

5D -2.17%

Buy Vol. 3,442,458

Sell Vol. 5,660,076

25,950

1D -0.76%

5D -6.32%

Buy Vol. 6,227,613

Sell Vol. 5,175,697

17,800

1D -1.93%

5D -3.52%

Buy Vol. 44,270,707

Sell Vol. 46,074,708

17,400

1D -0.29%

5D -3.33%

Buy Vol. 15,717,639

Sell Vol. 10,518,134

15,900

1D -1.85%

5D -5.64%

Buy Vol. 2,808,334

Sell Vol. 2,621,473

21,400

1D 0.00%

5D -4.25%

Buy Vol. 4,197,322

Sell Vol. 5,847,826

22,350

1D -2.40%

5D -4.49%

Buy Vol. 14,548,207

Sell Vol. 26,235,546

18,900

1D -0.53%

5D -5.26%

Buy Vol. 3,783,278

Sell Vol. 3,070,428

22,000

1D 0.00%

5D -3.93%

Buy Vol. 3,543,590

Sell Vol. 3,434,595

VIB: At the beginning of December, the ceremony to announce the Top 50 Most Effective Companies in Vietnam of the year named 8 banks with outstanding business performance and sustainable growth rate. In which, VIB continues to be honored at the leading position in the banking industry. Banks honored in Top 50 include: VIB, VCB, ACB, MBB, VPBank, TCB, TPB and SHB.

REAL ESTATE

14,650

1D 2.09%

5D -5.48%

Buy Vol. 39,852,167

Sell Vol. 41,149,939

27,950

1D 3.33%

5D 4.10%

Buy Vol. 2,462,812

Sell Vol. 2,506,315

13,400

1D -0.37%

5D 4.69%

Buy Vol. 15,177,356

Sell Vol. 19,239,753

NVL: Mr. Bui Thanh Nhon was nominated to the Board of Directors of Novaland for the term 2021-2026, preparing for the step back to the position of Chairman.

OIL & GAS

102,600

1D -0.39%

5D 1.38%

Buy Vol. 254,462

Sell Vol. 313,395

10,500

1D -1.41%

5D -1.87%

Buy Vol. 21,988,329

Sell Vol. 8,573,233

31,350

1D -0.48%

5D 2.28%

Buy Vol. 1,039,011

Sell Vol. 1,577,640

POW: Total electricity output is estimated at 13.94 billion kWh for the whole year (-5% yoy) due to serious shortage of coal and gas supply sources in the first period of 2022.

VINGROUP

53,600

1D 0.19%

5D -2.55%

Buy Vol. 4,087,517

Sell Vol. 3,346,603

47,800

1D 0.21%

5D -2.45%

Buy Vol. 2,974,831

Sell Vol. 2,787,135

26,500

1D -1.49%

5D 1.92%

Buy Vol. 2,479,434

Sell Vol. 3,338,343

VIC: VinFast announced the return to the Consumer Electronics Show 2023 with a full electric vehicle ecosystem, including four SUV models, the launch of the electric bicycle concept.

FOOD & BEVERAGE

77,000

1D 0.00%

5D 0.00%

Buy Vol. 2,616,998

Sell Vol. 2,935,536

94,000

1D 1.08%

5D -0.42%

Buy Vol. 1,142,618

Sell Vol. 1,324,245

172,900

1D -2.04%

5D -1.37%

Buy Vol. 183,984

Sell Vol. 327,458

VNM: Vinamilk announced the record date for 2023 annual general meeting of shareholders, according to which the record date for the list of shareholders attending the meeting is March 16, 2023.

OTHERS

46,500

1D -0.43%

5D -3.53%

Buy Vol. 913,435

Sell Vol. 966,342

109,200

1D -1.18%

5D -1.89%

Buy Vol. 588,093

Sell Vol. 585,617

76,200

1D -0.65%

5D -1.30%

Buy Vol. 1,010,014

Sell Vol. 1,345,574

42,900

1D -0.23%

5D -7.74%

Buy Vol. 2,205,053

Sell Vol. 2,270,836

13,800

1D -2.82%

5D -4.83%

Buy Vol. 1,686,972

Sell Vol. 1,984,137

17,600

1D -3.03%

5D -7.85%

Buy Vol. 18,659,933

Sell Vol. 20,397,392

18,000

1D -1.10%

5D -4.76%

Buy Vol. 31,695,579

Sell Vol. 36,442,276

GVR: GVR has just announced the business results in 2022 with a total consolidated revenue of VND28,600 billion, consolidated pre-tax profit of VND5,200 billion, up 9% and down 16% (yoy) respectively. GVR has respectively exceeded 1% of revenue target and 6% of pre-tax profit target compared to the adjusted plan of 2022.

Market by numbers

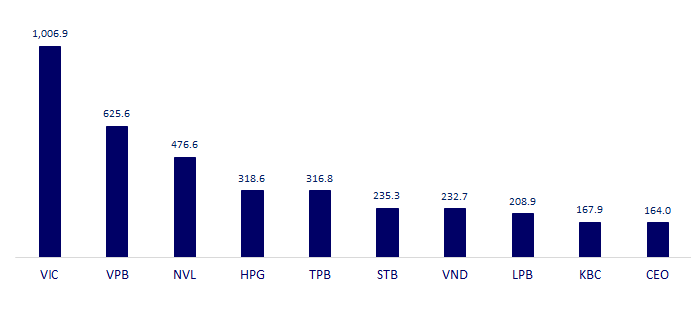

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

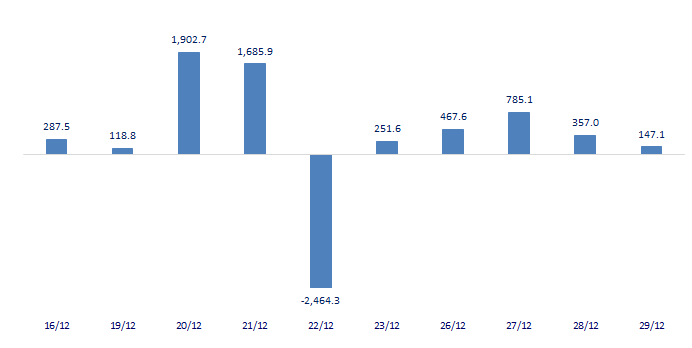

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

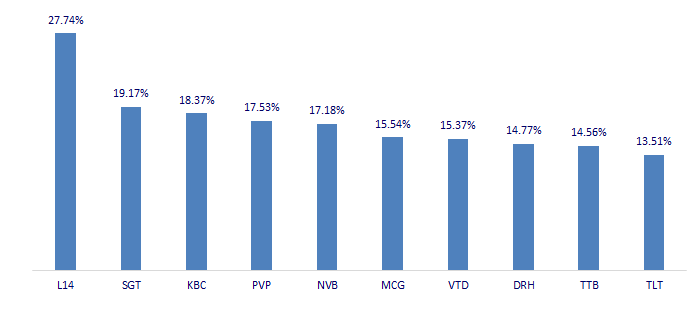

TOP INCREASES 3 CONSECUTIVE SESSIONS

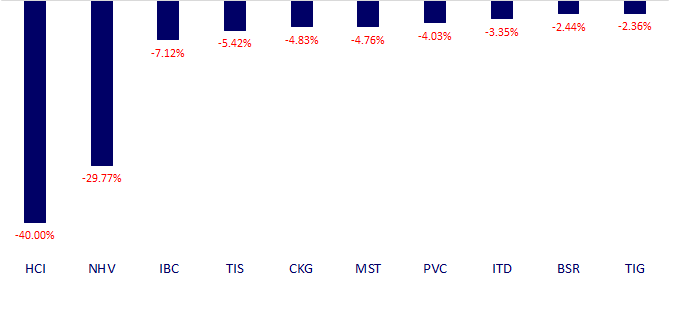

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.