Market Brief 30/12/2022

VIETNAM STOCK MARKET

1,007.09

1D -0.22%

YTD -32.78%

1,005.19

1D -0.31%

YTD -34.55%

205.31

1D -0.60%

YTD -56.68%

71.65

1D 1.07%

YTD -36.41%

518.32

1D 0.00%

YTD 0.00%

8,615.94

1D -6.42%

YTD -72.27%

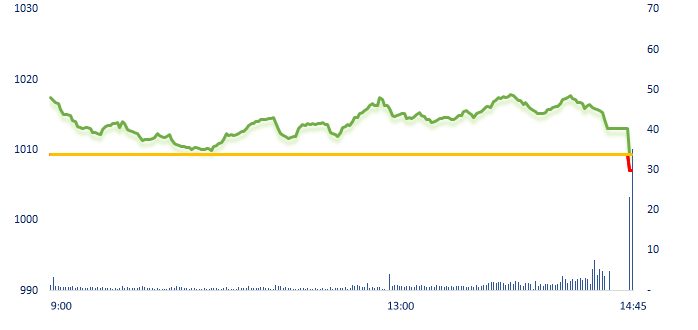

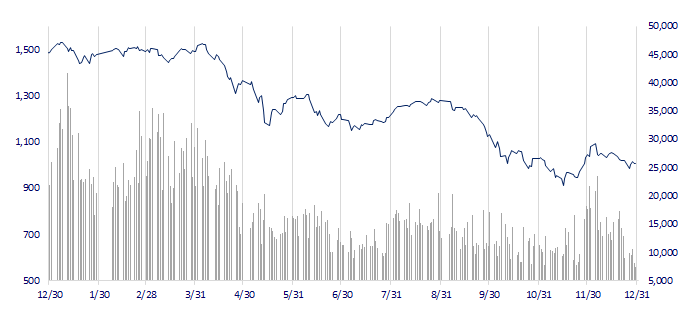

The last session of 2022, the market seems to be relatively quiet with super low liquidity. VN-Index set a record peak on January 6, 2022 with a closing price of 1,528 points, then officially entered a downtrend and lost 521 points (equivalent to 34%) within a year, returning to the price level of November 2020.

ETF & DERIVATIVES

17,330

1D 0.58%

YTD -32.91%

11,920

1D -0.17%

YTD -34.11%

12,480

1D -0.08%

YTD -34.32%

14,050

1D 1.37%

YTD -38.65%

14,350

1D 0.00%

YTD -36.17%

22,400

1D 0.81%

YTD -20.14%

12,950

1D 0.31%

YTD -39.71%

977

1D 0.38%

YTD 0.00%

990

1D 0.42%

YTD 0.00%

1,000

1D 1.01%

YTD 0.00%

1,005

1D 1.16%

YTD 0.00%

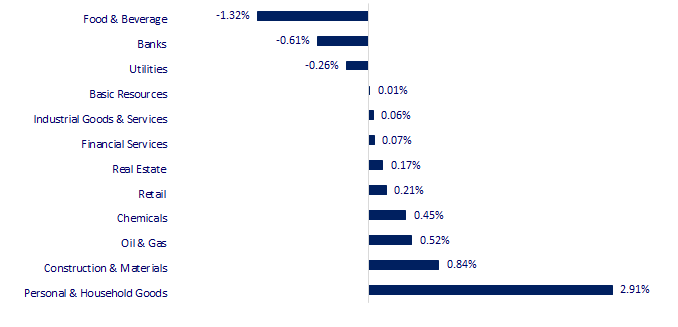

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,094.50

1D 0.00%

YTD -9.37%

3,089.26

1D 0.51%

YTD -15.13%

2,236.40

1D 0.00%

YTD -24.89%

19,781.41

1D 0.20%

YTD -15.46%

3,251.32

1D 0.06%

YTD 4.09%

1,670.36

1D 0.55%

YTD 0.77%

83.54

1D -0.36%

YTD 9.20%

1,822.70

1D -0.07%

YTD 0.10%

Asian equities rose on Friday as investors looked to end the year on an optimistic note after U.S. data showed the Federal Reserve's aggressive monetary policy was dampening inflationary pressures even as worries over COVID cases in China persist. The Korea stock exchange is closed for a holiday.

VIETNAM ECONOMY

4.97%

1D (bps) 204

YTD (bps) 416

7.40%

YTD (bps) 180

4.79%

1D (bps) 4

YTD (bps) 378

4.90%

1D (bps) 4

YTD (bps) 290

23,703

1D (%) -0.11%

YTD (%) 3.33%

25,822

1D (%) -0.11%

YTD (%) -2.44%

3,460

1D (%) 0.14%

YTD (%) -5.41%

The GSO has announced the report on socio-economic situation of Vietnam 2022. GDP in 2022 increased by 8.02% compared to the previous year, reaching the highest level in the 2011-2022 period. In 2022, CPI increased by 3.15%, core inflation increased by 2.59% compared to 2021, reaching the target set by the National Assembly. With this data, Vietnam's economy be the bright spot of the world in 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposing the State Bank to allocate credit room at the beginning of the year to banks;

- Bloomberg: Vietnam sees fastest growth in Southeast Asia in 2022;

- The scale of Vietnam's GDP in 2022 officially exceeds USD400 billion;

- BOJ Kuroda dismisses near-term chance of exiting easy policy;

- Biden signs USD1.7 trillion funding bill that includes Ukraine aid;

- European natural gas prices return to pre-Ukraine war levels.

VN30

BANK

80,000

1D -0.87%

5D 1.14%

Buy Vol. 2,044,736

Sell Vol. 2,448,388

38,600

1D -3.50%

5D -1.03%

Buy Vol. 5,023,433

Sell Vol. 5,206,715

27,250

1D 0.93%

5D -1.45%

Buy Vol. 3,087,293

Sell Vol. 4,906,064

25,850

1D -0.39%

5D -6.34%

Buy Vol. 5,187,786

Sell Vol. 4,273,491

17,900

1D 0.56%

5D -2.45%

Buy Vol. 24,179,806

Sell Vol. 28,294,195

17,100

1D -1.72%

5D -3.66%

Buy Vol. 9,988,703

Sell Vol. 10,691,617

15,950

1D 0.31%

5D -6.18%

Buy Vol. 3,458,300

Sell Vol. 3,796,362

21,050

1D -1.64%

5D -4.32%

Buy Vol. 4,325,192

Sell Vol. 6,314,101

22,500

1D 0.67%

5D -4.26%

Buy Vol. 18,164,597

Sell Vol. 26,050,739

19,000

1D 0.53%

5D -3.31%

Buy Vol. 3,751,357

Sell Vol. 3,368,447

21,900

1D -0.45%

5D -4.37%

Buy Vol. 2,592,357

Sell Vol. 3,417,105

VCB: By the end of 2022, VCB's total assets are estimated at more than VND1,649 trillion; deposit balance from market 1 is nearly VND1,370 trillion; credit balance is estimated at over VND1,179 trillion. Notably, the proportion of retail banks in total outstanding loans has increased from 40% in 2017 to over 55% in 2022. Income structure has shifted positively towards increasing the proportion of non-interest income.

REAL ESTATE

14,000

1D -4.44%

5D -7.28%

Buy Vol. 18,675,804

Sell Vol. 29,914,772

26,500

1D -5.19%

5D 0.95%

Buy Vol. 1,124,685

Sell Vol. 2,323,054

13,600

1D 1.49%

5D 4.21%

Buy Vol. 15,662,776

Sell Vol. 15,637,341

NVL: Requesting Novaland to sell off projects that have not been implemented to restructure the business, focusing on projects that are being implemented.

OIL & GAS

101,500

1D -1.07%

5D 0.00%

Buy Vol. 333,355

Sell Vol. 348,468

10,650

1D 1.43%

5D -2.74%

Buy Vol. 20,904,143

Sell Vol. 9,689,692

31,700

1D 1.12%

5D 2.59%

Buy Vol. 826,484

Sell Vol. 1,473,226

Considering the proposal to reduce the environmental protection tax for gasoline and oil to the floor level in 2023 to reduce difficulties for people when gasoline prices are still high.

VINGROUP

53,800

1D 0.37%

5D -2.36%

Buy Vol. 3,906,883

Sell Vol. 4,040,428

48,000

1D 0.42%

5D -3.61%

Buy Vol. 2,323,487

Sell Vol. 3,979,775

26,300

1D -0.75%

5D 1.94%

Buy Vol. 3,249,110

Sell Vol. 3,827,637

VIC: CEO Le Thi Thu Thuy said VinFast's goal is to sell 1 million electric cars globally in the next 5-6 years, while Tesla takes 12 years to sell the first 100,000 electric cars.

FOOD & BEVERAGE

76,100

1D -1.17%

5D -0.13%

Buy Vol. 2,251,791

Sell Vol. 2,901,200

93,000

1D -1.06%

5D -2.11%

Buy Vol. 664,951

Sell Vol. 1,407,395

166,900

1D -3.47%

5D -4.63%

Buy Vol. 346,858

Sell Vol. 377,522

MSN: Starting from 09/2022, MSN launched the exclusive WIN membership program, which has so far attracted 600,000 customers and contributed nearly 60% of the revenue of WIN stores.

OTHERS

46,600

1D 0.22%

5D -2.71%

Buy Vol. 539,040

Sell Vol. 641,259

109,500

1D 0.27%

5D -1.79%

Buy Vol. 296,652

Sell Vol. 707,702

76,900

1D 0.92%

5D -1.41%

Buy Vol. 1,139,549

Sell Vol. 1,508,904

42,900

1D 0.00%

5D -6.33%

Buy Vol. 2,877,551

Sell Vol. 3,566,616

13,800

1D 0.00%

5D -3.83%

Buy Vol. 1,668,914

Sell Vol. 1,626,697

17,700

1D 0.57%

5D -3.28%

Buy Vol. 21,415,479

Sell Vol. 16,415,191

18,000

1D 0.00%

5D -1.91%

Buy Vol. 26,819,764

Sell Vol. 32,717,477

"GVR: On December 28, the BOD of Vietnam Rubber Group JSC approved a resolution to adjust the business plan in 2022. In which, the target of consolidated revenue decreased by 5% to nearly VND28.3 trillion. Profit before tax fell 24% to VND4.9 trillion, profit after tax fell 27% to VND3.88 trillion.

Market by numbers

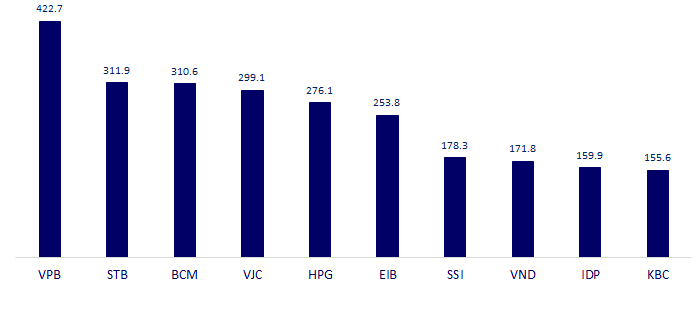

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

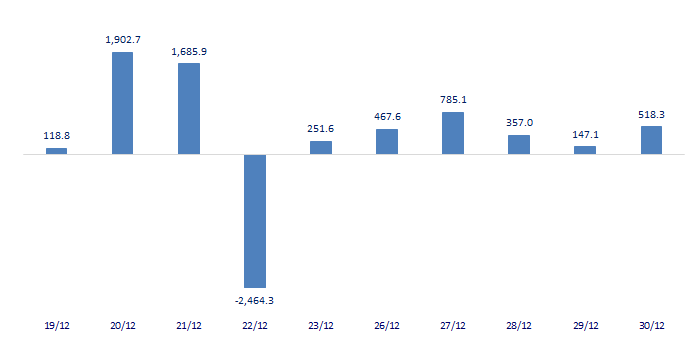

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

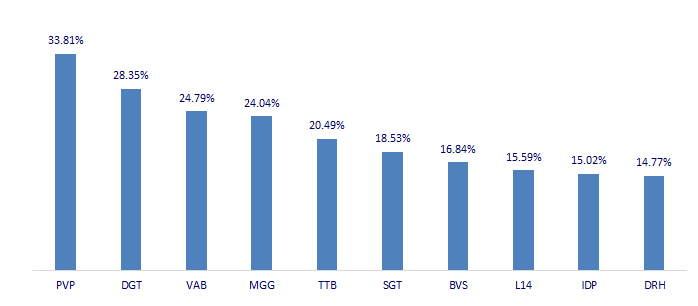

TOP INCREASES 3 CONSECUTIVE SESSIONS

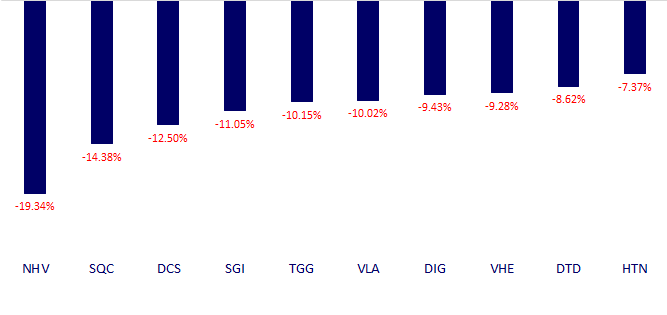

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.