Market brief 05/01/2023

VIETNAM STOCK MARKET

1,055.82

1D 0.91%

YTD 4.84%

1,061.90

1D 1.12%

YTD 5.64%

213.11

1D 0.02%

YTD 3.80%

72.82

1D 0.08%

YTD 1.63%

692.91

1D 0.00%

YTD 0.00%

10,336.83

1D -15.26%

YTD 19.97%

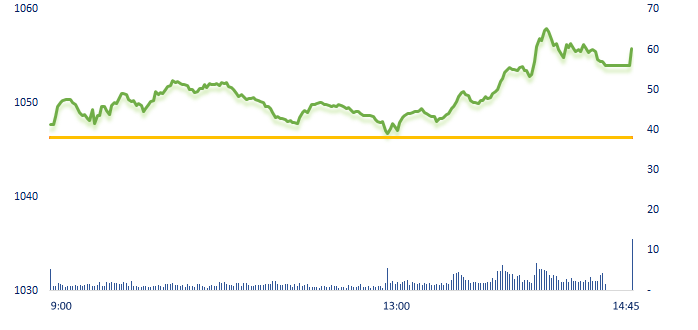

In contrast to the morning session, the afternoon session witnessed the sublimation of the VN-Index, with the push from many Large Caps, which were greatly supported by the cash flow of foreign investors. Some of the most active stocks in the market today can be mentioned as POW, VGC, STB, etc.

ETF & DERIVATIVES

18,070

1D 0.95%

YTD 4.27%

12,550

1D 1.21%

YTD 5.29%

12,980

1D 1.17%

YTD 4.01%

14,800

1D -0.54%

YTD 5.34%

15,080

1D 1.21%

YTD 5.09%

23,200

1D 1.09%

YTD 3.57%

13,640

1D 1.64%

YTD 5.33%

1,030

1D 1.03%

YTD 0.00%

1,043

1D 1.49%

YTD 0.00%

1,046

1D 0.72%

YTD 0.00%

1,054

1D 1.06%

YTD 0.00%

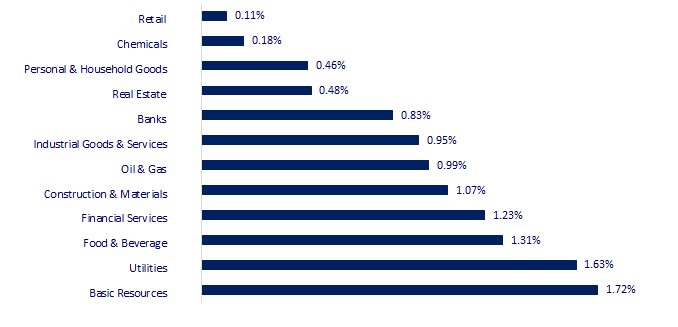

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

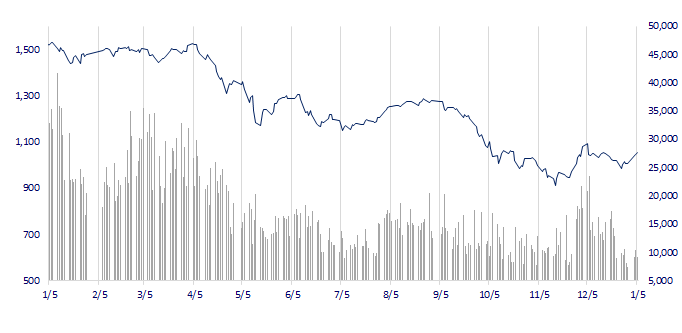

VNINDEX (12M)

GLOBAL MARKET

25,820.80

1D 0.40%

YTD -1.05%

3,155.22

1D 1.01%

YTD 2.14%

2,264.65

1D 0.38%

YTD 1.26%

21,052.17

1D 1.25%

YTD 6.42%

3,292.66

1D 1.55%

YTD 1.27%

1,663.86

1D -0.62%

YTD -0.39%

79.67

1D 1.50%

YTD -7.26%

1,853.60

1D -0.46%

YTD 1.50%

Asian stocks all rallied as investors ignored the information about the minutes of the Fed's meeting, which showed that the central bank will continue to be aggressive in its policy of controlling inflation. China and Hong Kong stocks continued to have a third increasing session thanks to investors' confidence about the economic growth in 2023.

VIETNAM ECONOMY

5.07%

YTD (bps) 10

7.40%

4.68%

1D (bps) -4

YTD (bps) -11

4.75%

1D (bps) -8

YTD (bps) -15

23,640

1D (%) -0.17%

YTD (%) -0.51%

25,670

1D (%) -0.23%

YTD (%) 0.04%

3,486

1D (%) 0.06%

YTD (%) 0.03%

Interest rates for home and car loans have increased significantly, up to 14%-15%/year in a short time, greatly affecting the borrower's financial calculation.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- National master plan: Vision to 2050, GDP/person reaching over USD27,000;

- Inspection of the wrong series of solar power projects;

- The Government promulgated 15 decrees on the Special Preferential Import Tariff;

- Samsung's profit may drop 50% in Q4 as chip prices and demand plummet;

- Fed officials want higher rates in the near term;

- Coinbase had to spend USD100 million for violating anti-money laundering laws.

VN30

BANK

84,000

1D 1.45%

5D 4.09%

Buy Vol. 1,902,900

Sell Vol. 1,715,482

40,750

1D -0.12%

5D 1.88%

Buy Vol. 2,319,875

Sell Vol. 3,004,615

28,500

1D 0.00%

5D 5.56%

Buy Vol. 3,512,822

Sell Vol. 7,667,560

27,650

1D 1.28%

5D 6.55%

Buy Vol. 4,479,797

Sell Vol. 5,857,615

18,950

1D 0.26%

5D 6.46%

Buy Vol. 31,462,720

Sell Vol. 33,316,029

18,200

1D 1.39%

5D 4.60%

Buy Vol. 17,377,885

Sell Vol. 13,946,124

16,400

1D 0.31%

5D 3.14%

Buy Vol. 3,095,373

Sell Vol. 3,984,879

22,550

1D 2.50%

5D 5.37%

Buy Vol. 14,348,147

Sell Vol. 12,867,377

24,200

1D 3.86%

5D 8.28%

Buy Vol. 47,624,934

Sell Vol. 39,265,977

20,100

1D 1.01%

5D 6.35%

Buy Vol. 4,431,796

Sell Vol. 4,683,874

22,850

1D 0.88%

5D 3.86%

Buy Vol. 3,465,349

Sell Vol. 4,641,118

BID: BIDV announces the second public offering of bonds in the form of direct distribution through branches/transaction offices/headquarters of the Bank. Accordingly, BIDV will issue VND2,500 billion of 7-year bonds, VND1,000 billion of 8-year bonds and VND500 billion of 10-year bonds. Expected issuable time is from December 2022 to January 2023.

REAL ESTATE

13,700

1D -2.14%

5D -6.48%

Buy Vol. 26,538,656

Sell Vol. 34,050,270

27,700

1D -0.54%

5D -0.89%

Buy Vol. 1,447,665

Sell Vol. 2,357,961

15,150

1D 1.00%

5D 13.06%

Buy Vol. 19,596,324

Sell Vol. 17,685,556

PDR: Phat Dat has just announced the dismissal of Ms. Trang Thanh Minh Thu from the position of Deputy General Director of the company, who has been appointed since September 1, 2022.

OIL & GAS

106,600

1D 1.52%

5D 3.90%

Buy Vol. 550,162

Sell Vol. 475,212

11,750

1D 6.82%

5D 11.90%

Buy Vol. 52,860,096

Sell Vol. 32,820,148

35,800

1D 1.56%

5D 14.19%

Buy Vol. 2,365,036

Sell Vol. 1,697,258

POW: PV Power has just announced business results in 2022 with the estimated revenue at VND28,527 billion, exceeding 18% of the year plan and increasing 17% compared to 2021.

VINGROUP

56,200

1D 0.36%

5D 4.85%

Buy Vol. 2,826,728

Sell Vol. 3,117,321

49,700

1D 1.43%

5D 3.97%

Buy Vol. 2,509,279

Sell Vol. 3,436,715

29,200

1D 2.10%

5D 10.19%

Buy Vol. 6,380,463

Sell Vol. 5,747,835

VIC: The standard version of the VinFast electric car VF8 currently has a price of about VND850 million in Vietnam, after deducting by the offer of Vinhomes voucher.

FOOD & BEVERAGE

81,200

1D 2.40%

5D 5.45%

Buy Vol. 5,262,197

Sell Vol. 4,845,067

99,500

1D 0.20%

5D 5.85%

Buy Vol. 860,618

Sell Vol. 1,688,137

174,200

1D 1.57%

5D 0.75%

Buy Vol. 592,453

Sell Vol. 478,113

MSN: After approving the issuing plan at the end of October, Masan approved the application of the bond batch with total par value of VND4,000 billion for the purpose of debt restructuring.

OTHERS

48,050

1D 0.73%

5D 3.33%

Buy Vol. 599,720

Sell Vol. 1,053,271

110,000

1D -0.36%

5D 0.73%

Buy Vol. 474,167

Sell Vol. 484,817

80,600

1D 0.75%

5D 5.77%

Buy Vol. 1,632,611

Sell Vol. 1,828,533

43,600

1D 0.23%

5D 1.63%

Buy Vol. 1,938,716

Sell Vol. 2,602,465

14,900

1D 0.34%

5D 7.97%

Buy Vol. 4,701,358

Sell Vol. 6,242,685

19,300

1D 1.58%

5D 9.66%

Buy Vol. 22,491,114

Sell Vol. 26,779,112

19,800

1D 2.06%

5D 10.00%

Buy Vol. 35,717,514

Sell Vol. 45,325,719

HPG: Quang Ngai Provincial Tax Department has just issued a tax inspection decision for Hoa Phat Dung Quat Steel Joint Stock Company. Accordingly, the decision was issued by the Tax Department of Quang Ngai province on December 20.

Market by numbers

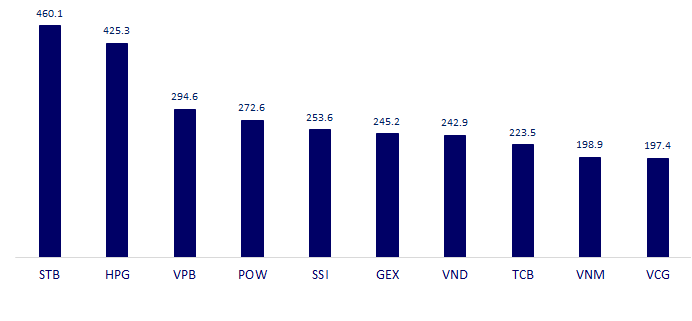

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

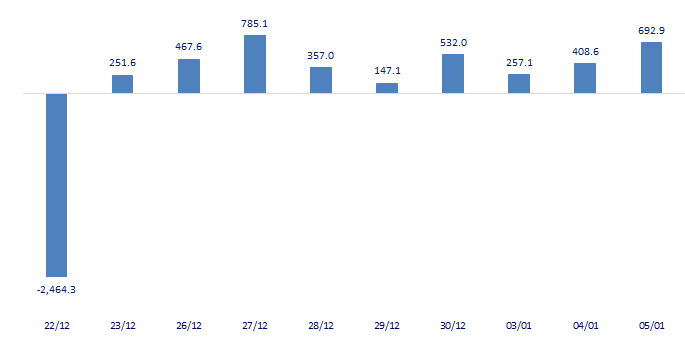

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

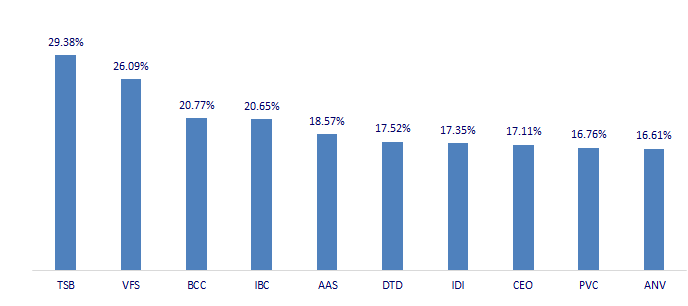

TOP INCREASES 3 CONSECUTIVE SESSIONS

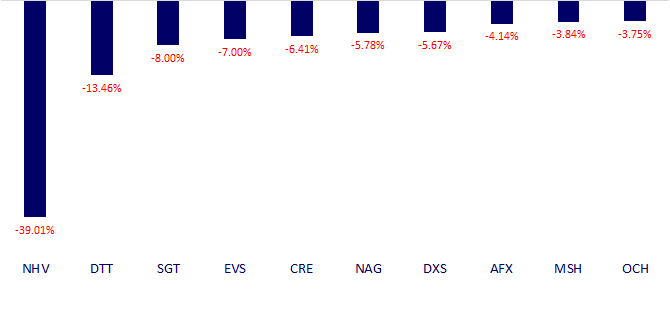

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.