Market Brief 09/01/2023

VIETNAM STOCK MARKET

1,054.21

1D 0.26%

YTD 4.68%

1,061.14

1D 0.35%

YTD 5.57%

209.67

1D -0.47%

YTD 2.12%

72.73

1D -0.03%

YTD 1.51%

551.33

1D 0.00%

YTD 0.00%

9,593.93

1D -30.04%

YTD 11.35%

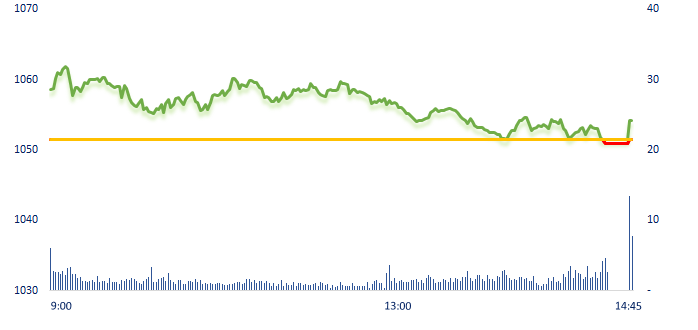

The market was quite dull in the session 9/1, although the market started the new week with excitement that the new Chairman of the State Securities Commission of Vietnam was appointed after many days this position was vacant. Liquidity after an improvement session returned to a low level, trading volume on HOSE today decreased by 37% compared to session 6/1.

ETF & DERIVATIVES

18,050

1D 0.39%

YTD 4.15%

12,500

1D 0.00%

YTD 4.87%

12,820

1D -1.61%

YTD 2.72%

14,760

1D -1.53%

YTD 5.05%

15,120

1D -0.13%

YTD 5.37%

23,190

1D 0.30%

YTD 3.53%

13,620

1D 0.37%

YTD 5.17%

1,031

1D 0.59%

YTD 0.00%

1,040

1D 0.49%

YTD 0.00%

1,047

1D 0.07%

YTD 0.00%

1,054

1D 0.25%

YTD 0.00%

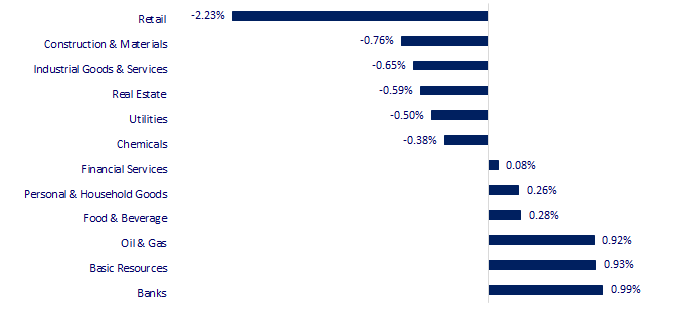

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

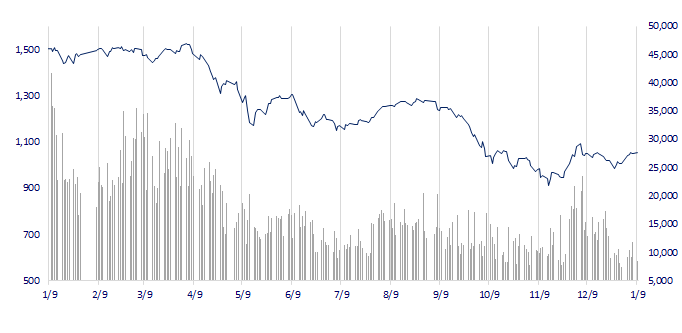

VNINDEX (12M)

GLOBAL MARKET

25,973.85

1D 0.00%

YTD -0.46%

3,176.08

1D 0.58%

YTD 2.81%

2,350.19

1D 2.63%

YTD 5.09%

21,388.34

1D 1.89%

YTD 8.12%

3,305.67

1D 0.88%

YTD 1.67%

1,691.12

1D 0.99%

YTD 1.24%

81.09

1D 2.32%

YTD -5.61%

1,878.20

1D 0.22%

YTD 2.85%

Asian shares rallied on Monday as the opening of China's borders bolstered the outlook for the global economy. Travellers streamed into China by air, land and sea on Sunday. After three years, mainland China opened sea and land crossings with Hong Kong and ended a requirement for incoming travellers to quarantine, dismantling a final pillar of a zero-COVID policy.

VIETNAM ECONOMY

5.08%

1D (bps) 5

YTD (bps) 11

7.40%

4.67%

1D (bps) 7

YTD (bps) -12

4.72%

1D (bps) 1

YTD (bps) -18

23,611

1D (%) -0.10%

YTD (%) -0.63%

25,759

1D (%) 0.03%

YTD (%) 0.39%

3,528

1D (%) 0.71%

YTD (%) 1.23%

In the first week of new year (3/1-6/1/2023), the State Bank of Vietnam (SBV) provided liquidity for commercial banks in the first three sessions of the week. In the last session of the week, SBV net sucked through both channels. For the whole week, SBV net provided more than VND6,000 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Industry and Trade wants to transfer the management of petrol prices to the Ministry of Finance;

- The Civil Aviation Administration of Vietnam proposes allowing airlines to double their fleets to meet recovery needs;

- Natural rubber exports set a record of USD3.31 billion;

- Goldman Sachs to start cutting thousands of jobs midweek;

- ECB sees 'very strong' wage growth ahead in next few quarters;

- Swiss National Bank posts record USD143 billion loss in 2022.

VN30

BANK

86,900

1D 3.45%

5D 8.63%

Buy Vol. 2,309,233

Sell Vol. 2,323,706

41,000

1D -1.56%

5D 6.22%

Buy Vol. 2,342,603

Sell Vol. 4,109,432

29,100

1D 1.75%

5D 6.79%

Buy Vol. 7,612,250

Sell Vol. 9,078,631

27,750

1D 0.18%

5D 7.35%

Buy Vol. 3,712,618

Sell Vol. 6,348,322

18,850

1D -0.53%

5D 5.31%

Buy Vol. 28,112,073

Sell Vol. 42,075,288

18,250

1D 0.00%

5D 6.73%

Buy Vol. 9,700,631

Sell Vol. 15,117,296

16,750

1D 1.82%

5D 5.02%

Buy Vol. 3,185,557

Sell Vol. 3,755,327

22,500

1D 0.00%

5D 6.89%

Buy Vol. 6,975,143

Sell Vol. 10,571,376

24,650

1D 1.44%

5D 9.56%

Buy Vol. 32,962,289

Sell Vol. 27,871,321

21,150

1D 2.67%

5D 11.32%

Buy Vol. 8,168,110

Sell Vol. 10,187,999

23,100

1D -0.22%

5D 5.48%

Buy Vol. 3,234,908

Sell Vol. 4,137,555

CTG: By the end of 2022, Vietinbank has completed the targets approved at annual general meeting of shareholders. In which, individual pre-tax profit in 2022 is estimated at VND20,500 billion. The ratio of NPL was low at less than 1.2%. The CIR is less than 30%, in the group with the lowest CIR in the banking industry. Mr.Tran Minh Binh said that currently 63% of operations have been performed on digital channels, the bank is closely following the digital transformation plan of the banking industry.

REAL ESTATE

13,850

1D 1.84%

5D -1.07%

Buy Vol. 20,250,376

Sell Vol. 23,412,452

27,950

1D 0.54%

5D 5.47%

Buy Vol. 3,530,816

Sell Vol. 3,955,710

14,250

1D -3.39%

5D 4.78%

Buy Vol. 16,059,626

Sell Vol. 16,752,961

More than VND16,000 billion of real estate and construction corporate bonds are due in January.

OIL & GAS

104,500

1D -0.19%

5D 2.96%

Buy Vol. 341,162

Sell Vol. 493,853

11,600

1D -1.28%

5D 8.92%

Buy Vol. 13,549,260

Sell Vol. 19,021,038

35,500

1D 1.14%

5D 11.99%

Buy Vol. 1,489,642

Sell Vol. 1,419,602

The Ministry of Industry and Trade does not want to abandon the petroleum stabilization fund.

VINGROUP

55,000

1D -1.96%

5D 2.23%

Buy Vol. 1,744,803

Sell Vol. 2,391,324

50,200

1D 0.60%

5D 4.58%

Buy Vol. 1,410,708

Sell Vol. 2,289,985

29,400

1D 0.51%

5D 11.79%

Buy Vol. 2,094,686

Sell Vol. 2,452,966

VIC: VinFast factory in North Carolina has a capacity of phase 1 of 150,000 vehicles/year, after completion of phase 2 will expand to 250,000 vehicles/year.

FOOD & BEVERAGE

80,700

1D 1.13%

5D 6.04%

Buy Vol. 1,719,150

Sell Vol. 2,118,264

96,500

1D 0.73%

5D 3.76%

Buy Vol. 672,610

Sell Vol. 746,807

179,600

1D -0.61%

5D 7.61%

Buy Vol. 132,413

Sell Vol. 116,254

VNM: Phase 1 of the project Vinamilk cooperates with Sojitz Corporation (Japan) to produce beef, is expected to go into operation in 2023 with a capacity of about 30,000 beef cattle/year.

OTHERS

47,900

1D -0.31%

5D 2.79%

Buy Vol. 347,242

Sell Vol. 722,936

109,200

1D 1.30%

5D -0.27%

Buy Vol. 479,606

Sell Vol. 498,094

80,300

1D 0.00%

5D 4.42%

Buy Vol. 919,649

Sell Vol. 1,243,434

42,000

1D -2.67%

5D -2.10%

Buy Vol. 3,602,783

Sell Vol. 4,156,833

14,400

1D 0.00%

5D 4.35%

Buy Vol. 3,091,828

Sell Vol. 4,062,395

19,000

1D 0.53%

5D 7.34%

Buy Vol. 16,398,142

Sell Vol. 22,070,431

19,600

1D 1.03%

5D 8.89%

Buy Vol. 27,054,316

Sell Vol. 47,482,647

HPG: In December 2022, sales of steel products reached 558,000 tons, up 26% compared to November. In which, finished construction steel was 358,000 tons, up slightly over the same period. However, HRC reached 144,000 tons, the lowest bottom since early 2021.

Market by numbers

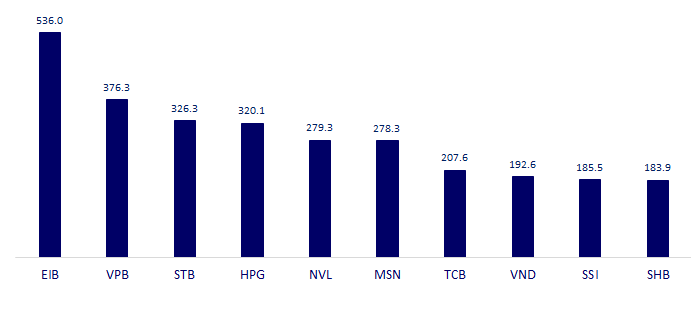

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

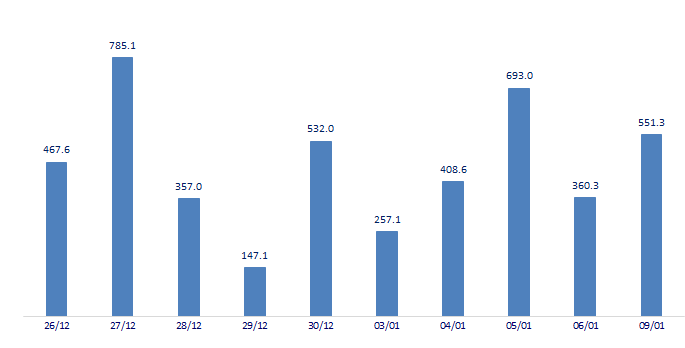

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

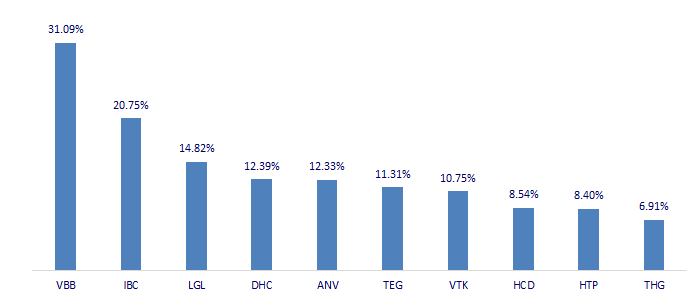

TOP INCREASES 3 CONSECUTIVE SESSIONS

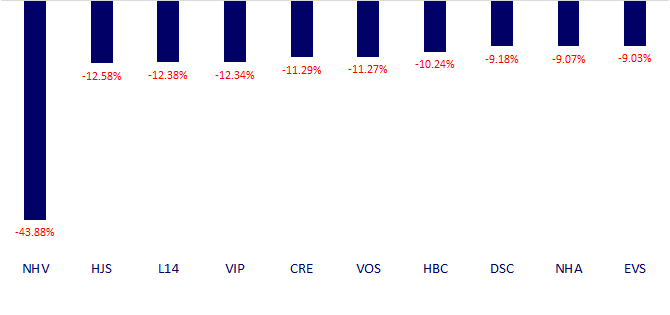

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.