Market Brief 10/01/2023

VIETNAM STOCK MARKET

1,053.35

1D -0.08%

YTD 4.59%

1,060.53

1D -0.06%

YTD 5.51%

210.63

1D 0.46%

YTD 2.59%

72.48

1D -0.34%

YTD 1.16%

464.84

1D 0.00%

YTD 0.00%

10,985.09

1D 14.50%

YTD 27.50%

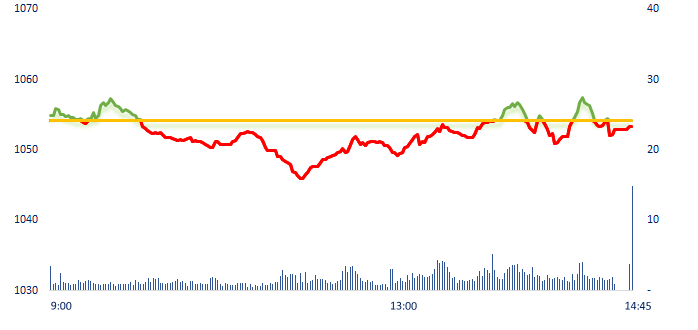

The market was more active today with a trading volume nearly 10% higher than the previous session, but in terms of scores, there was still no improvement. The highlight of today's session was the breakthrough of public investment stocks, leading the gain, including some stocks that hit the ceiling like VCG, HHV, FCN, KSB.

ETF & DERIVATIVES

18,070

1D 0.11%

YTD 4.27%

12,510

1D 0.08%

YTD 4.95%

12,810

1D -0.08%

YTD 2.64%

14,520

1D -1.63%

YTD 3.35%

15,210

1D 0.60%

YTD 5.99%

23,100

1D -0.39%

YTD 3.13%

13,500

1D -0.88%

YTD 4.25%

1,031

1D 0.03%

YTD 0.00%

1,046

1D 0.51%

YTD 0.00%

1,052

1D 0.54%

YTD 0.00%

1,057

1D 0.28%

YTD 0.00%

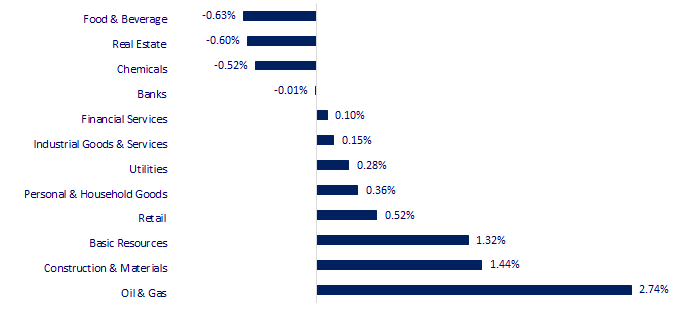

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

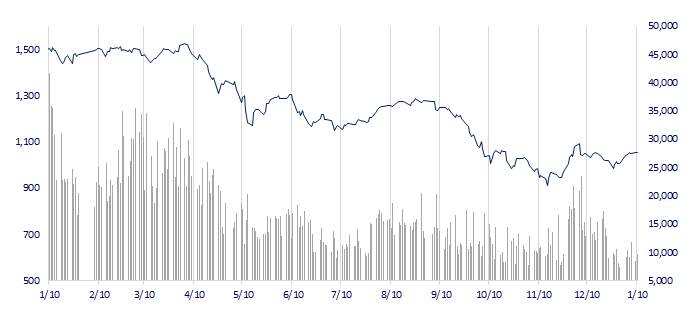

VNINDEX (12M)

GLOBAL MARKET

26,175.56

1D 0.78%

YTD 0.31%

3,169.51

1D -0.21%

YTD 2.60%

2,351.31

1D 0.05%

YTD 5.14%

21,331.46

1D -0.27%

YTD 7.84%

3,262.91

1D -1.29%

YTD 0.36%

1,691.41

1D 0.02%

YTD 1.26%

80.06

1D 0.54%

YTD -6.81%

1,879.20

1D 0.06%

YTD 2.90%

Core consumer prices in Japan's capital, a leading indicator of nationwide trends, rose a faster-than-expected 4.0% in December from a year earlier, exceeding the central bank's 2% target for a seventh straight month in a sign of broadening inflationary pressure.

VIETNAM ECONOMY

5.17%

1D (bps) 9

YTD (bps) 20

7.40%

4.69%

1D (bps) 2

YTD (bps) -10

4.70%

1D (bps) -2

YTD (bps) -20

23,650

1D (%) 0.17%

YTD (%) -0.46%

25,618

1D (%) -1.04%

YTD (%) -0.16%

3,528

1D (%) -0.14%

YTD (%) 1.23%

On January 10, the State Bank net withdrew about VND13,000 billion. In the OMO channel, SBV bought VND5,648 billion, interest rate of 6%/year with a term of 7 days. In the treasury bill issuance channel, SBV sold VND18,500 billion of bills with interest rate of 6%/year with a term of 7 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's iron and steel exports recorded recovery signals;

- Vietnam spends nearly USD9 billion on petroleum imports in 2022;

- Banks expects credit to increase by 13.7% in 2023;

- Japan: The number of daily COVID-19 cases nears 100,000;

- Billionaire Jeff Bezos may return to Amazon;

- Apple plans to drop key broadcom chip to use in-house design by 2025.

VN30

BANK

87,300

1D 0.46%

5D 5.69%

Buy Vol. 3,311,695

Sell Vol. 3,734,403

41,300

1D 0.73%

5D 0.24%

Buy Vol. 2,476,296

Sell Vol. 2,658,201

28,550

1D -1.89%

5D 1.96%

Buy Vol. 4,813,805

Sell Vol. 8,053,949

27,450

1D -1.08%

5D 0.00%

Buy Vol. 4,396,429

Sell Vol. 6,022,911

18,700

1D -0.80%

5D 1.08%

Buy Vol. 23,736,735

Sell Vol. 27,012,780

18,200

1D -0.27%

5D 1.11%

Buy Vol. 12,598,666

Sell Vol. 12,956,679

16,750

1D 0.00%

5D 1.52%

Buy Vol. 3,919,467

Sell Vol. 2,902,590

22,500

1D 0.00%

5D 2.74%

Buy Vol. 5,360,796

Sell Vol. 5,944,011

24,950

1D 1.22%

5D 6.17%

Buy Vol. 39,693,724

Sell Vol. 28,303,668

21,150

1D 0.00%

5D 6.28%

Buy Vol. 6,968,821

Sell Vol. 8,154,711

23,450

1D 1.52%

5D 3.30%

Buy Vol. 5,887,600

Sell Vol. 5,342,489

TPB: TPB announced business results in 2022 with pre-tax profit of VND7,828 billion, equivalent to an increase of about 30% compared to 2021. Total assets recorded an increase of more than 12% compared to the same period last year, reaching the milestone of nearly VND329 trillion. TPBank's total operating income this year reached over VND15,600 billion, up more than 15.5% compared to 2021. Net profit from services reached about VND2,700 billion, up nearly 75% over the same period.

REAL ESTATE

13,950

1D 0.72%

5D -4.78%

Buy Vol. 19,394,186

Sell Vol. 21,964,001

27,900

1D -0.18%

5D -0.36%

Buy Vol. 1,921,975

Sell Vol. 2,696,493

14,250

1D 0.00%

5D -2.06%

Buy Vol. 11,239,795

Sell Vol. 11,826,404

DKRA group forecasts that the supply in the apartment segment in 2023 will decrease sharply to 20,000 units, equal to about 75% compared to 2022.

OIL & GAS

104,600

1D 0.10%

5D -0.38%

Buy Vol. 513,379

Sell Vol. 437,850

11,700

1D 0.86%

5D 5.88%

Buy Vol. 24,329,339

Sell Vol. 12,545,332

36,850

1D 3.80%

5D 11.84%

Buy Vol. 1,907,015

Sell Vol. 1,945,717

PLX: In Q4/2022, consolidated revenue is estimated at more than VND74,200 billion and pre-tax profit is estimated at VND1,454 billion, up 50% and 75% respectively compared to 2021.

VINGROUP

54,500

1D -0.91%

5D -4.05%

Buy Vol. 3,046,823

Sell Vol. 2,680,558

49,750

1D -0.90%

5D 0.71%

Buy Vol. 1,117,307

Sell Vol. 1,663,654

29,400

1D 0.00%

5D 4.63%

Buy Vol. 1,774,017

Sell Vol. 3,309,271

VRE: 6 shopping centers scheduled to open in 2023 will bring VRE's total retail leasing gross floor area to 2.08 million m2 by the end of the year.

FOOD & BEVERAGE

81,000

1D 0.37%

5D 3.18%

Buy Vol. 1,826,321

Sell Vol. 2,949,721

95,400

1D -1.14%

5D -0.63%

Buy Vol. 911,899

Sell Vol. 1,218,553

176,100

1D -1.95%

5D 4.20%

Buy Vol. 184,519

Sell Vol. 170,887

MSN: After only 3 days of officially launching all WinMart/WinMart+ points of sale nationwide, WIN members have reached 1 million participants.

OTHERS

48,000

1D 0.21%

5D 0.63%

Buy Vol. 652,797

Sell Vol. 678,241

109,100

1D -0.09%

5D -2.33%

Buy Vol. 492,087

Sell Vol. 555,278

80,400

1D 0.12%

5D 0.50%

Buy Vol. 1,469,039

Sell Vol. 1,966,733

42,200

1D 0.48%

5D -3.98%

Buy Vol. 2,393,125

Sell Vol. 2,670,770

14,400

1D 0.00%

5D -1.37%

Buy Vol. 2,988,865

Sell Vol. 3,156,743

18,900

1D -0.53%

5D 0.00%

Buy Vol. 22,928,106

Sell Vol. 22,483,586

19,800

1D 1.02%

5D 2.86%

Buy Vol. 45,962,635

Sell Vol. 71,503,394

HPG: For the whole year of 2022, Hoa Phat steel pipe output will reach nearly 750,000 tons, up about 11% compared to 2021. Hoa Phat steel sheet products will reach 328,000 tons, down 23% in volume compared to the same period last year, but sales volume goods in the domestic market increased by about 21% compared to 2021.

Market by numbers

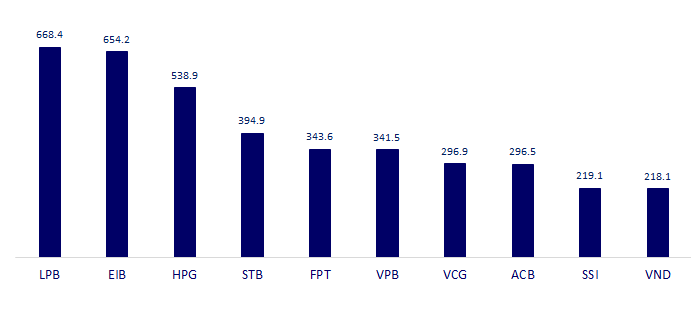

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

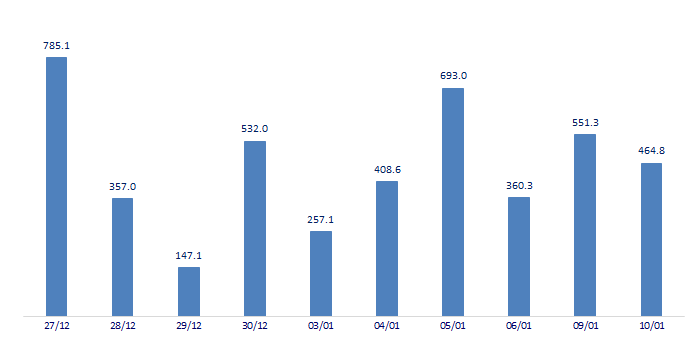

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

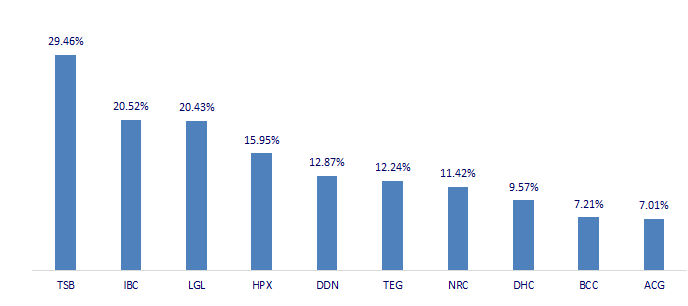

TOP INCREASES 3 CONSECUTIVE SESSIONS

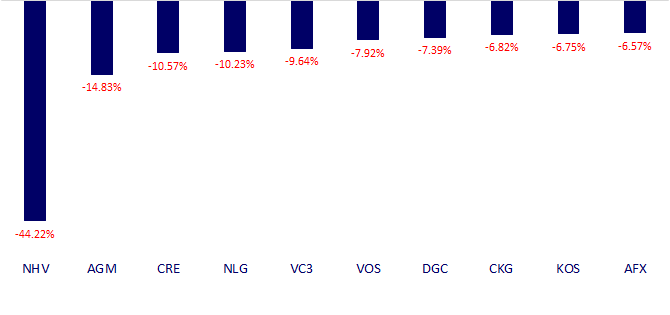

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.