Market Brief 13/01/2023

VIETNAM STOCK MARKET

1,060.17

1D 0.36%

YTD 5.27%

1,069.86

1D 0.34%

YTD 6.43%

211.26

1D -0.32%

YTD 2.90%

72.09

1D -0.14%

YTD 0.61%

-3,009.89

1D 0.00%

YTD 0.00%

13,697.67

1D 37.05%

YTD 58.98%

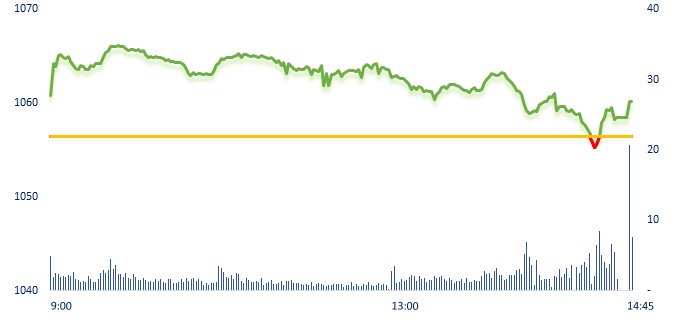

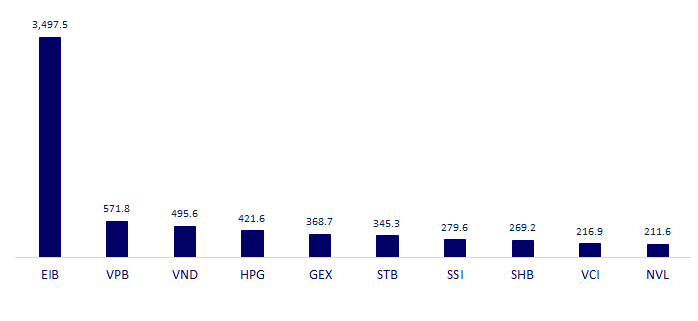

The market has moved sideways in a narrow range of 1045-1060 points for the 8th consecutive session since the 50-point increase in the first session of the new year until now. Liquidity improved slightly, mainly contributed by more than 134 million EIB shares suddenly in put-through transaction by foreign investors since 2pm.

ETF & DERIVATIVES

18,360

1D 1.27%

YTD 5.94%

12,650

1D 0.56%

YTD 6.12%

13,130

1D 0.15%

YTD 5.21%

14,830

1D 0.88%

YTD 5.55%

15,320

1D 0.79%

YTD 6.76%

23,080

1D -0.35%

YTD 3.04%

13,660

1D 1.11%

YTD 5.48%

1,042

1D 0.24%

YTD 0.00%

1,059

1D 0.65%

YTD 0.00%

1,065

1D 0.48%

YTD 0.00%

1,069

1D 0.37%

YTD 0.00%

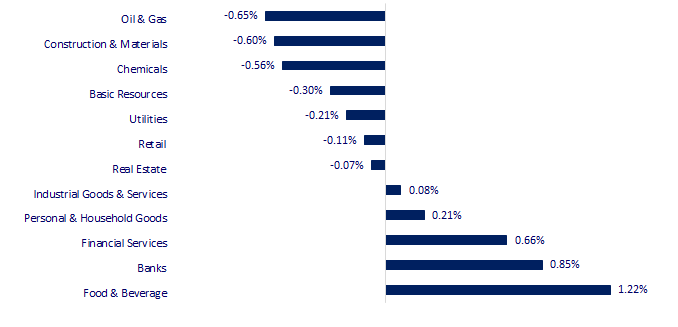

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

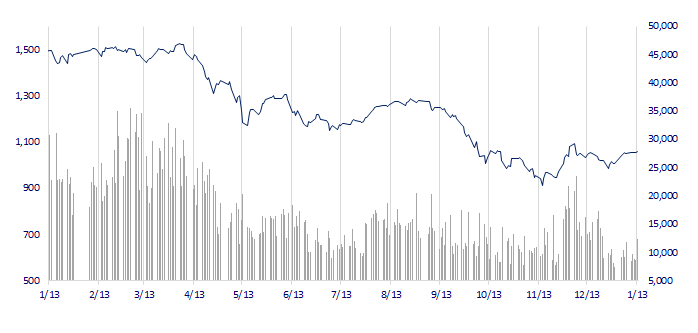

VNINDEX (12M)

GLOBAL MARKET

26,119.52

1D -1.25%

YTD 0.10%

3,195.31

1D 1.01%

YTD 3.43%

2,386.09

1D 0.89%

YTD 6.69%

21,738.66

1D 1.04%

YTD 9.89%

3,293.75

1D 0.79%

YTD 1.31%

1,681.73

1D -0.34%

YTD 0.68%

84.92

1D 1.31%

YTD -1.15%

1,907.35

1D 0.34%

YTD 4.44%

China's crude oil imports fell for the second year in a row in 2022 despite a burst of purchases in the fourth quarter, as the country's strict COVID-19 control measures hobbled the economy and fuel demand. Oil prices next year are forecast to be supported from hopes for fuel demand growth in China, the world's second-largest oil consumer after the United States, after it eased its COVID-19 curbs and increased crude import quotas by 20%.

VIETNAM ECONOMY

6.02%

1D (bps) 7

YTD (bps) 105

7.40%

4.56%

1D (bps) -2

YTD (bps) -23

4.65%

1D (bps) 1

YTD (bps) -25

23,643

1D (%) 0.17%

YTD (%) -0.49%

25,863

1D (%) -1.18%

YTD (%) 0.80%

3,560

1D (%) 0.31%

YTD (%) 2.15%

In session 13/01, the State Bank net withdrew more than VND5,000 billion through both channels. On the OMO channel, SBV provided VND15,477 billion with an interest rate of 6%/year, with a term of 14 days. On the treasury bills issuance channel, SBV attracted VND20,500 billion with an interest rate of 6%/year, with a term of 14 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit balance exceeds deposits after 10 years, banks are looking for a support channel;

- Taxes collected from houses and land are at a record high;

- Launching the Vietnam - Kazakhstan special container train;

- China's exports fell nearly 10% in December as global demand falls;

- World oil prices may decrease in the last 6 months of 2023;

- Interest rates in Southeast Asia are about to peak.

VN30

BANK

85,800

1D 1.18%

5D 2.14%

Buy Vol. 1,091,626

Sell Vol. 1,365,887

41,800

1D 0.84%

5D 0.36%

Buy Vol. 3,046,174

Sell Vol. 4,775,737

29,100

1D 0.69%

5D 1.75%

Buy Vol. 4,543,455

Sell Vol. 7,596,229

27,800

1D -0.18%

5D 0.36%

Buy Vol. 4,942,054

Sell Vol. 6,890,567

19,400

1D 3.74%

5D 2.37%

Buy Vol. 44,633,308

Sell Vol. 41,380,948

18,250

1D 0.00%

5D 0.00%

Buy Vol. 14,334,351

Sell Vol. 19,756,929

16,650

1D 0.30%

5D 1.22%

Buy Vol. 4,666,265

Sell Vol. 5,907,996

22,400

1D 0.00%

5D -0.44%

Buy Vol. 9,037,799

Sell Vol. 11,480,351

25,300

1D 1.40%

5D 4.12%

Buy Vol. 25,480,895

Sell Vol. 27,546,903

22,050

1D 1.15%

5D 7.04%

Buy Vol. 10,057,119

Sell Vol. 13,510,296

24,150

1D -1.43%

5D 4.32%

Buy Vol. 3,243,449

Sell Vol. 6,597,179

CTG: Vietinbank announces the liquidation of collateral of Louis Rice Import-Export JSC (an associate company of Louis Capital JSC - HOSE: TGG). As of September 20, Louis Rice's total outstanding debt at VietinBank is more than USD1.64 million, of which principal debt is more than USD1.59 million (equivalent to more than VND37 billion), outstanding balance of interest is USD41,854 (more than VND981 million).

REAL ESTATE

14,300

1D -4.35%

5D 5.15%

Buy Vol. 26,609,961

Sell Vol. 38,557,812

26,200

1D -2.24%

5D -5.76%

Buy Vol. 2,150,749

Sell Vol. 2,772,178

14,000

1D -4.44%

5D -5.08%

Buy Vol. 14,839,918

Sell Vol. 18,213,527

IKDH: VOF Investment Limited registered to sell all 5.89 million KDH shares (accounting for 0.83%), expected to trade from January 17 to February 15.

OIL & GAS

104,500

1D -0.48%

5D -0.19%

Buy Vol. 320,282

Sell Vol. 547,138

11,850

1D 0.85%

5D 0.85%

Buy Vol. 20,825,321

Sell Vol. 25,499,437

37,050

1D -0.13%

5D 5.56%

Buy Vol. 1,339,165

Sell Vol. 2,908,907

POW: The corporation is estimated to exceed the revenue target by 18% and the profit target by 37% in 2022.

VINGROUP

55,000

1D 0.00%

5D -1.96%

Buy Vol. 1,742,516

Sell Vol. 2,190,553

52,000

1D 0.97%

5D 4.21%

Buy Vol. 1,399,307

Sell Vol. 1,994,428

28,600

1D -0.35%

5D -2.22%

Buy Vol. 1,294,394

Sell Vol. 1,684,967

VHM: Utilities such as Vinschool inter-school, Vincom Mega Mall, Vinmec Health hospital... will be completed in 2023 at Vinhomes Ocean Park 3.

FOOD & BEVERAGE

80,600

1D 0.75%

5D 1.00%

Buy Vol. 2,461,183

Sell Vol. 3,638,159

95,000

1D 1.82%

5D -0.84%

Buy Vol. 512,461

Sell Vol. 677,719

185,900

1D 3.39%

5D 2.88%

Buy Vol. 406,030

Sell Vol. 295,353

SAB: Since 2017 until now, Vietnam Beverage Co., Ltd (belonging to Thai Beverage Group) has received more than VND7,730 billion in dividends from SAB.

OTHERS

48,900

1D -0.41%

5D 1.77%

Buy Vol. 480,838

Sell Vol. 1,097,903

107,700

1D -1.91%

5D -0.09%

Buy Vol. 309,878

Sell Vol. 402,273

80,000

1D -0.87%

5D -0.37%

Buy Vol. 868,735

Sell Vol. 1,338,131

42,050

1D -0.12%

5D -2.55%

Buy Vol. 1,805,259

Sell Vol. 2,753,969

14,550

1D -1.69%

5D 1.04%

Buy Vol. 4,358,303

Sell Vol. 6,048,360

19,200

1D -0.52%

5D 1.59%

Buy Vol. 23,654,106

Sell Vol. 36,260,141

19,950

1D -0.50%

5D 2.84%

Buy Vol. 33,658,906

Sell Vol. 40,725,013

HPG: After 2 months of announcing the shutdown of 4 vital blast furnaces, Hoa Phat has restarted one blast furnace from December 27. Accordingly, the restarted blast furnace in Hai Duong will increase rebar capacity by 700,000 tons/year.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

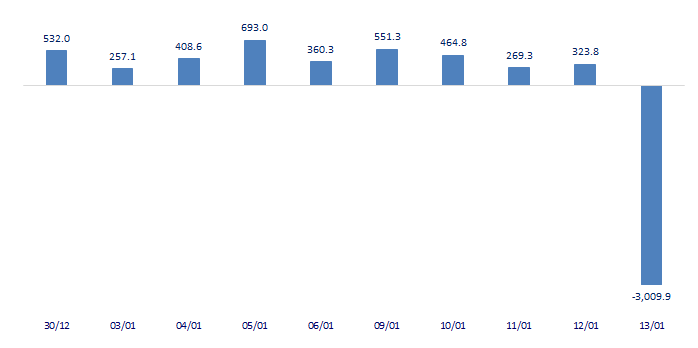

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

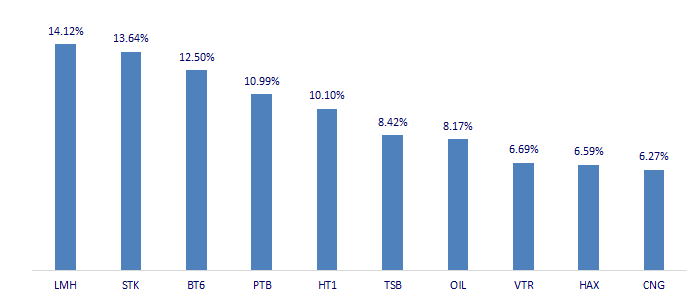

TOP INCREASES 3 CONSECUTIVE SESSIONS

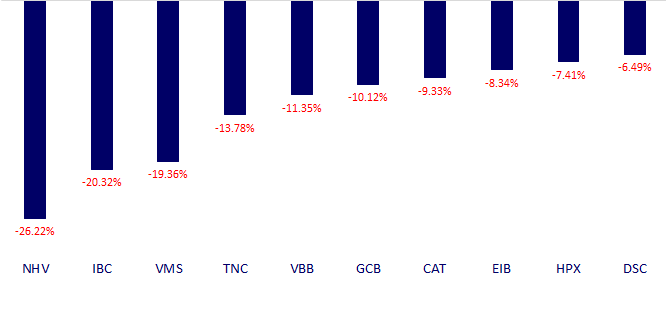

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.