Market brief 27/01/2023

VIETNAM STOCK MARKET

1,117.10

1D 0.81%

YTD 10.92%

1,130.65

1D 0.78%

YTD 12.48%

220.76

1D 0.40%

YTD 7.53%

74.99

1D 1.37%

YTD 4.66%

554.87

1D 0.00%

YTD 0.00%

12,579.54

1D -4.25%

YTD 46.00%

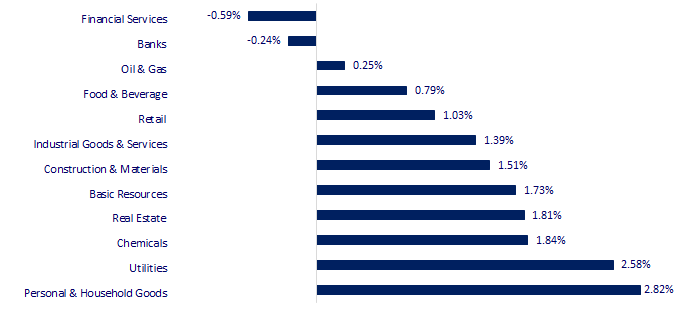

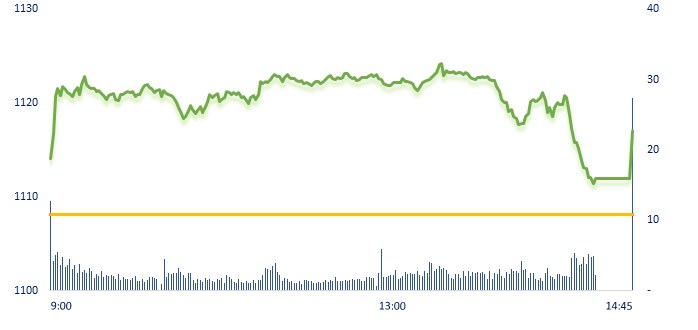

The market rallied strongly at the beginning of the morning session with a positive response from the US GDP growth data exceeding expectations as well as the good sentiment of investors after Tet holiday. However, the market gaining momentum began to fade at the end of the afternoon when lots of unsatisfactory business results were announced. The most positive sectors in the market today are retail, utilities, and public investment...

ETF & DERIVATIVES

19,210

1D -0.98%

YTD 10.85%

13,320

1D 0.30%

YTD 11.74%

13,810

1D 0.07%

YTD 10.66%

15,930

1D 1.21%

YTD 13.38%

16,310

1D 0.62%

YTD 13.66%

24,460

1D 2.77%

YTD 9.20%

14,580

1D 1.82%

YTD 12.59%

1,106

1D 0.38%

YTD 0.00%

1,112

1D 0.88%

YTD 0.00%

1,125

1D 0.55%

YTD 0.00%

1,127

1D 0.54%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

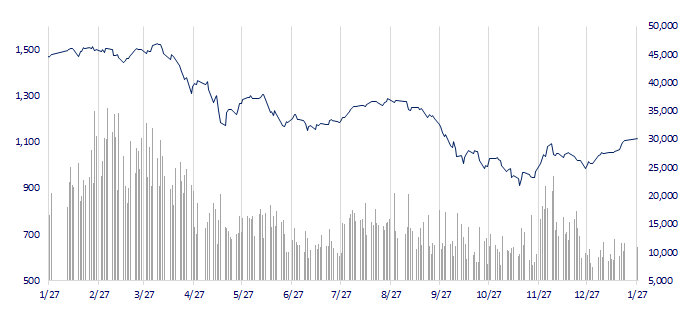

VNINDEX (12M)

GLOBAL MARKET

27,382.56

1D 0.07%

YTD 4.94%

3,264.81

1D 0.00%

YTD 5.68%

2,484.02

1D 0.62%

YTD 11.07%

22,688.90

1D 0.54%

YTD 14.70%

3,394.21

1D 3.18%

YTD 4.39%

1,681.65

1D 0.62%

YTD 0.68%

88.62

1D 1.23%

YTD 3.15%

1,925.35

1D -0.29%

YTD 5.43%

At the end of the session, Asian stocks increased following the US market yesterday as investors looked at lots of business result reports and higher-than-expected US GDP figures for the fourth quarter of 2022.

VIETNAM ECONOMY

6.20%

1D (bps) -12

YTD (bps) 123

7.40%

4.53%

1D (bps) -3

YTD (bps) -26

4.58%

YTD (bps) -32

23,636

1D (%) -0.14%

YTD (%) -0.52%

26,282

1D (%) 0.88%

YTD (%) 2.43%

3,529

1D (%) 0.03%

YTD (%) 1.26%

The dollar rose after data showed the US economy maintained its growth rate in the fourth quarter of 2022, although the momentum seems to slow down towards the end of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Minister of Finance: Continuing to extend and delay tax for businesses;

- Hanoi tourism collects more than VND1,000 billion during Tet holiday;

- Dung Quat Oil Refinery maintains operation at 110% capacity during Tet holiday;

- BOJ shows no sign of monetary policy change in January meeting;

- Germany can avoid a recession in 2023;

- Boeing reported a loss of more than $660 million in the fourth quarter of 2022.

VN30

BANK

93,000

1D 0.00%

5D 0.00%

Buy Vol. 1,954,004

Sell Vol. 2,240,406

44,550

1D -3.05%

5D -3.05%

Buy Vol. 2,365,009

Sell Vol. 3,362,362

30,350

1D -2.41%

5D -2.41%

Buy Vol. 5,193,686

Sell Vol. 7,340,230

29,050

1D -0.17%

5D -0.17%

Buy Vol. 7,682,897

Sell Vol. 8,757,045

19,700

1D 1.03%

5D 1.03%

Buy Vol. 43,444,627

Sell Vol. 41,533,689

19,700

1D 0.51%

5D 0.51%

Buy Vol. 13,717,446

Sell Vol. 16,012,098

17,700

1D 1.14%

5D 1.14%

Buy Vol. 2,649,381

Sell Vol. 3,862,528

24,500

1D 2.08%

5D 2.08%

Buy Vol. 22,487,003

Sell Vol. 19,830,772

26,650

1D -0.56%

5D -0.56%

Buy Vol. 17,662,551

Sell Vol. 16,420,786

23,350

1D 1.97%

5D 1.97%

Buy Vol. 8,012,885

Sell Vol. 5,605,881

26,350

1D 1.35%

5D 1.35%

Buy Vol. 5,493,623

Sell Vol. 6,794,488

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) reported a pre-tax income of more than VND7,828 billion in 2022, increasing 30% compared to the previous year, thanks to increased revenue from services and from written-off debts. For the whole year of 2022, TPBank net interest income increased by 14% compared to the previous year, reaching nearly VND11,387 billion.

REAL ESTATE

13,950

1D -0.71%

5D -0.71%

Buy Vol. 20,012,012

Sell Vol. 24,565,221

27,650

1D 0.18%

5D 0.18%

Buy Vol. 1,401,662

Sell Vol. 1,776,522

13,700

1D -3.18%

5D -3.18%

Buy Vol. 10,011,500

Sell Vol. 12,000,312

PDR: In quarter 4/2022, Phat Dat pre-tax loss is nearly VND229.5 billion, while the same period income is nearly VND751.5 billion.

OIL & GAS

108,200

1D 3.54%

5D 3.54%

Buy Vol. 1,013,831

Sell Vol. 843,216

12,200

1D 0.00%

5D 0.00%

Buy Vol. 12,778,824

Sell Vol. 15,053,186

38,100

1D 0.26%

5D 0.26%

Buy Vol. 944,284

Sell Vol. 1,019,737

POW: Nhon Trach 2(NT2)- a subsidiary of PV Power has exceeded 56% of its profit target for the year, accordingly, the company is likely to pay a cash dividend in 2022 at the rate of 18% - 20%.

VINGROUP

59,200

1D 3.14%

5D 3.14%

Buy Vol. 2,705,239

Sell Vol. 3,811,732

53,300

1D 2.11%

5D 2.11%

Buy Vol. 1,566,063

Sell Vol. 2,297,848

30,300

1D 2.19%

5D 2.19%

Buy Vol. 2,313,535

Sell Vol. 4,498,241

Vingroup stocks gained impressively in the first session of the year of the Cat as a pillar for VN-Index.

FOOD & BEVERAGE

80,000

1D -1.60%

5D -1.60%

Buy Vol. 2,968,595

Sell Vol. 3,790,801

103,700

1D 1.67%

5D 1.67%

Buy Vol. 873,236

Sell Vol. 1,237,389

193,100

1D 3.98%

5D 3.98%

Buy Vol. 244,606

Sell Vol. 226,445

MSN: Mr. Nguyen Dang Quang, Chairman of Masan Group is the only Vietnamese businessman, born in the year of the Cat, honored by Forbes in the global billionaires list with a fortune of $1.6 billion.

OTHERS

51,000

1D 2.20%

5D 2.20%

Buy Vol. 1,083,841

Sell Vol. 1,323,954

116,200

1D 1.48%

5D 1.48%

Buy Vol. 272,910

Sell Vol. 400,681

84,000

1D 0.12%

5D 0.12%

Buy Vol. 1,505,739

Sell Vol. 2,123,266

45,900

1D 0.66%

5D 0.66%

Buy Vol. 3,290,974

Sell Vol. 4,370,550

16,850

1D 3.37%

5D 3.37%

Buy Vol. 4,156,696

Sell Vol. 4,803,733

20,950

1D -1.18%

5D -1.18%

Buy Vol. 28,052,160

Sell Vol. 36,088,431

21,500

1D 1.65%

5D 1.65%

Buy Vol. 45,117,552

Sell Vol. 40,888,216

SSI: SSI Securities Joint Stock Company has just announced business results for the fourth quarter of 2022 with total revenue down 46% over the same period, to VND1,465 billion and pre-tax income down 77%, to nearly VND289 billion.

Market by numbers

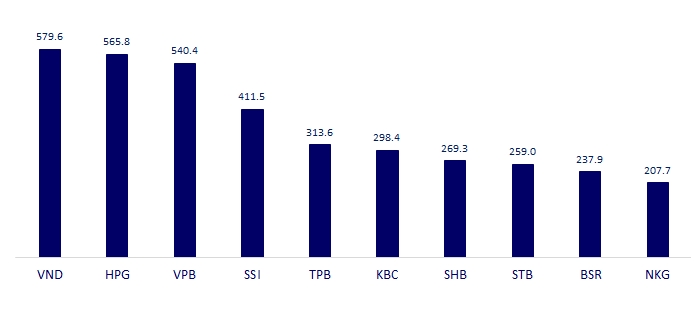

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

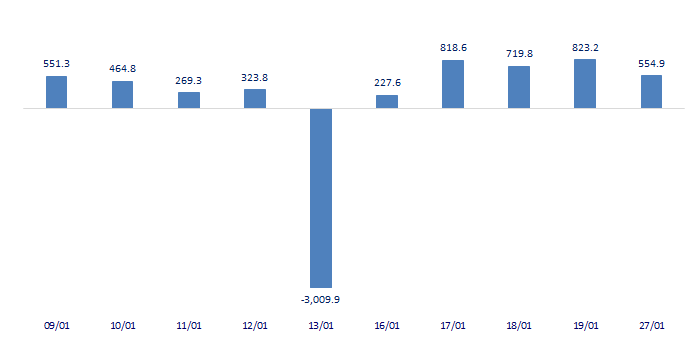

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

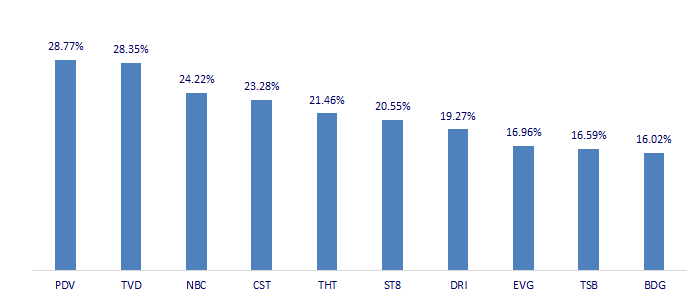

TOP INCREASES 3 CONSECUTIVE SESSIONS

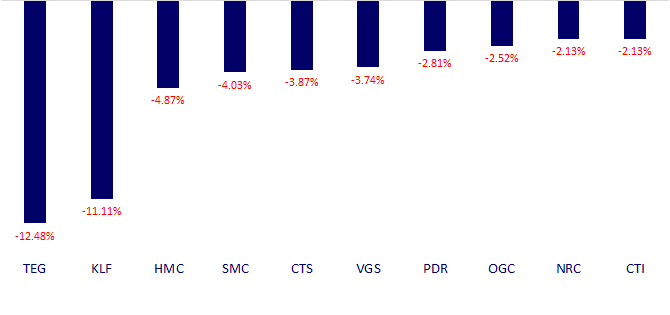

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.