Market Brief 03/02/2023

VIETNAM STOCK MARKET

1,077.15

1D -0.04%

YTD 6.96%

1,085.70

1D -0.71%

YTD 8.01%

215.28

1D -0.01%

YTD 4.86%

75.54

1D 0.88%

YTD 5.43%

546.74

1D 0.00%

YTD 0.00%

11,957.29

1D -6.54%

YTD 38.78%

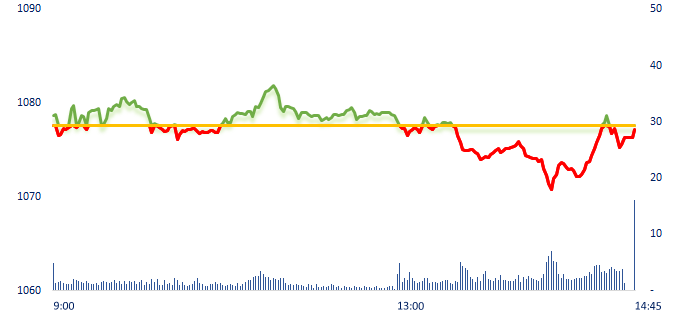

The market continued to have a mixed session on Friday. VN-Index had a slight increase in the morning session but the liquidity was very low. In the afternoon session, the market started shaking and returned to near reference at ATC session. VCB was the market's main gainer when it contributed 2.9 points to the VN-Index, followed by SAB and NVL.

ETF & DERIVATIVES

18,490

1D -0.32%

YTD 6.69%

12,800

1D -0.39%

YTD 7.38%

13,400

1D 0.75%

YTD 7.37%

16,000

1D 0.63%

YTD 13.88%

15,640

1D 0.06%

YTD 8.99%

23,560

1D -0.17%

YTD 5.18%

13,910

1D -0.93%

YTD 7.41%

1,065

1D -0.27%

YTD 0.00%

1,067

1D -0.47%

YTD 0.00%

1,083

1D 0.38%

YTD 0.00%

1,082

1D -0.56%

YTD 0.00%

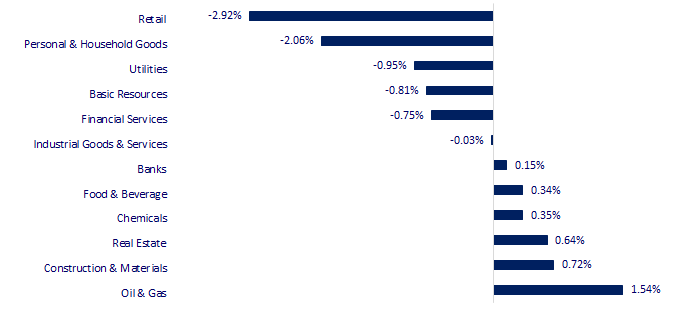

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

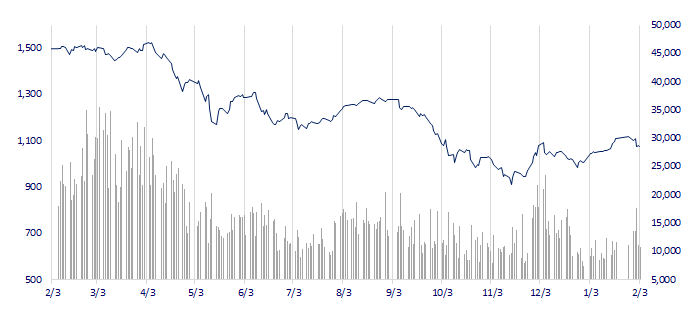

VNINDEX (12M)

GLOBAL MARKET

27,511.60

1D 0.40%

YTD 5.43%

3,263.41

1D -0.68%

YTD 5.64%

2,480.40

1D 0.47%

YTD 10.91%

21,660.47

1D -1.36%

YTD 9.50%

3,384.29

1D 0.61%

YTD 4.09%

1,688.36

1D 0.34%

YTD 1.08%

82.08

1D -0.44%

YTD -4.46%

1,924.60

1D -0.35%

YTD 5.39%

Chinese stocks fell despite data on China's services activity in January expanded for the first time in five months as spending and travel got a boost from the lifting of stringent COVID-19 curbs, sending business confidence to near 12-year highs.

VIETNAM ECONOMY

6.12%

1D (bps) -8

YTD (bps) 115

7.40%

4.20%

1D (bps) -12

YTD (bps) -59

4.26%

1D (bps) -11

YTD (bps) -64

23,619

1D (%) 0.00%

YTD (%) -0.59%

26,356

1D (%) 0.29%

YTD (%) 2.72%

3,548

1D (%) -0.14%

YTD (%) 1.81%

Deposit interest rates at banks showed signs of cooling down, down from 0.1 to 0.5% per year compared to the end of 2022. According to the SBV, the amount of deposits from the population's savings has flowed into the banking system that increased sharply by 8.9% compared to 6.8% in October, with a strong increase of 8.9% compared to 6.8% in October. This trend continued to be stronger after Tet, which contributed to creating a stable capital source for the banking system.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- HCMC – Hanoi City has approved a proposal to expand the Ngoc Hoi station as the largest railway 'super station' in Vietnam;

- Ho Chi Minh City disburses public investment for 44 power grid projects;

- The Ministry of Industry and Trade talked about handling the loss of VND31 trillion of EVN;

- Apple drops sales for the first time since 2019, but is determined not to lay off employees;

- Germany left open the possibility that Russia was unjustly blamed in the Nord Stream pipeline case;

- The Suez Canal has the highest revenue in history.

VN30

BANK

93,000

1D 2.65%

5D 0.00%

Buy Vol. 1,721,606

Sell Vol. 1,396,764

43,350

1D 0.46%

5D -2.69%

Buy Vol. 1,933,708

Sell Vol. 2,339,218

29,050

1D -0.51%

5D -4.28%

Buy Vol. 5,120,104

Sell Vol. 5,879,566

27,100

1D -3.21%

5D -6.71%

Buy Vol. 15,074,315

Sell Vol. 9,637,474

18,250

1D -0.82%

5D -7.36%

Buy Vol. 37,699,261

Sell Vol. 30,965,218

18,600

1D -1.85%

5D -5.58%

Buy Vol. 24,855,917

Sell Vol. 17,858,393

18,550

1D 1.09%

5D 4.80%

Buy Vol. 3,929,572

Sell Vol. 4,701,030

24,000

1D 0.42%

5D -2.04%

Buy Vol. 9,367,192

Sell Vol. 13,461,974

26,050

1D -0.38%

5D -2.25%

Buy Vol. 45,982,806

Sell Vol. 61,107,653

24,300

1D 2.97%

5D 4.07%

Buy Vol. 8,513,740

Sell Vol. 5,760,986

24,500

1D -2.00%

5D -7.02%

Buy Vol. 16,851,157

Sell Vol. 12,739,700

Brand Finance announced the top 500 Banking Brands 2023, in which 12 banks in Vietnam entered the ranking of the top 500 in the world in terms of brand value. Big4 group hold the highest position among 12 Vietnamese banks in the list. Specifically, Vietcombank is the bank with the highest position in this ranking with 137th position, up 25 places compared to the previous year.

REAL ESTATE

14,950

1D 5.28%

5D 7.17%

Buy Vol. 32,594,501

Sell Vol. 37,033,848

26,950

1D 1.32%

5D -2.53%

Buy Vol. 3,811,581

Sell Vol. 2,615,517

13,700

1D -0.36%

5D 0.00%

Buy Vol. 18,165,642

Sell Vol. 16,212,810

NVL: Novaland has just announced the appointment of Mr.Bui Thanh Nhon as Chairman of the BOD.

OIL & GAS

105,200

1D -1.68%

5D -2.77%

Buy Vol. 462,425

Sell Vol. 627,448

12,150

1D 1.25%

5D -0.41%

Buy Vol. 20,285,726

Sell Vol. 14,717,101

37,300

1D 3.04%

5D -2.10%

Buy Vol. 1,603,633

Sell Vol. 1,645,859

POW: As of December 31, total assets reached VND56,642 billion, up 7% ytd. In which, fixed assets reached VND29,155 billion, accounting for 51% of total assets.

VINGROUP

56,000

1D 0.36%

5D -5.41%

Buy Vol. 1,941,519

Sell Vol. 1,901,436

48,100

1D 0.42%

5D -9.76%

Buy Vol. 2,327,593

Sell Vol. 1,877,534

29,200

1D 1.21%

5D -3.63%

Buy Vol. 1,960,360

Sell Vol. 2,023,283

VHM: In 2022, Vinhomes sold 30,900 apartments, down 21% yoy, in which wholesale transactions accounted for 68% and retail transactions accounted for 32%.

FOOD & BEVERAGE

76,000

1D -0.91%

5D -5.00%

Buy Vol. 2,823,916

Sell Vol. 3,371,290

96,500

1D -0.21%

5D -6.94%

Buy Vol. 1,048,685

Sell Vol. 1,277,534

192,800

1D 2.83%

5D -0.16%

Buy Vol. 196,371

Sell Vol. 160,437

SAB: Sabeco still holds the "big" position in Vietnam's beer industry with revenue of VND10,029 billion in Q4/2022, nearly double the total revenue of businesses in the industry combined.

OTHERS

49,700

1D -0.50%

5D -2.55%

Buy Vol. 822,189

Sell Vol. 1,309,043

109,100

1D -2.59%

5D -6.11%

Buy Vol. 242,902

Sell Vol. 316,990

80,100

1D -2.20%

5D -4.64%

Buy Vol. 4,597,640

Sell Vol. 2,278,351

47,800

1D -4.21%

5D 4.14%

Buy Vol. 8,377,396

Sell Vol. 18,168,327

15,400

1D 0.98%

5D -8.61%

Buy Vol. 3,160,584

Sell Vol. 3,373,336

19,750

1D -1.99%

5D -5.73%

Buy Vol. 24,032,228

Sell Vol. 26,472,242

21,100

1D -0.94%

5D -1.86%

Buy Vol. 37,130,921

Sell Vol. 39,596,630

HPG: Hoa Phat signed a contract with WinMart. On average, each month, Hoa Phat Phu Tho Poultry Co., Ltd. will supply about 500,000 - 550,000 clean chicken eggs that have been processed into the WinMart supermarket chain through distribution agents.

Market by numbers

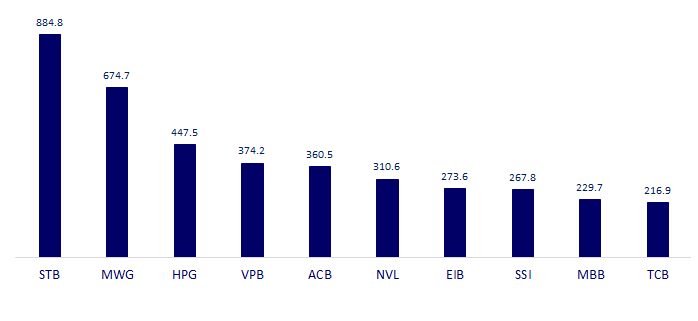

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

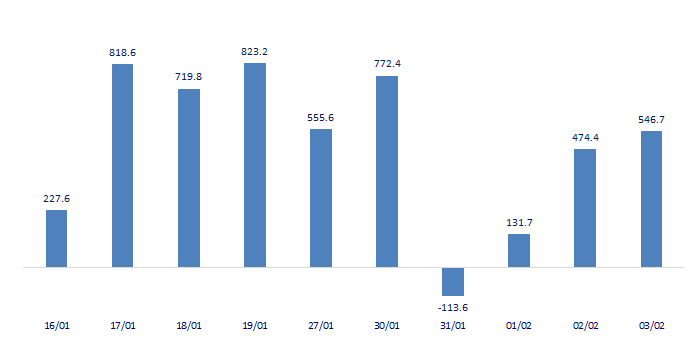

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

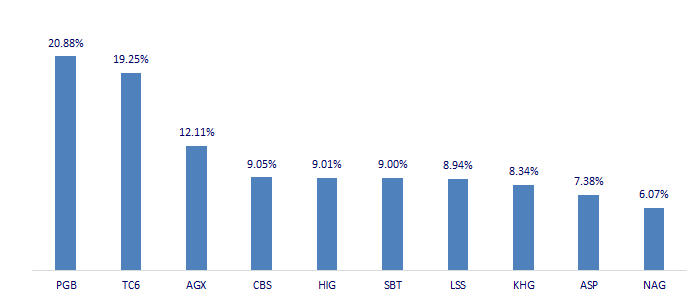

TOP INCREASES 3 CONSECUTIVE SESSIONS

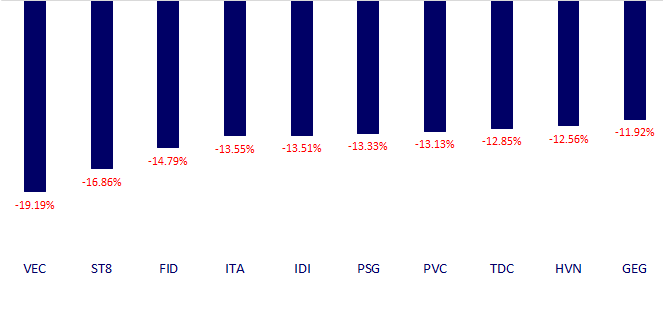

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.