Market brief 08/02/2023

VIETNAM STOCK MARKET

1,072.22

1D 0.60%

YTD 6.47%

1,073.38

1D 0.36%

YTD 6.78%

210.62

1D 0.30%

YTD 2.59%

76.43

1D 1.18%

YTD 6.67%

397.66

1D 0.00%

YTD 0.00%

11,210.72

1D -17.59%

YTD 30.12%

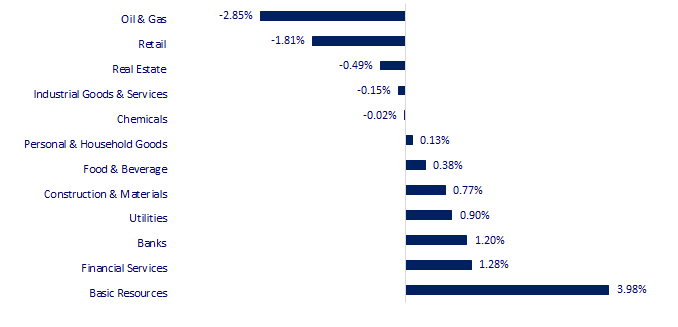

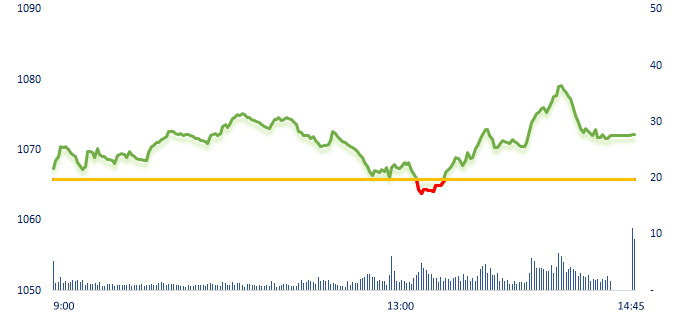

Following the US market, the Vietnamese market rallied from the beginning of the morning session. The market had a strong pullback over the reference. The three most positive sectors that helped the market gain today were basic resources, financial services and banking with typical stocks such as HPG, SSI, CTG, VCB, etc.

ETF & DERIVATIVES

18,380

1D -0.59%

YTD 6.06%

12,630

1D 0.48%

YTD 5.96%

13,150

1D 0.84%

YTD 5.37%

15,500

1D -1.90%

YTD 10.32%

15,300

1D -0.65%

YTD 6.62%

23,110

1D -1.03%

YTD 3.17%

13,750

1D -0.58%

YTD 6.18%

1,063

1D 1.19%

YTD 0.00%

1,057

1D 0.21%

YTD 0.00%

1,068

1D 0.49%

YTD 0.00%

1,072

1D 0.44%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

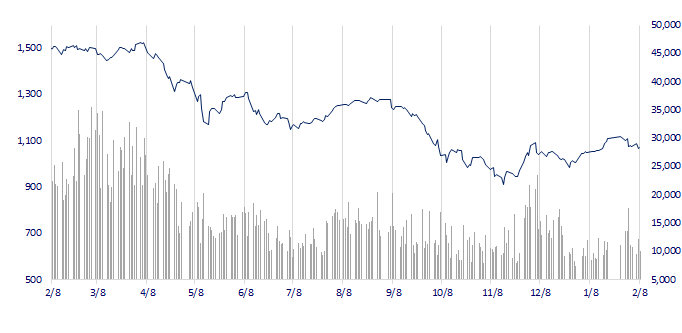

VNINDEX (12M)

GLOBAL MARKET

27,606.46

1D -0.29%

YTD 5.79%

3,232.11

1D -0.49%

YTD 4.62%

2,483.64

1D 1.30%

YTD 11.06%

21,283.52

1D -0.07%

YTD 7.59%

3,388.52

1D 0.23%

YTD 4.22%

1,670.16

1D -0.61%

YTD -0.01%

84.71

1D 1.13%

YTD -1.40%

1,897.20

1D 0.42%

YTD 3.89%

Stocks in Asia mixed today following a late rally in US shares in a volatile session after Federal Reserve Chair Jerome Powell rebuffed an opportunity to tamp down investor optimism.

VIETNAM ECONOMY

5.67%

1D (bps) -33

YTD (bps) 70

7.40%

3.99%

1D (bps) -10

YTD (bps) -80

4.18%

1D (bps) -1

YTD (bps) -72

23,765

1D (%) -0.19%

YTD (%) 0.02%

26,106

1D (%) 0.03%

YTD (%) 1.74%

3,549

1D (%) -0.03%

YTD (%) 1.84%

This morning on February 8, at the headquarters of the SBV, a conference on credit work for the real estate sector took place. In which, SBV announced lots of actions to remove difficulties for the real estate market in the future.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many Japanese enterprises have plans to expand their investment in Vietnam;

- In 2022, real estate credit increased by nearly 25%, reaching VND2.58 trillion;

- There was no corporate bond issuance in January 2023;

- Saudi Arabia will raise oil prices in March;

- Russia survived a year of sanctions thanks to unprecedented investment;

- Fed Chairman: Inflation has dropped, but interest rates still need to rise.

VN30

BANK

94,200

1D 2.39%

5D 5.72%

Buy Vol. 1,823,109

Sell Vol. 1,665,769

44,500

1D 1.60%

5D 3.97%

Buy Vol. 3,211,005

Sell Vol. 2,780,842

29,900

1D 2.40%

5D 3.10%

Buy Vol. 5,321,440

Sell Vol. 6,926,678

27,850

1D 1.64%

5D -1.24%

Buy Vol. 5,467,225

Sell Vol. 4,632,587

17,950

1D 0.00%

5D -1.91%

Buy Vol. 21,707,960

Sell Vol. 22,444,432

18,400

1D 0.27%

5D -2.65%

Buy Vol. 13,845,703

Sell Vol. 16,943,281

18,300

1D 1.67%

5D -3.68%

Buy Vol. 3,104,276

Sell Vol. 3,725,265

24,600

1D 0.82%

5D 3.80%

Buy Vol. 9,767,681

Sell Vol. 13,358,997

25,000

1D -2.91%

5D -2.53%

Buy Vol. 39,746,260

Sell Vol. 55,738,541

23,200

1D 0.65%

5D -1.69%

Buy Vol. 4,240,114

Sell Vol. 4,322,657

24,650

1D 0.20%

5D -2.18%

Buy Vol. 3,722,409

Sell Vol. 3,589,203

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) has just announced the results of collecting written shareholders' opinions on the dividend payment in 2023. Specifically, TPBank general meeting of shareholders approved the dividend payment plan of 25% in cash, with an approval rating of 77.69%. As planned, TPBank will pay a dividend of VND2,500/share. With nearly 1,582 billion shares outstanding and no treasury shares, it is estimated that TPBank will spend about VND3,955 billion to pay dividends to shareholders.

REAL ESTATE

14,300

1D -2.05%

5D -1.72%

Buy Vol. 27,566,660

Sell Vol. 29,262,556

84,500

1D 0.60%

5D 0.60%

Buy Vol. 225,293

Sell Vol. 177,685

12,350

1D -3.52%

5D -11.15%

Buy Vol. 16,638,655

Sell Vol. 15,366,320

BCM: Becamex has just announced its financial report for the 4th quarter of 2022 with net revenue of nearly VND879 billion, down 72% over the same period.

OIL & GAS

107,300

1D 0.94%

5D 0.66%

Buy Vol. 488,007

Sell Vol. 689,489

12,250

1D 0.41%

5D 2.51%

Buy Vol. 10,332,593

Sell Vol. 12,134,433

37,200

1D -4.62%

5D 2.62%

Buy Vol. 1,268,802

Sell Vol. 1,447,005

PLX: On March 8, Petrolimex will auction 443,500 shares of Dong Nai Fuel and Building Materials Joint Stock Company.

VINGROUP

54,400

1D -1.09%

5D -1.45%

Buy Vol. 2,917,852

Sell Vol. 3,058,990

46,600

1D -0.43%

5D -2.92%

Buy Vol. 6,845,700

Sell Vol. 6,841,958

28,500

1D -0.18%

5D 1.79%

Buy Vol. 3,004,699

Sell Vol. 2,325,686

VIC: U.S. Bank is the preferred partner of VinFast to provide long-term loan and rental solutions when buying a car in the US.

FOOD & BEVERAGE

75,800

1D -0.39%

5D -1.81%

Buy Vol. 2,245,371

Sell Vol. 3,150,777

93,500

1D -0.64%

5D -1.79%

Buy Vol. 732,544

Sell Vol. 837,707

197,200

1D 3.14%

5D 5.45%

Buy Vol. 192,611

Sell Vol. 182,804

VNM: Mr. Mai Quang Liem - younger brother of General Director of Vinamilk has just registered to sell 36,094 VNM shares from February 13 to March 10.

OTHERS

49,250

1D 0.10%

5D -1.50%

Buy Vol. 964,016

Sell Vol. 945,449

108,000

1D -1.28%

5D -5.18%

Buy Vol. 204,062

Sell Vol. 240,679

81,200

1D 0.62%

5D -0.98%

Buy Vol. 1,133,875

Sell Vol. 1,302,768

44,500

1D -2.63%

5D -5.52%

Buy Vol. 2,393,419

Sell Vol. 4,234,813

14,750

1D -0.34%

5D -5.14%

Buy Vol. 4,056,751

Sell Vol. 3,055,340

19,500

1D 2.36%

5D -3.23%

Buy Vol. 24,667,812

Sell Vol. 24,421,439

20,850

1D 5.57%

5D -1.18%

Buy Vol. 60,661,495

Sell Vol. 47,844,890

MWG: Foreign funds continued to sell another 5.3 million shares of MWG when the company finished its continuous growth period from 2014 to present. Specifically, on February 3, related fund group of Dragon Capital has just sold 5,343,700 MWG shares to reduce its ownership from 9.33% to 8.96% of charter capital.

Market by numbers

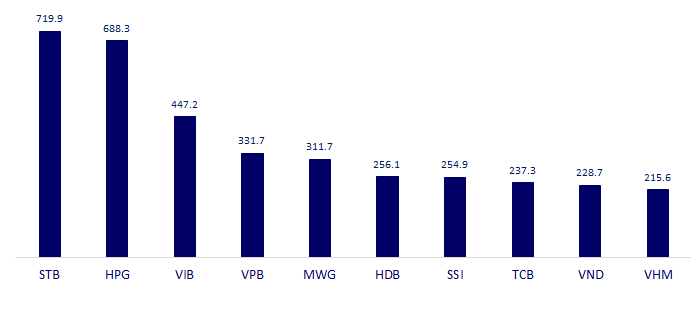

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

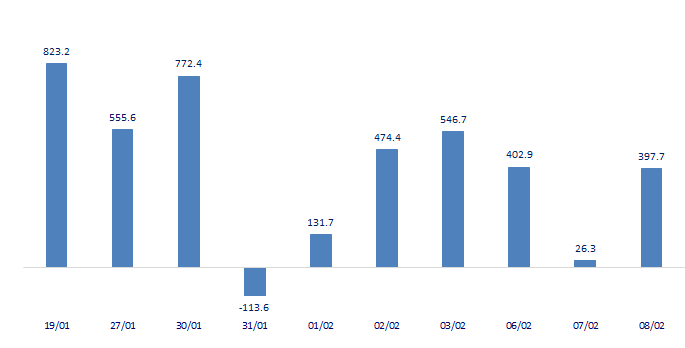

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

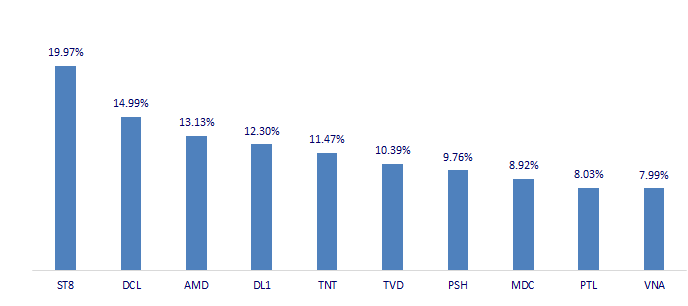

TOP INCREASES 3 CONSECUTIVE SESSIONS

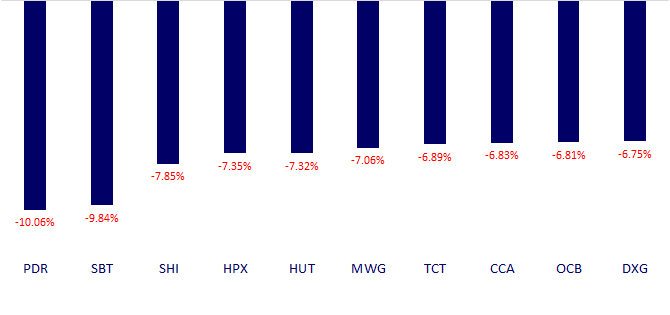

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.