Market brief 09/02/2023

VIETNAM STOCK MARKET

1,064.03

1D -0.76%

YTD 5.65%

1,059.91

1D -1.25%

YTD 5.44%

210.91

1D 0.14%

YTD 2.73%

77.25

1D 1.07%

YTD 7.82%

23.82

1D 0.00%

YTD 0.00%

10,466.58

1D -6.64%

YTD 21.48%

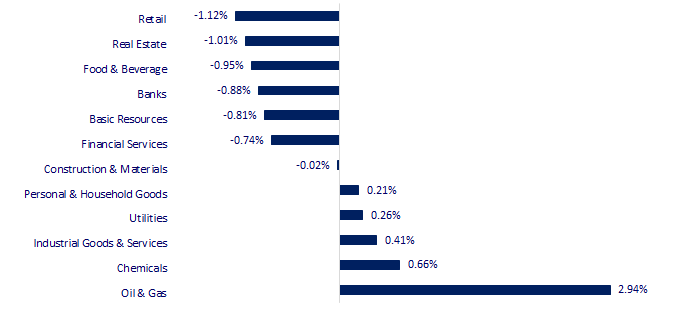

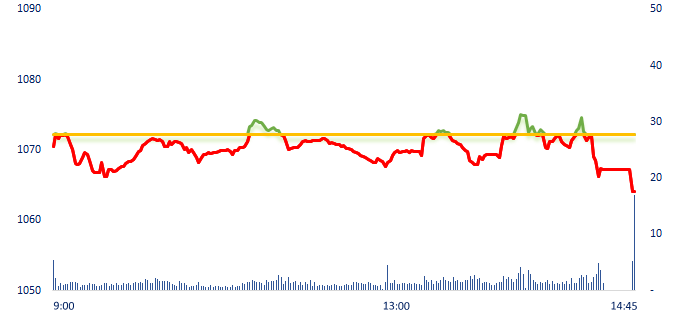

Vietnam's market has dropped since the beginning of the morning session. The market fluctuated strongly below the reference. Oil and gas is the most positive sector in the market with typical stocks such as PVD, PVC, PLC, PVS, BSR,... Besides, seafood stocks were also positive today with a lot of ceiling stocks due to news about significant increase in orders, mainly coming from the Chinese market.

ETF & DERIVATIVES

18,120

1D -1.41%

YTD 4.56%

12,500

1D -1.03%

YTD 4.87%

12,970

1D -1.37%

YTD 3.93%

15,510

1D 0.06%

YTD 10.39%

15,300

1D 0.00%

YTD 6.62%

23,100

1D -0.04%

YTD 3.13%

13,590

1D -1.16%

YTD 4.94%

1,047

1D -1.48%

YTD 0.00%

1,049

1D -0.79%

YTD 0.00%

1,055

1D -1.17%

YTD 0.00%

1,057

1D -1.40%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

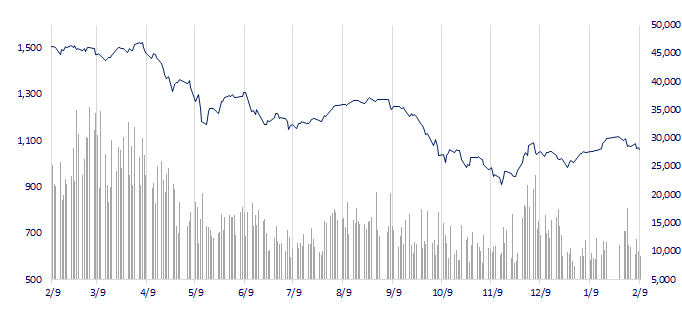

VNINDEX (12M)

GLOBAL MARKET

27,584.35

1D -0.08%

YTD 5.71%

3,270.38

1D 1.18%

YTD 5.86%

2,481.52

1D -0.09%

YTD 10.96%

21,624.36

1D 1.60%

YTD 9.32%

3,359.48

1D -0.86%

YTD 3.33%

1,669.88

1D -0.02%

YTD -0.03%

85.24

1D 0.19%

YTD -0.78%

1,893.45

1D 0.40%

YTD 3.68%

At the end of the session, Asian markets were mixed after the reports of the fourth quarter business results. Markets in China and Hong Kong increased strongly today. Barclays upgraded their forecast of China's economic growth to 5.3% this year, from 4.8% previously, while Fitch revised up their forecasts on China's economic growth this year to 5%. Both cited accelerated recovery in consumer spending.

VIETNAM ECONOMY

5.28%

1D (bps) -39

YTD (bps) 31

7.40%

4.02%

1D (bps) 3

YTD (bps) -77

4.16%

1D (bps) -2

YTD (bps) -74

23,740

1D (%) -0.04%

YTD (%) -0.08%

26,080

1D (%) 0.33%

YTD (%) 1.64%

3,547

1D (%) 0.11%

YTD (%) 1.78%

On the morning of February 9, the domestic price of SJC gold bars increased sharply, with an increase of up to 450,000 VND/tael. The increase in world gold price has led to the increase of domestic gold.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- China does not open tours to Vietnam: Travel businesses are like 'sitting on a fire';

- FDI enterprises enjoy many incentives but continuously report losses and pay the state budget far behind domestic enterprises;

- Can Tho solves difficulties in 2 key traffic projects;

- The competitor of ChatGPT made a mistake, parent company Google lost more than USD100 billion;

- Container shipments from Asia to the US dropped sharply due to the inflation;

- Foreign investors poured record capital into Chinese stocks.

VN30

BANK

93,000

1D -1.27%

5D 2.65%

Buy Vol. 1,214,493

Sell Vol. 1,594,311

44,000

1D -1.12%

5D 1.97%

Buy Vol. 2,038,050

Sell Vol. 2,138,772

29,400

1D -1.67%

5D 0.68%

Buy Vol. 3,791,282

Sell Vol. 6,588,331

27,300

1D -1.97%

5D -2.50%

Buy Vol. 3,852,593

Sell Vol. 4,420,580

18,000

1D 0.28%

5D -2.17%

Buy Vol. 27,404,062

Sell Vol. 25,449,090

18,450

1D 0.27%

5D -2.64%

Buy Vol. 12,029,528

Sell Vol. 19,466,886

18,200

1D -0.55%

5D -0.82%

Buy Vol. 2,940,459

Sell Vol. 3,790,809

24,250

1D -1.42%

5D 1.46%

Buy Vol. 19,756,329

Sell Vol. 16,667,029

24,450

1D -2.20%

5D -6.50%

Buy Vol. 73,171,221

Sell Vol. 74,782,142

22,000

1D -0.90%

5D -2.58%

Buy Vol. 3,083,848

Sell Vol. 3,997,724

24,500

1D -0.61%

5D -2.00%

Buy Vol. 5,551,700

Sell Vol. 5,311,576

Talking at the Real Estate Credit Conference held by the SBV on the morning of February 8, representatives of three state-owned commercial banks, VCB, BIDV, and VietinBank said that the bank would sit down and work with each real estate business to solve each specific problem and difficulty of each project.

REAL ESTATE

14,150

1D -1.05%

5D -0.35%

Buy Vol. 18,407,932

Sell Vol. 17,932,166

84,700

1D 0.24%

5D 0.83%

Buy Vol. 131,151

Sell Vol. 104,739

12,050

1D -2.43%

5D -12.36%

Buy Vol. 8,153,891

Sell Vol. 7,732,783

BCM: Becamex was selected by Binh Duong to prepare a pre-feasibility study report on the HCMC-Thu Dau Mot-Chon Thanh expressway.

OIL & GAS

108,100

1D 0.75%

5D 1.03%

Buy Vol. 765,158

Sell Vol. 664,458

12,000

1D -2.04%

5D 0.00%

Buy Vol. 8,515,495

Sell Vol. 11,677,109

37,900

1D 1.88%

5D 4.70%

Buy Vol. 991,395

Sell Vol. 1,068,642

Oil prices rose for a third straight session, as investors became more comfortable with risk after the Fed chairman's comments eased concerns about future rate hikes.

VINGROUP

54,200

1D -0.37%

5D -2.87%

Buy Vol. 4,510,442

Sell Vol. 4,080,114

45,300

1D -2.79%

5D -5.43%

Buy Vol. 5,244,999

Sell Vol. 4,490,682

28,200

1D -1.05%

5D -2.25%

Buy Vol. 2,849,648

Sell Vol. 2,111,879

VIC: VinFast announced to cut jobs in the US to 'streamline' operations.

FOOD & BEVERAGE

75,000

1D -1.06%

5D -2.22%

Buy Vol. 2,953,056

Sell Vol. 3,867,883

91,800

1D -1.82%

5D -5.07%

Buy Vol. 1,104,767

Sell Vol. 1,364,615

193,800

1D -1.72%

5D 3.36%

Buy Vol. 95,227

Sell Vol. 213,810

MSN: Masan and its subsidiary are expected to borrow up to more than USD650 million from five foreign banks.

OTHERS

49,350

1D 0.20%

5D -1.20%

Buy Vol. 623,354

Sell Vol. 562,889

101,900

1D -5.65%

5D -9.02%

Buy Vol. 286,206

Sell Vol. 413,056

80,700

1D -0.62%

5D -1.47%

Buy Vol. 1,177,340

Sell Vol. 1,245,912

44,000

1D -1.12%

5D -11.82%

Buy Vol. 2,973,890

Sell Vol. 2,655,279

14,950

1D 1.36%

5D -1.97%

Buy Vol. 3,472,758

Sell Vol. 2,734,036

19,350

1D -0.77%

5D -3.97%

Buy Vol. 14,299,427

Sell Vol. 15,678,938

20,600

1D -1.20%

5D -3.29%

Buy Vol. 29,234,226

Sell Vol. 39,202,139

MWG: A representative of MWG said that there was no lay-off of 7,000 employees in the fourth quarter of 2022. According to accurate data from the company's human resources department, the number of employees of Mobile World as of September 2022 and December 2022 was 76,550 and 74,008, respectively.

Market by numbers

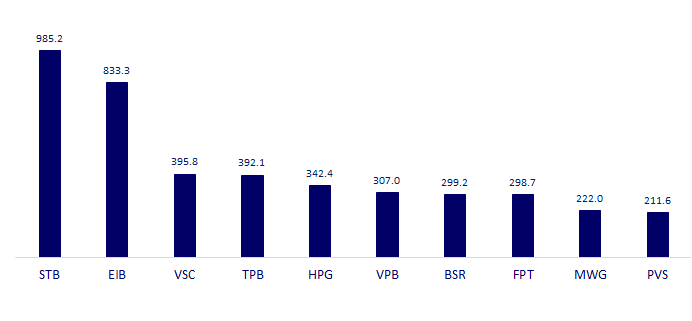

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

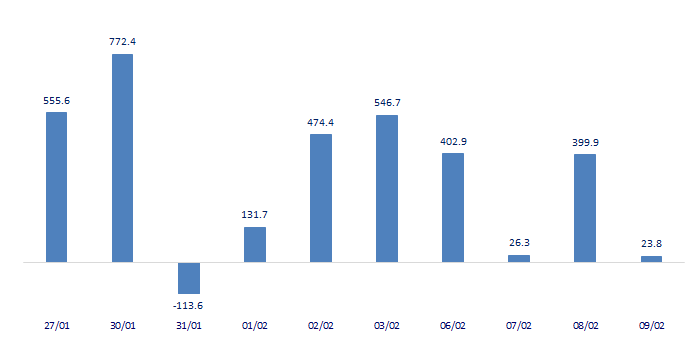

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

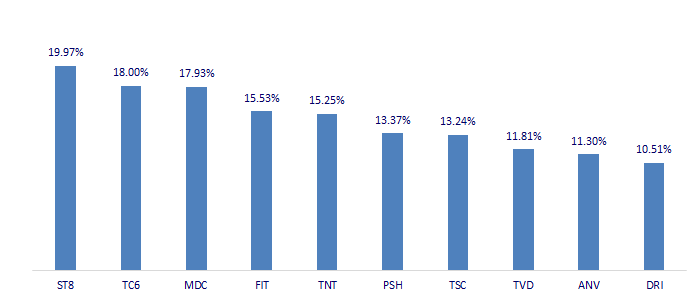

TOP INCREASES 3 CONSECUTIVE SESSIONS

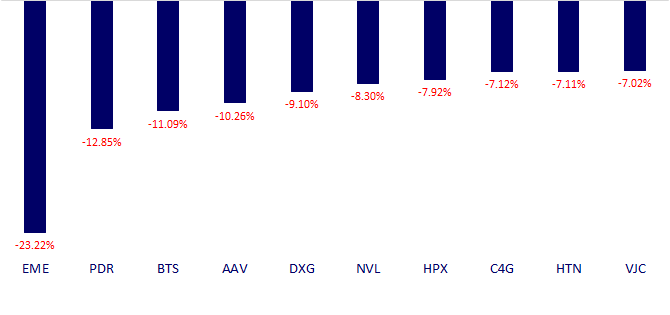

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.