Market brief 10/02/2023

VIETNAM STOCK MARKET

1,055.30

1D -0.82%

YTD 4.79%

1,048.74

1D -1.05%

YTD 4.33%

208.50

1D -1.14%

YTD 1.55%

77.34

1D 0.12%

YTD 7.94%

53.82

1D 0.00%

YTD 0.00%

9,232.41

1D -11.79%

YTD 7.15%

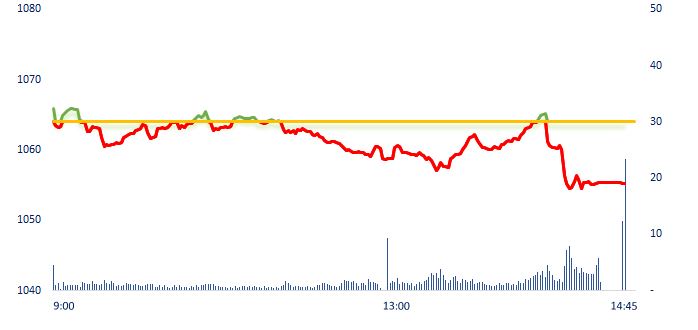

Vietnam market continued to have a decreased session today. Although opening the morning session in green, this position did not last long, the market fluctuated below the reference with very weak liquidity. In the afternoon session, it seemed that there was a recovery for the market when the cash flow started to work, however, the market witnessed a sharp decline after 2pm.

ETF & DERIVATIVES

18,120

1D 0.00%

YTD 4.56%

12,350

1D -1.20%

YTD 3.61%

12,900

1D -0.54%

YTD 3.37%

15,330

1D -1.16%

YTD 9.11%

15,120

1D -1.18%

YTD 5.37%

22,800

1D -1.30%

YTD 1.79%

13,440

1D -1.10%

YTD 3.78%

1,038

1D -0.83%

YTD 0.00%

1,035

1D -1.29%

YTD 0.00%

1,044

1D -1.08%

YTD 0.00%

1,045

1D -1.14%

YTD 0.00%

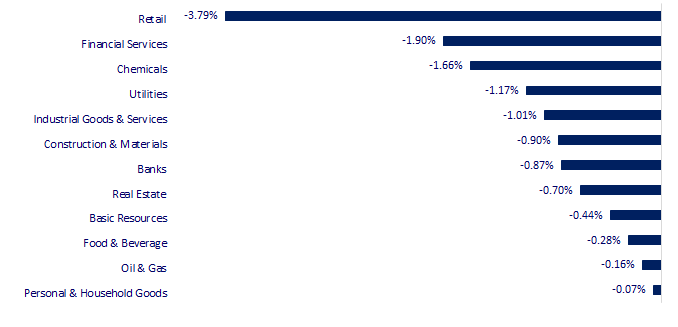

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

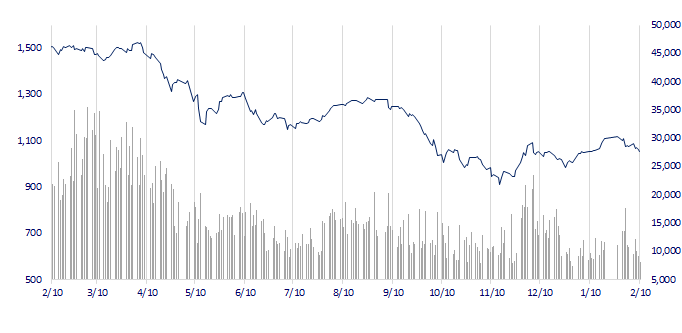

VNINDEX (12M)

GLOBAL MARKET

27,670.98

1D 0.31%

YTD 6.04%

3,260.67

1D -0.30%

YTD 5.55%

2,469.73

1D -0.48%

YTD 10.43%

21,190.42

1D -2.01%

YTD 7.12%

3,360.69

1D 0.04%

YTD 3.36%

1,664.37

1D -0.33%

YTD -0.36%

86.61

1D 2.75%

YTD 0.81%

1,875.30

1D -0.03%

YTD 2.69%

Asia-Pacific stocks retreated on Friday, slumping toward a second weekly loss as investors fretted about the potential for further Federal Reserve tightening and the effect on the economy. Nikkei 225 (Japan) bucked the trend with a 0.31% rise, supported by some strong earnings reports.

VIETNAM ECONOMY

4.97%

1D (bps) -31

7.40%

3.98%

1D (bps) -4

YTD (bps) -81

4.11%

1D (bps) -5

YTD (bps) -79

23,739

1D (%) 0.04%

YTD (%) -0.09%

25,994

1D (%) -0.13%

YTD (%) 1.31%

3,533

1D (%) -0.34%

YTD (%) 1.38%

The dollar mostly fell against other major currencies amid a decline in US Treasury yields as investors remained steadfast in the view that the US Federal Reserve (Fed) did not need to raise interest rates when the inflation begins to come under control.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deposit interest rates continue to "cool down" after the Lunar New Year;

- Export orders for wooden furniture began to return;

- Many textile and garment orders moved to Vietnam;

- After the bankruptcy rumors ended, Credit Suisse reported a record loss;

- Chinese consumers save a record $2.6 trillion;

- The British government announced a new round of sanctions against Russia.

VN30

BANK

94,500

1D 1.61%

5D 1.61%

Buy Vol. 1,043,263

Sell Vol. 1,407,274

42,950

1D -2.39%

5D -0.92%

Buy Vol. 2,184,970

Sell Vol. 2,311,677

29,100

1D -1.02%

5D 0.17%

Buy Vol. 3,578,949

Sell Vol. 4,520,120

26,950

1D -1.28%

5D -0.55%

Buy Vol. 5,114,857

Sell Vol. 4,183,853

17,500

1D -2.78%

5D -4.11%

Buy Vol. 26,119,240

Sell Vol. 24,341,287

18,300

1D -0.81%

5D -1.61%

Buy Vol. 11,768,063

Sell Vol. 18,161,411

18,150

1D -0.27%

5D -2.16%

Buy Vol. 2,783,579

Sell Vol. 3,676,209

23,550

1D -2.89%

5D -1.88%

Buy Vol. 7,782,574

Sell Vol. 7,607,431

23,650

1D -3.27%

5D -9.21%

Buy Vol. 29,433,467

Sell Vol. 32,591,295

21,000

1D -4.55%

5D -9.69%

Buy Vol. 4,829,190

Sell Vol. 7,261,888

24,200

1D -1.22%

5D -1.22%

Buy Vol. 3,974,794

Sell Vol. 3,708,541

ACB: ACB leaders said that credit growth in 2023 will follow the SBV target of 14-15%. Deposit growth was lower and close to credit, estimated at 10%. The planned profit before tax for 2023 is over VND20,000 billion. However, the specific target must wait for the General Meeting of Shareholders in April.

REAL ESTATE

13,750

1D -2.83%

5D -8.03%

Buy Vol. 22,262,715

Sell Vol. 22,034,203

84,500

1D -0.24%

5D 0.60%

Buy Vol. 133,988

Sell Vol. 137,789

12,050

1D 0.00%

5D -12.04%

Buy Vol. 8,823,520

Sell Vol. 7,897,797

NVL: Novaland Group proposed the SBV to consider allowing real estate corporations to restructure debts and delay debts within 24-36 months.

OIL & GAS

106,100

1D -1.85%

5D 0.86%

Buy Vol. 387,166

Sell Vol. 524,358

12,000

1D 0.00%

5D -1.23%

Buy Vol. 18,187,945

Sell Vol. 17,776,168

38,300

1D 1.06%

5D 2.68%

Buy Vol. 1,860,316

Sell Vol. 1,816,457

The Ministry of Industry and Trade has abandoned the proposal to transfer managing petrol and oil to the Ministry of Finance.

VINGROUP

54,000

1D -0.37%

5D -3.57%

Buy Vol. 2,873,779

Sell Vol. 3,287,721

45,400

1D 0.22%

5D -5.61%

Buy Vol. 2,944,267

Sell Vol. 2,833,015

28,200

1D 0.00%

5D -3.42%

Buy Vol. 2,287,175

Sell Vol. 1,684,573

VHM: In the midst of the layoff storm, Vinhomes massively recruited 3,000 employees with attractive salary of 15-25 million VND/month.

FOOD & BEVERAGE

75,900

1D 1.20%

5D -0.13%

Buy Vol. 2,029,263

Sell Vol. 2,668,897

91,200

1D -0.65%

5D -5.49%

Buy Vol. 977,726

Sell Vol. 1,345,138

189,400

1D -2.27%

5D -1.76%

Buy Vol. 106,930

Sell Vol. 147,998

SAB: Sabeco wants to buy more shares of two companies that are losing hundreds of billions, Saigon Binh Tay Beer and Saigon Packaging Group, making them becoming subsidiaries.

OTHERS

49,800

1D 0.91%

5D 0.20%

Buy Vol. 933,252

Sell Vol. 931,638

102,000

1D 0.10%

5D -6.51%

Buy Vol. 254,951

Sell Vol. 287,307

80,700

1D 0.00%

5D 0.75%

Buy Vol. 1,549,904

Sell Vol. 1,298,675

42,100

1D -4.32%

5D -11.92%

Buy Vol. 3,461,169

Sell Vol. 3,687,779

14,650

1D -2.01%

5D -4.87%

Buy Vol. 3,834,469

Sell Vol. 2,579,015

19,000

1D -1.81%

5D -3.80%

Buy Vol. 20,522,473

Sell Vol. 18,802,071

20,500

1D -0.49%

5D -2.84%

Buy Vol. 32,639,829

Sell Vol. 34,604,670

FPT: Realizing that the application of artificial intelligence (AI), the call center virtual assistant is an irreversible trend in business, FPT Retail has collaborated with FPT Smart Cloud to build and put into use the assistant solution - CSAT voicebot, initially gave positive results. Applied at FPT Long Chau from April 2022, CSAT voicebot will continue to be deployed at FPT Shop block from February 2023.

Market by numbers

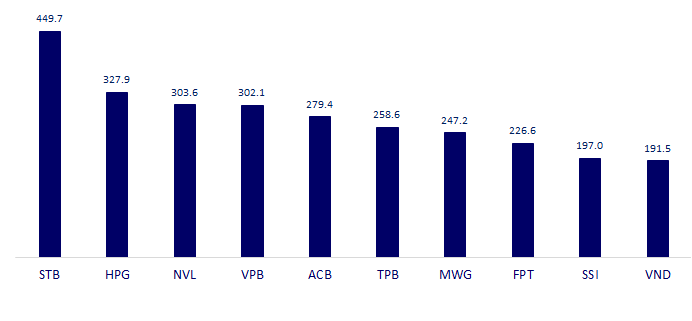

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

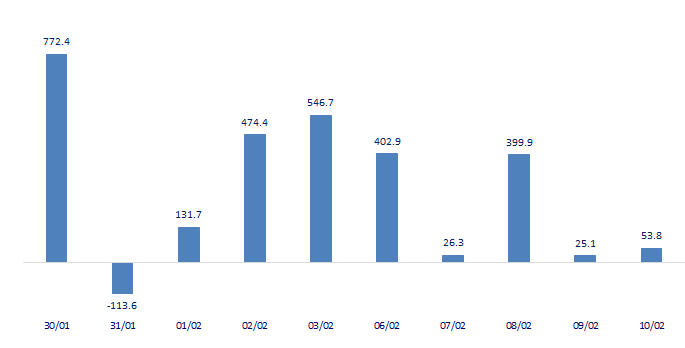

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

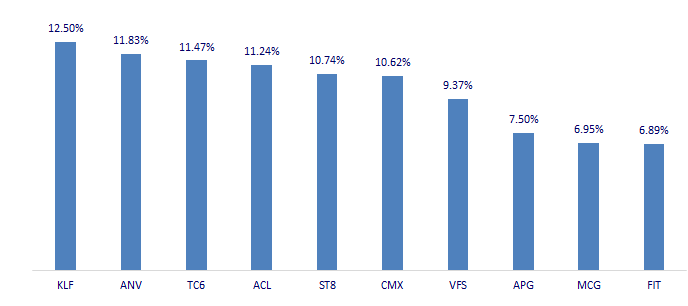

TOP INCREASES 3 CONSECUTIVE SESSIONS

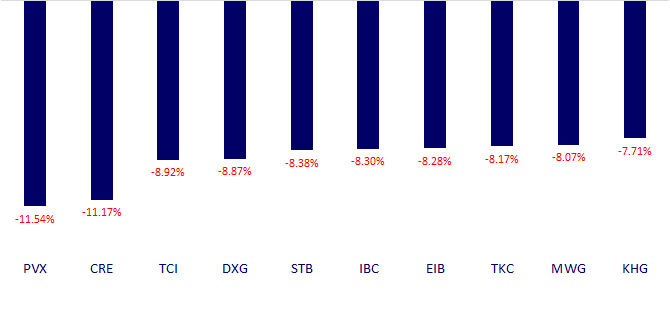

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.