Market brief 20/02/2023

VIETNAM STOCK MARKET

1,086.69

1D 2.58%

YTD 7.90%

1,087.36

1D 3.19%

YTD 8.17%

215.83

1D 2.80%

YTD 5.12%

78.82

1D -0.15%

YTD 10.01%

-82.57

1D 0.00%

YTD 0.00%

13,656.09

1D 51.50%

YTD 58.50%

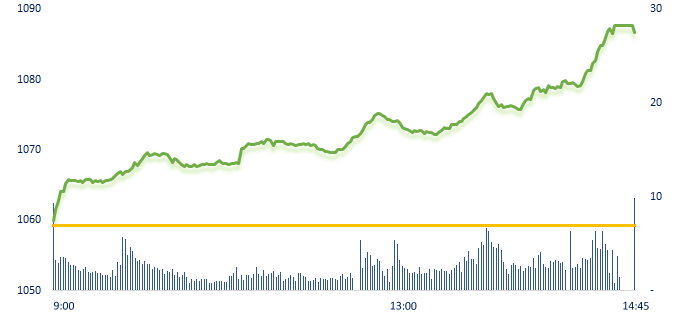

Vietnam stock market witnessed a strong rally since the beginning of February. VN-Index started the session positively thanks to real estate sector on the news about the credit package for real estate from 4 state-owned commercial banks with total value of VND120,000 bil. After that, the green color continued to spread to financial services, banking,...and the market continued to extend the uptrend until the end of the session.

ETF & DERIVATIVES

18,320

1D 2.58%

YTD 5.71%

12,820

1D 3.30%

YTD 7.55%

13,240

1D 3.36%

YTD 6.09%

16,010

1D 2.96%

YTD 13.95%

15,700

1D 4.60%

YTD 9.41%

23,470

1D 2.40%

YTD 4.78%

13,970

1D 4.33%

YTD 7.88%

1,080

1D 3.69%

YTD 0.00%

1,082

1D 3.37%

YTD 0.00%

1,087

1D 3.97%

YTD 0.00%

1,088

1D 3.72%

YTD 0.00%

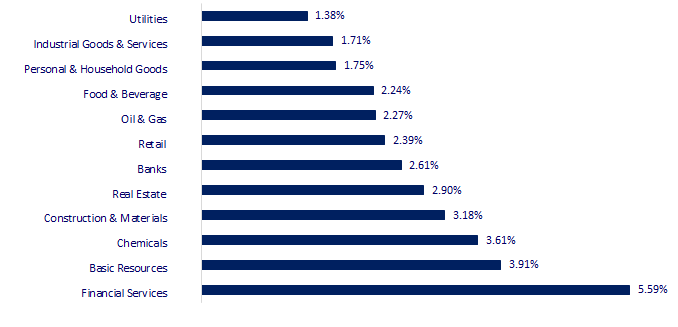

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

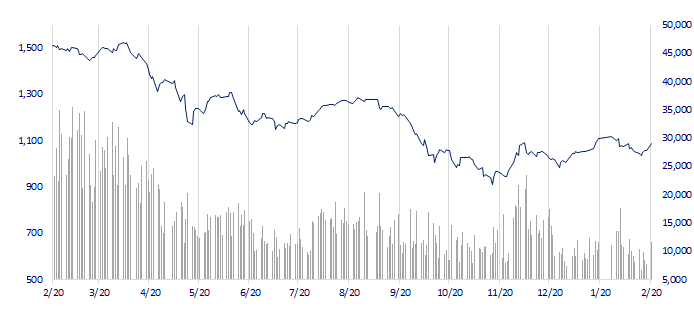

VNINDEX (12M)

GLOBAL MARKET

27,531.94

1D 0.07%

YTD 5.51%

3,290.34

1D 2.06%

YTD 6.51%

2,455.12

1D 0.16%

YTD 9.78%

20,886.96

1D 0.81%

YTD 5.59%

3,308.75

1D -0.59%

YTD 1.77%

1,657.69

1D 0.36%

YTD -0.76%

83.56

1D 0.64%

YTD -2.74%

1,852.25

1D 0.15%

YTD 1.43%

Asia-Pacific markets were mostly higher on Monday, as investors look ahead to a batch of economic data later in the week, including minutes for the U.S. Federal Open Market Committee (FOMC).The People’s Bank of China left its 1-year and 5-year prime loan rates unchanged, widely in line with expectations.

VIETNAM ECONOMY

4.67%

1D (bps) -9

YTD (bps) -30

7.40%

3.97%

1D (bps) -3

YTD (bps) -82

4.13%

YTD (bps) -77

23,900

1D (%) -0.42%

YTD (%) 0.59%

26,074

1D (%) -0.38%

YTD (%) 1.62%

3,529

1D (%) -0.31%

YTD (%) 1.26%

After increasing by VND250 last week, the USD price at commercial banks in the early trading session of this week (February 20) turned to decrease sharply.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi compensation and resettlement of Ring Road 4 is more than VND13 trillion;

- The Ministry of Transport accelerates the Mai Son - 45 National Highway 45;

- Hung Yen invests in electricity grid infrastructure to serve industrial parks and large-scale urban areas;

- Americans owe a record $16.9 trillion;

- Analysts: BOJ will end ultra-easy monetary policy this year;

- United Nations Secretary-General Antonio Guterres urged more investment in Africa.

VN30

BANK

93,800

1D 0.86%

5D 0.32%

Buy Vol. 1,907,051

Sell Vol. 1,553,009

47,200

1D 3.06%

5D 6.31%

Buy Vol. 2,561,846

Sell Vol. 3,142,921

30,450

1D 2.70%

5D 4.46%

Buy Vol. 7,063,571

Sell Vol. 8,221,411

28,600

1D 2.88%

5D 7.52%

Buy Vol. 4,935,615

Sell Vol. 4,786,984

18,300

1D 5.78%

5D 7.65%

Buy Vol. 38,496,697

Sell Vol. 30,929,308

18,900

1D 4.42%

5D 5.00%

Buy Vol. 18,252,070

Sell Vol. 17,656,603

18,800

1D 1.90%

5D 4.16%

Buy Vol. 4,622,130

Sell Vol. 4,758,515

24,600

1D 3.14%

5D 6.96%

Buy Vol. 15,116,154

Sell Vol. 12,678,492

25,700

1D 5.33%

5D 4.90%

Buy Vol. 49,825,745

Sell Vol. 37,347,882

22,000

1D 2.33%

5D 8.91%

Buy Vol. 6,906,990

Sell Vol. 5,754,063

25,800

1D 4.03%

5D 7.95%

Buy Vol. 10,669,157

Sell Vol. 7,307,611

STB: Sacombank has applied new interest rate and simultaneously reduced sharply in many terms. For the form of savings deposit at the counter, the 36-month interest rate decreased from 9%/year to 8.65%/year, or 0.35% adjustment. Similarly, interest rate for 12-month term decreased by 0.5% to 8.4%/year. Interest rate for 6-month term was 8%/year, decreased 0.3%.

REAL ESTATE

12,450

1D 6.87%

5D -2.73%

Buy Vol. 50,499,749

Sell Vol. 36,313,277

86,000

1D 1.30%

5D 2.63%

Buy Vol. 157,865

Sell Vol. 131,739

11,700

1D 6.85%

5D 4.00%

Buy Vol. 18,224,469

Sell Vol. 11,569,543

NVL: Novaland added collateral for a loan of VND1,600 billion at MSB.

OIL & GAS

109,000

1D 1.68%

5D 2.93%

Buy Vol. 452,171

Sell Vol. 437,992

12,650

1D 2.02%

5D 8.12%

Buy Vol. 23,536,885

Sell Vol. 24,846,626

39,400

1D 2.07%

5D 3.96%

Buy Vol. 1,359,342

Sell Vol. 1,213,163

POW: According to the updated business results report, in January, PV POWER recorded total revenue of VND1,712 billion, fulfilling 85% of the monthly plan.

VINGROUP

54,100

1D 1.12%

5D 1.31%

Buy Vol. 2,901,272

Sell Vol. 2,606,240

45,200

1D 4.39%

5D 1.80%

Buy Vol. 11,100,276

Sell Vol. 6,328,141

29,350

1D 3.35%

5D 2.98%

Buy Vol. 4,834,077

Sell Vol. 5,138,645

VHM: On February 17, Vinhomes announced the transfer of all shares in Lang Van Company to Vingroup JSC. The transfer value is not specified.

FOOD & BEVERAGE

77,500

1D 1.97%

5D 2.92%

Buy Vol. 3,528,516

Sell Vol. 2,809,561

94,500

1D 3.50%

5D 1.72%

Buy Vol. 1,125,722

Sell Vol. 1,040,148

190,200

1D 1.66%

5D -0.89%

Buy Vol. 140,199

Sell Vol. 131,950

Experts predict that the F&B industry will have stronger growth from the recovery of global tourism in 2023.

OTHERS

51,200

1D 1.59%

5D 5.57%

Buy Vol. 1,122,936

Sell Vol. 1,080,814

102,600

1D 0.00%

5D -0.48%

Buy Vol. 390,592

Sell Vol. 328,989

82,800

1D 1.47%

5D 2.60%

Buy Vol. 2,604,062

Sell Vol. 2,307,623

44,300

1D 2.43%

5D 4.24%

Buy Vol. 4,101,773

Sell Vol. 3,720,363

15,450

1D 5.10%

5D 10.36%

Buy Vol. 4,792,840

Sell Vol. 3,856,559

20,750

1D 6.68%

5D 12.16%

Buy Vol. 47,089,013

Sell Vol. 35,859,662

21,900

1D 4.29%

5D 8.42%

Buy Vol. 45,427,388

Sell Vol. 47,317,786

HPG: According to the latest inform of the Vietnam Steel Association (VSA), in January 2023, with a production output of over 326,400 tons and a sales volume of over 304,200 tons, Hoa Phat Group has increased its market share of construction steel from about 35% by the end of 2022 to 36.05%, leading the domestic steel enterprises.

Market by numbers

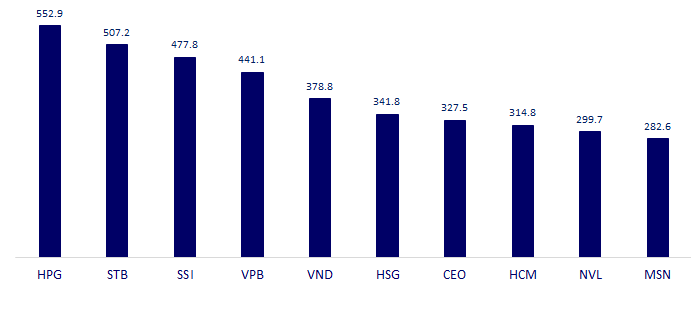

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

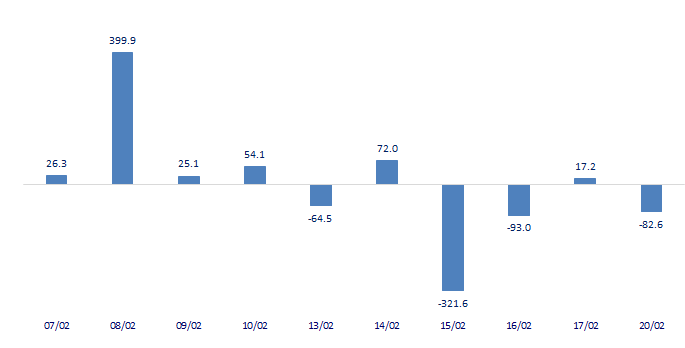

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

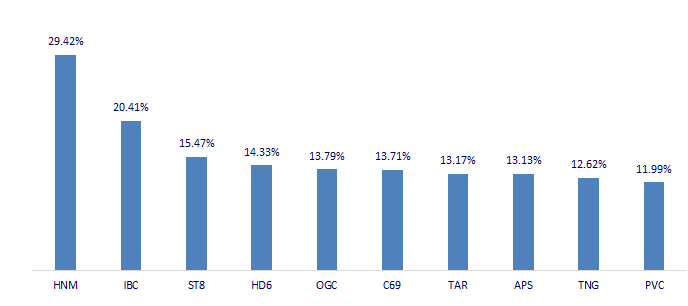

TOP INCREASES 3 CONSECUTIVE SESSIONS

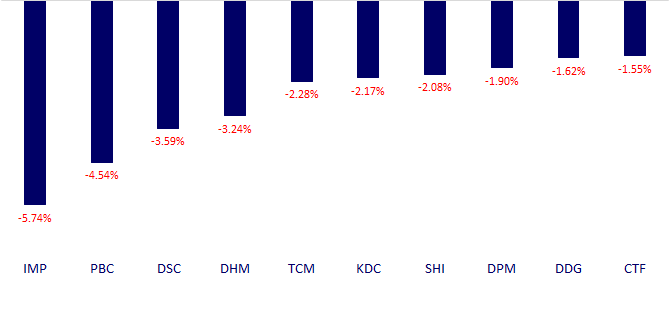

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.