Market brief 21/02/2023

VIETNAM STOCK MARKET

1,082.23

1D -0.41%

YTD 7.46%

1,080.90

1D -0.59%

YTD 7.53%

214.08

1D -0.81%

YTD 4.27%

78.18

1D -0.81%

YTD 9.11%

-47.43

1D 0.00%

YTD 0.00%

13,871.28

1D 1.58%

YTD 61.00%

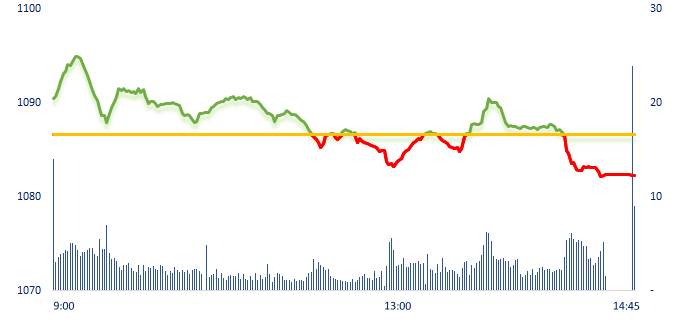

Vietnam stock market has started to decrease despite a very strong rally yesterday. The positivity of last breakout session made VN-Index opened in an uptrend and headed to the 1,100 point area in the morning. However, throughout the session, the market struggled strongly around reference before dropping sharply at the end of the session.

ETF & DERIVATIVES

18,400

1D 0.44%

YTD 6.17%

12,760

1D -0.47%

YTD 7.05%

13,240

1D 0.00%

YTD 6.09%

16,190

1D 1.12%

YTD 15.23%

15,640

1D -0.38%

YTD 8.99%

23,530

1D 0.26%

YTD 5.04%

13,720

1D -1.79%

YTD 5.95%

1,067

1D -1.22%

YTD 0.00%

1,073

1D -0.84%

YTD 0.00%

1,077

1D -0.84%

YTD 0.00%

1,076

1D -1.09%

YTD 0.00%

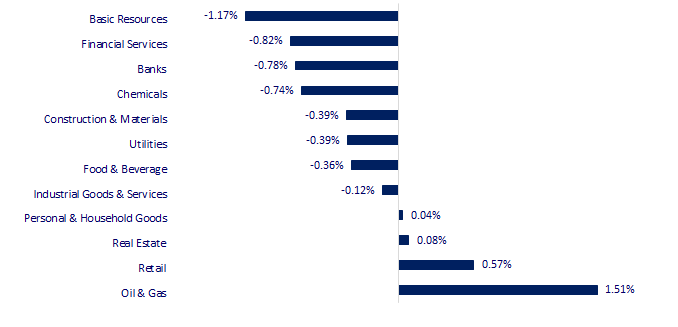

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

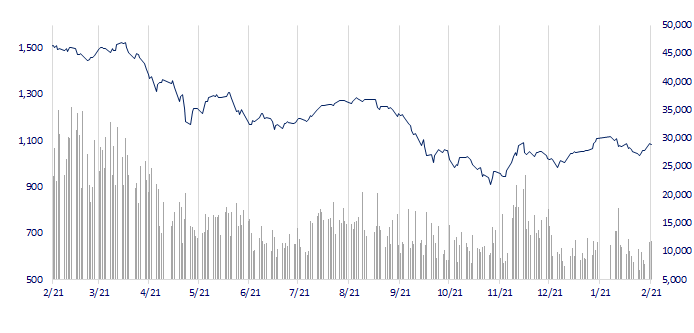

VNINDEX (12M)

GLOBAL MARKET

27,473.10

1D -0.21%

YTD 5.28%

3,306.52

1D 0.49%

YTD 7.03%

2,458.96

1D 0.16%

YTD 9.95%

20,529.49

1D -1.71%

YTD 3.78%

3,306.86

1D -0.06%

YTD 1.71%

1,667.63

1D 0.60%

YTD -0.16%

83.19

1D -0.41%

YTD -3.17%

1,844.35

1D -0.28%

YTD 0.99%

Asia-Pacific markets were mixed on Tuesday as investors await regional private surveys for factory activity. Hang Seng (Hong Kong) and Nikkei 225 (Japan) went down 1.71% and 0.21%, respectively. In contrast, China and Korea stock market increased for the positive results from the end of Zero Covid policy.

VIETNAM ECONOMY

4.58%

1D (bps) -9

YTD (bps) -39

7.40%

4.03%

1D (bps) 6

YTD (bps) -76

4.17%

1D (bps) 5

YTD (bps) -73

23,888

1D (%) -0.05%

YTD (%) 0.54%

26,001

1D (%) -0.19%

YTD (%) 1.33%

3,517

1D (%) -0.42%

YTD (%) 0.92%

SBV extended its withdraw activity on the interbank market in the first trading session of the week (February 20). Specifically, SBV has issued a total of VND35,000 billion of new bills, attracting the corresponding amount of money; while only VND7,000 billion of previously issued bills matured.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Prime Minister requested to disburse at least VND675,000 billion of public investment capital in 2023;

- The Ministry of Planning and Investment proposes to keep the Petroleum Stabilization Fund;

- Ministry of Home Affairs: An increase of 20.8% of the base salary is necessary;

- European central bank loss era returns after a decade;

- Russia's economy shrank 2.1% last year, less than the forecast;

- IMF: Asian central banks may have to continue raising interest rates.

VN30

BANK

94,200

1D 0.43%

5D 1.84%

Buy Vol. 1,164,167

Sell Vol. 1,272,309

46,250

1D -2.01%

5D 6.57%

Buy Vol. 1,750,192

Sell Vol. 2,361,406

29,850

1D -1.97%

5D 4.01%

Buy Vol. 4,833,695

Sell Vol. 7,272,144

28,400

1D -0.70%

5D 5.77%

Buy Vol. 4,149,054

Sell Vol. 7,691,837

17,800

1D -2.73%

5D 6.59%

Buy Vol. 31,949,920

Sell Vol. 36,510,683

18,600

1D -1.59%

5D 4.20%

Buy Vol. 13,372,655

Sell Vol. 22,905,151

19,000

1D 1.06%

5D 7.65%

Buy Vol. 4,785,838

Sell Vol. 6,091,676

24,800

1D 0.81%

5D 5.53%

Buy Vol. 21,733,920

Sell Vol. 23,454,809

25,350

1D -1.36%

5D 3.89%

Buy Vol. 32,342,418

Sell Vol. 39,373,161

21,800

1D -0.91%

5D 6.34%

Buy Vol. 5,469,489

Sell Vol. 6,296,134

25,500

1D -1.16%

5D 6.92%

Buy Vol. 3,044,009

Sell Vol. 4,796,405

TCB: Techcombank's representative said that with a return on assets (ROA) ratio of 3.2%, Techcombank continues to maintain its leading position in the industry (based on Techcombank's 2022 business results announcement) in terms of performance and good asset management.

REAL ESTATE

12,850

1D 3.21%

5D 7.53%

Buy Vol. 50,037,652

Sell Vol. 54,329,796

85,500

1D -0.58%

5D 1.18%

Buy Vol. 212,416

Sell Vol. 167,978

11,700

1D 0.00%

5D 10.38%

Buy Vol. 15,028,153

Sell Vol. 15,671,060

BCM: Becamex TDC - a subsidiary of Becamex IDC would like to delay payment of interest on a bond lot of VND700 billion.

OIL & GAS

108,300

1D -0.64%

5D 2.56%

Buy Vol. 377,909

Sell Vol. 581,993

12,450

1D -1.58%

5D 5.06%

Buy Vol. 17,613,166

Sell Vol. 25,094,685

40,600

1D 3.05%

5D 6.84%

Buy Vol. 2,647,688

Sell Vol. 3,729,464

GAS: PGD - a subsidiary of PV GAS plans to halve its profit in 2023 compared to 2022.

VINGROUP

54,300

1D 0.37%

5D 2.65%

Buy Vol. 2,432,594

Sell Vol. 2,935,928

45,200

1D 0.00%

5D 5.73%

Buy Vol. 2,560,082

Sell Vol. 3,425,864

29,600

1D 0.85%

5D 5.71%

Buy Vol. 1,972,699

Sell Vol. 3,617,333

VIC: VinFast has just received one of the important licenses, allowing it to start building a USD4 billion assembly plant as planned in North Carolina (USA).

FOOD & BEVERAGE

77,200

1D -0.39%

5D 3.35%

Buy Vol. 1,477,200

Sell Vol. 2,427,025

93,800

1D -0.74%

5D 0.97%

Buy Vol. 509,337

Sell Vol. 773,300

190,500

1D 0.16%

5D 1.33%

Buy Vol. 200,009

Sell Vol. 156,813

VNM: Mr. Mai Quang Liem - younger brother of a member of the Board of Directors of VInamilk has just registered to sell 36,094 VNM shares from February 13 to March 10.

OTHERS

50,500

1D -1.37%

5D 2.85%

Buy Vol. 829,502

Sell Vol. 833,048

102,500

1D -0.10%

5D -0.29%

Buy Vol. 425,770

Sell Vol. 378,787

82,800

1D 0.00%

5D 2.48%

Buy Vol. 1,944,882

Sell Vol. 2,269,732

44,500

1D 0.45%

5D 4.71%

Buy Vol. 2,429,986

Sell Vol. 3,128,373

15,350

1D -0.65%

5D 8.48%

Buy Vol. 3,995,104

Sell Vol. 4,636,270

20,450

1D -1.45%

5D 8.20%

Buy Vol. 25,197,445

Sell Vol. 32,141,402

21,600

1D -1.37%

5D 4.85%

Buy Vol. 34,033,251

Sell Vol. 51,994,189

FPT: FPT Smart Cloud announced an innovative startup support program, focusing on supporting start-ups from February 17, 2023. The program supports businesses at various stages to become digital businesses.

Market by numbers

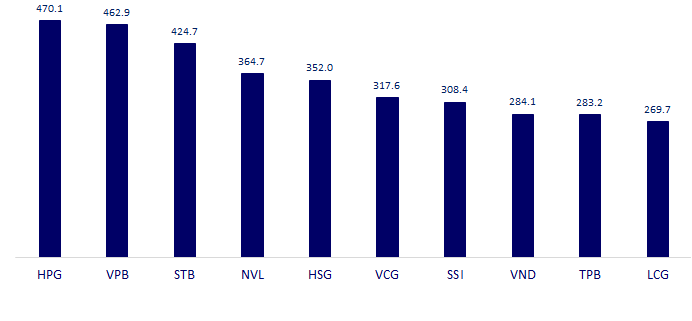

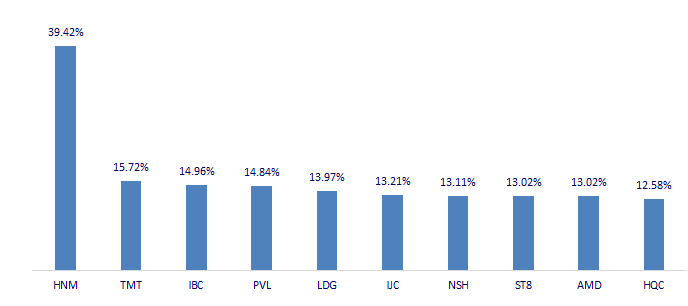

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

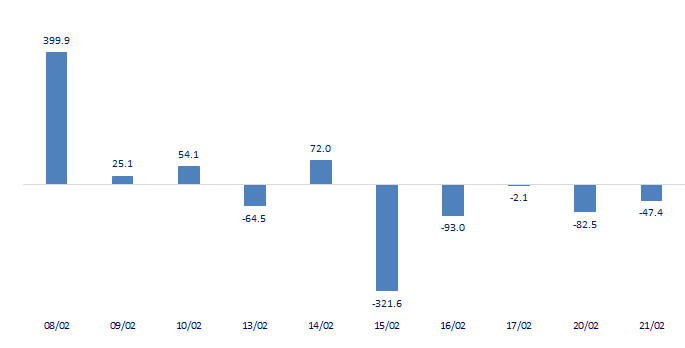

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

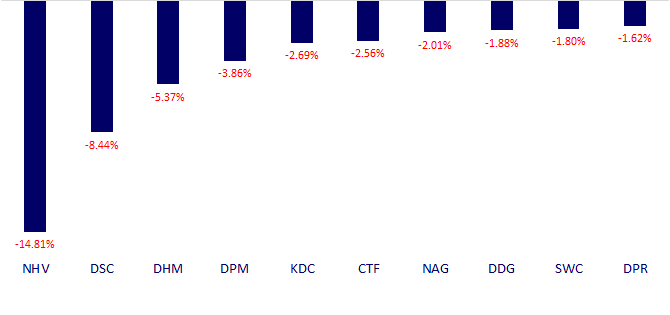

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.