Market Brief 27/02/2023

VIETNAM STOCK MARKET

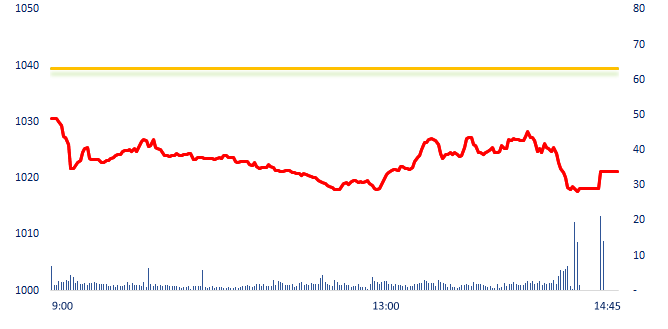

1,021.25

1D -1.76%

YTD 1.41%

1,011.46

1D -1.84%

YTD 0.62%

203.27

1D -1.95%

YTD -0.99%

75.85

1D -1.15%

YTD 5.86%

-658.70

1D 0.00%

YTD 0.00%

10,690.27

1D 39.23%

YTD 24.08%

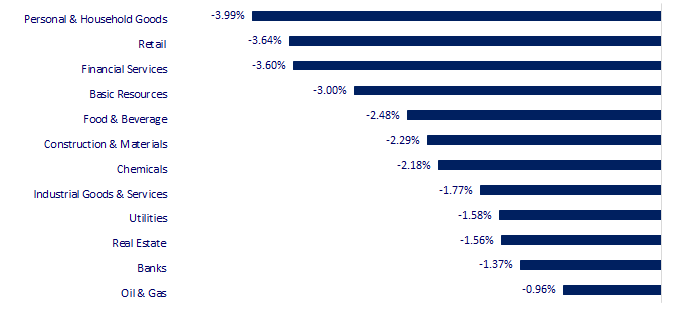

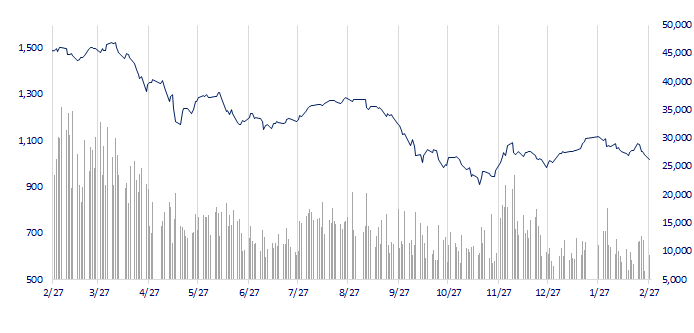

The market had the 5th consecutive drop. Red color almost covers the whole VN30 basket, only VJC and VNM can keep the green color. Retail, financial services and basic resources were the most negative sectors today, with typical stocks such as MSN ending at floor price, SSI (-3.9%), MWG (-3.8%), HPG (-3.4%).

ETF & DERIVATIVES

17,220

1D -2.82%

YTD -0.63%

11,920

1D -1.97%

YTD 0.00%

12,380

1D -2.21%

YTD -0.80%

15,430

1D -6.48%

YTD 9.82%

14,600

1D -1.68%

YTD 1.74%

21,870

1D -3.02%

YTD -2.37%

12,840

1D -1.83%

YTD -0.85%

1,001

1D -1.81%

YTD 0.00%

1,010

1D -1.95%

YTD 0.00%

1,005

1D -1.45%

YTD 0.00%

1,011

1D -0.88%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,423.96

1D -0.11%

YTD 5.09%

3,258.03

1D -0.28%

YTD 5.46%

2,402.64

1D -0.87%

YTD 7.43%

19,958.00

1D -0.26%

YTD 0.89%

3,263.24

1D -0.58%

YTD 0.37%

1,627.35

1D -0.41%

YTD -2.57%

82.36

1D -0.45%

YTD -4.13%

1,818.15

1D -0.07%

YTD -0.44%

Asian shares hit two-month lows on Monday as markets were forced to price in ever-loftier peaks for U.S. and European interest rates. China's blue chips (.CSI300) were off 0.2% while there is a survey on China manufacturing and the National People's Congress kicks off at the weekend and will see new economic policy targets and policies, as well as a reshuffling of government officials.

VIETNAM ECONOMY

5.83%

1D (bps) -19

YTD (bps) 86

7.40%

4.05%

1D (bps) 5

YTD (bps) -74

4.25%

1D (bps) -4

YTD (bps) -65

24,035

1D (%) 0.27%

YTD (%) 1.16%

25,609

1D (%) -0.94%

YTD (%) -0.19%

3,498

1D (%) 0.20%

YTD (%) 0.37%

The USD started to decline in the week of February 20-24, when the SBV increased net withdrawal of long-term liquidity and the Vnibor increased again. After the decline in the first half of February, the interest rate gap between VND and USD in the interbank market narrowed rapidly, especially in short terms. The swap point narrowed, even entering the negative zone, affecting the USD/VND exchange rate.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Research to collect tolls via satellite, remove barricades;

- Vietnam is a fintech bright spot in the Asia-Pacific region;

- VEC committed to arrange VND758 billion to complete the Ben Luc - Long Thanh expressway;

- Bloomberg: The dollar has passed its peak and will begin a multi-year bearish cycle;

- German economy shrinks by more than expected;

- Chinese smartphone giant Xiaomi takes aim at Samsung and Apple with latest USD1,000 device.

VN30

BANK

92,800

1D -0.75%

5D -1.07%

Buy Vol. 1,565,942

Sell Vol. 993,659

44,250

1D -0.78%

5D -6.25%

Buy Vol. 1,701,652

Sell Vol. 1,417,991

27,550

1D -2.48%

5D -9.52%

Buy Vol. 2,990,913

Sell Vol. 3,302,132

27,000

1D -0.92%

5D -5.59%

Buy Vol. 4,702,275

Sell Vol. 3,717,074

17,000

1D -0.87%

5D -7.10%

Buy Vol. 21,081,730

Sell Vol. 16,769,216

17,250

1D -2.54%

5D -8.73%

Buy Vol. 15,275,778

Sell Vol. 12,490,666

16,900

1D -3.43%

5D -10.11%

Buy Vol. 3,516,370

Sell Vol. 2,838,688

23,250

1D -1.06%

5D -5.49%

Buy Vol. 7,096,332

Sell Vol. 6,463,056

23,600

1D -2.88%

5D -8.17%

Buy Vol. 29,107,222

Sell Vol. 26,697,049

20,550

1D -2.14%

5D -6.59%

Buy Vol. 3,652,017

Sell Vol. 4,483,782

24,250

1D -1.42%

5D -6.01%

Buy Vol. 5,512,171

Sell Vol. 4,617,514

TCB: Debt restructuring for customers affected by Covid-19 in 2020-2021 was positive, helping TCB to reverse some significant provisions in the past year. Specifically, debt restructuring under this program by the end of 2022 is only at VND400 billion, equivalent to 0.1% of TCB's total outstanding loans, a sharp decrease compared to VND1,900 billion (0.5%) at the beginning of the year. This is also one of the reasons why TCB's provision expenses for credit losses in 2022 decreased by about 27% compared to 2021, to VND1,936 billion.

REAL ESTATE

10,750

1D -5.70%

5D -13.65%

Buy Vol. 24,861,995

Sell Vol. 28,918,045

83,400

1D -0.83%

5D -3.02%

Buy Vol. 160,729

Sell Vol. 137,027

10,200

1D -3.32%

5D -12.82%

Buy Vol. 9,496,905

Sell Vol. 7,790,803

NVL: Bondholder Dallas Vietnam Gamma Ltd. agreed to swap bonds for shares of NVL's subsidiaries company for the cancellation of a corresponding number of bonds and warrants.

OIL & GAS

104,000

1D -2.35%

5D -4.59%

Buy Vol. 511,085

Sell Vol. 548,845

12,000

1D 0.00%

5D -5.14%

Buy Vol. 13,572,321

Sell Vol. 12,885,406

37,050

1D -1.72%

5D -5.96%

Buy Vol. 1,548,419

Sell Vol. 1,127,742

The IEA forecasts about USD470 billion in upstream investment will be spent each year through 2030, up 50% more than in recent years, the oil and gas drilling market will benefit.

VINGROUP

52,500

1D -0.76%

5D -2.96%

Buy Vol. 2,227,014

Sell Vol. 3,264,939

40,900

1D -0.24%

5D -9.51%

Buy Vol. 7,026,191

Sell Vol. 6,532,026

25,750

1D -2.83%

5D -12.27%

Buy Vol. 3,240,221

Sell Vol. 2,445,990

VIC: VinFast reduced the battery rental price by more than 50% for first customers in California.

FOOD & BEVERAGE

75,200

1D 0.67%

5D -2.97%

Buy Vol. 1,944,890

Sell Vol. 2,196,138

79,900

1D -6.98%

5D -15.45%

Buy Vol. 1,190,592

Sell Vol. 1,297,922

185,300

1D -1.96%

5D -2.58%

Buy Vol. 116,201

Sell Vol. 152,772

MSN: Masan aims to 10,000 Point of Life stores within the next 5 years from the current 3,600 stores.

OTHERS

48,200

1D -1.43%

5D -5.86%

Buy Vol. 734,520

Sell Vol. 772,431

98,500

1D 2.39%

5D -4.00%

Buy Vol. 400,881

Sell Vol. 271,254

80,300

1D -0.62%

5D -3.02%

Buy Vol. 1,852,977

Sell Vol. 1,669,419

40,500

1D -3.80%

5D -8.58%

Buy Vol. 3,221,693

Sell Vol. 3,964,164

13,950

1D -2.45%

5D -9.71%

Buy Vol. 2,826,049

Sell Vol. 2,142,581

18,250

1D -3.95%

5D -12.05%

Buy Vol. 27,332,668

Sell Vol. 23,696,334

20,100

1D -3.37%

5D -8.22%

Buy Vol. 54,649,485

Sell Vol. 50,611,787

FPT: In the first 2 months of the year, the BOD estimated that the value of new contracts in the technology segment increased by 30% over the same period. Management aims that FPT's digital transformation revenue will increase by more than 35% compared to 2022 and account for 43%-44% of total software export revenue in 2023, led by new technologies such as: cloud, AI & big data analytics and robotic process automation.

Market by numbers

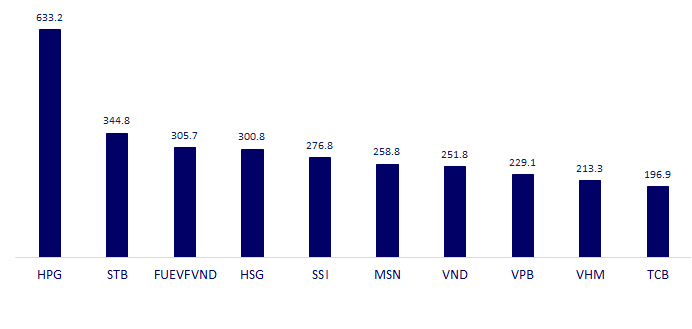

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

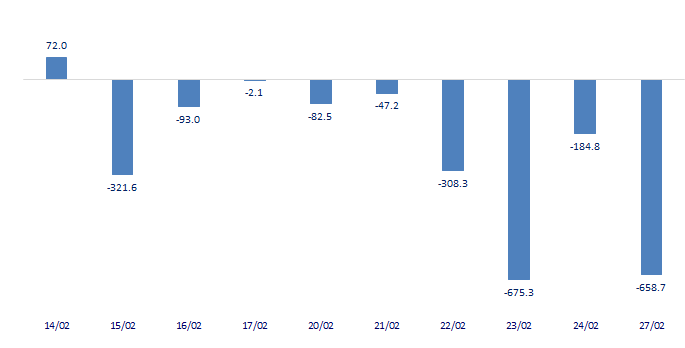

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

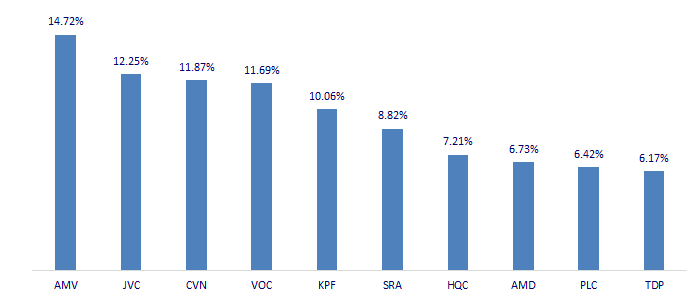

TOP INCREASES 3 CONSECUTIVE SESSIONS

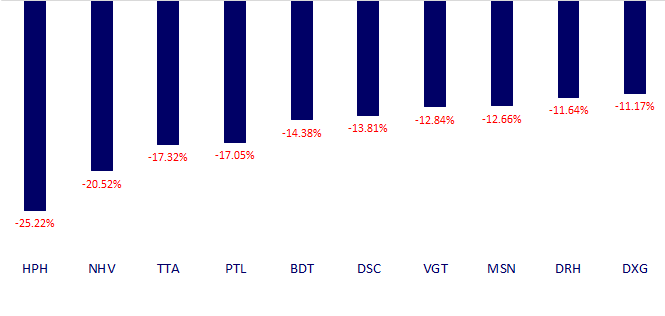

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.