Market brief 07/03/2023

VIETNAM STOCK MARKET

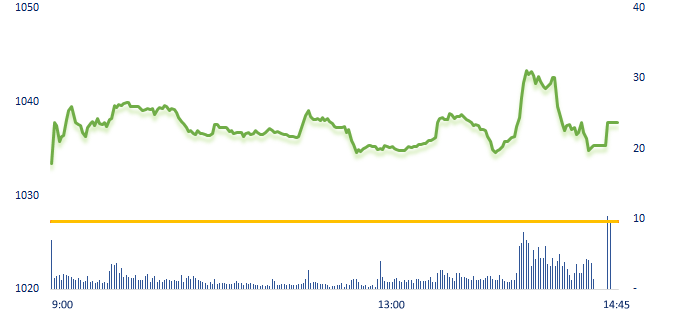

1,037.84

1D 1.04%

YTD 3.05%

1,027.16

1D 1.27%

YTD 2.19%

207.50

1D 0.46%

YTD 1.07%

76.17

1D 0.22%

YTD 6.31%

206.95

1D 0.00%

YTD 0.00%

9,168.50

1D 16.68%

YTD 6.41%

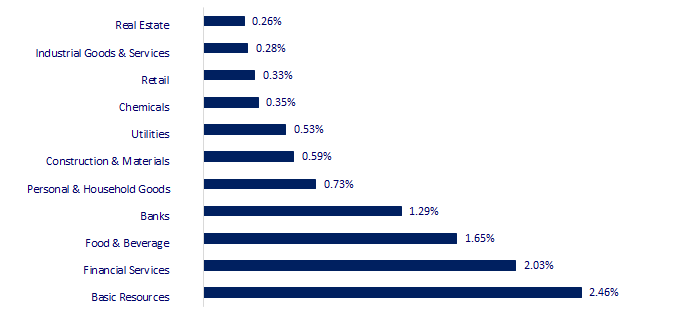

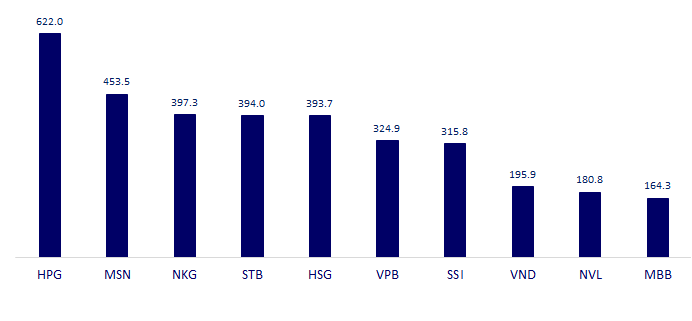

With Decree 8 on issued corporate bonds to support real estate businesses, market sentiment showed positive signs from the beginning of the session. Basic resources, securities and food and beverage are the 3 most active sectors in the market today with some typical stocks such as MSN(+5.2%), SSI(+3.5%), HPG(+3.4%),..

ETF & DERIVATIVES

17,450

1D 0.87%

YTD 0.69%

12,090

1D 1.17%

YTD 1.43%

12,610

1D 1.53%

YTD 1.04%

16,400

1D 5.81%

YTD 16.73%

14,860

1D 0.95%

YTD 3.55%

21,900

1D 0.55%

YTD -2.23%

13,010

1D 0.85%

YTD 0.46%

1,024

1D 1.98%

YTD 0.00%

1,024

1D 1.90%

YTD 0.00%

1,024

1D 1.89%

YTD 0.00%

1,028

1D 1.77%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

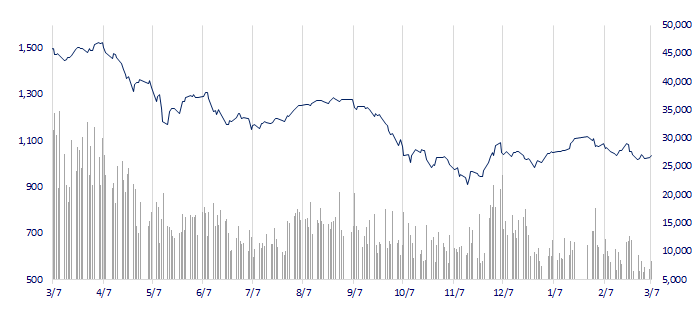

VNINDEX (12M)

GLOBAL MARKET

28,309.16

1D 0.25%

YTD 8.49%

3,285.10

1D -1.11%

YTD 6.34%

2,463.35

1D 0.03%

YTD 10.15%

20,534.48

1D -0.33%

YTD 3.81%

3,245.27

1D 0.18%

YTD -0.19%

1,618.51

1D 0.72%

YTD -3.10%

86.05

1D -0.50%

YTD 0.16%

1,848.85

1D -0.15%

YTD 1.24%

Shares in Asia are mixed following listless trading on Wall Street, where stocks gave up most of their early gains to close little changed. Traders and investors in Asia are also looking to regain momentum lost on Monday in the wake of China’s disappointing National People’s Congress announcements at the weekend.

VIETNAM ECONOMY

6.08%

1D (bps) -14

YTD (bps) 111

7.40%

4.04%

1D (bps) -2

YTD (bps) -76

4.21%

1D (bps) -2

YTD (bps) -69

23,832

1D (%) 0.12%

YTD (%) 0.30%

25,947

1D (%) -0.10%

YTD (%) 1.12%

3,482

1D (%) 0.17%

YTD (%) -0.09%

The State Bank of Vietnam (SBV) Ho Chi Minh City branch has just sent an official document asking banks to remove difficulties and support businesses in 2023, including reducing loan interest rates.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Import and export plummeted, dragging down budget revenue;

- Metal mines in Vietnam have the third largest reserve in the world;

- Deputy Minister of Finance: Bringing investors back to the bond market;

- The risk of collateral debt crisis due to increased collateral debt obligations;

- El Nino phenomenon can make food prices more volatile;

- India: Per capita income doubled in 9 years;

VN30

BANK

91,900

1D 0.99%

5D -1.71%

Buy Vol. 1,277,217

Sell Vol. 1,690,861

46,900

1D 2.40%

5D 6.35%

Buy Vol. 2,439,902

Sell Vol. 3,083,127

29,000

1D 2.29%

5D 5.84%

Buy Vol. 4,193,145

Sell Vol. 5,724,593

27,100

1D -0.37%

5D 2.26%

Buy Vol. 3,054,141

Sell Vol. 4,891,859

17,400

1D 1.75%

5D 2.05%

Buy Vol. 24,426,606

Sell Vol. 24,826,865

17,400

1D 0.58%

5D 0.87%

Buy Vol. 13,082,154

Sell Vol. 12,702,068

18,500

1D 2.78%

5D 8.50%

Buy Vol. 4,816,128

Sell Vol. 5,626,624

23,500

1D 0.21%

5D 0.86%

Buy Vol. 3,636,143

Sell Vol. 4,295,756

25,000

1D 0.40%

5D 5.26%

Buy Vol. 27,954,249

Sell Vol. 30,283,623

20,600

1D 0.00%

5D 0.24%

Buy Vol. 3,240,235

Sell Vol. 4,795,164

24,500

1D 0.82%

5D 0.41%

Buy Vol. 8,482,349

Sell Vol. 7,772,958

19/27 banking stocks gained on March 7 with the strongest gainer of EIB(+6.8%). EIB shares increased dramatically with soaring liquidity. Nearly 4.9 million EIB shares were matched in the session, worth VND93 billion, up 173% compared to the 6/3 session. The next strong gainers were mainly small banks. Among banking stocks in the VN30 list, HDB gained the most with +2.8%, followed by BID (2.4%), CTG (2.3%), VPB (1.8%).

REAL ESTATE

10,850

1D -1.81%

5D 2.36%

Buy Vol. 26,215,746

Sell Vol. 37,515,026

84,000

1D 0.36%

5D 0.36%

Buy Vol. 115,982

Sell Vol. 111,743

11,300

1D 0.89%

5D 11.88%

Buy Vol. 12,370,426

Sell Vol. 17,712,613

NVL: Chairman Bui Thanh Nhon's wife wants to sell more than 3.6 million shares.

OIL & GAS

104,500

1D 0.77%

5D 0.97%

Buy Vol. 493,156

Sell Vol. 455,726

12,550

1D 0.80%

5D 3.72%

Buy Vol. 44,264,691

Sell Vol. 20,574,423

39,000

1D 0.26%

5D 4.56%

Buy Vol. 1,059,737

Sell Vol. 1,505,598

POW: PV Power held the signing ceremony of cooperation agreement with the College of Petroleum to jointly implement projects in the field of maintenance and repair of factories.

VINGROUP

52,700

1D 0.19%

5D 0.19%

Buy Vol. 2,118,839

Sell Vol. 2,828,245

42,300

1D 0.48%

5D 1.93%

Buy Vol. 2,528,717

Sell Vol. 3,688,851

26,600

1D 1.72%

5D -0.37%

Buy Vol. 3,400,697

Sell Vol. 3,733,702

VIC: A total of 6,032 VinFast VF 8 vehicles encountered errors related to the brake system.

FOOD & BEVERAGE

75,800

1D 1.07%

5D 0.40%

Buy Vol. 1,723,347

Sell Vol. 2,537,603

78,300

1D 5.24%

5D -4.51%

Buy Vol. 3,076,735

Sell Vol. 2,539,461

186,900

1D 1.03%

5D -0.07%

Buy Vol. 182,215

Sell Vol. 181,328

MSN: Masan has just approved the transfer of all shares owned in Masan MEATLife (MML) to Masan Agri, a member company of Masan.

OTHERS

48,300

1D 0.63%

5D -0.41%

Buy Vol. 357,924

Sell Vol. 490,344

97,100

1D 0.83%

5D -2.90%

Buy Vol. 380,033

Sell Vol. 371,484

78,800

1D 0.77%

5D -2.11%

Buy Vol. 1,630,096

Sell Vol. 1,395,036

39,700

1D 0.76%

5D -0.75%

Buy Vol. 2,638,353

Sell Vol. 2,877,278

14,400

1D 1.41%

5D 3.23%

Buy Vol. 1,867,336

Sell Vol. 1,741,347

19,400

1D 3.47%

5D 6.30%

Buy Vol. 28,136,359

Sell Vol. 31,986,974

21,100

1D 3.43%

5D 5.50%

Buy Vol. 49,036,281

Sell Vol. 57,010,952

MWG: On March 7, related to the case that F88 JSC was being investgated by the police, the representative of MWG said that it had sent a request to F88 to explain what was going on, and temporarily stop cooperating with this business.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

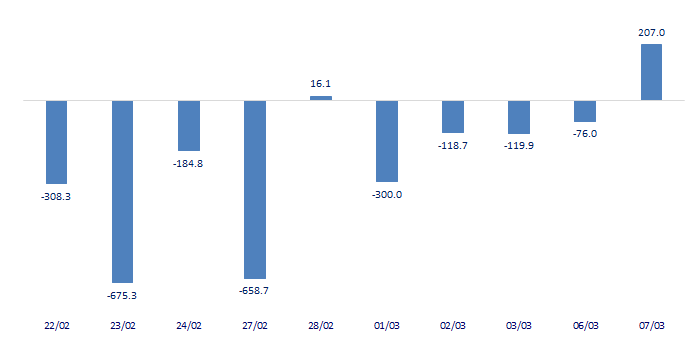

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

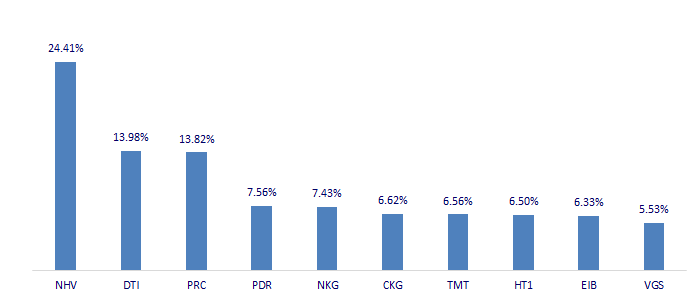

TOP INCREASES 3 CONSECUTIVE SESSIONS

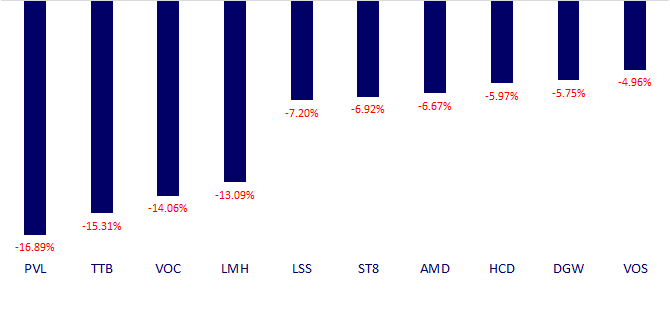

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.