Market Brief 17/03/2023

VIETNAM STOCK MARKET

1,045.14

1D -0.22%

YTD 3.78%

1,047.71

1D 0.07%

YTD 4.23%

204.47

1D 0.14%

YTD -0.41%

76.43

1D 0.54%

YTD 6.67%

730.77

1D 0.00%

YTD 0.00%

11,338.30

1D 7.47%

YTD 31.60%

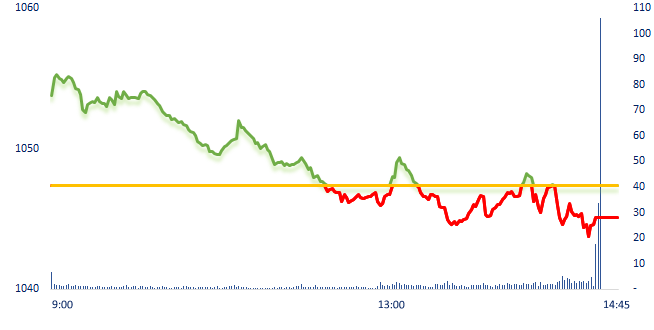

The market fluctuated in the portfolio restructuring session of ETFs , the trading volume in ATC session contributed more than 34% of the whole session. The oil and gas industry continued to have a negative session when Brent oil price broke through the bottom of 2022. Foreign investors net bought VND615 billion on HOSE but on the selling side, they sold strongly HPG VND400 billion, STB VND224 billion.

ETF & DERIVATIVES

17,800

1D 0.17%

YTD 2.71%

12,350

1D 0.16%

YTD 3.61%

13,100

1D 2.18%

YTD 4.97%

15,500

1D -0.26%

YTD 10.32%

15,160

1D 0.33%

YTD 5.64%

22,000

1D 0.23%

YTD -1.79%

13,300

1D 0.91%

YTD 2.70%

1,040

1D -0.38%

YTD 0.00%

1,041

1D -0.05%

YTD 0.00%

1,041

1D -1.00%

YTD 0.00%

1,045

1D -0.23%

YTD 0.00%

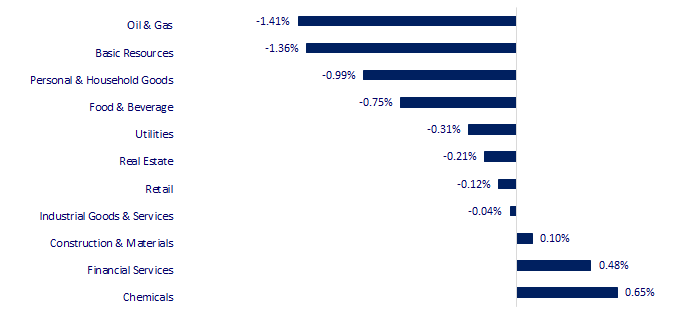

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

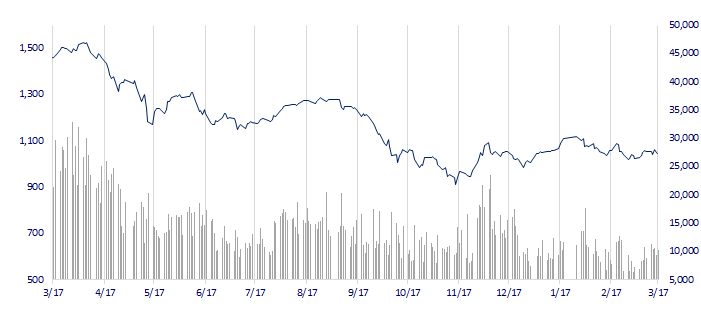

VNINDEX (12M)

GLOBAL MARKET

27,333.79

1D 1.20%

YTD 4.75%

3,250.55

1D 0.73%

YTD 5.22%

2,395.69

1D 0.75%

YTD 7.12%

19,518.59

1D 1.64%

YTD -1.33%

3,183.28

1D 0.88%

YTD -2.09%

1,563.67

1D 0.58%

YTD -6.39%

75.79

1D 1.49%

YTD -11.78%

1,935.20

1D 0.53%

YTD 5.97%

Asian stocks rebound strongly on Friday, ending a tumultuous week. Oil prices firmed on Friday after a meeting between Saudi Arabia and Russia, but were headed for their biggest weekly falls since December as a banking crisis rocked global financial and oil markets. Accordingly, OPEC+ chiefs from Saudi Arabia and Russia met in Riyadh on Thursday, and discussed efforts by the group to “promote market balance and stability."

VIETNAM ECONOMY

3.50%

1D (bps) -67

YTD (bps) -147

7.40%

3.86%

1D (bps) -3

YTD (bps) -93

3.93%

1D (bps) -7

YTD (bps) -97

23,760

1D (%) 0.08%

YTD (%) 0.00%

25,846

1D (%) 0.31%

YTD (%) 0.73%

3,495

1D (%) 0.23%

YTD (%) 0.29%

The USD has weakened, besides, the Euro has increased slightly after Credit Suisse bank received liquidity support. This has allayed concerns about the collapse of the banking system that could spread to Europe. In the domestic market, the USD/VND exchange rate doesn't seem to have much change today.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- EVN explains about stopping the purchase of 172 MW of solar power from Trung Nam;

- Quang Ninh will build a 130-hectare airport in Co To;

- Deposit interest rates continued to decline;

- ECB raises interest rates by 50 basis points;

- 11 banks pledge USD30 billion to rescue First Republic Bank;

- Treasury Secretary Yellen says not all uninsured deposits will be protected in future bank failures, SVB, Signature Bank are exceptions.

VN30

BANK

89,000

1D -2.20%

5D -3.37%

Buy Vol. 3,950,349

Sell Vol. 3,193,865

46,300

1D 0.11%

5D -1.80%

Buy Vol. 876,146

Sell Vol. 1,197,202

29,000

1D 0.17%

5D -0.68%

Buy Vol. 1,976,997

Sell Vol. 3,468,711

26,650

1D -0.37%

5D -1.84%

Buy Vol. 2,561,572

Sell Vol. 4,039,011

19,700

1D 1.29%

5D 7.65%

Buy Vol. 33,842,309

Sell Vol. 30,329,451

17,450

1D 0.00%

5D -1.69%

Buy Vol. 11,861,706

Sell Vol. 12,864,862

18,500

1D 3.64%

5D 0.00%

Buy Vol. 4,833,214

Sell Vol. 6,091,202

25,300

1D 2.64%

5D 5.42%

Buy Vol. 18,467,242

Sell Vol. 17,338,117

25,050

1D 1.83%

5D -3.65%

Buy Vol. 56,671,292

Sell Vol. 37,842,647

20,950

1D 0.24%

5D 0.00%

Buy Vol. 7,114,778

Sell Vol. 6,116,394

24,350

1D -0.20%

5D -2.21%

Buy Vol. 2,726,661

Sell Vol. 4,281,496

By the end of 2022, Vietcombank continued to lead the banking system for the 5th consecutive year, with profits far ahead of the two banks in the group: BIDV (VND23,058 billion) and VietinBank (VND21,113 billion). With the above results, VCB's ROE ratio is nearly 24.2%, much higher than BIDV (19.4%) and VietinBank (16.8%). In terms of asset quality, Vietcombank has the lowest NPL ratio in the Big3 group, at 0.64% of outstanding loans. This figure at VietinBank and BIDV is 1.24% and 1.16%, respectively.

REAL ESTATE

11,500

1D 3.14%

5D 7.98%

Buy Vol. 28,653,948

Sell Vol. 38,224,677

82,400

1D 0.24%

5D -1.67%

Buy Vol. 101,701

Sell Vol. 153,978

12,200

1D 0.00%

5D 3.83%

Buy Vol. 12,616,792

Sell Vol. 14,592,905

NVL: Mr. Dennis Ng Teck Yow has been appointed general director of local property firm Novaland. He previously worked as general director at Gamuda Land Vietnam.

OIL & GAS

103,700

1D -0.86%

5D -3.08%

Buy Vol. 465,724

Sell Vol. 401,061

13,400

1D 1.13%

5D 3.47%

Buy Vol. 25,407,588

Sell Vol. 26,863,541

35,400

1D -2.61%

5D -7.21%

Buy Vol. 9,600,697

Sell Vol. 6,568,858

GAS: Due to mistakes in information disclosure and lack of independent BOD members, PV Gas was fined VND270 million.

VINGROUP

53,200

1D -0.19%

5D 0.19%

Buy Vol. 4,169,009

Sell Vol. 4,482,866

43,350

1D -2.58%

5D 1.17%

Buy Vol. 6,571,359

Sell Vol. 6,757,285

29,500

1D 1.90%

5D 5.36%

Buy Vol. 8,154,118

Sell Vol. 12,160,414

VIC: The battery factory for VinFast is about to start operation in March with a scale of 24 million battery cells/year.

FOOD & BEVERAGE

74,500

1D -2.49%

5D -3.12%

Buy Vol. 4,788,588

Sell Vol. 4,513,928

83,500

1D -0.36%

5D -0.48%

Buy Vol. 1,703,275

Sell Vol. 2,147,600

192,000

1D 0.52%

5D 3.45%

Buy Vol. 508,730

Sell Vol. 814,726

MSN: In March, Masan paid on time VND3,000 billion of bonds advised by TCBS for issuance.

OTHERS

50,000

1D 2.88%

5D 1.63%

Buy Vol. 1,049,447

Sell Vol. 2,236,985

108,900

1D 6.76%

5D 8.25%

Buy Vol. 1,038,928

Sell Vol. 1,262,378

79,000

1D -0.25%

5D -0.63%

Buy Vol. 1,349,188

Sell Vol. 1,119,027

39,400

1D 0.00%

5D -0.88%

Buy Vol. 1,524,844

Sell Vol. 2,099,168

14,900

1D 0.34%

5D -0.67%

Buy Vol. 2,316,236

Sell Vol. 3,931,724

20,300

1D 0.74%

5D 2.53%

Buy Vol. 36,326,202

Sell Vol. 43,649,127

20,400

1D -2.16%

5D -4.23%

Buy Vol. 68,914,077

Sell Vol. 66,159,984

MWG: MWG plans for 2023 with net revenue of VND135,000 billion and profit after tax of VND4,200 billion, a slight increase of 1% and 2% respectively compared to the results of 2022.

Market by numbers

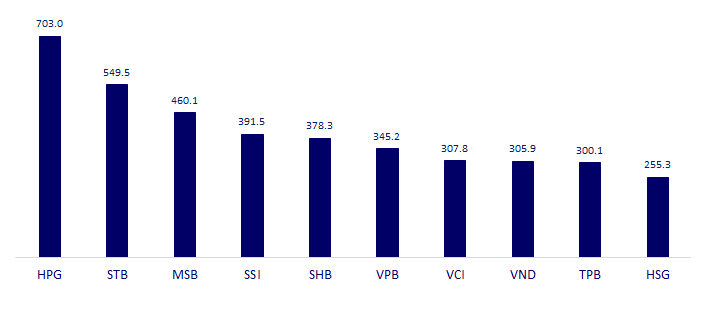

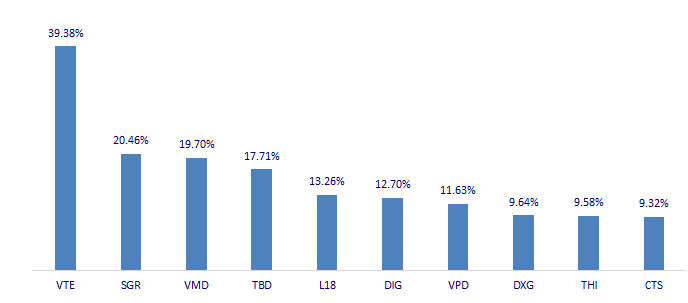

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

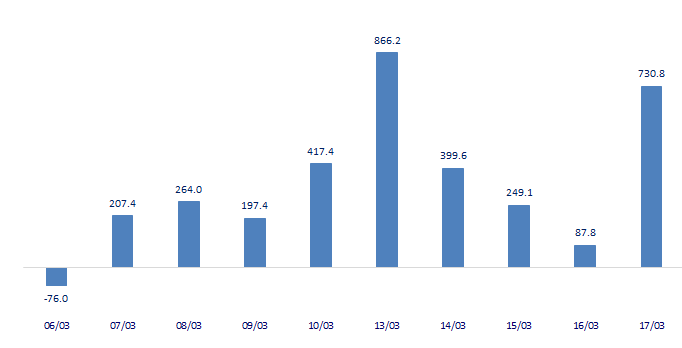

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

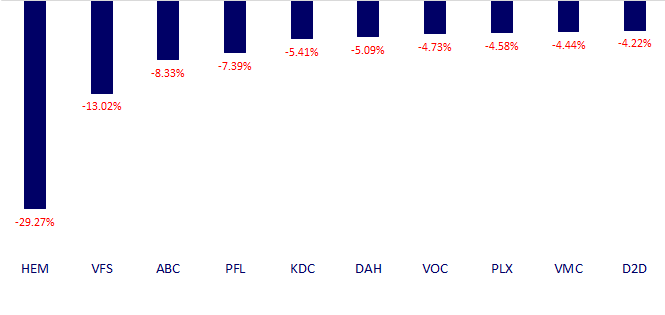

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.