Market brief 24/03/2023

VIETNAM STOCK MARKET

1,046.79

1D 0.16%

YTD 3.94%

1,051.42

1D 0.46%

YTD 4.60%

205.72

1D 1.18%

YTD 0.20%

76.17

1D 0.00%

YTD 6.31%

103.06

1D 0.00%

YTD 0.00%

10,691.65

1D 23.68%

YTD 24.09%

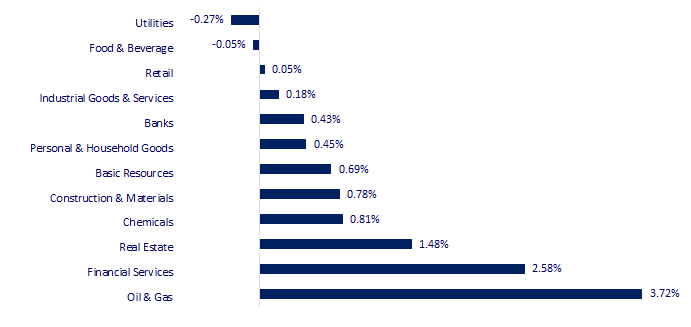

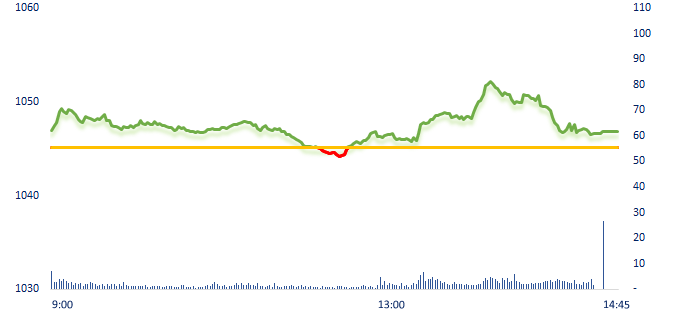

VN-Index opened the session in the green and fluctuated above the reference level until the end of the session. Oil and gas, financial services and real estates sectors were the most positive sectors today with leading stocks such as NVL, VHM, PLX,...

ETF & DERIVATIVES

17,970

1D 1.13%

YTD 3.69%

12,440

1D 0.97%

YTD 4.36%

12,910

1D 1.25%

YTD 3.45%

15,490

1D -1.34%

YTD 10.25%

15,400

1D 0.72%

YTD 7.32%

22,030

1D 0.96%

YTD -1.65%

13,200

1D 0.46%

YTD 1.93%

1,040

1D 0.86%

YTD 0.00%

1,039

1D 0.55%

YTD 0.00%

1,041

1D 0.64%

YTD 0.00%

1,043

1D 0.40%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

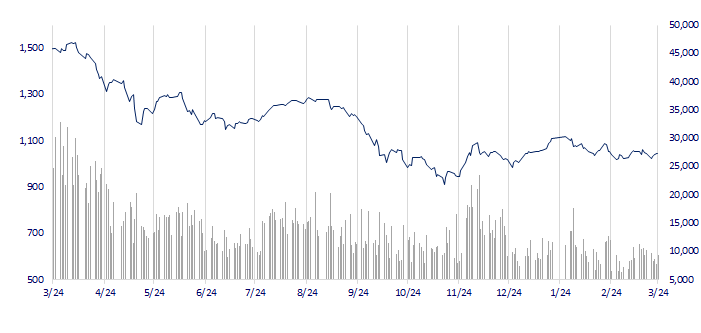

VNINDEX (12M)

GLOBAL MARKET

27,385.25

1D -0.13%

YTD 4.95%

3,265.65

1D -0.64%

YTD 5.71%

2,414.96

1D -0.39%

YTD 7.98%

19,915.68

1D -0.67%

YTD 0.68%

3,212.64

1D -0.20%

YTD -1.19%

1,591.85

1D -0.11%

YTD -4.70%

73.25

1D -2.57%

YTD -14.74%

1,999.60

1D 0.18%

YTD 9.50%

In contrast to the US stock market, at the end of the session, Asian markets mostly dropped as investors were still concerned about risks in the world banking system.

VIETNAM ECONOMY

1.20%

1D (bps) -27

YTD (bps) -377

7.40%

3.78%

1D (bps) 4

YTD (bps) -101

3.77%

1D (bps) -6

YTD (bps) -114

23,697

1D (%) 0.14%

YTD (%) -0.27%

25,965

1D (%) -0.74%

YTD (%) 1.19%

3,491

1D (%) -0.68%

YTD (%) 0.17%

The US dollar fell for 6 consecutive sessions, marking its longest losing streak in 2.5 years when the US Federal Reserve (Fed) is likely to stop raising interest rates.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Moody's upgraded credit ratings of 8 Vietnam banks;

- Hanoi expects to attract investment in supporting industries for the aviation;

- Directive of the Prime Minister on solutions to accelerate the allocation and disbursement of public investment capital;

- BoE continued to raise interest rate by 0.25%;

- Wood Mackenzie: China will account for nearly 40% of global oil demand growth in 2023;

- Reuters: There will be more failed banks in the next two years.

VN30

BANK

89,000

1D -1.87%

5D 0.00%

Buy Vol. 1,259,830

Sell Vol. 1,482,538

45,550

1D -0.76%

5D -1.62%

Buy Vol. 782,227

Sell Vol. 1,449,836

28,500

1D -0.70%

5D -1.72%

Buy Vol. 3,975,833

Sell Vol. 5,236,694

26,450

1D 0.95%

5D -0.75%

Buy Vol. 3,520,230

Sell Vol. 4,390,883

21,150

1D 0.48%

5D 7.36%

Buy Vol. 32,982,594

Sell Vol. 34,567,714

17,750

1D 2.01%

5D 1.72%

Buy Vol. 33,433,323

Sell Vol. 36,871,700

18,050

1D 2.27%

5D -2.43%

Buy Vol. 3,035,783

Sell Vol. 4,331,344

22,000

1D -0.23%

5D -3.51%

Buy Vol. 4,388,792

Sell Vol. 5,482,218

25,050

1D 0.20%

5D 0.00%

Buy Vol. 35,472,274

Sell Vol. 38,943,781

20,950

1D 1.45%

5D 0.00%

Buy Vol. 10,100,129

Sell Vol. 8,727,039

24,550

1D 0.20%

5D 0.82%

Buy Vol. 2,999,098

Sell Vol. 5,973,393

VPB: According to information from HoSE, Mr. Nguyen Thanh Binh, Deputy General Director of VPBank registered to buy 350,000 shares of VPB to serve financial needs. The transaction is expected to be executed by order matching method from March 27 to April 25, 2023. If successful, Mr.Binh will increase the number of shares of VPB from 572,364 to 922,364 shares, equivalent to an ownership rate of 0.01368%.

REAL ESTATE

11,900

1D 6.73%

5D 3.48%

Buy Vol. 55,795,956

Sell Vol. 43,464,648

82,000

1D 0.12%

5D -0.49%

Buy Vol. 226,488

Sell Vol. 143,791

12,350

1D 2.92%

5D 1.23%

Buy Vol. 13,242,181

Sell Vol. 18,375,141

NVL: Novaland successfully negotiated to extend 2 bond lots terms of NVLH2124002 and NVLH2224006 with a total value up to VND1,750 billion.

OIL & GAS

102,400

1D -0.10%

5D -1.25%

Buy Vol. 363,276

Sell Vol. 558,819

13,250

1D 0.38%

5D -1.12%

Buy Vol. 17,384,281

Sell Vol. 13,317,020

36,350

1D 1.39%

5D 2.68%

Buy Vol. 1,634,504

Sell Vol. 2,122,202

GAS: On March 2, Fitch Ratings announced the first international credit rating for PV GAS at 'BB' with a positive outlook.

VINGROUP

53,300

1D 0.95%

5D 0.19%

Buy Vol. 2,036,903

Sell Vol. 1,648,429

49,000

1D 2.08%

5D 13.03%

Buy Vol. 4,119,369

Sell Vol. 5,027,679

29,250

1D -0.17%

5D -0.85%

Buy Vol. 2,251,301

Sell Vol. 3,537,913

VIC: According to Ha Tinh province, it is expected that the VinES factory will complete the installation of the machinery system and put it into trial operation in March 2023.

FOOD & BEVERAGE

75,000

1D -0.40%

5D 0.67%

Buy Vol. 1,555,860

Sell Vol. 2,092,990

78,000

1D -1.27%

5D -6.59%

Buy Vol. 2,392,159

Sell Vol. 2,162,538

187,800

1D -0.11%

5D -2.19%

Buy Vol. 215,168

Sell Vol. 271,164

VNM: Although net profit in 2022 decreased compared to 2021, Vinamilk still expects to pay a dividend of 40% in cash.

OTHERS

48,500

1D -0.82%

5D -3.00%

Buy Vol. 707,998

Sell Vol. 599,901

106,200

1D 0.47%

5D -2.48%

Buy Vol. 412,682

Sell Vol. 520,263

78,600

1D 0.77%

5D -0.51%

Buy Vol. 1,411,095

Sell Vol. 872,688

37,950

1D 0.40%

5D -3.68%

Buy Vol. 3,264,953

Sell Vol. 3,954,315

14,800

1D 2.07%

5D -0.67%

Buy Vol. 5,427,679

Sell Vol. 6,614,782

20,450

1D 0.49%

5D 0.74%

Buy Vol. 32,487,398

Sell Vol. 43,313,073

20,400

1D 0.00%

5D 0.00%

Buy Vol. 36,488,087

Sell Vol. 36,592,627

FPT: Revenue and profit before tax in the first 2 months in 2023 of FPT Corporation reached VND7,295 billion and VND1,312 billion, respectively, up 19.6% and 19% over the same period.

Market by numbers

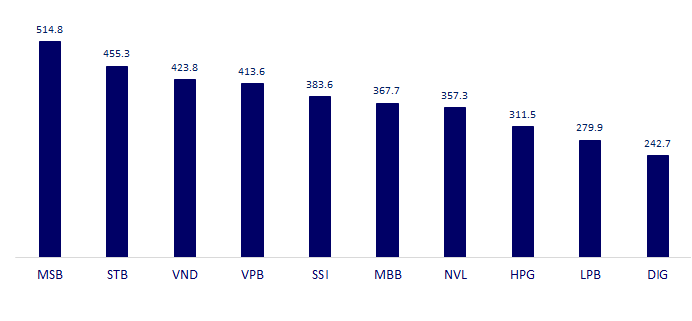

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

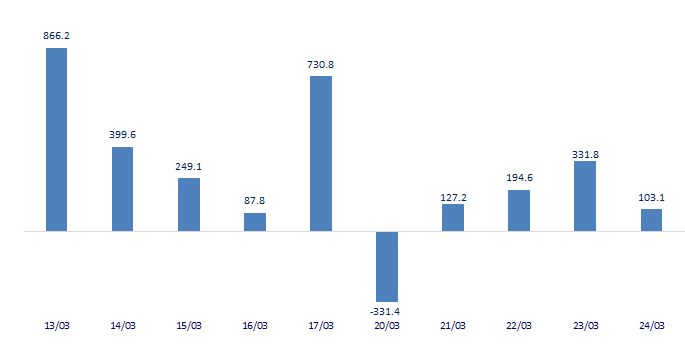

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

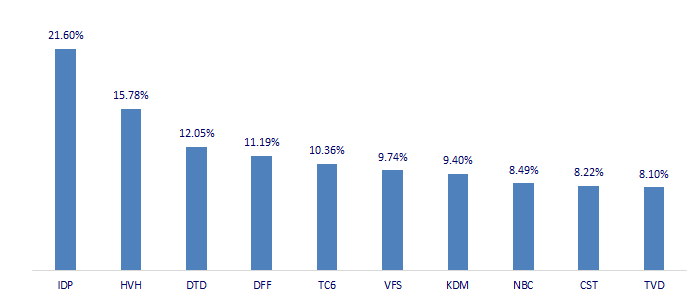

TOP INCREASES 3 CONSECUTIVE SESSIONS

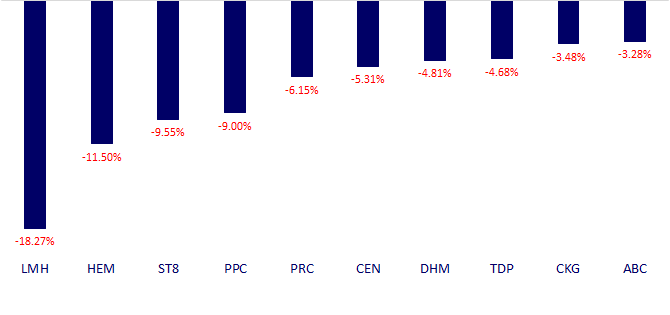

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.