Market Brief 27/03/2023

VIETNAM STOCK MARKET

1,052.25

1D 0.52%

YTD 4.48%

1,056.45

1D 0.48%

YTD 5.10%

206.67

1D 0.46%

YTD 0.66%

75.68

1D -0.64%

YTD 5.62%

174.62

1D 0.00%

YTD 0.00%

10,862.79

1D 1.60%

YTD 26.08%

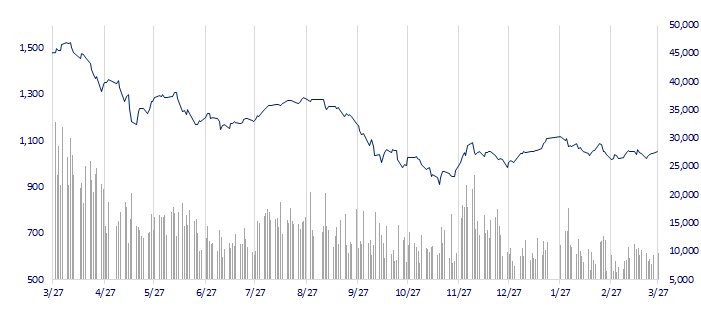

VNIndex started the session at the beginning of the week at a low level then extended its gain towards the end of the session. The market's gain today was mainly contributed by VCB. While on the other hand, VHM was the stock that dropped the most, affecting the VNIndex.

ETF & DERIVATIVES

17,980

1D 0.06%

YTD 3.75%

12,440

1D 0.00%

YTD 4.36%

12,890

1D -0.15%

YTD 3.29%

15,000

1D -3.16%

YTD 6.76%

15,430

1D 0.19%

YTD 7.53%

22,110

1D 0.36%

YTD -1.29%

13,180

1D -0.15%

YTD 1.78%

1,042

1D 0.19%

YTD 0.00%

1,042

1D 0.25%

YTD 0.00%

1,045

1D 0.38%

YTD 0.00%

1,047

1D 0.40%

YTD 0.00%

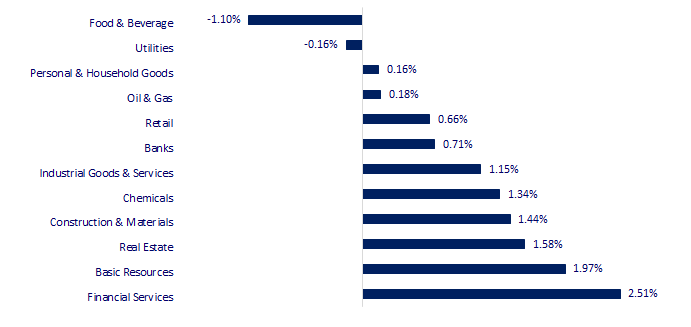

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,476.87

1D 0.33%

YTD 5.30%

3,251.40

1D -0.44%

YTD 5.25%

2,409.22

1D -0.24%

YTD 7.73%

19,567.69

1D -1.75%

YTD -1.08%

3,239.03

1D 0.82%

YTD -0.38%

1,593.37

1D 0.10%

YTD -4.61%

75.41

1D 1.11%

YTD -12.22%

1,969.15

1D -1.18%

YTD 7.83%

Gold prices slipped on Monday as a rebound in equities dented the metal's safe-haven appeal, while investors evaluated steps by authorities to calm fears of a crisis in the global banking system.

VIETNAM ECONOMY

1.16%

1D (bps) -4

YTD (bps) -381

7.40%

3.65%

1D (bps) -13

YTD (bps) -114

3.72%

1D (bps) -5

YTD (bps) -118

23,715

1D (%) 0.08%

YTD (%) -0.19%

25,751

1D (%) -1.17%

YTD (%) 0.36%

3,485

1D (%) -0.29%

YTD (%) 0.00%

With abundant liquidity, the average overnight interbank interest rate on March 27 fell to the lowest level since July 2022. Today's session is the 5th session in a row without any commercial banks in bidding on OMO channel.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- LEGO project in Binh Duong: Recruiting workers to be ready to operate from August 2024;

- Thai Binh 2 Thermal Power Plant is expected to operate at the end of the second quarter of 2023;

- MUJI revealed plans to expand in Vietnam because Vietnamese demand for high-value goods is strong;

- Taking advantage of the opportunity, Korea aims to surpass China in importing chip manufacturing equipment;

- First Citizens BancShares has agreed to buy back part of Silicon Valley Bank's assets;

- Deposits at small US banks fell to a record low.

VN30

BANK

91,000

1D 2.25%

5D 6.93%

Buy Vol. 1,580,595

Sell Vol. 1,413,152

46,000

1D 0.99%

5D 1.43%

Buy Vol. 1,534,233

Sell Vol. 1,214,445

28,750

1D 0.88%

5D 2.68%

Buy Vol. 2,707,315

Sell Vol. 3,219,208

26,500

1D 0.19%

5D 0.95%

Buy Vol. 3,130,146

Sell Vol. 3,804,539

21,250

1D 0.47%

5D 7.87%

Buy Vol. 43,179,870

Sell Vol. 55,792,902

17,950

1D 1.13%

5D 3.76%

Buy Vol. 18,575,741

Sell Vol. 21,611,291

18,200

1D 0.83%

5D 2.25%

Buy Vol. 2,175,350

Sell Vol. 3,344,794

21,900

1D -0.45%

5D 1.39%

Buy Vol. 3,975,730

Sell Vol. 5,732,591

25,500

1D 1.80%

5D 5.37%

Buy Vol. 39,753,161

Sell Vol. 33,887,223

21,100

1D 0.72%

5D 2.68%

Buy Vol. 9,335,357

Sell Vol. 8,526,209

24,450

1D -0.41%

5D 1.88%

Buy Vol. 4,670,693

Sell Vol. 5,437,354

VPB: On March 27, VPB officially issued a private placement of 15% of charter capital to SMBC Bank of Japan (belonging to SMFG financial group). With 15% of shares sold to SMBC, VPBank earned VND35.9 trillion and the deal officially made SMBC Group a strategic investor of VPBank.

REAL ESTATE

12,700

1D 6.72%

5D 14.41%

Buy Vol. 63,345,892

Sell Vol. 38,733,362

82,200

1D 0.24%

5D 0.74%

Buy Vol. 229,042

Sell Vol. 137,965

12,600

1D 2.02%

5D 6.78%

Buy Vol. 15,154,210

Sell Vol. 12,907,068

NVL: Shareholders have approved the plan to offer more than 2.9 billion shares of NVL, including more than 975 million common shares, 1.95 billion shares to existing shareholders at a ratio of 1:1.

OIL & GAS

102,000

1D -0.39%

5D -0.97%

Buy Vol. 187,312

Sell Vol. 336,707

13,300

1D 0.38%

5D 3.50%

Buy Vol. 16,471,971

Sell Vol. 16,483,052

35,700

1D -1.79%

5D 0.85%

Buy Vol. 1,563,792

Sell Vol. 1,969,087

On the world market, crude oil prices rebounded in this morning's session thanks to the easing of concerns about the banking crisis.

VINGROUP

53,300

1D 0.00%

5D 0.95%

Buy Vol. 1,448,101

Sell Vol. 1,870,100

48,400

1D -1.22%

5D 13.75%

Buy Vol. 2,738,623

Sell Vol. 3,853,615

29,300

1D 0.17%

5D 1.03%

Buy Vol. 2,986,331

Sell Vol. 4,340,441

VIC: GSM is expected to launch in Hanoi in April 2023, the plan will be present in at least 5 major cities in this year.

FOOD & BEVERAGE

74,600

1D -0.53%

5D 0.40%

Buy Vol. 2,267,614

Sell Vol. 2,445,653

76,700

1D -1.67%

5D -5.89%

Buy Vol. 3,295,302

Sell Vol. 2,702,518

186,000

1D -0.96%

5D -1.59%

Buy Vol. 119,055

Sell Vol. 130,938

VNM: Vinamilk spent VND1,198 billion on advertising in 2022 (equivalent to VND3.3 billion per day).

OTHERS

48,500

1D 0.00%

5D -1.02%

Buy Vol. 585,734

Sell Vol. 636,626

106,500

1D 0.28%

5D 0.85%

Buy Vol. 479,234

Sell Vol. 396,201

79,100

1D 0.64%

5D 1.93%

Buy Vol. 1,669,480

Sell Vol. 1,542,812

38,100

1D 0.40%

5D 0.00%

Buy Vol. 4,523,282

Sell Vol. 4,421,190

14,900

1D 0.68%

5D 3.83%

Buy Vol. 3,177,385

Sell Vol. 3,841,391

21,000

1D 2.69%

5D 7.69%

Buy Vol. 44,775,862

Sell Vol. 53,516,100

20,800

1D 1.96%

5D 4.00%

Buy Vol. 40,184,260

Sell Vol. 45,012,724

MWG: By the end of February 2023, the value of inventory at MWG had decreased by more than 30% compared to the end of the fourth quarter of 2022, to about VND17,987 billion. Total accumulated revenue of two chains The Gioi Di Dong and Dien May Xanh decreased by 32% over the same period.

Market by numbers

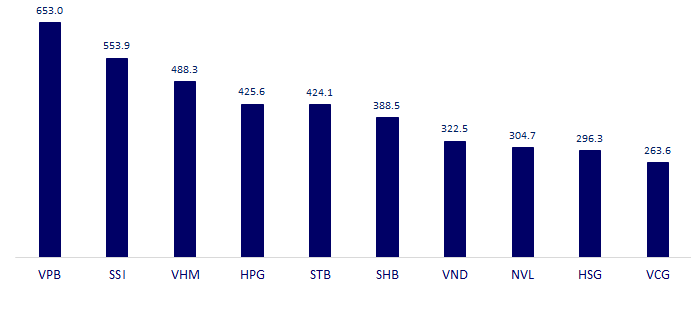

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

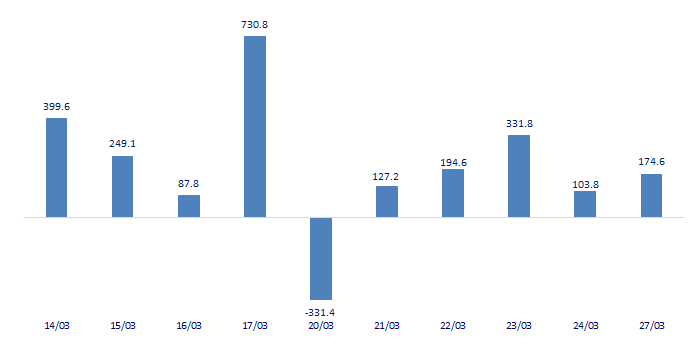

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

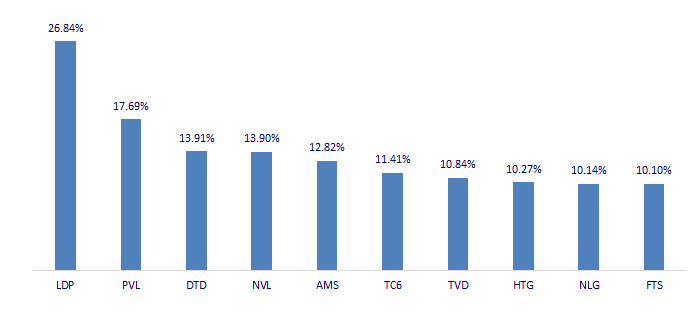

TOP INCREASES 3 CONSECUTIVE SESSIONS

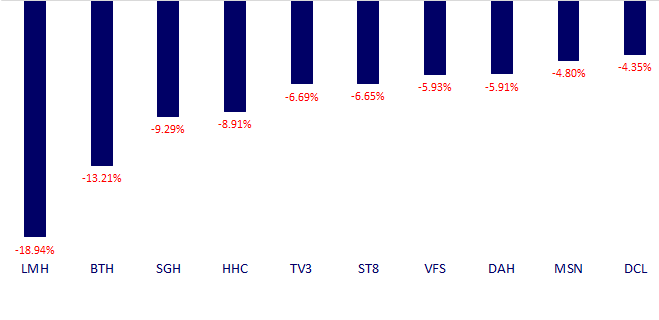

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.