Market Brief 28/03/2023

VIETNAM STOCK MARKET

1,054.29

1D 0.19%

YTD 4.69%

1,058.82

1D 0.22%

YTD 5.34%

205.76

1D -0.44%

YTD 0.22%

75.58

1D -0.13%

YTD 5.48%

140.02

1D 0.00%

YTD 0.00%

12,702.25

1D 16.93%

YTD 47.43%

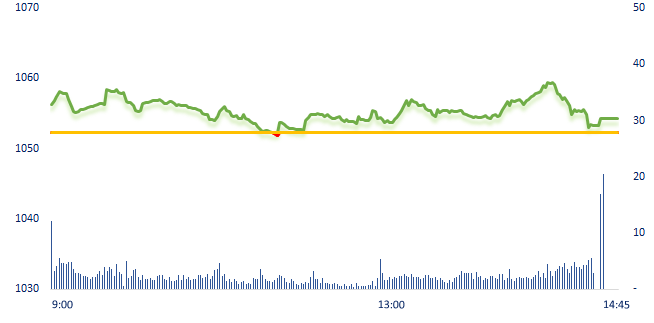

The market fluctuated in a narrow range, the index closed at near the lowest level of the session. The retail industry led the market, with contributions mainly from the duo MWG and MSN. TCB rose the most in VN30, due to the positive effect from the Draft Amendment of Circular 16 on regulations related to the purchase/sale of corporate bonds (CB) by credit institutions, helping to remove difficulties for the CB market.

ETF & DERIVATIVES

18,180

1D 1.11%

YTD 4.90%

12,500

1D 0.48%

YTD 4.87%

13,050

1D 1.24%

YTD 4.57%

15,200

1D 1.33%

YTD 8.19%

15,870

1D 2.85%

YTD 10.59%

22,250

1D 0.63%

YTD -0.67%

13,350

1D 1.29%

YTD 3.09%

1,044

1D 0.22%

YTD 0.00%

1,047

1D 0.51%

YTD 0.00%

1,048

1D 0.24%

YTD 0.00%

1,052

1D 0.40%

YTD 0.00%

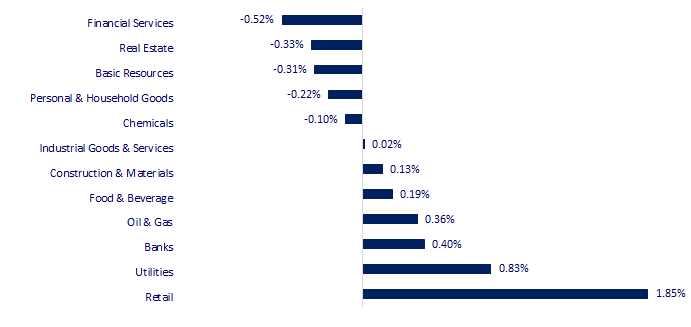

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

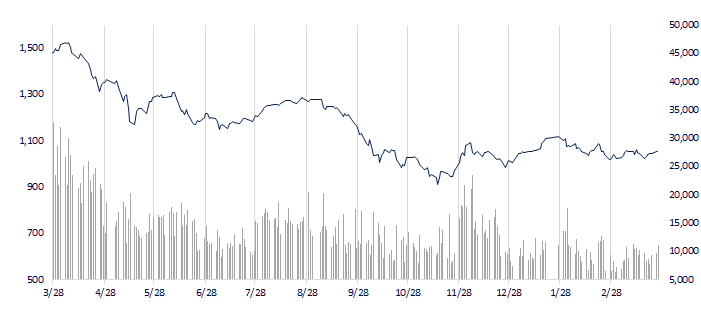

VNINDEX (12M)

GLOBAL MARKET

27,518.25

1D 0.15%

YTD 5.46%

3,245.38

1D -0.19%

YTD 5.05%

2,434.94

1D 1.07%

YTD 8.88%

19,784.65

1D 1.11%

YTD 0.02%

3,255.54

1D 0.51%

YTD 0.13%

1,606.91

1D 0.85%

YTD -3.80%

78.08

1D 0.59%

YTD -9.11%

1,975.75

1D -0.30%

YTD 8.19%

World gold prices edged lower on Tuesday as an improvement in risk appetite after efforts by regulators to allay fears over the global banking system slowed safe-haven inflows into bullion.

VIETNAM ECONOMY

1.08%

1D (bps) -8

YTD (bps) -389

7.40%

3.61%

1D (bps) -4

YTD (bps) -118

3.70%

1D (bps) -2

YTD (bps) -120

23,705

1D (%) 0.13%

YTD (%) -0.23%

25,879

1D (%) -1.03%

YTD (%) 0.86%

3,484

1D (%) 0.00%

YTD (%) -0.03%

According to the State Bank of Vietnam (SBV), credit growth as of March 9 was only 1.12% compared to the end of 2022. The credit growth slowing down is one of the leading factors to abundant system liquidity in recent times.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Chairman of FiinRatings: Amendment to Circular 16 has positive impact on corporate bond market;

- Increase construction time of Long Thanh airport terminal to 39 months;

- HCM City police raid Home Credit office;

- UN Security Council declines Russian request to probe Nord Stream blasts;

- China's industrial profits slump deepens on soft demand;

- Germany's largest strike in decades brings country to standstill.

VN30

BANK

91,800

1D 0.88%

5D 6.13%

Buy Vol. 1,356,808

Sell Vol. 1,599,533

46,000

1D 0.00%

5D 1.43%

Buy Vol. 1,100,699

Sell Vol. 1,352,460

28,900

1D 0.52%

5D 2.12%

Buy Vol. 3,399,106

Sell Vol. 4,134,629

27,550

1D 3.96%

5D 4.55%

Buy Vol. 15,660,342

Sell Vol. 12,572,838

21,000

1D -1.18%

5D 3.19%

Buy Vol. 57,585,161

Sell Vol. 66,262,139

18,000

1D 0.28%

5D 3.75%

Buy Vol. 23,253,947

Sell Vol. 26,151,593

18,150

1D -0.27%

5D 4.31%

Buy Vol. 3,514,865

Sell Vol. 4,696,705

21,850

1D -0.23%

5D 1.16%

Buy Vol. 3,826,290

Sell Vol. 5,588,101

25,400

1D -0.39%

5D 3.25%

Buy Vol. 31,548,055

Sell Vol. 41,714,128

21,150

1D 0.24%

5D 1.93%

Buy Vol. 13,447,155

Sell Vol. 11,498,507

24,450

1D 0.00%

5D 1.03%

Buy Vol. 11,300,239

Sell Vol. 12,489,236

TCB gained the most in the VN30 basket today, thanks to the impact of the draft amendment to Circular 16. Accordingly, thedraft amendment to Circular 16 on regulations related to the purchase/sale of corporate bonds by credit institutions is expected to be able to defuse the crisis in the current corporate bond market.

REAL ESTATE

12,600

1D -0.79%

5D 14.03%

Buy Vol. 58,028,417

Sell Vol. 68,710,179

82,300

1D 0.12%

5D 0.37%

Buy Vol. 237,639

Sell Vol. 136,363

12,450

1D -1.19%

5D 7.33%

Buy Vol. 11,274,290

Sell Vol. 14,211,044

NVL: NovaGroup wants to sell 38 million shares of NVL. If the transaction is successful, NovaGroup will reduce its ownership rate from 29.379% to 27.431%.

OIL & GAS

103,700

1D 1.67%

5D 0.48%

Buy Vol. 479,201

Sell Vol. 513,905

13,300

1D 0.00%

5D 0.76%

Buy Vol. 14,730,893

Sell Vol. 13,914,697

35,800

1D 0.28%

5D 3.17%

Buy Vol. 1,106,685

Sell Vol. 1,368,541

Brent oil prices turned sharply higher as investors became less concerned about the collapse of the global banking system.

VINGROUP

53,400

1D 0.19%

5D 1.14%

Buy Vol. 1,467,007

Sell Vol. 1,624,314

48,000

1D -0.83%

5D 5.73%

Buy Vol. 4,626,878

Sell Vol. 4,042,312

29,250

1D -0.17%

5D -0.68%

Buy Vol. 3,843,552

Sell Vol. 4,842,324

VHM: The market capitalization of VinHomes (VHM) increased by more than USD1 billion just a few days after the announcement of the sale of USD1.5 billion of assets to CapitaLand.

FOOD & BEVERAGE

74,400

1D -0.27%

5D 0.00%

Buy Vol. 2,416,644

Sell Vol. 2,724,162

77,600

1D 1.17%

5D -3.12%

Buy Vol. 2,817,809

Sell Vol. 2,662,825

186,000

1D 0.00%

5D 0.00%

Buy Vol. 120,675

Sell Vol. 117,962

MSN: In 2022, Wincommerce's net revenue fell 5% year-on-year, from VND30,900 billion in 2021 to VND29,369 billion.

OTHERS

48,500

1D 0.00%

5D -1.02%

Buy Vol. 426,933

Sell Vol. 621,560

106,400

1D -0.09%

5D 2.50%

Buy Vol. 387,835

Sell Vol. 432,463

79,200

1D 0.13%

5D 1.41%

Buy Vol. 1,968,082

Sell Vol. 1,651,341

39,100

1D 2.62%

5D 1.56%

Buy Vol. 9,091,887

Sell Vol. 7,115,826

14,800

1D -0.67%

5D 2.42%

Buy Vol. 5,234,654

Sell Vol. 6,977,333

20,800

1D -0.95%

5D 4.00%

Buy Vol. 31,103,358

Sell Vol. 46,185,064

20,700

1D -0.48%

5D 1.22%

Buy Vol. 28,239,056

Sell Vol. 37,774,644

MWG: MWG has supplemented its 2022 dividend statement with the rate of 1 share receiving VND500. This is the lowest dividend of MWG in recent years. At the peak in 2021, the company decided to pay a dividend of 10% in cash and 100% in shares.

Market by numbers

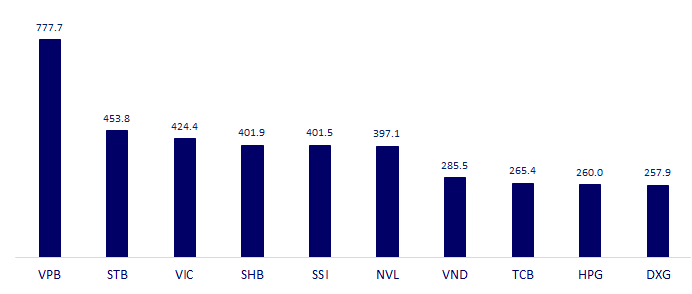

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

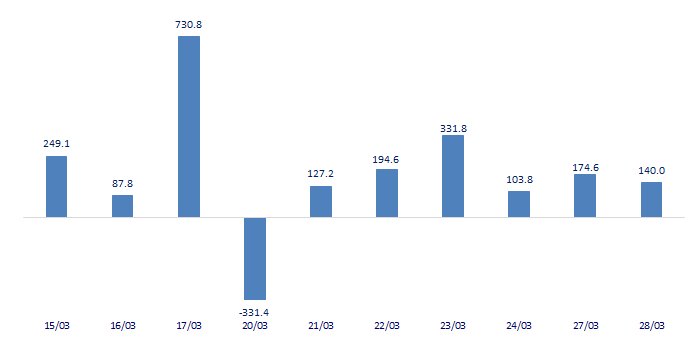

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

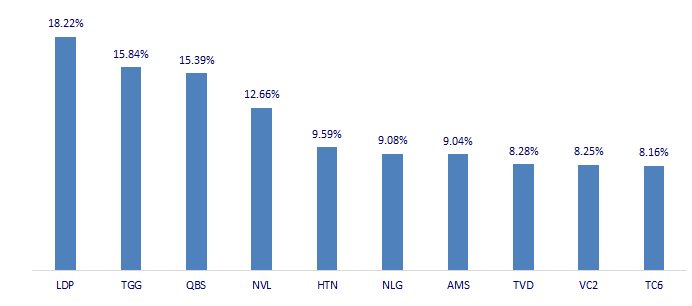

TOP INCREASES 3 CONSECUTIVE SESSIONS

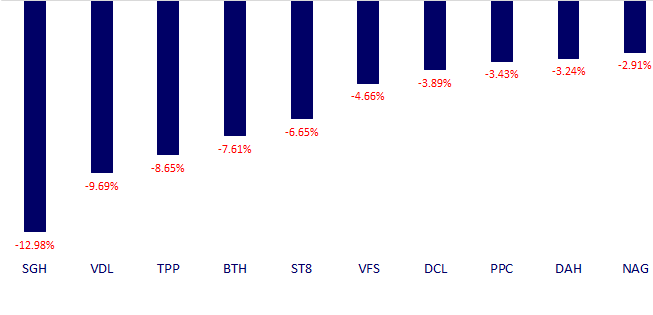

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.