Market Brief 29/03/2023

VIETNAM STOCK MARKET

1,056.33

1D 0.19%

YTD 4.89%

1,061.45

1D 0.25%

YTD 5.60%

205.59

1D -0.08%

YTD 0.14%

76.73

1D 1.52%

YTD 7.09%

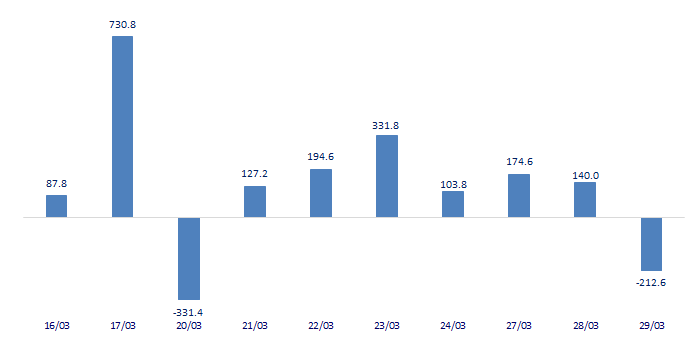

-212.60

1D 0.00%

YTD 0.00%

9,357.04

1D -26.34%

YTD 8.60%

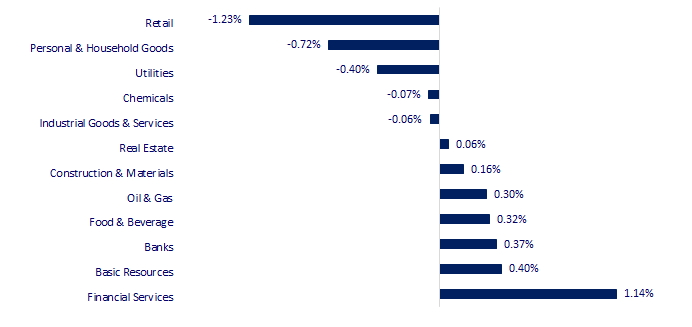

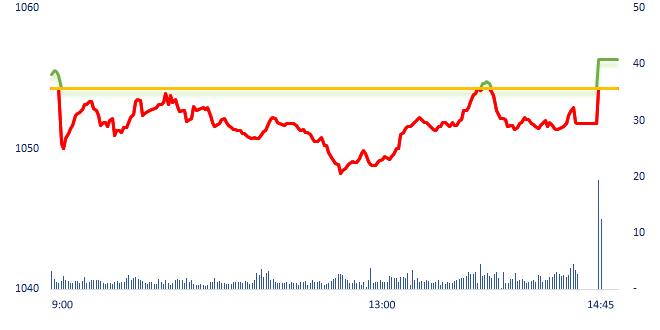

VCB was pulled at the end of the session, becoming the stock that contributed the most to the increase of VNIndex. On the other side, GAS dropped the most, putting pressure on VNIndex. The retail industry fell deeply, mainly from the duo MWG and FRT. The controversy related to Home Credit yesterday could be a negative factor for this retail stock duo.

ETF & DERIVATIVES

18,030

1D -0.83%

YTD 4.04%

12,500

1D 0.00%

YTD 4.87%

13,000

1D -0.38%

YTD 4.17%

15,430

1D 1.51%

YTD 9.82%

15,760

1D -0.69%

YTD 9.83%

22,260

1D 0.04%

YTD -0.63%

13,420

1D 0.52%

YTD 3.63%

1,044

1D 0.00%

YTD 0.00%

1,047

1D 0.00%

YTD 0.00%

1,048

1D 0.00%

YTD 0.00%

1,052

1D 0.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

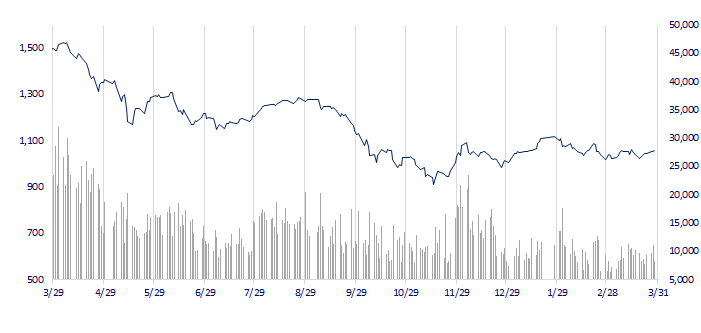

VNINDEX (12M)

GLOBAL MARKET

27,883.78

1D 1.33%

YTD 6.86%

3,240.06

1D -0.16%

YTD 4.88%

2,443.92

1D 0.37%

YTD 9.28%

20,192.40

1D 2.06%

YTD 2.08%

3,262.54

1D 0.22%

YTD 0.35%

1,610.52

1D 0.22%

YTD -3.58%

78.76

1D 0.25%

YTD -8.32%

1,986.20

1D -0.07%

YTD 8.76%

Hong Kong market rallied thanks to investor optimism after Alibaba's restructuring announcement. Hong Kong shares of Alibaba Group soared on Wednesday, marking a vote of confidence from investors after the company announced a major restructuring plan. The restructure, which was announced on Tuesday, has helped boost investor confidence in the wider Chinese tech sector, which has been battered by a heavy regulatory crackdown in recent years.

VIETNAM ECONOMY

1.05%

1D (bps) -3

YTD (bps) -392

7.40%

3.59%

1D (bps) -2

YTD (bps) -120

3.67%

1D (bps) -3

YTD (bps) -123

23,655

1D (%) -0.04%

YTD (%) -0.44%

26,235

1D (%) 0.09%

YTD (%) 2.24%

3,481

1D (%) -0.17%

YTD (%) -0.11%

Many banks have adjusted savings interest rates with a reduction of 0.1 - 0.7% for 12-month terms in the past half-month, bringing the interest rate down to less than 9%. Compared to the peak period at the end of last year, there was a time when the interest rate was up to 12% a year, then the savings interest rate has dropped sharply.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- CPI in the first quarter of 2023 increased by 4.18%;

- FDI in the first 3 months of 2023 decreased sharply compared to the previous year;

- Da Nang has a water plant worth VND1,200 billion;

- Sergio Ermotti returns as UBS CEO to oversee Credit Suisse takeover;

- French banks raided over tax fraud allegations;

- USD850 million withdrawn from Binance before CFTC’s lawsuit.

VN30

BANK

92,300

1D 0.54%

5D 3.71%

Buy Vol. 759,816

Sell Vol. 939,287

46,200

1D 0.43%

5D 0.22%

Buy Vol. 947,261

Sell Vol. 1,120,218

29,000

1D 0.35%

5D 1.75%

Buy Vol. 3,604,498

Sell Vol. 3,879,178

28,000

1D 1.63%

5D 6.87%

Buy Vol. 8,960,844

Sell Vol. 12,505,965

20,900

1D -0.48%

5D -0.48%

Buy Vol. 28,029,388

Sell Vol. 29,369,390

18,300

1D 1.67%

5D 5.17%

Buy Vol. 25,250,372

Sell Vol. 21,278,846

18,100

1D -0.28%

5D 2.55%

Buy Vol. 2,221,376

Sell Vol. 3,388,345

21,900

1D 0.23%

5D 0.46%

Buy Vol. 3,458,239

Sell Vol. 3,707,826

25,350

1D -0.20%

5D 2.22%

Buy Vol. 33,427,507

Sell Vol. 35,121,730

21,250

1D 0.47%

5D 2.66%

Buy Vol. 11,005,643

Sell Vol. 10,040,508

24,400

1D -0.20%

5D 1.04%

Buy Vol. 17,963,249

Sell Vol. 17,540,811

VPB: In 2023, VPBank aims to increase pre-tax profit by 13% to VND24,003 billion. Total assets are expected to increase by 39% to VND877trillion. Deposits and valuable papers increased by 41% to VND518 trillion. Credit balance increased by 33% to VND636 trillion. NPL ratio is controlled below 3%.

REAL ESTATE

12,550

1D -0.40%

5D 13.06%

Buy Vol. 25,624,780

Sell Vol. 29,889,197

82,200

1D -0.12%

5D 0.86%

Buy Vol. 263,803

Sell Vol. 207,746

12,400

1D -0.40%

5D 4.20%

Buy Vol. 7,857,484

Sell Vol. 12,096,303

As of March 27, there were more than 9 million comments from agencies, organizations and individuals on the Draft amended Land Law.

OIL & GAS

102,800

1D -0.87%

5D -0.10%

Buy Vol. 235,895

Sell Vol. 331,122

13,350

1D 0.38%

5D 1.52%

Buy Vol. 9,533,877

Sell Vol. 11,136,914

36,000

1D 0.56%

5D 3.75%

Buy Vol. 1,022,508

Sell Vol. 1,353,459

According to the IEA, global oil inventories hit the highest level since September 2021, with OECD oil inventories increasing by four times the average increase of the last five years.

VINGROUP

53,500

1D 0.19%

5D 1.33%

Buy Vol. 1,238,521

Sell Vol. 1,352,153

48,000

1D 0.00%

5D 0.73%

Buy Vol. 2,372,320

Sell Vol. 2,146,640

29,250

1D 0.00%

5D -1.52%

Buy Vol. 2,702,773

Sell Vol. 3,116,909

VIC: In terms of service charges, GSM is the company with the lowest fees when compared to traditional taxis.

FOOD & BEVERAGE

74,900

1D 0.67%

5D 0.67%

Buy Vol. 1,584,521

Sell Vol. 2,017,241

78,800

1D 1.55%

5D -2.11%

Buy Vol. 2,153,322

Sell Vol. 1,745,805

185,400

1D -0.32%

5D -1.12%

Buy Vol. 107,509

Sell Vol. 132,464

In 2023, MSR (subsidiary of MSN) sets a target of VND16,500 billion in revenue, up 6% y/y for scenario 1. Scenario 2, the company targets VND18,200 billion in revenue, up 17% y/y.

OTHERS

48,300

1D -0.41%

5D -1.43%

Buy Vol. 434,736

Sell Vol. 537,727

106,200

1D -0.19%

5D 1.34%

Buy Vol. 396,966

Sell Vol. 325,981

79,000

1D -0.25%

5D 0.64%

Buy Vol. 1,252,842

Sell Vol. 889,402

38,700

1D -1.02%

5D 1.98%

Buy Vol. 3,415,982

Sell Vol. 3,592,503

14,750

1D -0.34%

5D 1.72%

Buy Vol. 2,837,653

Sell Vol. 3,425,457

21,050

1D 1.20%

5D 6.05%

Buy Vol. 29,829,079

Sell Vol. 33,627,789

20,800

1D 0.48%

5D 2.46%

Buy Vol. 33,644,833

Sell Vol. 45,878,842

FPT: In the first 2 months of the year, FPT's profit before tax of foreign IT services increased by 27.3% over the same period. The education and investment sectors grew strongly. Particularly, the domestic information technology service segment is facing difficulties due to a decrease in demand.

Market by numbers

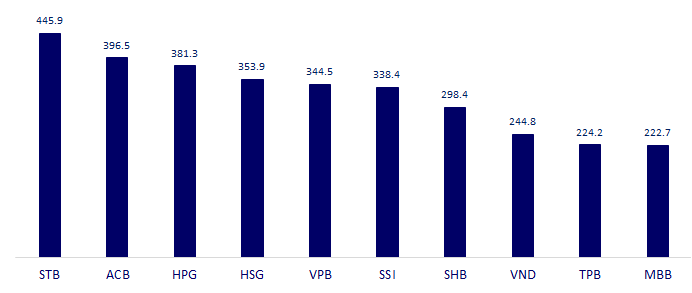

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

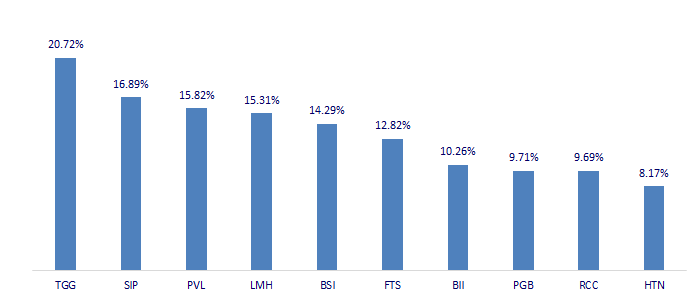

TOP INCREASES 3 CONSECUTIVE SESSIONS

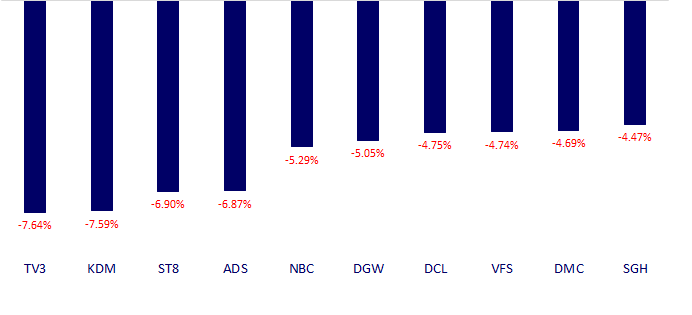

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.