Market brief 03/04/2023

VIETNAM STOCK MARKET

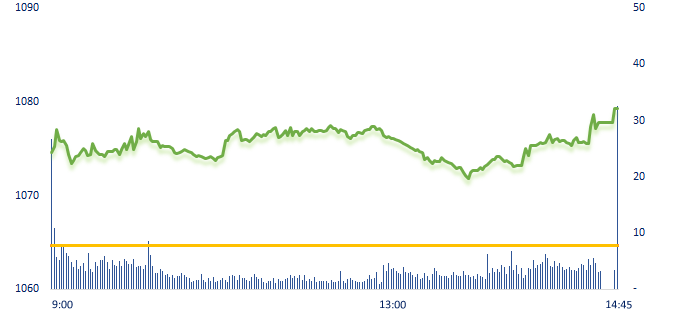

1,079.28

1D 1.38%

YTD 7.17%

1,088.72

1D 1.40%

YTD 8.31%

210.48

1D 1.44%

YTD 2.52%

77.28

1D 0.68%

YTD 7.86%

-305.75

1D 0.00%

YTD 0.00%

16,371.10

1D 22.96%

YTD 90.01%

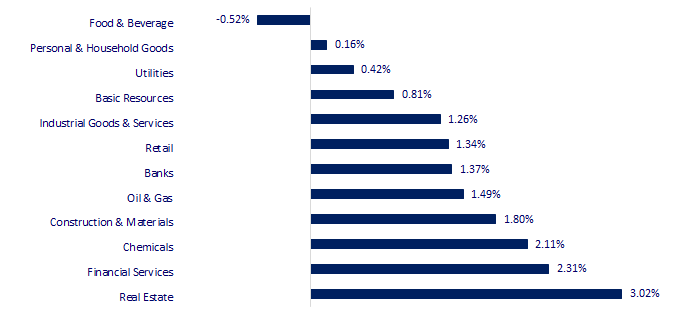

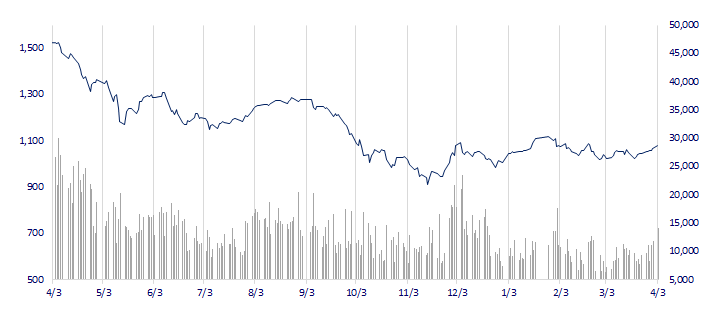

The market rebounded strongly from the beginning and remained positive until the end of the session. The market mostly rallied today, led by the real estates sector with many stocks hitting the ceiling price such as NLG, DXG, DIG, HQC when the government approved the 1 million social housing projects as well as SBV reduces the operating interest rate from April 3, 2023.

ETF & DERIVATIVES

18,570

1D 0.92%

YTD 7.16%

12,850

1D 1.26%

YTD 7.80%

13,270

1D 0.91%

YTD 6.33%

15,500

1D -0.32%

YTD 10.32%

16,200

1D 0.56%

YTD 12.89%

22,650

1D 0.80%

YTD 1.12%

13,700

1D 1.41%

YTD 5.79%

1,077

1D 1.65%

YTD 0.00%

1,079

1D 1.54%

YTD 0.00%

1,079

1D 1.56%

YTD 0.00%

1,083

1D 1.59%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,188.15

1D 0.52%

YTD 8.02%

3,296.40

1D 0.72%

YTD 6.71%

2,472.34

1D -0.18%

YTD 10.55%

20,415.00

1D 0.07%

YTD 3.20%

3,281.08

1D 0.68%

YTD 0.92%

1,599.81

1D -0.58%

YTD -4.22%

84.29

1D 0.35%

YTD -1.89%

1,981.20

1D -0.01%

YTD 8.49%

At the end of the session, Asian markets mostly gained on positive news from the US market. The US PCE in February has cooled down compared to the previous month, which is a good sign in the Fed fight against inflation.

VIETNAM ECONOMY

1.92%

1D (bps) 42

YTD (bps) -305

7.40%

3.44%

1D (bps) 4

YTD (bps) -135

3.35%

1D (bps) -15

YTD (bps) -155

23,655

1D (%) 0.06%

YTD (%) -0.44%

26,206

1D (%) 0.38%

YTD (%) 2.13%

3,479

1D (%) -0.23%

YTD (%) -0.17%

After showing signs of recovery in February 2023, Vietnam PMI had a setback in March. Accordingly, the PMI in March fell to 47.7 points from 51.2 points in February. S&P Global assessed that, although the decline in business conditions was less than it between the end of last year and the beginning of this year, the decline was still relatively strong.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many key traffic projects will be completed in 2023;

- 2 economic growth scenarios in 2023;

- Thanh Hoa: Commencement of the GAS & LNG Zone Project with nearly VND4,000 billion;

- Q1/2023: Global M&A activity dropped to the lowest level in more than 10 years;

- Cash flow from China is pouring into the Asian real estates market;

- World gold increased for 2 consecutive quarters.

VN30

BANK

92,800

1D 1.53%

5D 1.98%

Buy Vol. 1,298,699

Sell Vol. 1,110,975

45,900

1D -0.65%

5D -0.22%

Buy Vol. 1,889,791

Sell Vol. 2,102,373

29,950

1D 2.57%

5D 4.17%

Buy Vol. 6,523,318

Sell Vol. 6,790,112

29,300

1D 3.35%

5D 10.57%

Buy Vol. 17,836,518

Sell Vol. 18,672,761

21,200

1D 0.71%

5D -0.24%

Buy Vol. 22,559,003

Sell Vol. 26,394,436

18,700

1D 2.47%

5D 4.18%

Buy Vol. 32,770,740

Sell Vol. 33,855,123

19,350

1D 0.52%

5D 6.32%

Buy Vol. 5,373,515

Sell Vol. 6,756,526

22,750

1D 2.48%

5D 3.88%

Buy Vol. 12,116,083

Sell Vol. 13,246,420

26,750

1D 2.10%

5D 4.90%

Buy Vol. 46,801,417

Sell Vol. 51,697,074

21,700

1D 1.40%

5D 2.84%

Buy Vol. 10,179,897

Sell Vol. 9,784,279

25,250

1D 1.00%

5D 3.27%

Buy Vol. 13,853,173

Sell Vol. 13,814,089

CTG: According to the audited financial report, Vietbank pre-tax income increased to VND656 billion, up 3.2% over the same period in 2021 (unaudited figure was VND649 billion); total assets reached VND111,307 billion, up 7.67% compared to the beginning of the year; The structure of the asset portfolio continued to be restructured in the direction of increasing profitable assets.

REAL ESTATE

12,850

1D 1.18%

5D 1.18%

Buy Vol. 52,178,153

Sell Vol. 63,014,045

83,500

1D 0.72%

5D 1.58%

Buy Vol. 208,569

Sell Vol. 157,425

13,250

1D 6.00%

5D 5.16%

Buy Vol. 21,285,016

Sell Vol. 13,441,689

The government has set a target that by 2030, the total number of social housing apartments in localities will be completed at 1.06 million units.

OIL & GAS

102,500

1D 0.49%

5D 0.49%

Buy Vol. 539,222

Sell Vol. 883,553

13,200

1D 0.00%

5D -0.75%

Buy Vol. 18,943,898

Sell Vol. 18,744,216

37,500

1D 0.13%

5D 5.04%

Buy Vol. 2,252,451

Sell Vol. 2,679,047

PLX: Petrolimex said it would cancel the last registration date in March 31, 2023 to finalize the list of shareholders participating in the 2023 Annual General Meeting of Shareholders.

VINGROUP

58,000

1D 5.45%

5D 8.82%

Buy Vol. 7,578,852

Sell Vol. 6,192,474

52,600

1D 2.14%

5D 8.68%

Buy Vol. 3,826,892

Sell Vol. 5,182,887

29,600

1D 0.17%

5D 1.02%

Buy Vol. 4,193,207

Sell Vol. 5,140,710

VIC: Vingroup shares increased strongly, even reaching the ceiling price before the news that the SBV had issued policy to reduce operating interest rates.

FOOD & BEVERAGE

74,400

1D 0.00%

5D -0.27%

Buy Vol. 1,499,607

Sell Vol. 1,826,714

76,800

1D -1.29%

5D 0.13%

Buy Vol. 2,648,887

Sell Vol. 2,659,741

181,000

1D -2.00%

5D -2.69%

Buy Vol. 164,308

Sell Vol. 255,407

MSN: In 2023, Masan Consumer sets a net revenue target from VND28,500 billion to VND31,500 billion; Profit after tax is estimated at about VND 5,600 billion to VND 6,500 billion.

OTHERS

49,000

1D 1.14%

5D 1.03%

Buy Vol. 654,270

Sell Vol. 574,826

102,600

1D -2.38%

5D -3.66%

Buy Vol. 478,957

Sell Vol. 434,264

80,900

1D 2.28%

5D 2.28%

Buy Vol. 2,168,535

Sell Vol. 2,073,647

39,000

1D 1.17%

5D 2.36%

Buy Vol. 3,598,549

Sell Vol. 4,221,419

15,950

1D 2.90%

5D 7.05%

Buy Vol. 8,501,535

Sell Vol. 7,566,703

22,000

1D 2.33%

5D 4.76%

Buy Vol. 54,706,232

Sell Vol. 52,811,750

21,000

1D 0.96%

5D 0.96%

Buy Vol. 37,272,329

Sell Vol. 48,896,175

HPG: As revealed by management, due to weak demand and steel price, Hoa Phat still suffered a net loss in the first 2 months of the year, but the lower-than-expected loss was included in the plan, the profit in March will have improvement.

Market by numbers

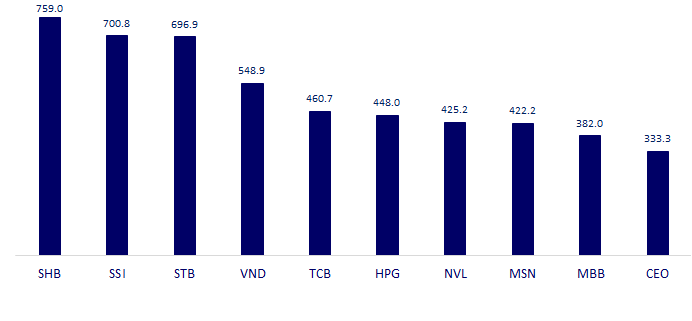

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

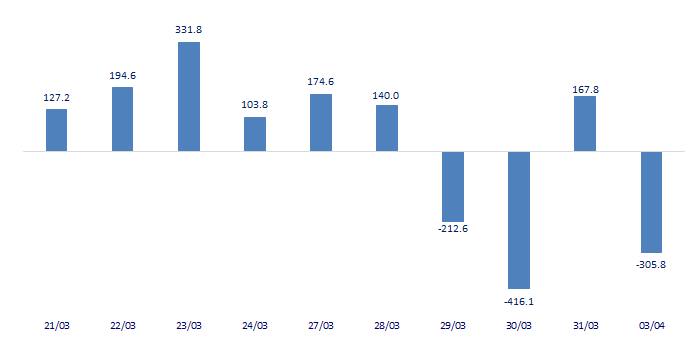

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

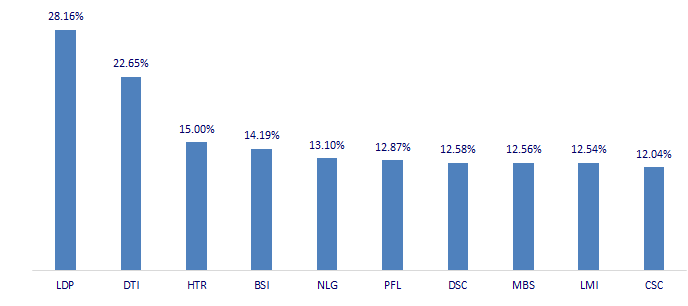

TOP INCREASES 3 CONSECUTIVE SESSIONS

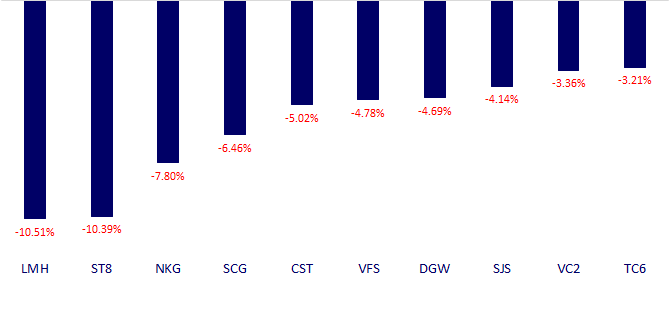

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.