Market brief 05/04/2023

VIETNAM STOCK MARKET

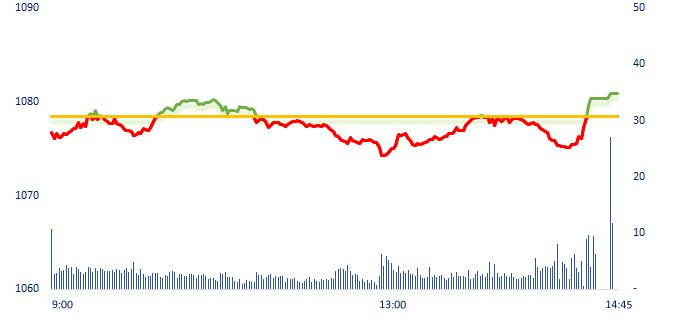

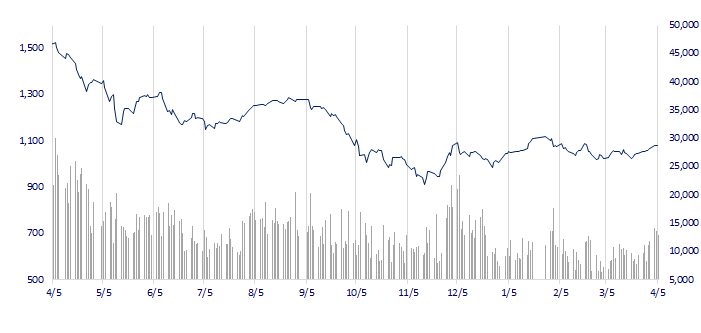

1,080.86

1D 0.22%

YTD 7.33%

1,089.83

1D 0.14%

YTD 8.42%

212.58

1D 0.88%

YTD 3.54%

77.74

1D 0.19%

YTD 8.50%

196.31

1D 0.00%

YTD 0.00%

15,280.72

1D -1.31%

YTD 77.35%

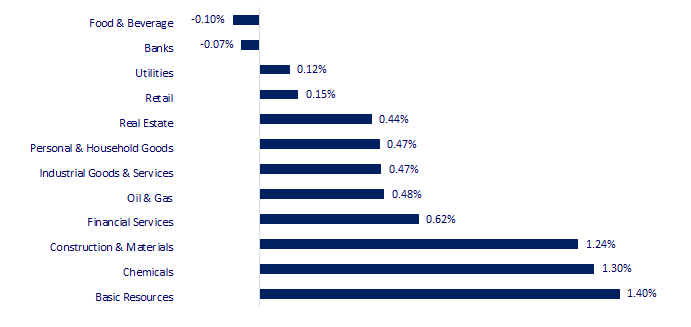

The market continued to have a strong fluctuation around the reference. Basic resources and construction sectors were bright spots in today with some typical stocks such as HTN, CTD, HPG,... In contrast, F&B and banks sectors were quite negative today.

ETF & DERIVATIVES

18,600

1D -0.11%

YTD 7.33%

12,870

1D 0.16%

YTD 7.97%

13,290

1D 0.15%

YTD 6.49%

15,400

1D -0.65%

YTD 9.61%

16,220

1D 0.00%

YTD 13.03%

22,870

1D 0.26%

YTD 2.10%

13,700

1D 0.22%

YTD 5.79%

1,079

1D 0.35%

YTD 0.00%

1,079

1D 0.09%

YTD 0.00%

1,080

1D 0.10%

YTD 0.00%

1,084

1D 0.36%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,813.26

1D -1.68%

YTD 6.59%

3,312.56

1D 0.00%

YTD 7.23%

2,495.21

1D 0.59%

YTD 11.57%

20,274.59

1D 0.00%

YTD 2.49%

3,318.87

1D 0.23%

YTD 2.08%

1,571.13

1D -1.44%

YTD -5.94%

84.56

1D -1.06%

YTD -1.57%

2,041.35

1D 0.17%

YTD 11.78%

Asian stocks were mixed today following the US jobs report as well as the OPEC+ oil production cuts. Notably, the Nikkei 225 dropped 1.68% today because BOJ will end the yield curve control policy.

VIETNAM ECONOMY

3.25%

1D (bps) 77

YTD (bps) -172

7.40%

3.16%

1D (bps) -17

YTD (bps) -163

3.35%

1D (bps) -1

YTD (bps) -155

23,623

1D (%) -0.05%

YTD (%) -0.58%

26,418

1D (%) -0.13%

YTD (%) 2.96%

3,479

1D (%) -0.06%

YTD (%) -0.17%

The world gold price on April 5 exceeded the $2,000/ounce and is expected to continue to rise sharply. Meanwhile, the domestic gold price remained unchanged.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Submitting to the Government to postpone VND11,000 billion of special consumption tax for cars;

- More than 350,000 tons of goods imported and exported through Mong Cai border gate;

- UOB: The SBV is likely to make the next interest rate decreases more cautiously;

- WB: The global economy faces a lost decade;

- IMF warns of the spreading risk to non-banking institutions;

- Japan broke the oil ceiling price of the West when buying Russian oil above 60 USD/barrel.

VN30

BANK

92,100

1D 0.11%

5D -0.22%

Buy Vol. 771,288

Sell Vol. 571,584

45,500

1D -1.09%

5D -1.52%

Buy Vol. 2,165,106

Sell Vol. 2,607,973

30,000

1D 1.18%

5D 3.45%

Buy Vol. 6,874,344

Sell Vol. 6,193,409

29,500

1D 0.00%

5D 5.36%

Buy Vol. 9,960,033

Sell Vol. 8,589,356

21,200

1D -0.93%

5D 1.44%

Buy Vol. 22,576,016

Sell Vol. 27,324,070

18,800

1D 0.27%

5D 2.73%

Buy Vol. 19,686,825

Sell Vol. 20,185,158

19,700

1D 2.87%

5D 8.84%

Buy Vol. 8,094,437

Sell Vol. 7,388,635

22,700

1D 0.44%

5D 3.65%

Buy Vol. 10,929,812

Sell Vol. 10,573,479

26,250

1D -2.42%

5D 3.55%

Buy Vol. 65,165,815

Sell Vol. 68,696,968

21,950

1D -0.68%

5D 3.29%

Buy Vol. 8,450,848

Sell Vol. 10,389,279

25,300

1D 0.60%

5D 3.69%

Buy Vol. 7,026,311

Sell Vol. 5,885,818

MBB: In 2023, MB management expects consolidated pre-tax income to increase by 15% compared to 2022, reaching VND26,100 billion. Total assets are estimated to increase 14% to VND830,000 billion. Charter capital will increase by 20%, reaching VND54,363 billion. Credit is expected to reach VND583,600 billion, up 15% compared to 2022 and in line with the orientation of the SBV. Capital mobilization is estimated at VND591,000 billion. The control target of consolidated NPL will be below 2%.

REAL ESTATE

12,850

1D 0.78%

5D 2.39%

Buy Vol. 54,887,136

Sell Vol. 59,152,945

81,200

1D -0.98%

5D -1.22%

Buy Vol. 185,424

Sell Vol. 157,146

13,400

1D 1.90%

5D 8.06%

Buy Vol. 16,814,473

Sell Vol. 16,671,623

NVL: Novaland Chairman Bui Thanh Nhon was officially removed from Forbes rankings this year, after being first recorded as a dollar billionaire in 2022 with total assets of $2.9 billion.

OIL & GAS

101,900

1D 0.00%

5D -0.88%

Buy Vol. 378,816

Sell Vol. 500,273

13,450

1D -0.37%

5D 0.75%

Buy Vol. 16,966,440

Sell Vol. 16,670,332

38,050

1D 0.26%

5D 5.69%

Buy Vol. 1,674,250

Sell Vol. 2,266,811

POW: PV POWER has just released its 2022 annual report with the expected profit after tax to decrease by 56% to VND1,118 billion.

VINGROUP

55,500

1D -2.29%

5D 3.74%

Buy Vol. 3,334,934

Sell Vol. 2,807,078

52,200

1D 2.35%

5D 8.75%

Buy Vol. 3,373,610

Sell Vol. 3,415,412

29,450

1D 0.00%

5D 0.68%

Buy Vol. 3,544,628

Sell Vol. 3,442,560

VHM: Vinhomes is about to deploy a social housing project with a scale of nearly 90 hectares in Cam Ranh City.

FOOD & BEVERAGE

74,500

1D 0.40%

5D -0.53%

Buy Vol. 2,116,139

Sell Vol. 1,829,406

78,400

1D 0.00%

5D -0.51%

Buy Vol. 1,509,188

Sell Vol. 1,768,857

176,500

1D -0.84%

5D -4.80%

Buy Vol. 250,880

Sell Vol. 353,601

MSN: Masan wants to issue up to USD500 million of bonds to the international market, also ESOPs and private shares.

OTHERS

49,050

1D -0.30%

5D 1.55%

Buy Vol. 419,624

Sell Vol. 549,890

102,900

1D 0.88%

5D -3.11%

Buy Vol. 365,137

Sell Vol. 333,762

80,600

1D 0.12%

5D 2.03%

Buy Vol. 1,359,539

Sell Vol. 983,343

39,750

1D -0.13%

5D 2.71%

Buy Vol. 3,756,878

Sell Vol. 3,454,199

16,200

1D 1.57%

5D 9.83%

Buy Vol. 8,470,968

Sell Vol. 7,551,368

22,500

1D 0.00%

5D 6.89%

Buy Vol. 38,325,576

Sell Vol. 34,671,456

21,500

1D 1.90%

5D 3.37%

Buy Vol. 44,826,502

Sell Vol. 43,625,602

HPG: Hoa Phat has just announced a reduction in selling prices in the South. In which, rebar is reduced to 100,000 VND/ton and all kinds of rolled steel is 300,000 VND/ton (excluding VAT).

Market by numbers

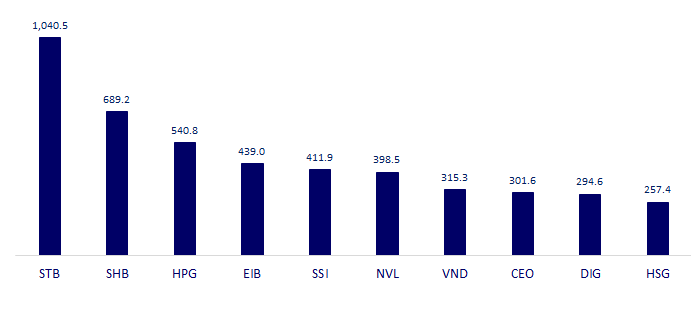

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

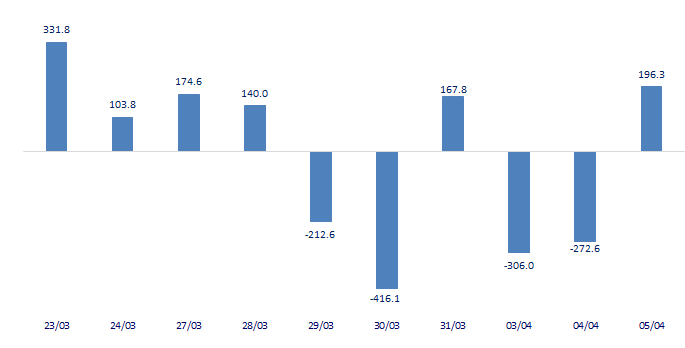

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

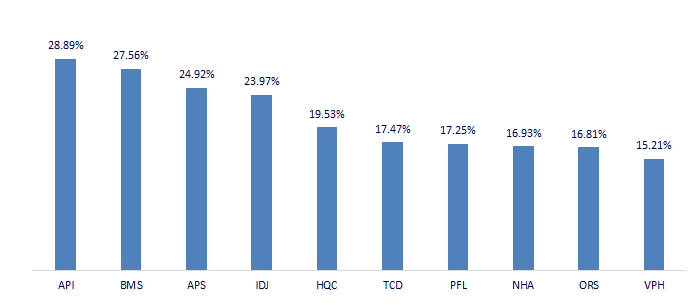

TOP INCREASES 3 CONSECUTIVE SESSIONS

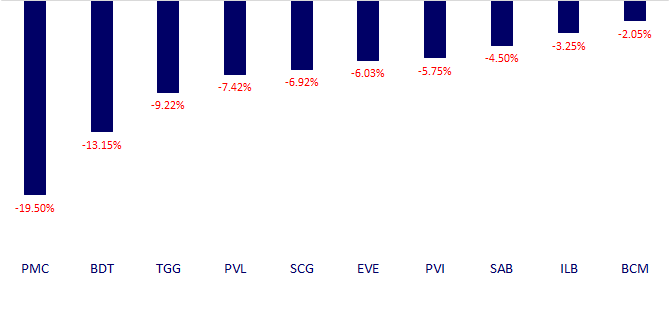

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.