Market Brief 14/04/2023

VIETNAM STOCK MARKET

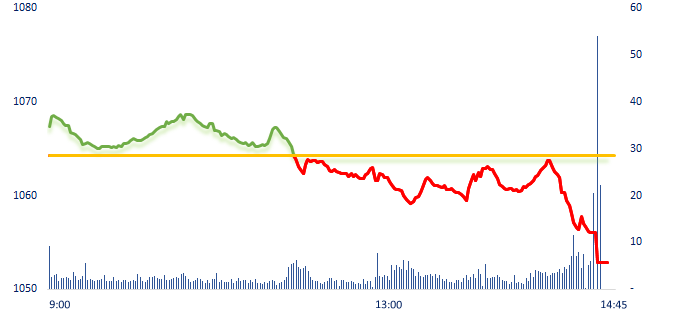

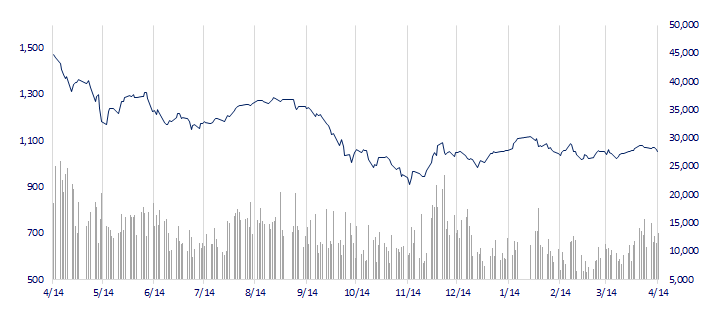

1,052.89

1D -1.07%

YTD 4.55%

1,063.43

1D -1.05%

YTD 5.79%

207.25

1D -1.23%

YTD 0.94%

78.69

1D -0.83%

YTD 9.83%

-204.40

1D 0.00%

YTD 0.00%

15,384.74

1D 14.38%

YTD 78.56%

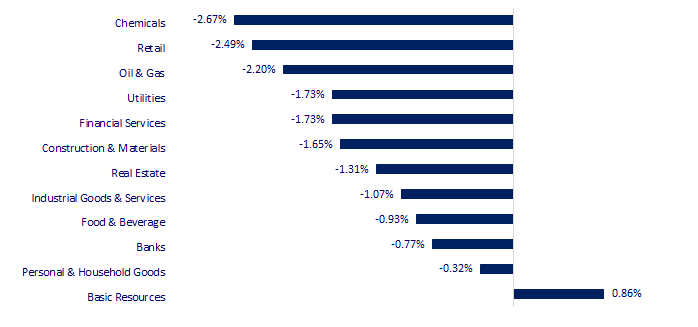

The chemical industry dropped the most with a decrease of 2.76%, mainly coming from the industrial real estate group with representatives such as GVR - 4.1%, PHR -4.4%, DPR -1.7%. Today's session also recorded a negative for real estate, when many stocks hit the floor price such as NLG, TDC, DIG, DXG, HDC, KBC, IJC, etc. MWG dropped 2.6% after reducing selling price to compete with CellphoneS, Hoang Ha Mobile.

ETF & DERIVATIVES

18,300

1D -0.22%

YTD 5.60%

12,560

1D -1.02%

YTD 5.37%

12,830

1D 0.16%

YTD 2.80%

15,500

1D 1.11%

YTD 10.32%

16,280

1D 0.18%

YTD 13.45%

22,840

1D -0.26%

YTD 1.96%

13,550

1D -0.44%

YTD 4.63%

1,057

1D -0.57%

YTD 0.00%

1,058

1D -0.65%

YTD 0.00%

1,061

1D -0.67%

YTD 0.00%

1,063

1D -0.64%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,493.47

1D 1.20%

YTD 9.19%

3,338.15

1D 0.60%

YTD 8.06%

2,571.49

1D 0.38%

YTD 14.98%

20,438.81

1D 0.46%

YTD 3.32%

3,302.66

1D 0.25%

YTD 1.58%

1,592.67

1D 0.00%

YTD -4.65%

86.42

1D -0.03%

YTD 0.59%

2,052.25

1D -0.23%

YTD 12.38%

Gold prices held near one-year highs on Friday as recent U.S. economic data reinforced hopes that the Federal Reserve was close to the end of its rate-hiking cycle, which drove non-yielding bullion towards a second straight weekly rise.

VIETNAM ECONOMY

5.45%

1D (bps) 1

YTD (bps) 48

7.40%

3.10%

1D (bps) -3

YTD (bps) -169

3.32%

1D (bps) 6

YTD (bps) -158

23,658

1D (%) 0.19%

YTD (%) -0.43%

26,385

1D (%) -0.98%

YTD (%) 2.83%

3,493

1D (%) 0.29%

YTD (%) 0.23%

According to the State Bank of Vietnam, the average interbank interest rate continued to increase in some terms of less than 1 month. The State Bank has provided more than VND46,000 billion via OMO channel at 5% interest rate for 6 consecutive sessions (April 6-13). Besides the 28-day term, the SBV also used an additional 7-day term to support liquidity.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- GDP in 2023 is forecasted to increase by 5.5 - 6%

- EVN continues to record losses;

- In 2023: Thu Duc city must disburse public investment over 95%;

- Beijing chooses targets carefully as it goes on offensive in US chip wars;

- Gas prices fell to a nearly 2-year low, stimulating demand in Asian countries;

- World's largest commercial printer of money issues profit warning.

VN30

BANK

88,400

1D 0.23%

5D -1.78%

Buy Vol. 874,231

Sell Vol. 807,408

44,450

1D -1.11%

5D -2.63%

Buy Vol. 1,177,240

Sell Vol. 1,554,374

29,100

1D -1.02%

5D -1.36%

Buy Vol. 2,423,143

Sell Vol. 3,502,950

28,900

1D -4.30%

5D -2.20%

Buy Vol. 12,786,084

Sell Vol. 17,093,863

20,500

1D -0.49%

5D -1.91%

Buy Vol. 15,311,050

Sell Vol. 18,963,009

18,300

1D -1.35%

5D -1.61%

Buy Vol. 12,365,338

Sell Vol. 20,859,240

19,500

1D -1.02%

5D 0.26%

Buy Vol. 3,517,178

Sell Vol. 4,509,032

23,200

1D 0.00%

5D 0.43%

Buy Vol. 10,655,035

Sell Vol. 13,772,547

25,700

1D -2.84%

5D -1.15%

Buy Vol. 23,965,134

Sell Vol. 40,239,546

20,800

1D -1.65%

5D -0.48%

Buy Vol. 7,172,939

Sell Vol. 10,018,142

24,950

1D 0.00%

5D -0.40%

Buy Vol. 6,887,030

Sell Vol. 8,949,114

VPB: In 2023, VPB sets a target of 13% growth in pre-tax profit compared to the previous year. The private placement deal of 15% for SMBC, equivalent to VND35,900 billion, is one of the growth drivers of VPB in 2023. According to VPBank's expectations, the deal is expected to be completed in the second quarter or third quarter of 2023.

REAL ESTATE

14,200

1D -2.07%

5D 5.97%

Buy Vol. 95,693,766

Sell Vol. 73,175,222

79,300

1D -0.63%

5D -1.12%

Buy Vol. 71,468

Sell Vol. 133,853

13,400

1D -4.29%

5D -0.74%

Buy Vol. 15,583,422

Sell Vol. 19,495,515

General Director of Colliers Vietnam: "At least until the third quarter, the real estate market may recover".

OIL & GAS

98,100

1D -1.90%

5D -3.06%

Buy Vol. 444,940

Sell Vol. 991,750

13,100

1D -2.60%

5D 0.38%

Buy Vol. 14,582,778

Sell Vol. 16,847,842

36,500

1D -1.88%

5D -3.18%

Buy Vol. 924,365

Sell Vol. 1,692,885

Southern Gas (PGS - an associate company of PV GAS) sets a profit before tax plan in 2023 to reach VND102.35 billion, down 17.5%.

VINGROUP

52,900

1D -0.19%

5D -2.76%

Buy Vol. 3,221,861

Sell Vol. 3,144,465

50,000

1D -0.99%

5D -1.38%

Buy Vol. 2,117,642

Sell Vol. 3,178,157

28,600

1D 0.70%

5D -2.05%

Buy Vol. 3,667,680

Sell Vol. 4,596,154

VIC: In 2022, Vingroup achieved net revenue of VND101.8 trillion, accounting for 1.1% of Vietnam's GDP.

FOOD & BEVERAGE

72,800

1D -0.95%

5D -2.54%

Buy Vol. 2,387,677

Sell Vol. 2,293,230

78,100

1D -1.39%

5D 0.64%

Buy Vol. 2,208,012

Sell Vol. 2,809,176

167,000

1D -1.47%

5D -5.65%

Buy Vol. 451,307

Sell Vol. 494,364

VNM: VNM ranked in the top 3 stocks that were sold the most by foreign investors on April 14, with a value of more than VND35 billion.

OTHERS

48,000

1D -0.83%

5D -1.03%

Buy Vol. 490,362

Sell Vol. 680,523

98,500

1D -0.81%

5D -4.37%

Buy Vol. 215,554

Sell Vol. 227,396

79,600

1D 0.00%

5D -1.12%

Buy Vol. 930,928

Sell Vol. 930,351

40,000

1D -2.56%

5D 2.56%

Buy Vol. 4,817,196

Sell Vol. 5,682,802

15,300

1D -4.08%

5D -3.77%

Buy Vol. 7,409,657

Sell Vol. 7,983,898

21,200

1D -2.53%

5D -5.78%

Buy Vol. 45,233,883

Sell Vol. 44,798,151

20,650

1D 0.98%

5D -2.59%

Buy Vol. 29,904,985

Sell Vol. 25,341,658

MWG: Chairman of the Board of Directors has announced a new business strategy for Apple product lines. Accordingly, MWG will set a selling price closer to the competitors, "declaring war" on a new price race.

Market by numbers

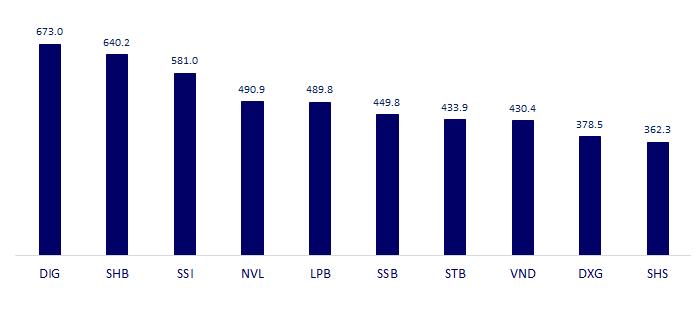

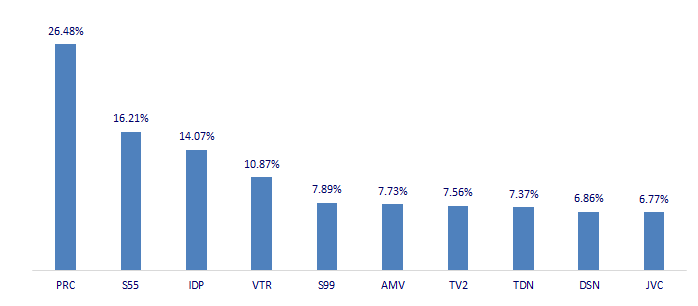

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

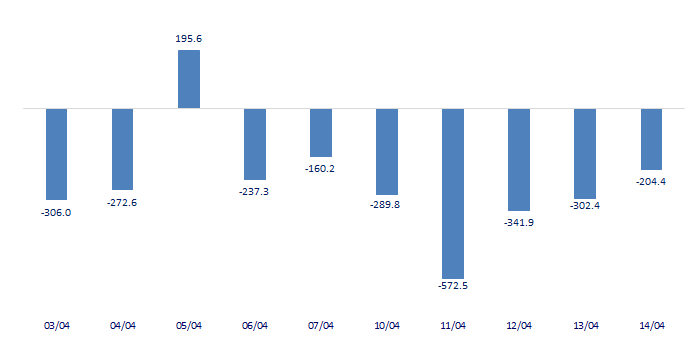

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

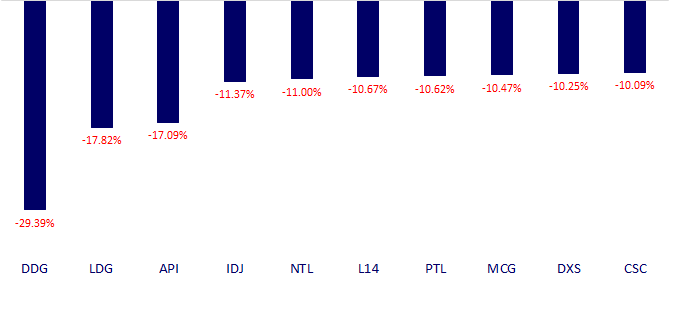

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.