Market brief 24/04/2023

VIETNAM STOCK MARKET

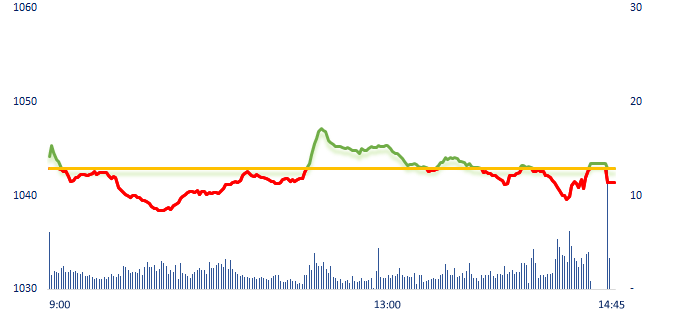

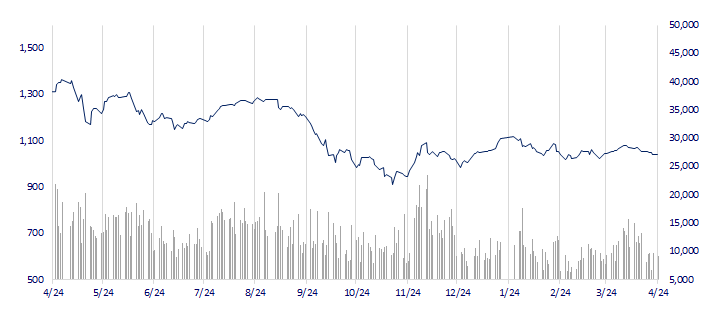

1,041.36

1D -0.15%

YTD 3.40%

1,046.17

1D 0.00%

YTD 4.08%

206.76

1D -0.08%

YTD 0.71%

77.90

1D -0.12%

YTD 8.72%

273.25

1D 0.00%

YTD 0.00%

10,673.01

1D -11.86%

YTD 23.88%

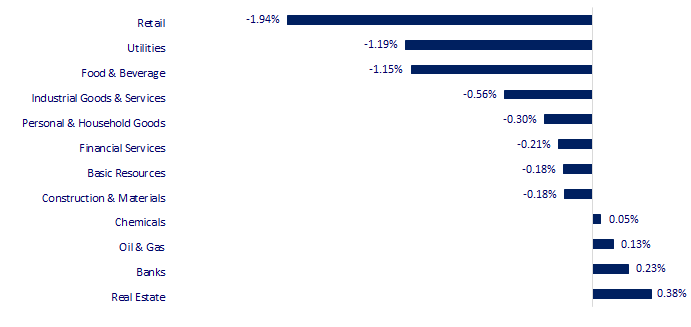

Vietnam stock market had a volatile session when many financial reports of businesses were released. Real estate and banking are the two most positive sectors in the market today when SBV officially allows the bank to restructure the repayment term and keep the debt group unchanged for customers in difficulty. Some notable gainers today include BCG, HQC, SCR, NVL, TCB,...

ETF & DERIVATIVES

17,900

1D 0.06%

YTD 3.29%

12,420

1D 0.00%

YTD 4.19%

12,860

1D -6.74%

YTD 3.04%

15,720

1D 0.00%

YTD 11.89%

15,620

1D -0.76%

YTD 8.85%

22,200

1D -0.58%

YTD -0.89%

13,320

1D -1.11%

YTD 2.86%

1,034

1D 0.04%

YTD 0.00%

1,037

1D 0.03%

YTD 0.00%

1,039

1D 0.06%

YTD 0.00%

1,041

1D 0.09%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,593.52

1D 0.10%

YTD 9.58%

3,275.41

1D -0.78%

YTD 6.03%

2,523.50

1D -0.82%

YTD 12.84%

19,959.94

1D -0.58%

YTD 0.90%

3,324.55

1D 0.08%

YTD 2.25%

1,557.87

1D -0.03%

YTD -6.73%

81.09

1D -0.14%

YTD -5.61%

1,994.85

1D 0.06%

YTD 9.24%

At the end of the session, Asian markets continued to be gloomy due to the negative business results of businesses in the first quarter of 2023. Nikkei 225 gained slightly as investors watched the BOJ's move to fight inflation in Friday meeting.

VIETNAM ECONOMY

3.81%

1D (bps) 58

YTD (bps) -116

7.40%

3.07%

1D (bps) -2

YTD (bps) -172

3.24%

1D (bps) 6

YTD (bps) -167

23,643

1D (%) -0.09%

YTD (%) -0.49%

26,570

1D (%) 0.08%

YTD (%) 3.55%

3,474

1D (%) -0.12%

YTD (%) -0.32%

SBV allows credit institutions and foreign banks to restructure debt repayment terms and maintain the same debt group in order to support customers who have difficulties in production, business activities and paying debts for life and consumption. The implementation period is from April 24 to the end of June 30, 2024.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV allows banks to buy back corporate bonds from April 24;

- Hanoi attracted a breakthrough in FDI capital reaching USD1.71 billion, ranking first in the country in the first 4 months of 2023;

- Delay the start date of Bien Hoa - Vung Tau expressway project;

- Fed officials favor rate hikes as inflation remains high;

- China real estate market is gradually recovering, but the period of rapid growth is over;

- China plans to invest more than USD7 billion to upgrade its chip supply chain.

VN30

BANK

87,900

1D 0.46%

5D -0.57%

Buy Vol. 724,951

Sell Vol. 866,717

43,700

1D -1.13%

5D -2.89%

Buy Vol. 674,897

Sell Vol. 996,678

28,900

1D 1.05%

5D -1.03%

Buy Vol. 4,744,782

Sell Vol. 4,331,514

29,500

1D 2.79%

5D 0.17%

Buy Vol. 6,577,156

Sell Vol. 6,205,549

19,500

1D 0.26%

5D -4.65%

Buy Vol. 15,013,524

Sell Vol. 13,754,523

18,250

1D 1.11%

5D 0.00%

Buy Vol. 11,127,071

Sell Vol. 10,116,625

18,750

1D -0.27%

5D -2.85%

Buy Vol. 2,830,156

Sell Vol. 2,509,376

22,850

1D 1.33%

5D -0.65%

Buy Vol. 10,310,292

Sell Vol. 7,510,489

25,550

1D -0.20%

5D -1.35%

Buy Vol. 14,858,952

Sell Vol. 18,169,648

20,300

1D 0.74%

5D -1.69%

Buy Vol. 7,866,998

Sell Vol. 5,682,988

24,200

1D -0.21%

5D -3.20%

Buy Vol. 4,080,323

Sell Vol. 4,171,116

VIB: At the end of the first quarter, VIB recorded a pre-tax profit of approximately VND2,700 billion, up 18% over the same period. In which, total operating income reached more than VND4,900 billion, an increase of more than 19%. The bank maintained a highly effective net interest margin (NIM) at 4.6% amid fluctuations in both deposit and lending rates.

REAL ESTATE

14,050

1D 3.31%

5D -5.07%

Buy Vol. 52,436,308

Sell Vol. 47,961,481

79,100

1D 0.00%

5D -0.38%

Buy Vol. 75,316

Sell Vol. 109,455

13,200

1D 1.54%

5D -5.04%

Buy Vol. 13,134,532

Sell Vol. 9,119,641

NVL: Novaland added apartments and shophouses to guarantee bonds at MBS with a total value of up to VND400 billion.

OIL & GAS

93,100

1D -2.41%

5D -4.22%

Buy Vol. 838,554

Sell Vol. 1,038,750

13,000

1D 1.56%

5D -2.62%

Buy Vol. 23,702,465

Sell Vol. 6,917,200

36,750

1D 0.00%

5D 1.80%

Buy Vol. 692,069

Sell Vol. 836,833

POW: PV Power cooperates with Armex (Czech Republic) to find coal and gas sources for power plants.

VINGROUP

52,600

1D -0.19%

5D -0.57%

Buy Vol. 2,601,462

Sell Vol. 2,576,292

50,500

1D 0.40%

5D 0.40%

Buy Vol. 2,096,350

Sell Vol. 2,509,169

28,150

1D 0.90%

5D -0.53%

Buy Vol. 6,195,764

Sell Vol. 6,187,487

VHM: Net sales reached VND29,299 billion, 3.3 times higher than the same period last year. Gross profit reached VND6,643 billion, 1.7 times higher. Gross profit margin reached 22.7%.

FOOD & BEVERAGE

70,500

1D -0.56%

5D -1.67%

Buy Vol. 1,995,060

Sell Vol. 1,875,714

73,300

1D -4.06%

5D -6.15%

Buy Vol. 2,354,781

Sell Vol. 2,783,185

171,100

1D 0.35%

5D 4.33%

Buy Vol. 246,583

Sell Vol. 258,564

MSN: Masan sets a revenue target of VND100,000 billion for the third time with the main expectation on WinCommerce in 2023.

OTHERS

46,400

1D -0.96%

5D -1.69%

Buy Vol. 451,758

Sell Vol. 362,436

97,400

1D -0.10%

5D -2.21%

Buy Vol. 327,199

Sell Vol. 351,463

79,100

1D -0.25%

5D -0.63%

Buy Vol. 1,878,472

Sell Vol. 1,783,964

38,400

1D -2.29%

5D -3.64%

Buy Vol. 5,973,066

Sell Vol. 4,869,191

15,300

1D 1.32%

5D -0.65%

Buy Vol. 2,194,644

Sell Vol. 2,334,025

21,500

1D -0.69%

5D 0.70%

Buy Vol. 19,675,429

Sell Vol. 24,775,902

20,650

1D -0.24%

5D -0.96%

Buy Vol. 19,289,725

Sell Vol. 22,874,421

BVH: Baoviet targets total revenue in 2023 to reach VND768.5 billion, equivalent to 83% of the implementation level in 2022. Profit after tax will reach VND155.7 billion, equivalent to 106% of the implementation level in 2022.

Market by numbers

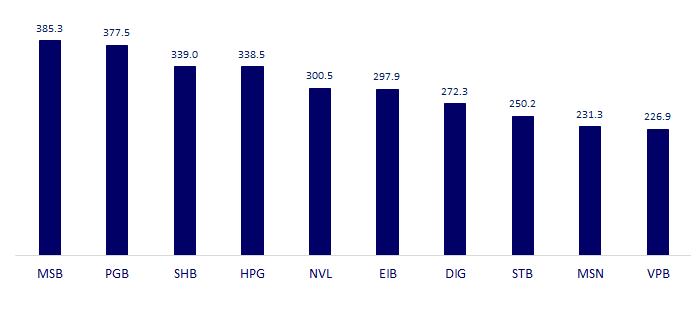

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

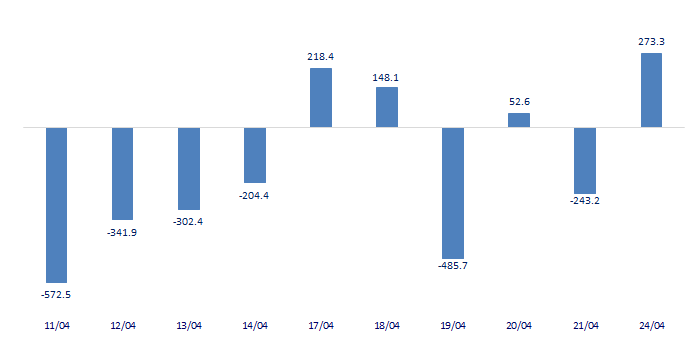

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

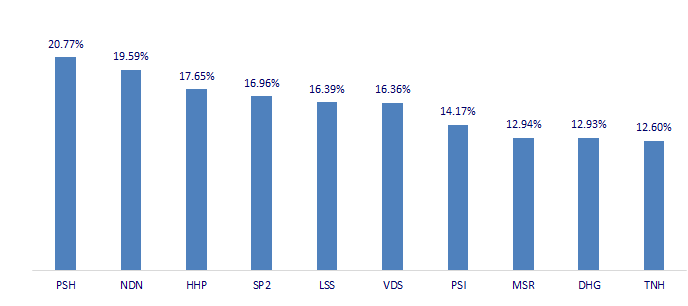

TOP INCREASES 3 CONSECUTIVE SESSIONS

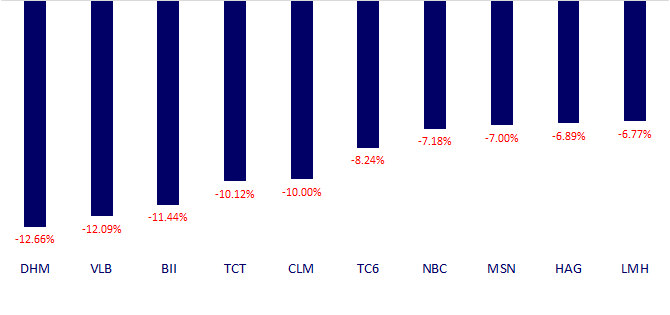

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.