Market brief 25/04/2023

VIETNAM STOCK MARKET

1,034.86

1D -0.62%

YTD 2.76%

1,037.04

1D -0.87%

YTD 3.17%

204.69

1D -1.00%

YTD -0.30%

77.99

1D 0.12%

YTD 8.85%

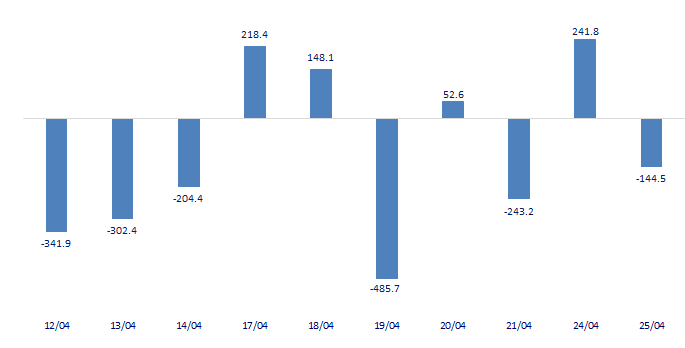

-144.50

1D 0.00%

YTD 0.00%

11,677.59

1D 9.41%

YTD 35.53%

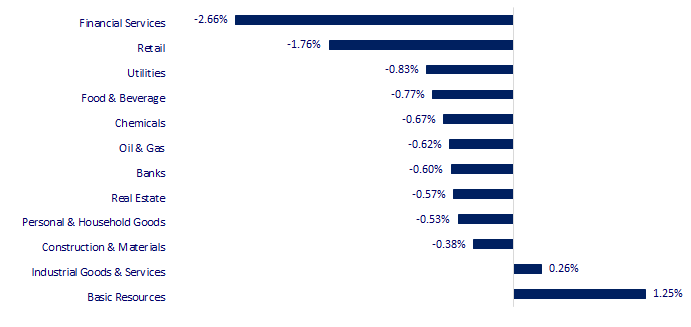

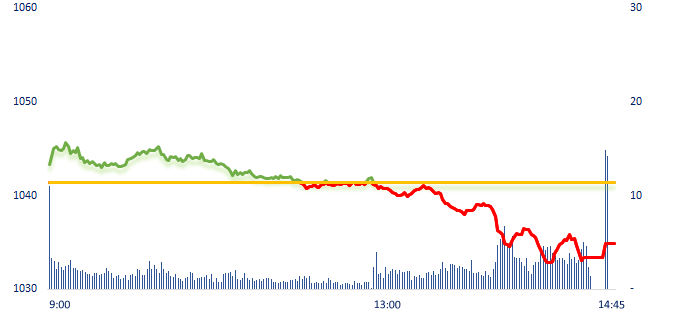

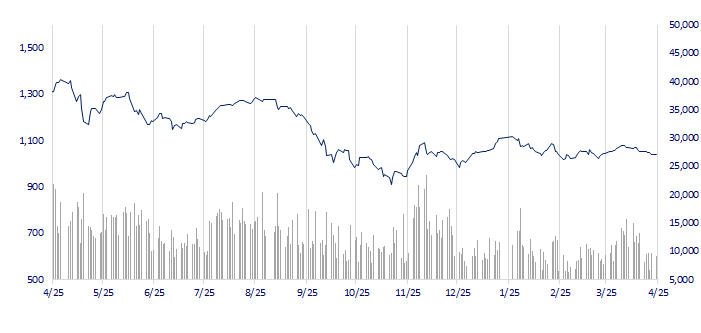

Today, VNIndex continued having a red session and closed at the lowest level in more than one month recently. Basic resources are the exotic sector gaining, with typical contributors such as HPG (+1.9%) and HSG (+2.4%). Foreign investors saw a net selling session of 140 billion dong, mainly VIC (-44.2 billion), STB (-41.3 billion), BMP (-35.9 billion). On the other side, they net bought HPG up to nearly 67 billion dong.

ETF & DERIVATIVES

17,700

1D -1.12%

YTD 2.14%

12,190

1D -1.85%

YTD 2.27%

12,750

1D -0.86%

YTD 2.16%

15,400

1D -2.04%

YTD 9.61%

15,600

1D -0.13%

YTD 8.71%

22,000

1D -0.90%

YTD -1.79%

13,190

1D -0.98%

YTD 1.85%

1,029

1D -0.52%

YTD 0.00%

1,026

1D -1.05%

YTD 0.00%

1,029

1D -0.99%

YTD 0.00%

1,031

1D -0.98%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,620.07

1D 0.09%

YTD 9.68%

3,264.87

1D -0.32%

YTD 5.68%

2,489.02

1D -1.37%

YTD 11.30%

19,617.88

1D -1.71%

YTD -0.83%

3,294.39

1D -0.91%

YTD 1.32%

1,541.77

1D -1.03%

YTD -7.70%

81.98

1D -0.97%

YTD -4.57%

1,993.55

1D -0.80%

YTD 9.16%

Asian stock markets mostly fell in the afternoon session of April 25 as investors were still waiting for important economic data to be released such as important economic data from Australia and the euro area, as well as the Bank of Japan (BoJ) policy meeting.

VIETNAM ECONOMY

6.03%

1D (bps) 222

YTD (bps) 106

7.40%

3.08%

1D (bps) 1

YTD (bps) -171

3.18%

1D (bps) -5

YTD (bps) -172

23,655

1D (%) 0.01%

YTD (%) -0.44%

26,657

1D (%) -0.17%

YTD (%) 3.89%

3,466

1D (%) -0.26%

YTD (%) -0.55%

The State Bank is expected to reduce 50% of the credit risk coefficient applied to loans for social housing projects and 20% to credit to finance industrial real estate projects. With the remaining mortgage loans (not to buy social housing under the Government's programs and projects), the credit risk ratio is kept at 25% to 100%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- For social housing loans, banks are entitled to a 50% reduction in credit risk coefficient;

- Government permanent meeting discuss difficulties in interest rates and corporate bonds;

- Textile enterprises flexibly produce, transfer and find small and difficult orders;

- US proposed rule to accelerate risk assessment to financial stability;

- IMF: There are many risks to the global economyr;

- Europe is facing a battle for new oil supplies.

VN30

BANK

88,300

1D 0.46%

5D 0.34%

Buy Vol. 775,388

Sell Vol. 900,206

43,550

1D -0.34%

5D -2.35%

Buy Vol. 781,961

Sell Vol. 918,176

28,500

1D -1.38%

5D -2.06%

Buy Vol. 2,752,676

Sell Vol. 3,608,368

29,000

1D -1.69%

5D -0.51%

Buy Vol. 3,027,012

Sell Vol. 5,230,601

19,300

1D -1.03%

5D -4.69%

Buy Vol. 12,930,542

Sell Vol. 13,901,812

18,250

1D 0.00%

5D 0.55%

Buy Vol. 9,203,971

Sell Vol. 12,337,412

18,350

1D -2.13%

5D -5.17%

Buy Vol. 2,620,937

Sell Vol. 2,545,364

22,750

1D -0.44%

5D -0.22%

Buy Vol. 2,606,970

Sell Vol. 2,697,178

25,050

1D -1.96%

5D -3.28%

Buy Vol. 24,786,375

Sell Vol. 35,278,737

20,000

1D -1.48%

5D -3.15%

Buy Vol. 5,217,616

Sell Vol. 4,517,738

24,150

1D -0.21%

5D -2.42%

Buy Vol. 8,754,907

Sell Vol. 8,780,705

MBB: At the GM today, MBB presented to shareholders the business plan for 2023 with the goal of consolidated pre-tax profit increasing by 15% compared to 2022, reaching 26,138 billion VND. Total assets increased by 14%, bad debt ratio was controlled not more than 2%. The bank also expects that in the future (2024) will pay a dividend rate of 10-15%.

REAL ESTATE

13,750

1D -2.14%

5D -7.41%

Buy Vol. 29,936,579

Sell Vol. 34,438,280

78,700

1D -0.51%

5D -1.01%

Buy Vol. 133,281

Sell Vol. 140,534

12,950

1D -1.89%

5D -6.83%

Buy Vol. 9,796,646

Sell Vol. 11,399,739

NVL: NovaGroup sold 98,377 shares of NVL in the form of order matching from April 18 to April 20. The reason for the transaction is because the securities company sells pledged shares.

OIL & GAS

92,000

1D -1.18%

5D -4.96%

Buy Vol. 544,997

Sell Vol. 987,671

12,800

1D -1.54%

5D -5.19%

Buy Vol. 40,921,223

Sell Vol. 13,781,662

36,400

1D -0.95%

5D -1.09%

Buy Vol. 521,012

Sell Vol. 899,261

GAS: In the 2023 plan, business gas output is 7.7 billion m3, down 1% over the same period. LPG production was 1.76 million tons, down 14% and 84,000 tons of Condensate, down 17%.

VINGROUP

52,500

1D -0.19%

5D -0.57%

Buy Vol. 3,890,342

Sell Vol. 4,380,874

50,200

1D -0.59%

5D -1.18%

Buy Vol. 2,855,863

Sell Vol. 3,228,183

27,700

1D -1.60%

5D -2.81%

Buy Vol. 4,708,325

Sell Vol. 5,459,025

VRE: 2023 plan, net revenue of 10,350 billion dong, profit after tax of 4,680 billion dong, up 41% and 69% respectively compared to 2022

FOOD & BEVERAGE

69,900

1D -0.85%

5D -4.25%

Buy Vol. 2,344,900

Sell Vol. 2,298,519

71,300

1D -2.73%

5D -8.82%

Buy Vol. 1,766,118

Sell Vol. 1,810,525

171,000

1D -0.06%

5D 3.14%

Buy Vol. 305,538

Sell Vol. 366,688

VNM: In 2023, VNM will pay cash dividends of at least 50% of consolidated profit after tax to be distributed to company owners.

OTHERS

45,600

1D -1.72%

5D -2.98%

Buy Vol. 560,359

Sell Vol. 452,074

95,900

1D -1.54%

5D -3.13%

Buy Vol. 378,900

Sell Vol. 467,629

78,400

1D -0.88%

5D -1.26%

Buy Vol. 1,172,928

Sell Vol. 913,377

37,700

1D -1.82%

5D -5.63%

Buy Vol. 5,139,520

Sell Vol. 5,746,339

15,100

1D -1.31%

5D -2.58%

Buy Vol. 2,940,983

Sell Vol. 3,596,222

21,100

1D -1.86%

5D -2.99%

Buy Vol. 32,307,172

Sell Vol. 39,389,883

21,050

1D 1.94%

5D 0.48%

Buy Vol. 30,471,218

Sell Vol. 40,991,003

HPG: In Q1.2023, Hoa Phat Group achieved revenue of 26,865 billion VND, down 39% compared to the same period of 2022. Consolidated profit after tax reached 383 billion VNM, reaching 5% of the plan in 2023. Steel production and related products are still the mainstay and contribute 94% of the Group's profit after tax.

Market by numbers

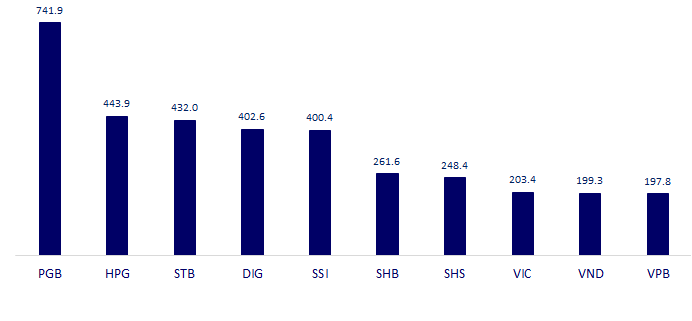

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

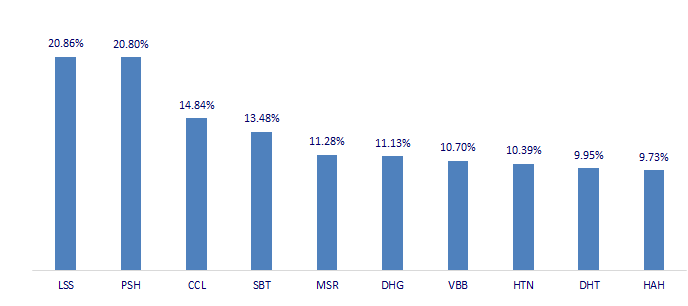

TOP INCREASES 3 CONSECUTIVE SESSIONS

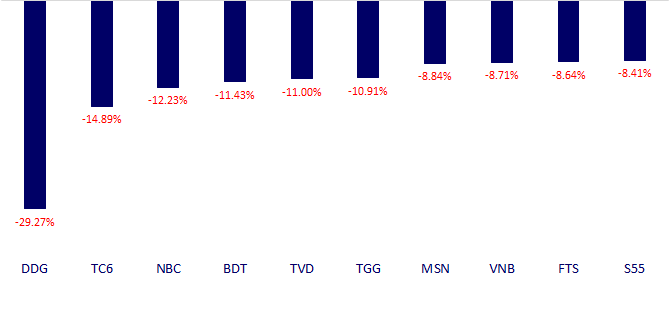

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.