Market brief 27/04/2023

VIETNAM STOCK MARKET

1,039.63

1D -0.11%

YTD 3.23%

1,041.54

1D -0.35%

YTD 3.62%

205.86

1D 0.01%

YTD 0.27%

77.42

1D -0.76%

YTD 8.05%

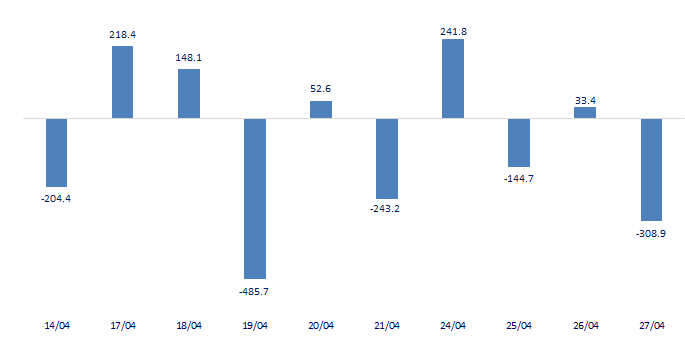

-308.88

1D 0.00%

YTD 0.00%

10,373.36

1D -20.21%

YTD 20.40%

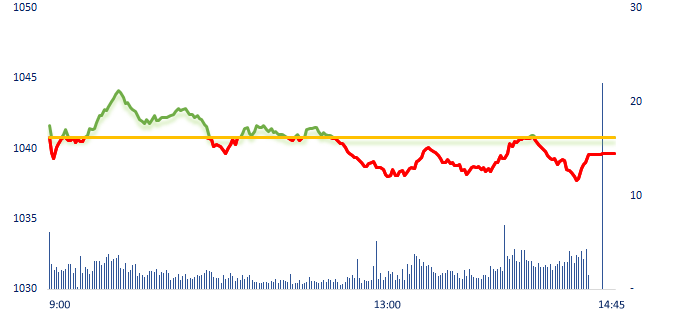

Today, VNIndex could not maintain the green and turned to decrease since the end of the morning session. Market liquidity improved and increased by 21% compared to yesterday, and approached the average of the last 20 sessions. Foreign investors net sold nearly VND300 billion, focusing on the trio of Vin stocks with a total net selling value of VND151 billion. On the other side, HPG continued to be net bought VND71.37 billion.

ETF & DERIVATIVES

17,780

1D -0.78%

YTD 2.60%

12,300

1D -0.40%

YTD 3.19%

12,760

1D 0.00%

YTD 2.24%

15,510

1D -3.36%

YTD 10.39%

15,800

1D 0.89%

YTD 10.10%

22,220

1D 0.00%

YTD -0.80%

13,200

1D 0.38%

YTD 1.93%

1,031

1D -0.11%

YTD 0.00%

1,029

1D -0.33%

YTD 0.00%

1,032

1D -0.19%

YTD 0.00%

1,035

1D -0.24%

YTD 0.00%

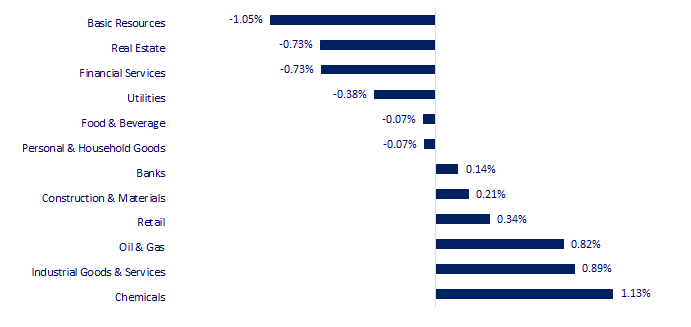

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

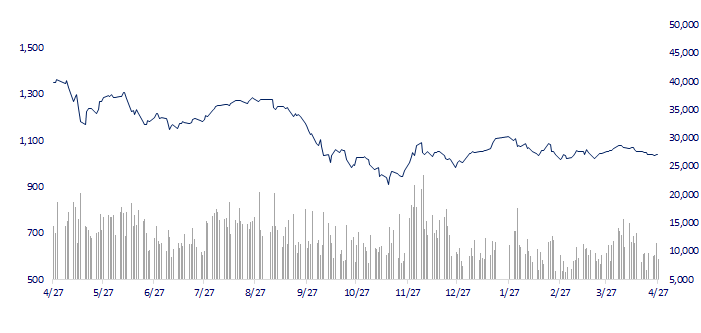

VNINDEX (12M)

GLOBAL MARKET

28,457.68

1D 0.15%

YTD 9.06%

3,285.88

1D 0.67%

YTD 6.36%

2,495.81

1D 0.44%

YTD 11.60%

19,840.28

1D 0.42%

YTD 0.30%

3,282.03

1D -0.36%

YTD 0.94%

1,531.23

1D -0.82%

YTD -8.33%

77.94

1D 0.01%

YTD -9.28%

2,009.95

1D 0.56%

YTD 10.06%

After strong fluctuations at the beginning of the session on April 27, Asian stock markets closed this session with a slight increase although many large companies recorded less satisfactory profit results. Global investor sentiment is dominated by concerns about the health of the banking sector. Along with the negative data on consumer confidence and other data has raised concerns about the possibility of an economic recession.

VIETNAM ECONOMY

4.10%

1D (bps) -42

YTD (bps) -87

7.40%

2.99%

1D (bps) -6

YTD (bps) -180

3.14%

1D (bps) -9

YTD (bps) -176

23,665

1D (%) 0.08%

YTD (%) -0.40%

26,330

1D (%) -1.25%

YTD (%) 2.62%

3,458

1D (%) -0.03%

YTD (%) -0.77%

In general, the deposit interest rate in the system is still going down. Surveyed on April 27, no banks listed interest rates for 12-month term from 9%/year. In longer terms, only a few banks listed 9.1-9.2%/year. The State Bank also said that it will continue to take measures to further lower deposit interest rates, creating favorable conditions for lowering lending rates in the coming time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Rice exports bring in nearly 1 billion USD;

- Remove the problem of disbursing the allocated public investment capital;

- Hanoi studies to build an airport in the southern part of the city;

- EU activates plan to reform pharmaceutical industry regulation;

- The Fed sets a date for the publication of the report on the banking supervision of SVB;

- The US and EU welcomed the phone call of the leaders of China and Ukraine..

VN30

BANK

90,000

1D 0.67%

5D 1.93%

Buy Vol. 983,785

Sell Vol. 1,209,080

43,900

1D -0.45%

5D -1.57%

Buy Vol. 413,865

Sell Vol. 579,348

28,350

1D -0.18%

5D -1.39%

Buy Vol. 4,556,454

Sell Vol. 4,504,040

29,900

1D -0.33%

5D 3.64%

Buy Vol. 3,298,047

Sell Vol. 6,423,714

19,400

1D 0.26%

5D 0.26%

Buy Vol. 11,736,861

Sell Vol. 11,628,432

18,400

1D 0.27%

5D 1.38%

Buy Vol. 7,459,909

Sell Vol. 10,352,657

19,000

1D 0.53%

5D -1.04%

Buy Vol. 2,078,187

Sell Vol. 2,058,575

23,050

1D 0.22%

5D 2.90%

Buy Vol. 3,738,694

Sell Vol. 4,791,685

25,150

1D -0.98%

5D -2.14%

Buy Vol. 12,327,642

Sell Vol. 17,066,355

20,250

1D -0.98%

5D -0.74%

Buy Vol. 3,594,369

Sell Vol. 4,868,666

24,150

1D 0.00%

5D -0.41%

Buy Vol. 4,435,812

Sell Vol. 5,018,923

TUp to now, 16 banks have announced Q1 business results. Vietcombank is the bank with the highest pre-tax profit in the first quarter of 2023, reaching about VND11,200 billion, up 14% compared to the same period last year. Techcombank is currently the second highest profit before tax , reaching VND5,623 billion, down 17% over the same period.

REAL ESTATE

14,100

1D 1.08%

5D -2.08%

Buy Vol. 56,557,323

Sell Vol. 52,645,785

78,500

1D -0.25%

5D -1.13%

Buy Vol. 74,065

Sell Vol. 94,551

13,750

1D 4.96%

5D 2.61%

Buy Vol. 24,850,314

Sell Vol. 16,665,781

NVL: As of December 31, 2022, the two largest creditors of NVL, Credit Suisse AG and MBB, have lent nearly VND 21,000 billion.

OIL & GAS

92,200

1D -1.28%

5D -3.96%

Buy Vol. 520,046

Sell Vol. 583,124

12,850

1D 0.39%

5D -2.28%

Buy Vol. 31,167,936

Sell Vol. 8,812,996

37,450

1D 1.49%

5D 2.74%

Buy Vol. 1,522,554

Sell Vol. 1,883,211

Ending Wednesday's session, the Brent oil contract dropped $3.08 (or 3.8%) to $77.69 per barrel. WTI oil contract lost $2.77 (equivalent to 3.6%) to $74.30/barrel.

VINGROUP

50,500

1D -2.70%

5D -3.99%

Buy Vol. 5,275,037

Sell Vol. 5,501,851

47,500

1D -1.04%

5D -6.31%

Buy Vol. 4,310,384

Sell Vol. 3,714,888

27,000

1D -1.82%

5D -4.59%

Buy Vol. 3,944,520

Sell Vol. 3,446,374

VHM: In 2023, VHM is expected to launch and sell the remaining apartment funds of Vinhomes Ocean Park 2 and 3, along with Vinhomes Ocean Park, Smart City and Grand Park.

FOOD & BEVERAGE

69,500

1D -2.11%

5D -3.34%

Buy Vol. 2,253,933

Sell Vol. 2,300,707

72,300

1D 1.26%

5D -7.31%

Buy Vol. 1,493,061

Sell Vol. 1,034,921

174,000

1D 1.75%

5D 2.05%

Buy Vol. 244,469

Sell Vol. 279,780

SAB: Q1/2023 net revenue reached nearly VND6,214 billion, down 15% QoQ. Cost of capital decreased by 16%. Gross profit margin improved slightly to approximately 31%.

OTHERS

44,850

1D -2.18%

5D -4.57%

Buy Vol. 925,043

Sell Vol. 1,105,724

95,100

1D -0.11%

5D -4.42%

Buy Vol. 201,097

Sell Vol. 198,815

78,300

1D 0.00%

5D -1.39%

Buy Vol. 823,249

Sell Vol. 593,272

38,650

1D 0.65%

5D -4.33%

Buy Vol. 1,963,899

Sell Vol. 3,146,531

15,450

1D 0.65%

5D 1.98%

Buy Vol. 5,219,608

Sell Vol. 5,938,094

21,150

1D -0.94%

5D 0.24%

Buy Vol. 20,121,643

Sell Vol. 23,310,933

21,700

1D -1.36%

5D 4.33%

Buy Vol. 31,549,645

Sell Vol. 42,635,092

PNJ: Q1.2023 profit before tax reached VND943 billion, up 3%, profit after tax reached VND749 billion, up 3.8% over the same period, this is also considered a new record ever.

Market by numbers

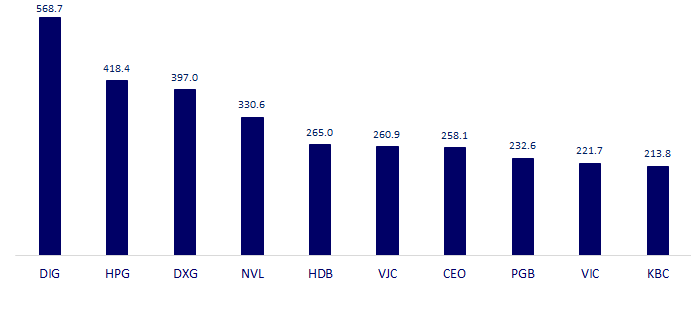

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

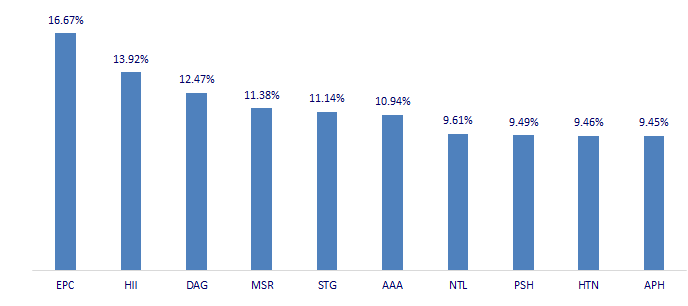

TOP INCREASES 3 CONSECUTIVE SESSIONS

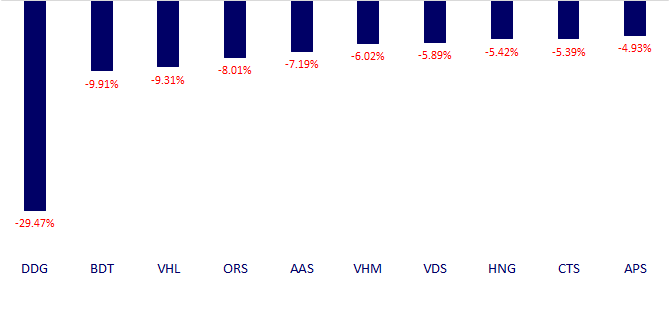

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.