Market brief 28/04/2023

VIETNAM STOCK MARKET

1,049.12

1D 0.91%

YTD 4.17%

1,051.43

1D 0.95%

YTD 4.60%

207.48

1D 0.79%

YTD 1.06%

77.77

1D 0.45%

YTD 8.54%

189.11

1D 0.00%

YTD 0.00%

11,812.15

1D 13.87%

YTD 37.10%

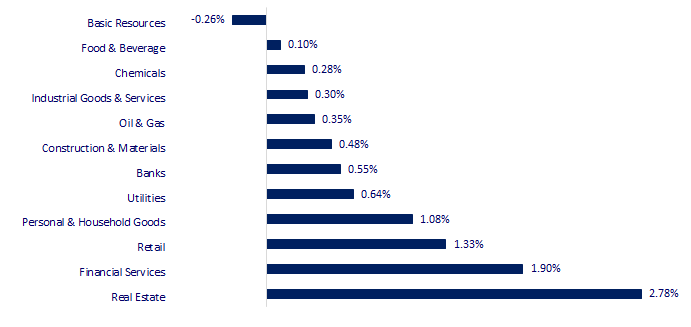

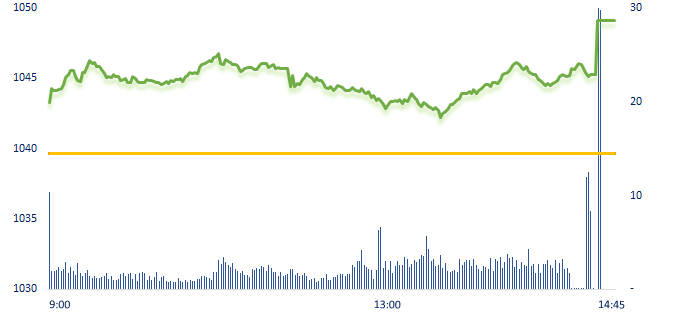

Today, VNIndex rebounded at the end of the session when ETFs completed the portfolio structure. Real estates and financial services were two leading industries when they increased by 2.78% and 1.9%, respectively. The real estate industry rose from the beginning of the morning, with representatives of DIG, DXG, NVL, PDR.

ETF & DERIVATIVES

18,200

1D 2.36%

YTD 5.02%

12,430

1D 1.06%

YTD 4.28%

13,350

1D 4.62%

YTD 6.97%

16,500

1D 6.38%

YTD 17.44%

15,970

1D 1.08%

YTD 11.29%

22,700

1D 2.16%

YTD 1.34%

13,350

1D 1.14%

YTD 3.09%

1,032

1D 0.13%

YTD 0.00%

1,039

1D 0.96%

YTD 0.00%

1,032

1D 0.01%

YTD 0.00%

1,043

1D 0.72%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

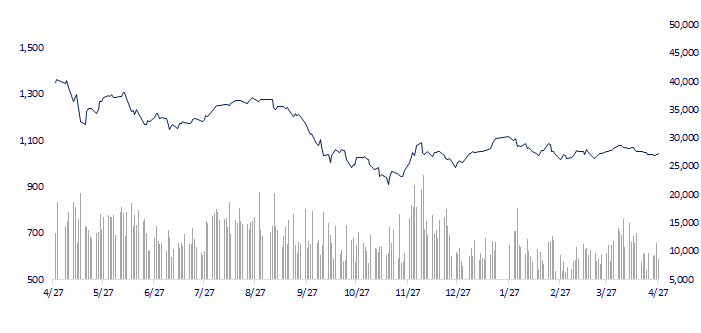

VNINDEX (12M)

GLOBAL MARKET

28,856.44

1D 1.40%

YTD 10.58%

3,323.27

1D 1.14%

YTD 7.57%

2,501.53

1D 0.23%

YTD 11.86%

19,894.57

1D 0.27%

YTD 0.57%

3,270.51

1D -0.35%

YTD 0.59%

1,529.12

1D -0.14%

YTD -8.46%

78.66

1D 0.64%

YTD -8.44%

1,993.15

1D -0.06%

YTD 9.14%

Asian stocks rallied in the afternoon session of April 28 thanks to the push from investors' optimism and positive profit results of many large companies. In which, the Nikkei 225 index in Tokyo led the gain in the region after the decision to maintain the loose monetary policy of the Bank of Japan (BoJ).

VIETNAM ECONOMY

4.61%

1D (bps) 51

YTD (bps) -36

7.40%

2.99%

YTD (bps) -180

3.16%

1D (bps) 2

YTD (bps) -174

23,690

1D (%) 0.28%

YTD (%) -0.29%

26,233

1D (%) -1.42%

YTD (%) 2.24%

3,464

1D (%) 0.17%

YTD (%) -0.60%

Deputy Governor of the State Bank Dao Minh Tu said that the disbursement process for the 2% interest rate support package was not as expected, due to many reasons such as inadequate regulations, changed practical conditions, etc. The State Bank has reported that this source should be transferred to other areas where capital is lacking in order to take advantage of redundant resources.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government maintains the view that real estate trading must go through the exchange;

- The Ministry of Industry and Trade supports a 50% reduction in registration fees for domestic vehicles;

- The position of the industrial center of Ho Chi Minh City is gradually decreasing;

- US GDP grew 1.1% in Q1, weaker than forecast;

- China and the Fed cause investors having a difficult choice between oil and gold;

- Coal demand falls in Europe during winter despite energy crisis.

VN30

BANK

90,500

1D 0.56%

5D 3.43%

Buy Vol. 1,015,371

Sell Vol. 1,299,569

43,500

1D -0.91%

5D -1.58%

Buy Vol. 725,273

Sell Vol. 899,894

28,850

1D 1.76%

5D 0.87%

Buy Vol. 7,256,167

Sell Vol. 8,406,215

29,500

1D -1.34%

5D 2.79%

Buy Vol. 4,090,118

Sell Vol. 7,118,157

19,900

1D 2.58%

5D 2.31%

Buy Vol. 15,464,003

Sell Vol. 16,945,914

18,450

1D 0.27%

5D 2.22%

Buy Vol. 9,491,505

Sell Vol. 13,876,087

18,800

1D -1.05%

5D 0.00%

Buy Vol. 2,432,969

Sell Vol. 2,719,651

23,800

1D 3.25%

5D 5.54%

Buy Vol. 17,701,289

Sell Vol. 16,137,354

25,300

1D 0.60%

5D -1.17%

Buy Vol. 15,331,377

Sell Vol. 17,680,281

20,500

1D 1.23%

5D 1.74%

Buy Vol. 8,440,282

Sell Vol. 7,632,517

24,200

1D 0.21%

5D -0.21%

Buy Vol. 21,832,718

Sell Vol. 13,330,757

BID: In 2022, BIDV profit after tax is VND18,064 billion. The bank plans to use VND11,634 billion of retained earnings in 2022 to pay stock dividends, equivalent to 23% of charter capital as of December 31, 2022. In 2023, BIDV submitted to shareholders a business plan with the expected profit before tax to increase by 10-15%. The bad debt ratio is controlled at no more than 1.4%.

REAL ESTATE

14,300

1D 1.42%

5D 5.15%

Buy Vol. 57,339,362

Sell Vol. 54,296,453

78,700

1D 0.25%

5D -0.51%

Buy Vol. 122,128

Sell Vol. 96,201

14,150

1D 2.91%

5D 8.85%

Buy Vol. 30,978,249

Sell Vol. 32,882,182

NVL: The major shareholder of NVL, Diamond Properties JSC, has registered to sell 18.4 million shares from May 8 to June 8, 2023 for balancing the portfolio and supporting debt restruction.

OIL & GAS

92,800

1D 0.65%

5D -2.73%

Buy Vol. 377,901

Sell Vol. 389,122

13,100

1D 1.95%

5D 2.34%

Buy Vol. 27,569,171

Sell Vol. 16,167,537

37,450

1D 0.00%

5D 1.90%

Buy Vol. 658,100

Sell Vol. 1,285,603

POW: PV Power is negotiating with Jadestone to buy gas from Nam Du-U Minh field, researching additional imported LNG gas sources and buying more gas from Malaysia

VINGROUP

52,100

1D 3.17%

5D -1.14%

Buy Vol. 3,917,352

Sell Vol. 3,563,210

49,500

1D 4.21%

5D -1.59%

Buy Vol. 2,400,157

Sell Vol. 1,625,291

27,700

1D 2.59%

5D -0.72%

Buy Vol. 5,552,070

Sell Vol. 4,922,009

VIC: Mr. Vuong will donate $1 billion to VinFast from his personal assets.

FOOD & BEVERAGE

70,000

1D 0.72%

5D -1.27%

Buy Vol. 2,355,840

Sell Vol. 2,442,372

73,100

1D 1.11%

5D -4.32%

Buy Vol. 1,061,274

Sell Vol. 1,235,099

172,000

1D -1.15%

5D 0.88%

Buy Vol. 183,056

Sell Vol. 208,530

MSN: Masan is going to commercialize electric vehicle battery with charging time of only 5 minutes for 90% capacity.

OTHERS

44,900

1D 0.11%

5D -4.16%

Buy Vol. 503,654

Sell Vol. 536,710

97,000

1D 2.00%

5D -0.51%

Buy Vol. 241,876

Sell Vol. 302,847

77,500

1D -1.02%

5D -2.27%

Buy Vol. 1,807,476

Sell Vol. 1,394,010

39,200

1D 1.42%

5D -0.25%

Buy Vol. 4,013,665

Sell Vol. 5,512,833

15,550

1D 0.65%

5D 2.98%

Buy Vol. 3,464,063

Sell Vol. 4,823,696

21,550

1D 1.89%

5D -0.46%

Buy Vol. 32,429,196

Sell Vol. 32,021,977

21,650

1D -0.23%

5D 4.59%

Buy Vol. 28,282,456

Sell Vol. 36,021,534

PNJ: General Director of Phu Nhuan Jewelry Company (PNJ) said that planned profit will increase by 7% and planned revenue will increase by 5% to VND35,600 billion. This is the highest plan in 35 years of operation of PNJ, extending the chain of 5 consecutive years of profit over trillion

Market by numbers

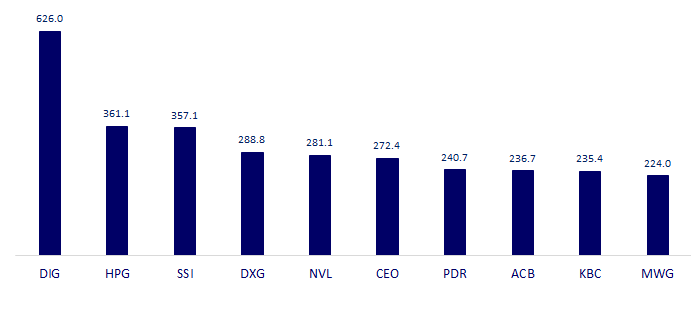

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

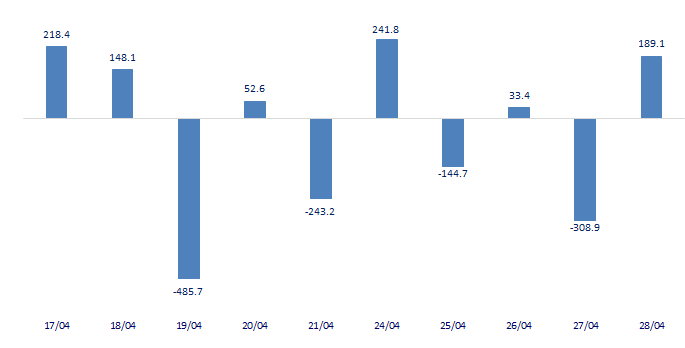

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

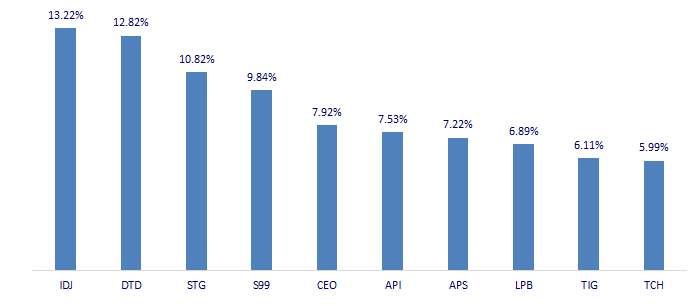

TOP INCREASES 3 CONSECUTIVE SESSIONS

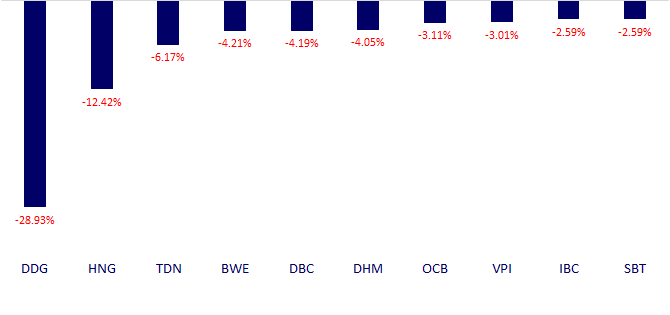

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.